Securing the right workers’ compensation insurance is crucial for small businesses. It’s not just about legal compliance; it’s about protecting your employees and safeguarding your financial future. A workplace injury can significantly impact your bottom line, but with the right policy and proactive safety measures, you can mitigate these risks and foster a safer, more productive work environment. Understanding the nuances of workers’ compensation insurance is key to navigating this complex landscape and ensuring your business thrives.

This guide explores the essential aspects of workers’ compensation insurance for small businesses, from understanding eligibility and compliance requirements to selecting the appropriate policy and managing costs effectively. We’ll delve into the claims process, the role of insurance brokers, and the overall financial implications of workers’ compensation, providing you with the knowledge to make informed decisions and protect your business.

Understanding Workers’ Compensation Insurance Basics for Small Businesses

Workers’ compensation insurance is a crucial aspect of running a small business. It protects both you and your employees in the event of workplace injuries or illnesses. This insurance provides a safety net, ensuring medical expenses and lost wages are covered, minimizing financial burdens and potential legal ramifications. Understanding the fundamentals of this insurance is vital for responsible business ownership.

Workplace Injuries and Illnesses Covered

Workers’ compensation typically covers a wide range of workplace injuries and illnesses. This includes accidents resulting in physical harm, such as cuts, burns, broken bones, and sprains. It also encompasses illnesses directly caused by the work environment, including repetitive strain injuries like carpal tunnel syndrome, exposure to hazardous materials leading to respiratory problems, or hearing loss from prolonged exposure to loud noises. The specific coverage can vary depending on the state and the specific policy, but the goal is to provide comprehensive protection for employees injured or sickened on the job.

Typical Costs Associated with Workers’ Compensation Premiums

The cost of workers’ compensation insurance premiums varies significantly based on several factors. The most influential factor is the industry’s risk profile. High-risk industries, such as construction or manufacturing, typically face higher premiums due to the increased likelihood of workplace accidents. The number of employees is another key determinant; more employees generally mean higher premiums. The company’s claims history also plays a critical role; a history of frequent or costly claims will likely result in higher premiums. Finally, the state in which the business operates significantly impacts premium costs, as each state has its own regulatory framework and rate structures. For example, a small construction company in a state with a high rate of workplace accidents might pay significantly more than a similar-sized office in a state with a lower accident rate. It’s essential to obtain quotes from multiple insurers to compare pricing and coverage options.

Comparison of Workers’ Compensation Policies

Choosing the right workers’ compensation policy is crucial. Different policies offer varying levels of coverage and cost. While specific details vary by state and insurer, the following table provides a simplified comparison of common policy types:

| Policy Type | Coverage | Premium Cost (Generally) | Suitable for |

|---|---|---|---|

| Basic Policy | Covers basic medical expenses and lost wages. | Lower | Small businesses with low risk profiles. |

| Comprehensive Policy | Covers a wider range of medical expenses, lost wages, and rehabilitation costs. May include additional benefits. | Higher | Businesses with higher risk profiles or a desire for more extensive coverage. |

| Customized Policy | Tailored to meet the specific needs of the business, often including specific industry-related risks. | Variable | Businesses with unique risk profiles or specific coverage requirements. |

| State Fund Policy | Provided by the state’s workers’ compensation fund. | Can vary, often competitive. | Businesses seeking a reliable and potentially cost-effective option. |

Eligibility and Compliance Requirements

Securing workers’ compensation insurance is a crucial step for small business owners, not only to protect their employees but also to ensure compliance with the law. Understanding eligibility criteria and state-specific regulations is vital to avoid potential penalties and maintain a legally sound business operation. This section clarifies the requirements and Artikels steps to ensure full compliance.

Eligibility for workers’ compensation insurance generally hinges on the presence of employees. Most states mandate coverage if you employ one or more individuals. However, specific definitions of “employee” can vary, and some states may have exceptions for certain types of businesses or independent contractors. It is crucial to consult your state’s specific regulations to determine your exact eligibility. The number of employees often influences the premium calculation, with higher numbers generally leading to higher premiums. Sole proprietors or independent contractors who do not employ others might not be required to have workers’ compensation insurance, though this also varies by state.

State-Specific Regulations and Compliance Requirements

Workers’ compensation laws are determined at the state level, meaning requirements differ significantly across the country. For example, California might have stricter reporting requirements than Texas, and the types of injuries covered could vary slightly. Each state has its own workers’ compensation board or agency responsible for administering the laws, handling claims, and enforcing compliance. These agencies usually provide detailed information on their websites, including forms, guidelines, and FAQs. It is absolutely critical to contact the relevant agency in your state to understand your specific obligations. Failure to do so could result in significant legal and financial repercussions. Key aspects to investigate include the classification of your business, the required reporting procedures, and the specific forms needed for employee injury reporting. Some states might have online portals for easy access to information and filing, while others might require manual submissions.

Penalties for Non-Compliance

Non-compliance with workers’ compensation laws carries serious consequences. Penalties can include significant fines, back payments for missed premiums, and potential legal action from injured employees. In some cases, businesses facing non-compliance might find it difficult to secure future insurance coverage. Furthermore, the reputational damage from non-compliance can impact your business’s credibility and ability to attract and retain both clients and employees. The severity of penalties often depends on the nature and duration of the non-compliance. A simple oversight might result in a smaller fine, while intentional evasion could lead to much more severe penalties, including criminal charges in some extreme instances. For instance, a small business in New York might face thousands of dollars in fines for failing to secure coverage, while a similar offense in a state with less stringent enforcement might result in a lower penalty, but this is not a reason to disregard compliance.

Steps to Ensure Compliance

Ensuring compliance with workers’ compensation laws requires proactive steps. The following Artikel provides a practical guide to help small businesses navigate this critical aspect of legal and operational management.

- Determine Eligibility: Contact your state’s workers’ compensation agency to ascertain your eligibility based on your business structure and the number of employees.

- Secure Coverage: Obtain workers’ compensation insurance from a reputable insurer. Compare quotes and coverage options to find the best fit for your business.

- Maintain Accurate Records: Keep meticulous records of employee information, payroll, and any work-related injuries.

- Report Injuries Promptly: Report any work-related injuries to your insurer and the state agency within the required timeframe.

- Regularly Review Policies and Regulations: Stay updated on changes in state regulations and your insurance policy to ensure continued compliance.

- Consult with Professionals: Seek advice from legal or insurance professionals to ensure proper interpretation and implementation of workers’ compensation laws.

Choosing the Right Workers’ Compensation Policy

Selecting the appropriate workers’ compensation insurance policy is crucial for small businesses. The right policy protects your business from the potentially devastating financial consequences of workplace injuries or illnesses, while an unsuitable one could leave you underinsured and facing significant liabilities. Careful consideration of several factors ensures you obtain adequate coverage at a manageable cost.

Policy Options for Small Businesses

Small businesses generally have access to several types of workers’ compensation insurance policies. The most common are monopolistic state funds, competitive state funds, and private insurers. Monopolistic state funds are the sole provider of workers’ compensation insurance in some states, offering a standardized policy. Competitive state funds operate alongside private insurers, providing options for businesses. Private insurers offer a wider array of policy options and customization, often with more competitive pricing based on risk assessment. The choice depends largely on the specific state regulations and business needs.

Factors Influencing Policy Selection

Several key factors influence the selection of a suitable workers’ compensation policy. These include the nature of the business’s industry, the number of employees, and the inherent risk level associated with the work performed. High-risk industries, such as construction or manufacturing, will typically require more comprehensive coverage and may face higher premiums. The number of employees directly impacts the premium calculation, with larger workforces generally leading to higher costs. A thorough risk assessment, identifying potential hazards and implementing preventative measures, can significantly influence the premium rate.

Common Policy Exclusions and Limitations

While workers’ compensation insurance provides crucial protection, it’s essential to understand its limitations. Common exclusions might include injuries resulting from an employee’s intentional self-harm or injuries sustained while engaging in activities outside the scope of employment. Policies often have limitations on the duration of benefit payments or the total amount payable for specific types of injuries. Careful review of the policy wording is vital to understand these limitations and ensure adequate coverage. For example, a policy might exclude coverage for injuries caused by an employee’s willful misconduct or gross negligence. Similarly, there might be limitations on the amount paid for certain medical treatments or rehabilitation services.

Comparison of Policy Types

| Policy Type | Provider | Customization | Cost |

|---|---|---|---|

| Monopolistic State Fund | State-run entity | Limited | Potentially standardized rates |

| Competitive State Fund | State-run entity | Moderate | Competitive rates, may vary |

| Private Insurer | Private insurance company | High | Variable, based on risk assessment |

Filing a Workers’ Compensation Claim

Filing a workers’ compensation claim can seem daunting, but understanding the process can alleviate stress and ensure a smoother experience for both the employee and the employer. This section Artikels the steps involved, the responsibilities of each party, and clarifies the rights afforded to injured workers.

The Claim Filing Process

The process generally begins with immediate reporting of the workplace injury or illness to the employer. Prompt notification is crucial for initiating the claim and ensuring timely medical attention. Following the employer’s internal reporting procedures, the employee will typically need to complete a claim form provided by the insurer or the state’s workers’ compensation board. This form will require details about the incident, the resulting injuries, and the employee’s medical treatment. Supporting documentation, such as medical reports and witness statements, may also be necessary. The claim is then submitted to the insurer, who will review the information and begin the investigation process. This process may involve interviews, medical evaluations, and a review of workplace safety records. The insurer will then determine the eligibility of the claim and the extent of benefits to be provided.

Employer Responsibilities During the Claims Process

Employers have several key responsibilities during a workers’ compensation claim. Firstly, they must maintain accurate records of workplace injuries and illnesses. This includes promptly reporting incidents to their insurer and cooperating fully with the investigation. Employers are also responsible for providing a safe working environment to minimize the risk of workplace accidents. This involves adhering to safety regulations, providing appropriate safety training, and implementing preventative measures. Furthermore, employers should cooperate with the injured employee’s medical treatment and facilitate their return to work, where possible. Failure to fulfill these responsibilities can lead to penalties and increased insurance premiums.

Employee Rights and Responsibilities

Employees have the right to receive medical care for work-related injuries or illnesses, as well as wage replacement benefits during their recovery period. They also have the right to a fair and impartial claims process. However, employees also have responsibilities. This includes promptly reporting the injury or illness to their employer, truthfully providing information to the insurer, and following the prescribed medical treatment plan. Employees should also cooperate with the investigation and avoid actions that could jeopardize their claim, such as failing to attend scheduled medical appointments or providing false information.

Workers’ Compensation Claim Flowchart

The following illustrates the typical steps involved in a workers’ compensation claim:

[Diagram description: A flowchart begins with “Workplace Injury/Illness Occurs.” An arrow points to “Employee Reports Injury to Employer.” Another arrow points to “Employer Reports Incident to Insurer.” The next step is “Insurer Reviews Claim and Begins Investigation.” This leads to “Medical Evaluation and Treatment.” Two arrows branch out from here: “Claim Approved – Benefits Paid” and “Claim Denied – Appeal Process.” The “Claim Denied” branch can lead back to “Insurer Reviews Claim and Begins Investigation” after the appeal is processed. The “Claim Approved” branch leads to “Return to Work/Modified Duty or Permanent Disability Benefits.” ]

Managing Workers’ Compensation Costs

Controlling workers’ compensation costs is crucial for the financial health of any small business. High premiums can significantly impact profitability, making proactive management essential. This section Artikels strategies to reduce premiums, enhance workplace safety, and minimize claim costs.

Effective management of workers’ compensation costs involves a multifaceted approach encompassing proactive safety measures, comprehensive employee training, and efficient claims handling. By prioritizing these areas, businesses can create a safer work environment, reduce the likelihood of workplace injuries, and ultimately lower their insurance premiums.

Strategies for Reducing Workers’ Compensation Premiums

Several strategies can help lower workers’ compensation premiums. A strong safety record is the most significant factor influencing premium rates. Insurers reward businesses with demonstrably safe workplaces through lower premiums. Additionally, exploring different insurance providers and policy options can reveal cost savings. Finally, implementing safety programs and investing in safety equipment can also lead to lower premiums in the long run.

Best Practices for Workplace Safety and Injury Prevention

Implementing a robust safety program is paramount. This involves regular safety inspections to identify and address potential hazards, providing appropriate personal protective equipment (PPE) to employees, and enforcing safety rules consistently. For example, a construction company might require hard hats, safety glasses, and steel-toed boots at all times on the job site. A retail store could implement procedures for safe lifting and handling of merchandise. A thorough risk assessment, identifying potential hazards specific to the business, should be conducted and regularly reviewed.

Examples of Effective Employee Training Programs

Effective employee training is vital in preventing workplace injuries. Training should cover relevant safety regulations, proper use of equipment, and safe work practices. For instance, a manufacturing company could conduct regular training on operating machinery safely, including lockout/tagout procedures. A restaurant could train employees on proper food handling and hygiene to prevent accidents and illnesses. Regular refresher courses ensure that employees remain up-to-date on safety protocols and best practices. Documentation of training is crucial for demonstrating compliance to insurance providers.

Implementing Safety Measures to Minimize Claim Costs

Implementing comprehensive safety measures directly minimizes claim costs. A strong safety culture, fostered through training and consistent enforcement, significantly reduces the frequency and severity of workplace accidents. Prompt reporting and investigation of incidents allow for quick remediation of hazards and prevention of future occurrences. Efficient claims management, including timely reporting and cooperation with insurance providers, can streamline the process and reduce associated costs. For example, a company with a well-documented safety program and rapid response to incidents may see significantly lower claim costs compared to a company with a lax safety culture and delayed incident reporting. This proactive approach not only reduces the financial burden of claims but also protects the company’s reputation and employee morale.

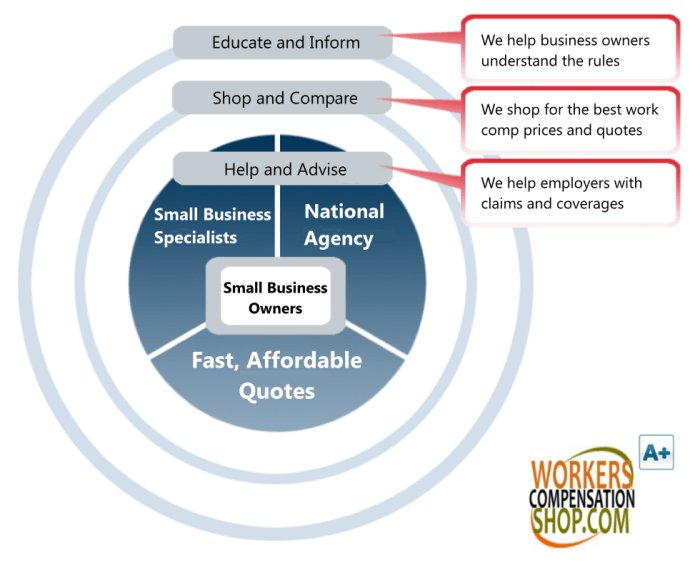

The Role of Insurance Brokers and Agents

Navigating the complexities of workers’ compensation insurance can be challenging for small business owners. This is where the expertise of insurance brokers and agents becomes invaluable. They act as intermediaries, connecting businesses with insurers and providing crucial guidance throughout the process.

Insurance brokers and agents specializing in workers’ compensation offer a wide range of services designed to simplify the process and secure the best possible coverage for your business. These services go beyond simply finding a policy; they involve careful assessment of your business’s specific needs, risk profile, and budget to tailor a solution that truly fits.

Services Provided by Workers’ Compensation Brokers and Agents

Brokers and agents perform several key functions. They analyze your business’s operations to determine your risk level and the appropriate coverage amount. They then shop around among multiple insurance carriers to find policies that meet your needs and budget. This competitive shopping process often leads to better rates and more favorable policy terms than you could achieve by going directly to an insurer. Beyond policy procurement, they also assist with claims management, providing guidance and support throughout the process. They can explain policy terms, answer questions about coverage, and help navigate the complexities of state regulations. Finally, they can often provide valuable risk management advice to help your business minimize workplace accidents and reduce premiums over time.

Benefits of Working with a Broker or Agent

Employing a workers’ compensation broker or agent offers several significant advantages. First, it saves you considerable time and effort. Finding and comparing policies from multiple insurers is a time-consuming task. Brokers handle this legwork, allowing you to focus on running your business. Second, their expertise ensures you obtain the most appropriate coverage for your specific circumstances. They understand the nuances of different policies and can identify gaps in coverage that you might miss. Third, brokers often negotiate better rates and terms with insurers due to their established relationships and volume of business. This can translate to significant cost savings over the life of your policy. Finally, they provide ongoing support and guidance, acting as a valuable resource throughout the policy period and during any claims process. A knowledgeable agent can help you avoid costly mistakes and ensure you receive the benefits to which you are entitled.

Comparing Services Offered by Different Brokers and Agents

Not all brokers and agents are created equal. It’s essential to compare their services, experience, and fees before making a decision. Some brokers specialize in specific industries or types of businesses, offering deeper expertise in your particular sector. Others may have stronger relationships with certain insurers, potentially leading to access to better rates or policy options. It’s also crucial to inquire about their fee structure; some brokers charge a commission based on the policy premium, while others may have a flat fee or hourly rate. The level of personalized service also varies, with some brokers offering more hands-on support than others. Consider the level of communication, responsiveness, and accessibility you require when making your selection. A thorough comparison allows you to choose a broker that best aligns with your needs and preferences.

Questions to Ask When Choosing a Broker or Agent

Choosing the right broker is a crucial decision. To ensure a good fit, consider asking the following questions:

- What is your experience with workers’ compensation insurance, and specifically with businesses like mine?

- Which insurance carriers do you work with, and what are their strengths and weaknesses?

- What is your fee structure, and how are your fees determined?

- What is your process for handling claims, and what level of support can I expect?

- Can you provide references from other small business clients?

- What risk management advice or services do you offer?

- How accessible are you, and what is your typical response time to inquiries?

Impact of Workers’ Compensation on Small Business Finances

Workers’ compensation insurance, while legally mandated, presents significant financial considerations for small businesses. Understanding these implications is crucial for effective budgeting, risk management, and overall financial stability. Ignoring these costs can lead to unexpected financial strain and even jeopardize the business’s survival.

Workers’ compensation insurance premiums are a direct expense, impacting profitability and cash flow. The cost of premiums is determined by several factors, including the business’s industry, payroll, and claims history. A high-risk industry, for example, will typically face higher premiums. Furthermore, a history of workplace accidents will result in increased premiums, creating a vicious cycle where poor safety practices lead to higher costs. Beyond premiums, the financial burden extends to the costs associated with actual claims. These costs can include medical expenses, lost wages, and legal fees, potentially causing significant financial setbacks. The severity of an injury directly correlates with the financial impact; a minor injury might only require a few days of lost wages, whereas a serious injury could lead to substantial long-term costs.

Workers’ Compensation Premiums and Profitability

Workers’ compensation premiums are a significant operating expense directly reducing a small business’s profit margin. The premium amount is calculated based on several factors, including the business’s classification code (which reflects the risk level of its operations), payroll, and experience modification rating (EMR). A high EMR, reflecting a history of claims, leads to higher premiums. This directly impacts the bottom line, reducing net profit. For instance, a small construction firm with a high EMR might see a significantly larger portion of its revenue consumed by workers’ compensation premiums compared to a similar-sized office-based business with a lower risk profile and a cleaner claims history. This difference in premiums can significantly affect the overall profitability and competitiveness of these businesses. Effective safety programs and proactive risk management strategies can help mitigate these costs and improve profitability.

Workers’ Compensation Claims and Cash Flow

Workers’ compensation claims can severely disrupt a small business’s cash flow. While premiums are a predictable expense, claims are not. A serious injury can result in substantial and immediate payouts for medical bills and lost wages, creating a significant drain on working capital. This can impact a company’s ability to meet its other financial obligations, such as payroll, rent, and supplier payments. Small businesses, often operating with limited financial reserves, are particularly vulnerable to the unpredictable nature of workers’ compensation claims. A single large claim could potentially deplete their cash reserves and necessitate borrowing, impacting creditworthiness and future financial stability. Therefore, adequate financial planning and contingency reserves are crucial to mitigate the impact of unexpected claims.

Budgeting Strategies for Workers’ Compensation Expenses

Effective budgeting is essential to manage workers’ compensation expenses. This involves accurately forecasting premium costs based on historical data, industry benchmarks, and anticipated payroll. Businesses should also establish a contingency fund specifically for workers’ compensation claims, allocating a percentage of their revenue to cover potential payouts. Regular reviews of safety protocols and employee training programs can help minimize the likelihood of claims and, consequently, reduce expenses. Furthermore, exploring different insurance options and negotiating with insurers can help secure more favorable premium rates. Regularly reviewing insurance policies and exploring alternative risk management strategies are also vital components of effective budgeting for workers’ compensation.

Hypothetical Case Study: The Impact of a Workplace Injury

Consider a small bakery employing five people. Their annual workers’ compensation premium is $2,000. One employee suffers a severe burn requiring extensive medical treatment and several months of lost wages. The total cost of the claim, including medical expenses, lost wages, and legal fees, reaches $50,000. This unexpected expense significantly impacts the bakery’s finances. It depletes their savings, potentially forcing them to take out a loan or delay planned investments. The claim also results in a higher EMR, leading to increased premiums in subsequent years. This case study illustrates the potential for a single workplace injury to have a devastating financial impact on a small business, highlighting the importance of robust safety measures and adequate financial planning.

Resources and Further Information

Navigating the complexities of workers’ compensation insurance can be challenging for small business owners. Fortunately, numerous resources are available to provide guidance and support throughout the process, from understanding eligibility requirements to filing claims and managing costs. This section Artikels key resources, frequently asked questions, and contact information to help you effectively manage your workers’ compensation needs.

Reliable Resources for Small Business Owners

Finding accurate and relevant information is crucial for making informed decisions about workers’ compensation. The following resources offer valuable insights and practical guidance for small business owners. This list is not exhaustive but provides a solid starting point for your research.

- Your State’s Workers’ Compensation Agency: Each state has its own agency responsible for overseeing workers’ compensation. These agencies typically offer detailed information on state-specific regulations, forms, and claim procedures. Their websites are usually a primary source of accurate information.

- The National Federation of Independent Business (NFIB): The NFIB is a powerful advocate for small businesses and provides resources, including information on workers’ compensation, through its website and publications. They often offer advice and guidance on navigating the complexities of workers’ compensation regulations.

- The Small Business Administration (SBA): The SBA offers general business advice and resources, including some information on workers’ compensation insurance. While not their primary focus, they can direct you to other helpful resources.

- Insurance Industry Associations: Organizations like the Independent Insurance Agents & Brokers of America (IIABA) or the National Association of Insurance Commissioners (NAIC) offer resources and information related to the insurance industry, including workers’ compensation.

- Online Resources: Reputable online sources, such as the websites of insurance companies and independent financial advisors, can offer valuable information, but always verify the information with your state’s workers’ compensation agency.

Contact Information for Relevant Government Agencies and Industry Associations

Direct contact with these organizations can provide personalized assistance and answer specific questions.

- Your State’s Workers’ Compensation Agency: Contact information varies by state. A web search for “[Your State] Workers’ Compensation” will provide the appropriate contact details.

- National Federation of Independent Business (NFIB): Their website provides contact information for their various offices and resources.

- Small Business Administration (SBA): The SBA’s website provides multiple contact options, including phone numbers and email addresses.

- Independent Insurance Agents & Brokers of America (IIABA): Their website provides contact information and resources for finding local agents.

- National Association of Insurance Commissioners (NAIC): The NAIC website offers contact information and resources for state insurance departments.

Frequently Asked Questions and Answers

Understanding common questions and their answers can help streamline the process of obtaining and managing workers’ compensation insurance.

- Question: What is the difference between employer and employee responsibility regarding workers’ compensation? Answer: Employers are responsible for providing workers’ compensation insurance coverage for their employees. Employees are responsible for reporting workplace injuries and following safety procedures.

- Question: How do I choose the right workers’ compensation policy for my business? Answer: Consider factors such as your industry, number of employees, and risk profile when selecting a policy. Consult with an insurance broker or agent to find a policy that meets your specific needs and budget.

- Question: What happens if I don’t carry workers’ compensation insurance? Answer: Failure to carry workers’ compensation insurance when required by law can result in significant penalties and liabilities, including lawsuits from injured employees.

- Question: What information do I need to file a workers’ compensation claim? Answer: Typically, you’ll need information about the injury, the date and time of the incident, witnesses, and medical treatment received. Your state’s workers’ compensation agency will provide specific requirements.

- Question: How can I manage workers’ compensation costs? Answer: Implement safety programs, provide employee training, and consider loss control measures to reduce workplace accidents and associated costs.

Ending Remarks

Successfully navigating the world of workers’ compensation insurance is vital for the long-term health and prosperity of any small business. By understanding the fundamentals, complying with regulations, and implementing proactive safety measures, you can create a secure environment for your employees while protecting your financial stability. Remember, proactive planning and informed decision-making are your best allies in managing this critical aspect of business ownership.

Question & Answer Hub

What if I have only one employee? Do I still need workers’ compensation insurance?

Generally, yes. Most states require workers’ compensation insurance even if you have only one employee. Check your state’s specific regulations for exceptions.

How are workers’ compensation premiums calculated?

Premiums are typically based on several factors, including your industry classification, payroll, and your company’s past claims history (experience modification rate). Higher-risk industries generally have higher premiums.

What types of injuries are NOT covered by workers’ compensation?

Coverage varies by state, but generally, injuries resulting from an employee’s willful misconduct, intoxication, or self-inflicted harm are often excluded. Specific exclusions are Artikeld in your policy.

Can I negotiate my workers’ compensation premium?

While you can’t directly negotiate the base rate, you can influence your premium by implementing robust safety programs, which may lower your experience modification rate over time.

What happens if I don’t carry workers’ compensation insurance?

Failing to carry required workers’ compensation insurance can result in significant penalties, including fines, legal action from injured employees, and potential business closure.