In the aftermath of a car accident, the physical and emotional toll can be significant. Financial burdens can quickly compound these issues, making Personal Injury Protection (PIP) a critical coverage to understand. This guide delves into the intricacies of PIP, empowering you to navigate the claim process effectively and secure the compensation you deserve.

Understanding PIP Coverage

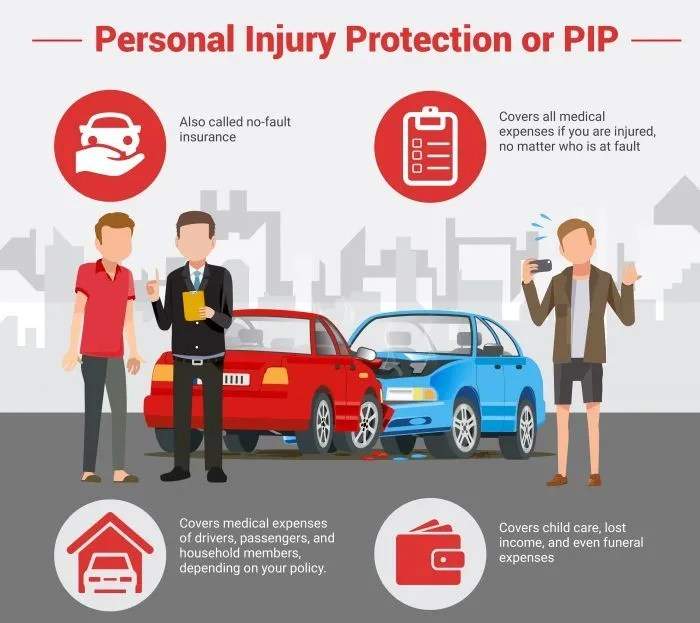

PIP, also known as no-fault insurance, serves as a financial safety net for individuals injured in car accidents. Regardless of who caused the accident, PIP coverage helps defray medical expenses, lost wages, and other accident-related costs. Similar to the Endangered Species Act’s protection of vulnerable wildlife, PIP safeguards individuals from financial hardship following an accident. By ensuring access to necessary resources, PIP promotes a smoother recovery and minimizes financial stress.

Eligibility and Requirements

PIP coverage typically extends to anyone sustaining physical injuries in a car accident, encompassing drivers, passengers, pedestrians, and cyclists. To receive benefits, you’ll need to file a claim with your insurance company within a specific timeframe following the accident. Specific requirements and procedures vary by state and insurance policy, so familiarizing yourself with these details is crucial.

Covered Expenses and Limitations

PIP benefits come with limitations and deductibles that dictate the maximum coverage amount and your out-of-pocket responsibility before coverage kicks in.

- Limits: PIP policies establish maximum coverage amounts for medical expenses, lost wages, and other covered costs. These limits vary by state and insurer. A policy with a $50,000 limit, for instance, signifies a maximum reimbursement of $50,000 for eligible expenses.

- Deductibles: A deductible represents the initial out-of-pocket expense you must cover before PIP coverage applies. Deductible amounts also vary by state and insurer, ranging from $0 to several thousand dollars. For example, a $1,000 deductible requires you to pay the first $1,000 of eligible expenses before PIP starts reimbursing you.

Required Documentation

To ensure a smooth claim process, gather the following documentation:

- Proof of Identity: Valid government-issued ID (driver’s license, passport, etc.)

- Proof of Insurance: Your insurance policy information

- Medical Records: Detailed medical records documenting your injuries and treatment

- Police Report (if applicable): A copy of the official police report

The Claim Process: A Step-by-Step Guide

Filing a PIP claim involves a structured process. Following these steps will ensure a smooth and efficient experience:

- Step 1: Prompt Notification: Contact your insurance company as soon as possible after the accident, adhering to the timeframe outlined in your policy. Provide details like the date, time, location, and parties involved in the accident.

- Step 2: Gather Documentation: Collect medical bills, receipts, and other relevant documentation that supports your claim. This includes medical records, proof of lost income (paystubs, etc.), and any other expenses incurred due to the accident (e.g., transportation costs to medical appointments).

- Step 3: Claim Form Completion: Obtain a claim form from your insurance company and fill it out accurately. Provide detailed information about the accident, your injuries, and the expenses you’ve incurred. Attach copies of your supporting documentation.

- Step 4: Claim Submission: Submit the completed claim form and supporting documents to your insurance company. Submission options typically include online portals, mail, or in-person delivery.

- Step 5: Review and Approval: Your insurance company will review your claim and supporting evidence to determine if it meets their policy requirements. If approved, they will issue payment for covered expenses, up to the policy limits.

- Step 6: Appeal Process (Optional): In the event of a claim denial, you have the right to appeal the decision. Contact your insurance company and follow the appeals process outlined in your policy.

Dispute Resolution: Navigating Denials

A denied PIP claim can be frustrating. However, understanding your rights and options empowers you to navigate the situation effectively.

-

Initial Contact and Review Request: If your claim is denied, contact your insurance company and request a review of the decision. You can also submit additional evidence to bolster your claim.

-

Alternative Dispute Resolution Options: If a resolution cannot be reached with your insurance company, you have several options:

- State Insurance Department Complaint: File a complaint with your state’s insurance department if you believe your insurer violated policy terms or state laws.

- Legal Representation: Consider hiring an attorney to represent you and navigate the legal process, potentially including court appearances.

- Lawsuit:As a last resort, you can file a lawsuit against your insurance company if you believe they wrongfully denied your claim. This option should be carefully considered due to the potential time and financial investment involved.

Beyond Car Accidents: The Broader Significance of PIP

Personal Injury Protection extends beyond car accidents, offering valuable insights into various legal contexts:

-

Environmental Protection: While PIP safeguards individuals financially, it also indirectly promotes environmental well-being. Environmental Impact Assessments, which evaluate the potential environmental consequences of projects, resonate with the spirit of PIP. By understanding the environmental impact of our actions, we can minimize risks and protect our planet, potentially reducing car accidents and injuries in the long run.

-

Environmental Regulations and Compliance: PIP aligns with the concept of Environmental Auditing and Compliance measures, which ensure vehicles meet emission standards and minimize their environmental footprint. By promoting responsible practices, both PIP and environmental regulations contribute to a cleaner and healthier environment, benefiting everyone on the road.

-

International Environmental Law: PIP’s focus on protecting individuals from financial burdens after accidents parallels International Environmental Law’s mission to safeguard the planet and its inhabitants from pollution and other environmental hazards. Understanding these connections highlights the multifaceted nature of law and its role in ensuring our collective well-being.

Car Accident Compensation and Additional Considerations

While PIP plays a crucial role in car accident compensation, it’s not the only factor to consider. Here’s a brief overview of related concepts:

-

Car Accident Compensation: Car accident compensation encompasses various avenues for recouping losses, including PIP coverage, bodily injury liability coverage from the at-fault driver’s insurance, and potential lawsuits against the at-fault party.

-

Fault-Based vs. No-Fault Systems: Car insurance operates under two primary systems: fault-based and no-fault. In a fault-based system, the at-fault driver’s insurance is responsible for covering the victim’s damages. No-fault systems, where PIP comes in, allow individuals to seek compensation from their own insurance company regardless of fault.

Closure: Your Guide to a Secure Future

By equipping yourself with a thorough understanding of Personal Injury Protection (PIP), you’ll be better prepared to handle any unfortunate events on the road. Remember:

- Know Your Coverage: Familiarize yourself with the details of your PIP coverage, including limits, deductibles, and covered expenses.

- Prompt Claim Filing: Don’t delay; report the accident and file your PIP claim as soon as possible after the accident.

- Gather Documentation: Maintain meticulous records of medical bills, lost wages, and other accident-related expenses.

By following these steps and wielding the knowledge gleaned from this guide, you can navigate the PIP claim process confidently and ensure you receive the financial support you deserve during a challenging time. Drive safely, and stay informed!

Detailed FAQs

To provide even more clarity, here are some frequently asked questions regarding PIP:

Q: What specific expenses does PIP typically cover?

A: PIP coverage typically covers medical expenses (doctor visits, hospital stays, medications, etc.), lost wages due to the accident, and replacement services (e.g., childcare or housekeeping if you’re unable to perform these tasks due to your injuries).

Q: Who is eligible for PIP coverage?

A: PIP coverage generally extends to drivers and passengers of insured vehicles, regardless of fault. In some states, pedestrians and cyclists involved in car accidents may also be eligible for PIP benefits.

Q: How long do I have to file a PIP claim?

A: The timeframe for filing a PIP claim varies by state. It’s crucial to consult your insurance policy and state regulations to determine the specific deadline in your jurisdiction. Generally, it’s best to file your claim as soon as possible after the accident.

Q: Can I be denied PIP coverage if I was partially at fault for the accident?

A: PIP is a no-fault insurance, so your eligibility for benefits shouldn’t be impacted by whether you were partially at fault for the accident. However, the specific rules regarding fault and PIP coverage may vary by state, so consulting your policy and state laws is recommended.

By understanding these details and the information outlined in this guide, you’ll be well-equipped to navigate the intricacies of Personal Injury Protection and ensure you receive the financial support you deserve after a car accident.