Protecting your most valuable asset, your home, requires a thorough understanding of the various types of home insurance available. More than just a simple policy, home insurance is a multifaceted shield against unforeseen circumstances, from minor damages to catastrophic events. This guide navigates the complexities of different coverage options, helping you choose the right protection for your specific needs and budget.

We will explore the core components of standard home insurance, delve into specialized policies designed for unique risks, and analyze the factors influencing premium costs. Furthermore, we’ll provide practical advice on selecting a policy, understanding policy documents, and navigating the claims process. By the end, you’ll possess the knowledge to confidently secure your home and peace of mind.

Basic Home Insurance Coverage

Understanding the core components of a standard homeowner’s insurance policy is crucial for protecting your most valuable asset: your home. This policy provides financial protection against various risks, offering peace of mind in the event of unforeseen circumstances. A thorough understanding of what’s covered and what’s excluded is essential for making informed decisions about your insurance needs.

Dwelling Coverage

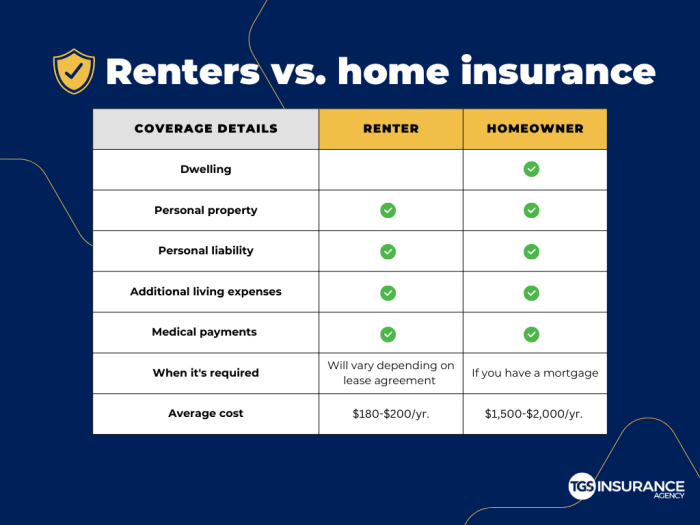

Dwelling coverage protects the physical structure of your home, including attached structures like garages and patios. This coverage typically compensates for damage caused by covered perils, such as fire, windstorms, hail, and vandalism. The amount of coverage is usually based on the replacement cost of your home, not its market value. This means the insurance company will pay to rebuild or repair your home to its pre-loss condition, even if the cost exceeds its current market value. Factors influencing the dwelling coverage amount include the size, location, and construction materials of your home.

Personal Property Coverage

Personal property coverage protects your belongings inside your home, such as furniture, electronics, clothing, and jewelry. This coverage typically extends to personal property located outside your home, such as a shed or patio furniture, up to a certain limit. The amount of coverage is usually a percentage of your dwelling coverage, for example, 50% or 70%. It’s important to carefully consider the value of your possessions and ensure you have adequate coverage. An inventory of valuable items with photos or receipts is recommended to facilitate a smoother claims process.

Liability Coverage

Liability coverage protects you financially if someone is injured on your property or if you accidentally damage someone else’s property. This coverage pays for medical expenses, legal fees, and settlements resulting from such incidents. For example, if a guest slips and falls on your icy driveway, liability coverage would help cover their medical bills and any legal costs. The amount of liability coverage is typically customizable, ranging from $100,000 to $1 million or more, depending on your needs and risk assessment. Higher coverage limits provide greater protection against significant financial losses.

Typical Exclusions

Most standard homeowner’s insurance policies exclude certain types of damage or events. Common exclusions include damage caused by floods, earthquakes, and normal wear and tear. Other exclusions may include acts of war, nuclear accidents, and intentional damage. It is important to review your policy carefully to understand the specific exclusions that apply to your coverage. In some cases, you may be able to purchase separate coverage for some of these excluded perils, such as flood insurance or earthquake insurance, through specialized providers.

Coverage Limits Comparison

This table compares the coverage limits of different standard homeowner’s insurance policies. Remember, these are examples and actual limits can vary significantly based on insurer, location, and specific policy details.

| Policy Type | Dwelling Coverage | Personal Property Coverage | Liability Coverage |

|---|---|---|---|

| Basic | $250,000 | $125,000 | $100,000 |

| Standard | $500,000 | $250,000 | $300,000 |

| Premium | $1,000,000 | $500,000 | $500,000 |

| Luxury | $2,000,000+ | $1,000,000+ | $1,000,000+ |

Specialized Home Insurance Types

Beyond the basic coverage offered by standard home insurance policies, several specialized options cater to specific risks and needs. Understanding these specialized policies is crucial for comprehensive protection of your home and belongings. These policies often address perils not typically included in standard plans, providing peace of mind in situations where standard coverage falls short.

Flood Insurance

Flood insurance protects your home and its contents from damage caused by flooding. Standard homeowners insurance typically excludes flood damage, making a separate flood insurance policy essential, especially for properties located in floodplains or areas prone to heavy rainfall. For example, a homeowner residing near a river or in a coastal region would greatly benefit from flood insurance, as even a moderate flood can cause significant and costly damage. The cost of flood insurance is influenced by factors such as the property’s location, the value of the structure, and the elevation relative to the flood plain. Properties in high-risk flood zones will naturally command higher premiums.

Earthquake Insurance

Earthquake insurance covers damage to your home and belongings caused by earthquakes. Similar to flood insurance, earthquake coverage is usually not included in standard homeowners policies. This specialized coverage is particularly important in seismically active regions. A homeowner living in California, for instance, might find earthquake insurance crucial due to the state’s history of seismic activity. The cost of earthquake insurance is determined by factors such as the property’s location, its construction type, and the proximity to known fault lines. Older homes, built with less earthquake-resistant materials, typically carry higher premiums.

Umbrella Insurance

Umbrella insurance provides additional liability coverage beyond the limits of your existing homeowners and auto insurance policies. It acts as a safety net, offering broader protection against lawsuits and claims related to accidents or injuries that occur on your property or involve you or your family members. For example, if someone is injured on your property and sues you for a significant amount exceeding your homeowners insurance limits, an umbrella policy would cover the excess. The cost of an umbrella policy depends on the amount of coverage desired and your existing insurance history. A clean driving record and no prior claims generally lead to lower premiums.

Windstorm Insurance

Windstorm insurance, often a separate policy or an endorsement to your homeowners insurance, covers damage caused by high winds, hurricanes, or tornadoes. This is especially crucial in areas frequently impacted by severe weather. A homeowner in a hurricane-prone coastal region, for example, would need robust windstorm coverage to protect against the devastating effects of strong winds and flying debris. Factors such as your home’s location, its construction (roof type, window strength), and the historical wind patterns in your area will affect the cost of windstorm insurance.

Personal Articles Floater

A personal articles floater provides additional coverage for high-value items that may not be adequately protected under a standard homeowners insurance policy. This is particularly useful for expensive jewelry, artwork, collectibles, or musical instruments. For example, a homeowner with a valuable collection of antique clocks would benefit from a personal articles floater to ensure adequate coverage in case of loss or damage. The cost of a personal articles floater depends on the value of the items being insured, their age, and their condition. A detailed appraisal may be required to determine the appropriate coverage and premium.

- Key Differences Between Specialized and Standard Home Insurance:

The following points highlight the key distinctions between specialized home insurance policies and standard homeowners insurance:

- Coverage: Standard policies cover basic perils; specialized policies address specific risks like floods, earthquakes, or high-value items.

- Exclusions: Standard policies often exclude coverage for events like floods and earthquakes; specialized policies explicitly cover these risks.

- Cost: Specialized policies usually carry additional premiums compared to standard policies, reflecting the higher risk involved.

- Necessity: Specialized policies are not always necessary, but they become crucial in high-risk areas or for individuals with valuable possessions.

- Customization: Specialized policies allow for tailored coverage based on individual needs and risk profiles, unlike standard policies which offer a more generalized approach.

Factors Affecting Home Insurance Premiums

Determining the cost of your home insurance involves a complex assessment by insurance companies. Numerous factors are weighed to calculate a premium that accurately reflects the risk involved in insuring your property. Understanding these factors can help you make informed decisions about your coverage and potentially lower your premiums.

Insurance companies use sophisticated actuarial models to analyze risk and price policies accordingly. These models consider a wide range of data points, both about the property itself and the homeowner. The goal is to create a fair and accurate premium that reflects the likelihood of a claim and the potential cost of that claim.

Home Characteristics

The physical characteristics of your home significantly influence your premium. Factors such as the age, size, construction materials, and location of your home all play a role. Older homes, for instance, might require higher premiums due to a potentially greater risk of needing repairs or replacements. Similarly, homes constructed with more fire-resistant materials might receive lower premiums. Location is crucial; homes in areas prone to natural disasters (hurricanes, earthquakes, wildfires) will typically command higher premiums than those in less hazardous areas. For example, a beachfront property in a hurricane-prone zone will likely have a much higher premium than an inland home in a stable geological region. The presence of security features, such as security systems or fire alarms, can also affect your premium, often resulting in a discount.

Homeowner Profile

Beyond the property itself, insurance companies also consider the homeowner’s profile. Your credit score, claims history, and the type of coverage you choose are all important factors. A strong credit score often correlates with lower premiums, as it suggests a lower risk of non-payment. A history of claims, particularly those considered preventable, can lead to higher premiums. The level of coverage you select (e.g., comprehensive versus basic) directly impacts the cost; more comprehensive coverage naturally leads to a higher premium. For example, adding liability coverage for injuries sustained on your property will increase the overall premium.

Premium Calculation Methods

Different insurers may employ slightly different methods for calculating premiums, though the underlying principles remain consistent. Some insurers may place greater weight on certain factors than others, leading to variations in premium quotes. For example, one insurer might heavily weigh the age of the home’s plumbing system, while another might prioritize the proximity to fire hydrants. These differences highlight the importance of comparing quotes from multiple insurers to find the most suitable and cost-effective policy. The final premium is often a complex formula that considers all the factors discussed above, weighted according to the insurer’s risk assessment model.

Illustrative Flowchart of Home Insurance Premium Calculation

The following describes a simplified flowchart illustrating the premium calculation process. It is important to note that actual processes are significantly more complex and involve proprietary algorithms.

The flowchart would begin with inputting data on the home (age, size, location, construction materials, security features) and the homeowner (credit score, claims history, desired coverage). This data would then be fed into a risk assessment model, which would assign risk scores to each factor. These scores are then combined using a proprietary formula to determine a base premium. This base premium is then adjusted based on discounts (e.g., for security systems, bundled policies) or surcharges (e.g., for high-risk locations, prior claims). The final output is the calculated home insurance premium.

Choosing the Right Home Insurance Policy

Selecting the right home insurance policy is crucial for protecting your most valuable asset. The process involves careful consideration of your individual needs, a thorough comparison of available options, and a clear understanding of the coverage provided. Failing to do so could leave you financially vulnerable in the event of unforeseen circumstances.

Understanding Your Specific Needs and Coverage Requirements

Before contacting insurers, accurately assessing your property’s value and your personal risk tolerance is paramount. This includes determining the replacement cost of your home, the value of your belongings, and the potential for specific risks in your area (e.g., flooding, wildfires, earthquakes). Consider the level of liability coverage you need, factoring in factors like the number of occupants and the frequency of visitors. A detailed inventory of your possessions, including photographs or video recordings, can significantly simplify the claims process in case of damage or theft. Furthermore, understanding your personal financial capacity to absorb potential losses will help you determine the appropriate deductible level.

Comparing Policy Options and Their Benefits and Drawbacks

Several types of home insurance policies exist, each offering varying levels of coverage and premiums. Basic policies typically cover damage from fire, theft, and vandalism, while comprehensive policies offer broader protection, including coverage for natural disasters (depending on location and policy add-ons). Specialized policies cater to specific needs, such as those for high-value items or properties in high-risk areas. A comparison of policy options should consider not only the premium cost but also the extent of coverage, deductibles, and the insurer’s reputation for claims processing efficiency and customer service. For instance, a higher premium for a comprehensive policy might be justified if you live in an area prone to natural disasters, while a lower premium for a basic policy might be suitable if you have a smaller, less valuable home and a higher risk tolerance.

Decision-Making Matrix for Home Insurance Policy Selection

A decision-making matrix can streamline the selection process. This matrix helps weigh the different factors against each other to arrive at the optimal policy choice.

| Factor | Weight (1-5, 5 being most important) | Policy A (e.g., Basic) Score | Policy B (e.g., Comprehensive) Score | Policy C (e.g., Specialized) Score |

|---|---|---|---|---|

| Premium Cost | 4 | 4 | 2 | 1 |

| Coverage for Fire/Theft | 5 | 5 | 5 | 4 |

| Coverage for Natural Disasters | 3 | 1 | 5 | 3 |

| Liability Coverage | 4 | 3 | 4 | 5 |

| Insurer Reputation | 3 | 3 | 4 | 2 |

| Total Weighted Score | 16 | 20 | 15 |

Note: The weights assigned to each factor reflect individual priorities. For example, someone living in a high-risk area might assign a higher weight to “Coverage for Natural Disasters.” The scores for each policy are subjective and based on the specific policy details. This is a simplified example, and a more comprehensive matrix should include additional factors relevant to the individual’s situation.

Understanding Policy Documents and Claims Processes

Navigating your home insurance policy and understanding the claims process can seem daunting, but familiarity with key sections and procedures can significantly ease the experience should you need to file a claim. This section clarifies the crucial elements of your policy document and provides a straightforward guide to managing the claims process effectively.

Key Sections of a Home Insurance Policy

A typical home insurance policy is a comprehensive document. Understanding its key sections is crucial for knowing your coverage and rights. These sections generally include the policy declaration page, outlining the insured property, coverage amounts, and policy period; the coverage sections, detailing the specific types of coverage provided (e.g., dwelling, personal property, liability); the exclusions section, specifying events or damages not covered by the policy; the conditions section, outlining the responsibilities and obligations of both the insured and the insurer; and finally, the definitions section, clarifying the meaning of specific terms used throughout the policy. Carefully reviewing each section ensures a clear understanding of your policy’s scope.

Filing a Home Insurance Claim: A Step-by-Step Guide

Filing a claim involves several steps. First, report the incident promptly to your insurance company, usually by phone. Next, gather all necessary documentation, including photos and videos of the damage, receipts for any related expenses, and police reports if applicable. Then, complete and submit a claim form provided by your insurer. Following submission, your insurer will likely assign an adjuster to investigate the claim and assess the damages. Finally, once the assessment is complete, you will receive a settlement offer, which you can accept or negotiate.

Documentation Required for a Home Insurance Claim

Supporting your claim with thorough documentation is essential for a smooth and efficient process. This typically includes photographic or video evidence of the damage, detailed descriptions of the incident and its circumstances, receipts for repairs or replacements already undertaken, and any relevant police reports or other official documents related to the incident. Maintaining accurate records throughout the process can expedite the claim settlement. For example, if a tree falls on your house, pictures showing the extent of the damage to the roof and the fallen tree itself are vital. Similarly, receipts for temporary repairs or for boarding up damaged windows should be kept for reimbursement.

Negotiating with Your Insurance Company During a Claim

Negotiating a fair settlement can be necessary. If you disagree with the initial offer, present your case clearly and calmly, supported by all the relevant documentation. Clearly articulate the extent of the damage and the costs associated with repairs or replacement. You may want to consult with an independent appraiser to obtain an objective assessment of the damages. Remember to remain polite and professional throughout the negotiation process. For instance, if the insurer undervalues the cost of replacing damaged furniture, providing detailed receipts and potentially even quotes from multiple furniture stores can strengthen your negotiation position.

Concluding Remarks

Securing adequate home insurance is a crucial step in responsible homeownership. Understanding the nuances of different policy types, from basic coverage to specialized options, empowers you to make informed decisions that best protect your investment. Remember to regularly review your policy and adjust coverage as your needs evolve. Proactive planning and a clear understanding of your insurance are key to mitigating risk and ensuring financial security in the face of unexpected events.

FAQ Section

What is the difference between actual cash value (ACV) and replacement cost coverage?

ACV coverage pays for the current market value of your damaged property, minus depreciation. Replacement cost coverage pays for the cost to replace your damaged property with new, similar items, without deducting for depreciation.

How does my credit score affect my home insurance premiums?

In many states, insurers use credit-based insurance scores to assess risk. A higher credit score generally translates to lower premiums, while a lower score can result in higher premiums.

What is an umbrella insurance policy?

An umbrella policy provides additional liability coverage beyond what’s included in your home or auto insurance. It protects you against significant lawsuits or judgments exceeding your primary policy limits.

Can I get home insurance if I have a dog?

Yes, but the type and cost of your insurance may be affected by the breed and history of your dog. Some insurers may exclude certain breeds considered high-risk.

What should I do immediately after a covered incident occurs?

Contact your insurance company as soon as possible to report the incident. Take photos or videos of the damage and secure the property to prevent further damage.