Securing adequate home insurance is a crucial step in protecting your most valuable asset. Understanding the intricacies of home insurance quotes, however, can feel overwhelming. This guide navigates the process, from obtaining quotes to choosing the right policy, empowering you to make informed decisions that safeguard your home and financial well-being.

We’ll demystify the jargon, compare policy features, and provide practical strategies to find the best home insurance quote tailored to your specific needs. Whether you’re a first-time homeowner or a seasoned pro, this resource offers valuable insights to simplify the often-complex world of home insurance.

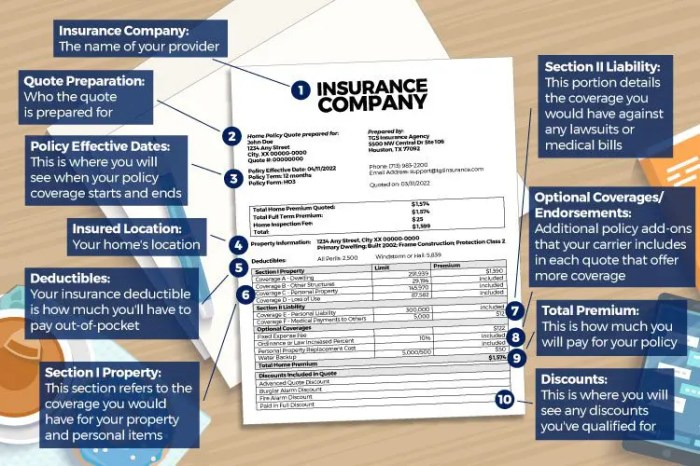

Deciphering Home Insurance Quote Details

Understanding your home insurance quote is crucial to ensuring you have adequate protection. A seemingly complex document, a quote actually contains straightforward information once you know what to look for. This section will guide you through the key elements, enabling you to make an informed decision.

Common Terms and Jargon in Home Insurance Quotes

Home insurance quotes often employ specific terminology. Familiarizing yourself with these terms will significantly improve your comprehension. For example, “Actual Cash Value (ACV)” refers to the replacement cost of your belongings minus depreciation. Conversely, “Replacement Cost Value (RCV)” covers the full cost of replacing damaged items without considering depreciation. “Liability coverage” protects you financially if someone is injured on your property. “Deductible” is the amount you pay out-of-pocket before your insurance coverage kicks in. “Premium” is the amount you pay regularly for your insurance policy. Understanding these core terms is foundational to interpreting your quote.

Understanding Policy Deductibles and Premiums

Your deductible and premium are inversely related. A higher deductible (the amount you pay before your insurance coverage begins) typically results in a lower premium (your regular payment). Conversely, a lower deductible leads to a higher premium. Consider your financial comfort level and risk tolerance when choosing a deductible. For instance, a $1,000 deductible might save you money on premiums but requires you to cover the first $1,000 of any claim. A $500 deductible, while more expensive in premiums, requires a smaller out-of-pocket expense in the event of a claim. The optimal balance depends on individual circumstances.

Scenarios Requiring Different Coverage Levels

Different life stages and property values necessitate varying coverage levels. A young homeowner with a modest mortgage might opt for a standard policy, focusing on basic coverage. However, a homeowner with valuable collectibles or a high-value property might require higher coverage limits to adequately protect their assets. Similarly, those living in high-risk areas, prone to natural disasters, may need supplemental coverage for specific perils such as floods or earthquakes. These added coverages, while increasing premiums, offer crucial protection against significant financial losses.

Comparison of Policy Coverage Limits for Different Types of Property Damage

The following table illustrates examples of coverage limits for various damage types, highlighting potential exclusions and out-of-pocket costs. Remember, these are examples and specific limits and exclusions will vary depending on your insurer and policy.

| Damage Type | Coverage Limit Examples | Policy Exclusions | Potential Out-of-Pocket Costs |

|---|---|---|---|

| Fire Damage | $250,000 – $500,000 (dwelling) | Intentional acts, neglect | Deductible (e.g., $1,000) + any amount exceeding coverage limit |

| Wind Damage | $200,000 – $400,000 (dwelling) | Flood damage (usually requires separate flood insurance) | Deductible + any amount exceeding coverage limit |

| Water Damage (from plumbing) | $10,000 – $25,000 | Flood damage, sewer backup (often requires separate coverage) | Deductible + any amount exceeding coverage limit |

| Theft | $5,000 – $25,000 (personal property) | Items not listed on inventory, certain valuable items requiring riders | Deductible + any amount exceeding coverage limit |

Final Summary

Ultimately, securing the right home insurance quote involves careful consideration of your individual needs, risk profile, and budget. By diligently comparing quotes, understanding policy details, and asking pertinent questions, you can confidently choose a policy that offers comprehensive protection without unnecessary expense. Remember, your home is a significant investment; protecting it requires informed decision-making, and this guide provides the tools to achieve just that.

Essential FAQs

What is a binder in home insurance?

A binder is a temporary insurance policy providing immediate coverage while you wait for your full policy to be issued. It typically lasts for a short period (e.g., 30 days).

Can I get a quote without providing my social security number?

While some insurers may request your SSN for a complete quote, many allow you to obtain preliminary quotes with limited personal information. However, providing your SSN usually leads to a more accurate quote.

What happens if I make a claim and my deductible is higher than the repair cost?

If your deductible exceeds the repair cost, you’ll likely be responsible for the entire cost, and filing a claim might not be financially beneficial.

How often should I review my home insurance policy?

It’s advisable to review your home insurance policy annually, or whenever there’s a significant change in your home’s value, risk factors, or your financial situation.