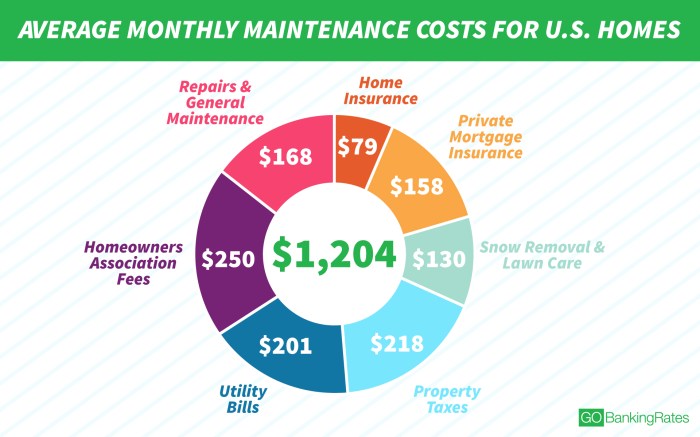

Securing your home is a significant investment, and understanding the typical cost of home insurance is crucial for responsible financial planning. This guide delves into the multifaceted world of home insurance premiums, exploring the key factors that influence pricing and offering practical strategies to help you find the best coverage at a price that suits your budget. We’ll examine various coverage options, the process of obtaining quotes, and how to decipher policy documents, ultimately empowering you to make informed decisions about protecting your most valuable asset.

From the impact of your location and the type of home you own to the level of coverage you choose, numerous variables contribute to your final premium. This guide will equip you with the knowledge to navigate these complexities, compare different insurers effectively, and ultimately secure affordable and comprehensive home insurance protection.

Types of Home Insurance Coverage

Understanding the different types of coverage offered in a home insurance policy is crucial for securing adequate protection for your property and belongings. A standard policy typically bundles several key coverages, each designed to address specific risks. Knowing what each covers and its limitations will help you choose a policy that best suits your needs and budget.

Dwelling Coverage

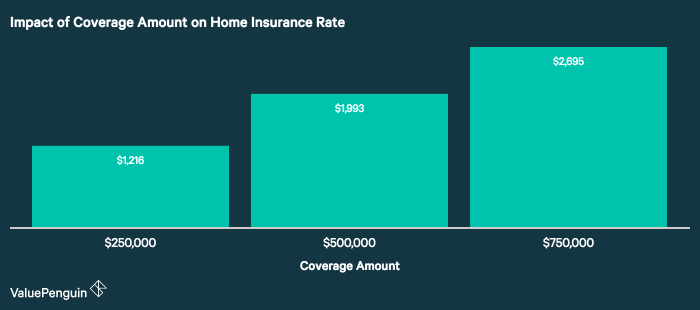

Dwelling coverage protects the physical structure of your home, including attached structures like garages and sheds. This coverage typically pays for repairs or rebuilding costs in the event of damage caused by covered perils, such as fire, windstorms, or hail. The amount of dwelling coverage you need is generally determined by the replacement cost of your home, not its market value. For example, if your home is destroyed by a fire, dwelling coverage would help pay to rebuild it to its pre-loss condition, even if the cost exceeds the home’s current market value. Limitations might include exclusions for certain types of damage (e.g., damage caused by floods or earthquakes, unless specifically added as endorsements), or a limit on the amount paid for debris removal.

Liability Coverage

Liability coverage protects you financially if someone is injured on your property or if you accidentally damage someone else’s property. This coverage pays for medical expenses, legal fees, and any judgments awarded against you. For instance, if a guest slips and falls on your icy walkway and suffers injuries, your liability coverage would help cover their medical bills and legal costs associated with any resulting lawsuit. Limitations include exclusions for intentional acts and certain types of injuries. The coverage amount you select will influence the extent of protection.

Personal Property Coverage

Personal property coverage protects your belongings inside your home, such as furniture, electronics, clothing, and jewelry. This coverage typically reimburses you for the actual cash value (ACV) or replacement cost of your damaged or stolen items, depending on your policy. For example, if a fire damages your furniture, this coverage would help replace or repair it. Limitations often include sub-limits for specific items like jewelry or artwork, and a limit on the total amount paid for all personal property losses. You may also have to provide proof of ownership and value for your claims.

Key Features of Common Home Insurance Policies

Understanding the key features of different policy types is vital for making informed decisions. Here’s a summary:

- Actual Cash Value (ACV): Pays for the replacement cost of your damaged or stolen items minus depreciation.

- Replacement Cost Value (RCV): Pays for the full cost of replacing your damaged or stolen items, without deducting for depreciation. Usually more expensive than ACV.

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in.

- Premium: The amount you pay regularly for your insurance coverage.

- Coverage Limits: The maximum amount your insurance company will pay for a covered loss.

- Exclusions: Specific events or damages that are not covered by your policy (e.g., floods, earthquakes).

Saving Money on Home Insurance

Reducing your home insurance premiums doesn’t require sacrificing coverage. Several strategies can significantly lower your monthly or annual costs without compromising your protection. By understanding these strategies and implementing them effectively, you can save a considerable amount of money over time.

Increasing Deductibles

A higher deductible means you’ll pay more out-of-pocket in the event of a claim. However, this increased personal responsibility translates to lower premiums. Insurance companies assess risk based on the likelihood of payouts; a higher deductible indicates a lower probability of a claim, thus reducing the insurer’s risk and lowering your premium. For example, increasing your deductible from $500 to $1000 could result in a 10-25% reduction in your annual premium, depending on your insurer and coverage. This savings should be weighed against your ability to comfortably cover a larger deductible in case of an unforeseen event.

Improving Home Security

Investing in home security measures can demonstrably lower your insurance costs. Features like security systems (including monitored systems), smoke detectors, and fire alarms significantly reduce the risk of theft and fire damage. Many insurers offer discounts for installing these safety features, recognizing the reduced risk they represent. For instance, a monitored security system might qualify you for a 5-10% discount, while installing updated smoke detectors could yield a smaller, but still valuable, discount. The exact savings will depend on your insurer and the specific security measures implemented.

Bundling Home and Auto Insurance

Bundling your home and auto insurance policies with the same company is a common and effective way to save money. Insurers often offer discounts for bundling policies, rewarding customer loyalty and streamlining their administrative processes. The discount can vary widely depending on the insurer and your specific policies, but it’s not uncommon to see savings of 10-15% or more when combining both types of insurance. This represents a substantial saving over the long term.

Impact of Cost-Saving Strategies on Premiums: Example Scenarios

Let’s illustrate the potential savings with a simple text-based representation:

Scenario | Initial Premium | Deductible Increase ($500 to $1000) | Security System Installation | Bundling Policies | Final Premium

——- | ——– | ——– | ——– | ——– | ——–

A | $1200 | -$150 (12.5%) | -$60 (5%) | -$120 (10%) | $870

B | $1500 | -$200 (13.3%) | -$75 (5%) | -$150 (10%) | $1075

C | $1000 | -$100 (10%) | -$50 (5%) | -$100 (10%) | $750

This table shows three hypothetical scenarios. Each scenario starts with a different initial premium. The subsequent columns show the estimated premium reductions achieved by increasing the deductible, installing a security system, and bundling policies. The final premium reflects the cumulative savings from implementing these strategies. Remember that these are examples, and your actual savings may vary. Contact your insurance provider for precise estimates based on your specific circumstances.

Final Review

Protecting your home requires a clear understanding of home insurance costs and coverage options. By carefully considering the factors influencing premiums, comparing quotes from multiple providers, and understanding your policy documents, you can secure the best possible protection for your investment. Remember, proactive planning and informed decision-making are key to obtaining affordable and comprehensive home insurance that provides peace of mind.

Detailed FAQs

What is a deductible?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums.

How often can I expect my premiums to change?

Premiums are typically reviewed annually and can fluctuate based on factors such as claims history, changes in your home’s value, or changes in risk factors in your area.

Can I get discounts on my home insurance?

Yes, many insurers offer discounts for various factors, including bundling home and auto insurance, installing security systems, or being a long-term customer.

What does “Act of God” coverage mean?

This typically covers damage caused by events outside of human control, such as hurricanes, earthquakes, or floods. Specific coverage varies by policy.

What should I do if I have a claim?

Contact your insurance provider immediately to report the claim and follow their instructions for filing the necessary documentation.