Finding the right home insurance can feel overwhelming. With a myriad of providers and policy options, securing adequate coverage at a competitive price requires careful consideration. This guide navigates the complexities of obtaining a quote for home insurance, empowering you to make informed decisions and protect your most valuable asset.

We’ll explore the factors influencing your quote, from your home’s location and value to its age and security features. We’ll also detail the various methods for obtaining quotes – online, by phone, or through an agent – comparing their respective advantages and disadvantages. Ultimately, this guide aims to equip you with the knowledge necessary to confidently compare quotes and choose a policy that best suits your needs and budget.

Finding and Comparing Home Insurance Quotes

Securing the best home insurance policy involves careful consideration and comparison of quotes from various providers. Understanding the different methods for obtaining quotes and effectively comparing them is crucial to finding the right coverage at the right price. This section will Artikel the process of obtaining and comparing home insurance quotes, highlighting the advantages and disadvantages of each method.

Methods for Obtaining Home Insurance Quotes

Consumers can obtain home insurance quotes through three primary methods: online quote tools, over the phone, and through an insurance agent. Each method offers distinct advantages and disadvantages that should be carefully weighed before choosing a method. Online quote tools provide a quick and convenient way to compare quotes from multiple insurers simultaneously. Phone quotes allow for direct interaction with an insurance representative, facilitating clarification of policy details and personalized recommendations. Working with an insurance agent offers a more comprehensive and personalized service, including assistance with policy selection and claims management.

Obtaining a Home Insurance Quote Online: A Step-by-Step Guide

The online process for obtaining a home insurance quote is generally straightforward and user-friendly. The specific steps may vary slightly depending on the insurer, but the general process typically involves the following:

- Visit the Insurer’s Website: Navigate to the website of the home insurance provider you are interested in.

- Locate the Quote Tool: Most insurers prominently feature a “Get a Quote” or similar button on their homepage.

- Provide Required Information: You will be asked to provide details about your property, such as its address, square footage, age, and construction materials. You will also need to provide information about yourself and your coverage preferences.

- Review and Submit: Carefully review the information you’ve provided to ensure accuracy. Once you are satisfied, submit your request.

- Receive Your Quote: The insurer will usually provide your quote instantly or within a short period. This quote will detail the coverage options, premiums, and any applicable deductibles.

Online Quote Tools vs. Insurance Agents

| Feature | Online Quote Tools | Insurance Agents |

|---|---|---|

| Convenience | High; readily accessible 24/7 | Moderate; requires scheduling appointments |

| Speed | High; often provides instant quotes | Moderate; quote generation may take some time |

| Personalization | Low; limited ability to tailor coverage | High; allows for customized policy design |

| Cost | Generally free to obtain quotes | May charge fees for their services, although some do not |

| Complexity | Suitable for simple needs; may lack nuance for complex situations | Handles complex situations effectively; can navigate policy details |

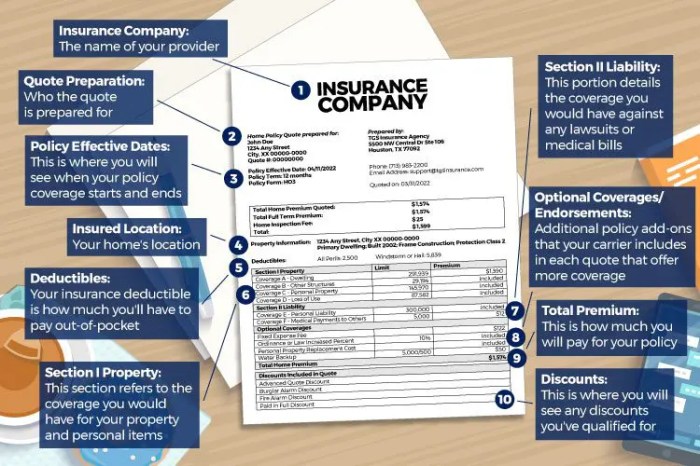

Comparing Multiple Home Insurance Quotes

Once you have obtained several quotes from different providers, it is crucial to compare them carefully. Focus on more than just the premium; consider the level of coverage, deductibles, and any additional features offered. For example, compare policies with similar coverage limits to ensure a fair comparison. Look for any exclusions or limitations in the policy wording. Consider factors like the insurer’s financial stability and customer service ratings. Using a spreadsheet or comparison chart can greatly assist in organizing and analyzing the information. This will allow for a more informed decision, ensuring you select a policy that meets your needs and budget.

Final Thoughts

Obtaining a quote for home insurance is a crucial step in protecting your home and financial well-being. By understanding the factors that influence premiums, employing effective comparison strategies, and leveraging money-saving tips, you can secure comprehensive coverage without breaking the bank. Remember to carefully review policy details, paying close attention to coverage types, deductibles, and exclusions, to ensure the policy aligns perfectly with your specific requirements. Take control of your home insurance journey and secure the peace of mind you deserve.

FAQ Insights

What is a home insurance deductible?

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums.

How often can I get a home insurance quote?

You can request quotes as often as needed, especially if your circumstances change (e.g., home improvements, changes in risk factors).

What if I have a claim? How does that affect future quotes?

Filing a claim can impact future premiums. The severity and frequency of claims are key factors considered by insurance companies.

Can I bundle my home and auto insurance?

Yes, bundling often leads to significant discounts from many insurers.

What documents do I need to get a home insurance quote?

Typically, you’ll need your address, home value estimate, and details about your property (age, features, etc.).