Securing adequate home insurance is a crucial step in protecting your most valuable asset. The process, however, can often feel overwhelming. Fortunately, the advent of online home insurance quotation systems has revolutionized the way homeowners find and compare coverage options. This guide delves into the intricacies of online home insurance quotations, exploring everything from consumer search behavior to the features and functionality of these increasingly popular platforms.

We’ll examine how consumers navigate the online landscape to find the best home insurance deals, analyzing competitor websites and identifying best practices for user experience. We’ll also explore the benefits of online quotation systems, including speed, convenience, and cost-effectiveness, while addressing potential concerns about data security and privacy. By the end, you’ll have a comprehensive understanding of how to leverage online tools to secure the right home insurance coverage for your needs.

Understanding Consumer Search Intent for “Online Home Insurance Quotation”

Consumers searching for “online home insurance quotation” are driven by a variety of needs and motivations, all stemming from a desire for a quick, convenient, and potentially cost-effective way to secure home insurance. This search reflects a proactive approach to managing risk and financial protection.

Understanding the motivations behind these searches is crucial for insurance providers to effectively tailor their online offerings and marketing strategies. The search itself reveals a specific stage in the customer journey, indicating a readiness to compare options and potentially purchase a policy.

Motivations Behind Searching for Online Home Insurance Quotes

Several key motivations drive consumers to seek online home insurance quotes. These include a desire for price comparison, convenience, speed, and a greater sense of control over the process. Many individuals are actively seeking the best value for their money, comparing premiums and coverage options from multiple providers simultaneously. The ease and accessibility of online platforms also significantly influence their decision to search online.

Stages of the Customer Journey

The search for an online home insurance quotation typically represents a stage of active consideration within the broader customer journey. This can be broken down into several phases: awareness (recognizing the need for insurance), consideration (researching options and comparing quotes), decision (selecting a provider and policy), and action (purchasing the policy). The online quote search falls squarely within the consideration and, often, the decision-making stages. Consumers at this point are actively engaged in comparing offers and weighing their options.

Factors Influencing the Choice of Online Quote Provider

The choice of an online quote provider is influenced by a range of factors. These include the perceived ease of use of the website or application, the reputation and trustworthiness of the provider, the breadth and clarity of the information provided, the speed and efficiency of the quote generation process, and the level of customer support offered. Consumers often prioritize websites with user-friendly interfaces, transparent pricing, and positive customer reviews. The ability to easily compare policies side-by-side is also a significant factor.

User Personas and Their Needs

Several user personas can be identified, each with unique needs and priorities when seeking online home insurance quotes.

For example, a first-time homebuyer (Persona A) might prioritize ease of understanding and comprehensive explanations of coverage options. They may need more hand-holding and readily available customer support. In contrast, a busy professional (Persona B) might value speed and efficiency above all else, seeking a quick and straightforward quote generation process with minimal paperwork. A financially savvy individual (Persona C) will likely focus on price comparison and value for money, actively seeking the lowest premium while ensuring adequate coverage. Finally, a risk-averse homeowner (Persona D) may prioritize comprehensive coverage and the reputation of the insurance provider above price, seeking a provider with a strong track record and positive customer reviews. Understanding these diverse needs is critical for tailoring online quote experiences to resonate with different target audiences.

Closure

The ease and efficiency of online home insurance quotation represent a significant advancement in the insurance industry. By understanding consumer behavior, optimizing website design, and addressing potential pain points, providers can enhance the user experience and empower homeowners to make informed decisions. Ultimately, the ability to quickly and easily compare quotes online empowers consumers with the knowledge and control they need to protect their homes effectively and affordably.

FAQ Overview

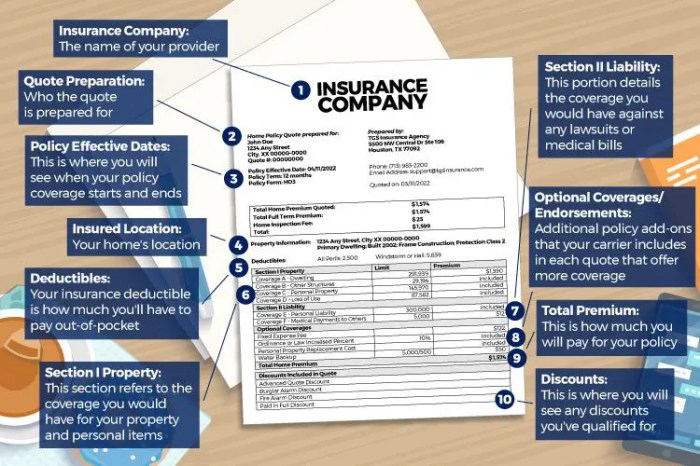

What information will I need to provide for an online home insurance quote?

Typically, you’ll need basic information about your home (address, size, age, construction type), your coverage needs, and your personal details.

Are online home insurance quotes binding?

No, online quotes are generally not binding. They provide an estimate of the cost of insurance based on the information you provide. A final policy price will be confirmed after a full application review.

How secure is my data when I provide it for an online home insurance quote?

Reputable insurers use robust security measures to protect your data. Look for websites with SSL encryption (https) and privacy policies outlining their data protection practices.

Can I get coverage for specific needs, like flood or earthquake insurance, through an online quote?

Most online platforms allow you to specify your coverage needs, including add-ons for specific risks. However, availability may vary by location and insurer.