Choosing the right home insurance can feel overwhelming, but understanding your options is key to securing your most valuable asset. This guide delves into Sainsbury’s home insurance offerings, providing a detailed analysis of their policies, pricing, customer experiences, and the benefits of integrating with other Sainsbury’s Bank services. We’ll explore the various coverage options, compare them to competitors, and highlight both the advantages and potential drawbacks to help you make an informed decision.

From building and contents insurance to the claims process and customer service, we aim to provide a clear and comprehensive overview of Sainsbury’s home insurance. We’ll also address frequently asked questions to ensure you have all the information needed to confidently choose the right policy for your needs and budget.

Policy Coverage and Exclusions

Sainsbury’s home insurance offers various policy types, each designed to provide a specific level of protection for your property and belongings. Understanding the coverage details and limitations is crucial for making an informed decision and ensuring you’re adequately protected. This section Artikels the key coverage areas and common exclusions to help you better comprehend your policy.

Sainsbury’s home insurance policies typically cover building damage, contents damage, and liability. Building cover protects the physical structure of your home against events such as fire, flood, and storms. Contents cover protects your personal possessions within the home from similar perils. Liability cover protects you financially if someone is injured or their property is damaged on your premises. The specific extent of this coverage varies depending on the chosen policy level – a comprehensive policy will offer broader protection than a more basic one. It is essential to carefully review your policy documents to understand the precise limits and conditions of your coverage.

Building and Contents Coverage Details

Building insurance typically covers damage to the structure of your home, including walls, roof, and foundations, caused by insured events. Contents insurance protects your personal belongings inside your home, such as furniture, clothing, and electronics. Policies often include options to increase coverage limits for high-value items. Specific exclusions, however, apply to both building and contents cover, as detailed below.

Common Exclusions in Sainsbury’s Home Insurance

Several common events or circumstances are generally excluded from Sainsbury’s home insurance policies. These exclusions are designed to manage risk and prevent the insurer from bearing responsibility for losses that are considered preventable or beyond the scope of typical home insurance. Understanding these exclusions is crucial to avoid unexpected claim rejections.

Implications of Exclusions for Policyholders

The presence of exclusions means that certain types of damage or loss will not be covered by your insurance policy, even if caused by an insured event. This could leave you financially responsible for significant repair or replacement costs. For instance, if your policy excludes damage caused by subsidence and your home suffers foundation damage due to ground movement, you will be responsible for the costs associated with the repairs. Therefore, it is vital to carefully review the policy wording and understand what is and isn’t covered.

Scenarios Leading to Claim Rejection

Understanding the circumstances under which a claim might be rejected can help policyholders avoid disappointment and financial burden. Here are some common examples:

- Damage caused by gradual wear and tear (e.g., a worn-out roof that leaks).

- Damage caused by neglect or failure to maintain the property (e.g., failing to clear blocked gutters leading to water damage).

- Damage caused by intentional acts (e.g., deliberate vandalism by the policyholder).

- Loss or damage caused by events specifically excluded in the policy wording (e.g., damage caused by flooding in areas designated as high-risk flood zones if this risk wasn’t explicitly covered).

- Failure to comply with policy conditions (e.g., not informing Sainsbury’s of a significant alteration to the property).

- Claims exceeding the policy’s sum insured (e.g., attempting to claim more than the stated building or contents cover).

Claims Process and Customer Service

Making a claim with Sainsbury’s Home Insurance is designed to be straightforward, aiming for a smooth and supportive experience for customers. The process involves several key steps, and Sainsbury’s provides customer service channels to assist throughout. The overall success of a claim depends on factors such as the validity of the claim, the completeness of the provided information, and adherence to the policy terms and conditions.

Sainsbury’s aims to provide a responsive and helpful customer service experience. However, individual experiences can vary depending on the complexity of the claim and the specific circumstances. While many customers report positive interactions, some may encounter longer wait times or challenges in resolving certain issues. Transparency and clear communication are key aspects of a successful claim process.

Claim Filing Procedure

Filing a claim with Sainsbury’s Home Insurance follows a structured process. It’s crucial to follow these steps to ensure a timely and efficient resolution.

Contact Sainsbury’s Home Insurance directly via phone or online. This is the initial step to report your incident.

Provide detailed information about the incident, including date, time, location, and a description of the damage or loss. Accurate and comprehensive information is vital for a smooth claim process.

Sainsbury’s may request supporting documentation, such as photos or videos of the damage, police reports (if applicable), and receipts for any related expenses. Gathering this evidence beforehand will expedite the process.

A claims adjuster will be assigned to assess the claim. They will contact you to schedule an inspection or further discuss the details of your claim.

Once the assessment is complete, Sainsbury’s will provide a decision on your claim. This will include details of the payout, if approved, or reasons for rejection, if applicable.

Customer Service Channels and Support

Sainsbury’s offers various channels for customers to contact them regarding their home insurance claims. These options allow customers to choose the method most convenient for them.

These channels include phone support, online portals for claim updates and communication, and potentially email correspondence. The availability and responsiveness of these channels can influence the overall customer experience.

Examples of Claim Resolutions

Successful claim resolutions often involve straightforward incidents with clear evidence of damage and adherence to policy terms. For example, a successful claim might involve a burst pipe causing water damage, where the customer promptly reports the incident, provides photographic evidence, and cooperates fully with the claims adjuster. The claim is then processed efficiently, and the customer receives compensation for the repairs.

Unsuccessful claim resolutions may arise from incidents not covered by the policy, insufficient evidence, or failure to comply with policy terms. For instance, a claim for damage caused by pre-existing conditions not disclosed during policy application may be rejected. Similarly, a lack of photographic evidence or a delayed reporting of the incident could hinder a successful claim resolution.

Wrap-Up

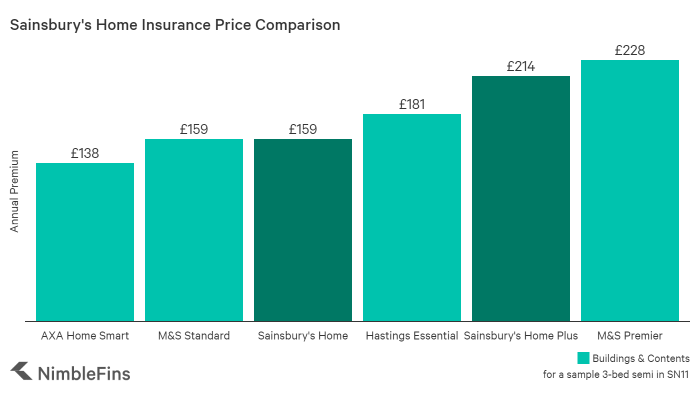

Ultimately, the decision of whether Sainsbury’s home insurance is right for you depends on your individual circumstances and priorities. By carefully considering the policy options, coverage details, pricing structure, and customer feedback Artikeld in this guide, you can make a well-informed choice that provides the protection and peace of mind you deserve. Remember to compare quotes from multiple providers to ensure you’re getting the best value for your money.

Quick FAQs

What types of properties does Sainsbury’s Home Insurance cover?

Sainsbury’s typically covers houses, flats, bungalows, and maisonettes. Specific eligibility criteria may vary; it’s best to check their website or contact them directly.

Does Sainsbury’s offer pet insurance as an add-on?

This would need to be verified on their website or by contacting them directly as add-on options can change.

What is the claims process like? How long does it typically take?

The claims process involves reporting the incident, providing necessary documentation, and cooperating with their investigation. Processing times vary depending on the complexity of the claim but are generally aimed to be resolved efficiently.

Can I get a discount if I bundle my home insurance with other Sainsbury’s products?

Yes, Sainsbury’s often offers discounts to customers who bundle their home insurance with other financial products, such as their bank accounts or credit cards. Check their website for current promotions.