Choosing the right home and car insurance is crucial for financial security. This guide navigates the complexities of selecting top-rated providers, analyzing factors beyond simple price comparisons. We delve into coverage options, customer experiences, claims processes, and the financial stability of leading companies to empower you with informed decisions.

Understanding the nuances of insurance policies, from liability limits to deductibles, can significantly impact your protection and financial well-being. This comprehensive review equips you with the knowledge to confidently select insurance providers that offer robust coverage, excellent customer service, and financial stability, ensuring peace of mind in times of need.

Car Insurance Coverage Analysis

Choosing the right car insurance policy can significantly impact your financial well-being in the event of an accident. Understanding the different coverage options and comparing prices from various insurers is crucial for making an informed decision. This analysis provides a breakdown of typical coverage, price comparisons, and factors influencing premiums.

Typical Car Insurance Coverage Options

Car insurance policies typically offer several coverage types. Liability coverage protects you financially if you cause an accident resulting in injuries or property damage to others. Collision coverage pays for repairs to your vehicle following an accident, regardless of fault. Comprehensive coverage protects against damage to your vehicle from non-collision events, such as theft, vandalism, or weather-related incidents. Understanding these distinctions is key to selecting appropriate coverage levels.

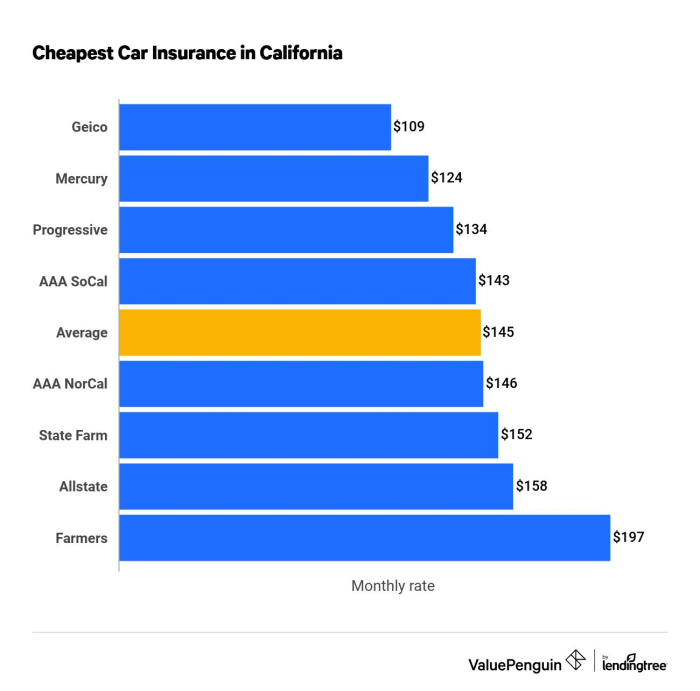

Pricing Structures of Top-Rated Car Insurance Companies

To illustrate pricing variations, let’s consider three hypothetical top-rated companies: Insurer A, Insurer B, and Insurer C. We will analyze premiums for a standard driver profile: a 35-year-old with a clean driving record, driving a mid-size sedan in a suburban area. The following table presents estimated annual premiums for different coverage levels. Note that these are illustrative examples and actual premiums will vary based on individual circumstances.

| Coverage | Insurer A | Insurer B | Insurer C |

|---|---|---|---|

| Liability Only ($100,000/$300,000) | $500 | $450 | $550 |

| Liability + Collision | $800 | $750 | $900 |

| Liability + Collision + Comprehensive | $950 | $900 | $1050 |

Factors Influencing Car Insurance Premiums

Several factors significantly influence car insurance premiums. Your driving record plays a crucial role; accidents and traffic violations typically lead to higher premiums. The type of vehicle you drive also matters; sports cars and luxury vehicles generally command higher premiums due to their higher repair costs and greater risk of theft. Your location is another key factor; areas with higher accident rates tend to have higher insurance premiums. Other factors include age, credit score, and the amount of coverage selected. For example, a driver with multiple speeding tickets will likely pay more than a driver with a clean record, and someone living in a high-crime area may pay more than someone in a safer neighborhood. Furthermore, choosing higher coverage limits (e.g., higher liability limits) will naturally increase the premium.

Illustrative Scenarios

Understanding how insurance claims are processed is crucial for navigating unexpected events. The following scenarios illustrate the typical steps involved in filing and settling home and auto insurance claims.

Home Insurance Claim: Fire Damage

Imagine a house fire caused by a faulty electrical appliance. The fire causes significant damage to the structure, requiring extensive repairs. The homeowner, let’s call her Sarah, immediately contacts her home insurance provider to report the incident. Sarah will likely need to provide details such as the date and time of the incident, the cause of the fire (if known), and a description of the damages. The insurance company will then assign an adjuster to assess the damage. The adjuster will inspect the property, taking photographs and documenting the extent of the damage. Sarah will need to provide supporting documentation, such as receipts for any temporary housing expenses, and potentially cooperate with fire investigators. Once the assessment is complete, the insurance company will determine the amount of the claim based on the policy coverage and the extent of the damage. The payout will typically cover the cost of repairs or rebuilding the house, up to the policy’s coverage limit. This might also include coverage for temporary living expenses and the replacement of damaged personal belongings, depending on the policy’s specifics. Sarah can expect a relatively smooth process if she provides all necessary documentation promptly and cooperates fully with the adjuster. However, disagreements over the extent of the damage or the value of lost belongings could lead to negotiations or, in rare cases, litigation.

Car Accident and Insurance Claim

Consider a scenario where John is involved in a car accident. Another driver, let’s call him Mark, runs a red light and collides with John’s car. Both drivers are unharmed, but both vehicles sustain considerable damage. John immediately calls the police to report the accident and obtain a police report, a crucial document for the insurance claim. He then contacts his car insurance company and provides details of the accident, including the date, time, location, and the other driver’s information. John’s insurer will likely initiate an investigation and assign an adjuster to assess the damage to his vehicle. It’s important that John gathers all relevant information from Mark, including his insurance details and contact information. Both drivers’ insurance companies will likely communicate to determine fault and liability. If Mark is deemed at fault, his insurance company will be responsible for covering the cost of repairs to John’s vehicle. However, if John shares some responsibility, his insurance company might handle the claim under his collision coverage, potentially resulting in an increase in his premiums. John should keep detailed records of all communication with both insurance companies, repair estimates, and any other relevant documentation. The settlement process may involve negotiations between the insurance companies, and potentially, independent appraisals if the value of the damage is disputed.

Role of Independent Adjusters

Independent adjusters are third-party professionals hired by insurance companies or directly by policyholders to assess damage and determine the value of insurance claims. They provide an unbiased evaluation of the loss, acting as an intermediary between the insurance company and the policyholder. Their role is particularly crucial in complex claims involving significant damage or disputes over liability. Independent adjusters conduct thorough investigations, reviewing documentation, inspecting damaged property, and interviewing witnesses. They then prepare detailed reports that include their findings and recommendations regarding the claim settlement. Their involvement can help expedite the claims process and reduce the potential for disputes, as their assessment is often considered objective and impartial. Independent adjusters are especially valuable in situations where the insurance company’s in-house adjusters might have a conflict of interest or when the damage is extensive and requires specialized expertise. They ensure a fair and transparent assessment of the loss, promoting a smoother and more efficient claims settlement process.

Last Recap

Securing adequate home and car insurance involves careful consideration of multiple factors. This guide has highlighted key aspects, including coverage options, pricing structures, customer satisfaction, and the critical role of a company’s financial strength. By using the information provided, you can make an informed decision that aligns with your specific needs and budget, providing you with the confidence of comprehensive protection.

FAQ Compilation

What is the difference between liability and comprehensive car insurance?

Liability insurance covers damages or injuries you cause to others. Comprehensive insurance covers damage to your own vehicle from events like theft or weather.

How often should I review my insurance policies?

It’s recommended to review your policies annually, or whenever there’s a significant life change (e.g., new home, new car, marriage).

What factors affect my home insurance premium?

Factors include your home’s location, age, value, construction materials, and the amount of coverage you choose.

Can I bundle my home and car insurance?

Yes, many companies offer discounts for bundling home and auto insurance policies.

What should I do immediately after a car accident?

Ensure everyone is safe, call emergency services if needed, exchange information with the other driver, and contact your insurance company.