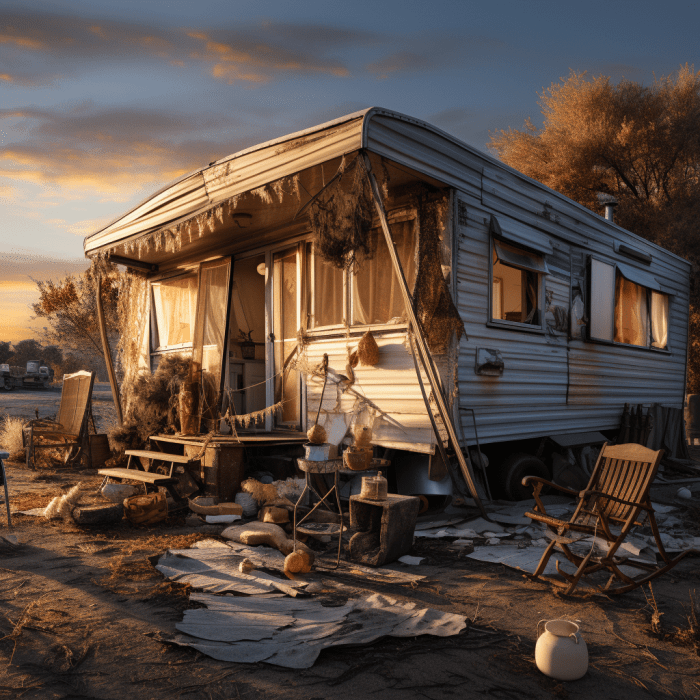

Insuring an older mobile home presents unique challenges compared to newer models. Factors like age, condition, and location significantly impact insurance premiums and coverage options. This guide navigates the complexities of securing adequate protection for your mature mobile home, exploring everything from finding affordable insurance to understanding policy exclusions and maximizing coverage.

We’ll delve into the crucial aspects of older mobile home insurance, examining the key factors influencing premiums, comparing coverage options from different providers, and offering practical strategies for maintaining your home to secure better rates. By understanding the nuances of this specialized insurance market, you can confidently protect your investment and ensure peace of mind.

Understanding Older Mobile Home Insurance

Insuring an older mobile home presents unique challenges compared to insuring a newer model. The age of the home significantly impacts the risk assessment performed by insurance companies, leading to variations in coverage options and premiums. This section will clarify these differences and provide a clearer understanding of the factors involved.

Differences Between Insuring Newer and Older Mobile Homes

Newer mobile homes, generally less than 10 years old, are typically considered lower risk due to their newer construction, updated safety features, and less accumulated wear and tear. Insurance companies often view these homes as less prone to damage from age-related issues, resulting in lower premiums and potentially broader coverage options. Conversely, older mobile homes, especially those over 20 years old, are seen as higher risk due to potential deterioration of materials, outdated building codes, and increased vulnerability to damage from storms or other events. This increased risk translates to higher premiums and potentially more restrictive coverage. The difference in perceived risk directly affects the cost and comprehensiveness of the insurance policy.

Factors Influencing Insurance Costs for Older Mobile Homes

Several key factors contribute to the higher cost of insuring an older mobile home. The age of the home is paramount, but other factors also play a significant role. The condition of the home, including the state of its roof, plumbing, and electrical systems, heavily influences the risk assessment. Location is another critical factor; homes in areas prone to natural disasters like hurricanes, wildfires, or earthquakes will command higher premiums regardless of age. The home’s overall value and the level of coverage desired further influence the cost. Finally, the insurance company’s own risk assessment models and underwriting guidelines will also determine the final premium. For example, a mobile home in a flood zone, even if in excellent condition, will likely have a much higher premium than a similar home in a safer location.

Coverage Options Available for Older Mobile Homes

While coverage options may be more limited for older mobile homes, standard coverage types remain available. These typically include dwelling coverage (covering the structure itself), personal property coverage (protecting the contents within the home), liability coverage (protecting against lawsuits resulting from accidents on the property), and additional living expenses coverage (compensating for temporary housing costs if the home becomes uninhabitable). However, the extent of coverage offered, particularly for dwelling damage, may be less comprehensive or may require higher deductibles for older homes. It is crucial to carefully compare policies from different insurers to find the best coverage at a reasonable price. Some insurers specialize in insuring older mobile homes and may offer more competitive rates and broader coverage than others.

Common Exclusions in Older Mobile Home Insurance Policies

Certain types of damage are often excluded from older mobile home insurance policies, or may be subject to limitations. These exclusions frequently include damage caused by normal wear and tear, gradual deterioration, or settling of the home’s foundation. Coverage for specific perils, such as flooding or earthquakes, might require separate endorsements or may be unavailable altogether depending on the location and the age of the home. Furthermore, policies may exclude damage resulting from improper maintenance or lack of upkeep. It is vital to thoroughly review the policy documents to understand the specific exclusions and limitations before purchasing insurance. For instance, a policy might exclude coverage for roof damage resulting from age-related deterioration, but cover damage from a sudden storm.

Factors Affecting Premiums

Several key factors influence the cost of mobile home insurance, particularly for older models. Insurance companies carefully assess risk to determine appropriate premiums, balancing the potential for claims with the need for fair pricing. Understanding these factors can help you better understand your insurance costs and make informed decisions.

Mobile Home Age and Condition

The age and condition of a mobile home significantly impact insurance premiums. Older mobile homes, especially those showing signs of wear and tear, are considered higher risk due to increased vulnerability to damage from storms, fire, and general deterioration. Factors like roof condition, foundation stability, and the overall structural integrity are carefully evaluated. A mobile home with a newer roof, well-maintained systems, and recent updates will generally command lower premiums than one with significant damage or deferred maintenance. For example, a 15-year-old mobile home in excellent condition might receive a more favorable rate than a 25-year-old home showing signs of significant age and neglect. Insurance companies often require inspections to assess the condition and accurately price the risk.

Location and Climate

Geographic location and prevailing climate conditions are major determinants of insurance costs. Mobile homes situated in areas prone to hurricanes, tornadoes, wildfires, or flooding will typically face higher premiums due to the increased likelihood of damage. Coastal areas, for instance, are generally more expensive to insure than inland locations. Similarly, regions with harsh winters that increase the risk of damage from snow and ice will see higher premiums. A mobile home in a hurricane-prone region might require wind mitigation features to lower the premium, such as hurricane straps or impact-resistant windows. The specific climate data for the location, including historical claims data, is used to assess risk.

Insurance Provider Differences

Premiums for older mobile homes can vary considerably among different insurance providers. Each company uses its own risk assessment models and pricing structures. Some insurers may specialize in insuring older homes, offering more competitive rates for this segment. Others might have stricter underwriting guidelines, resulting in higher premiums or even a refusal to insure older mobile homes altogether. Comparing quotes from multiple insurers is crucial to finding the best rate. It’s recommended to obtain at least three quotes to compare coverage, deductibles, and overall cost before making a decision. Factors such as the insurer’s financial stability and customer service reputation should also be considered alongside price.

Maintaining Your Mobile Home for Better Insurance Rates

Maintaining your older mobile home is crucial not only for your comfort and safety but also for securing more favorable insurance rates. Insurance companies assess risk, and a well-maintained home presents a lower risk of damage or loss, translating to lower premiums. Proactive maintenance demonstrates responsible homeownership, influencing the insurer’s perception of your risk profile.

Regular maintenance significantly reduces the likelihood of costly repairs and insurance claims. By addressing potential problems before they escalate, you minimize the chance of major damage, which can lead to substantial increases in your insurance premiums or even policy cancellation. Investing time and effort in upkeep can result in significant long-term savings on your insurance costs.

Essential Maintenance Tasks for Older Mobile Homes

A proactive approach to maintenance is key to preserving your mobile home’s value and securing lower insurance premiums. This involves regular inspections and timely repairs to prevent minor issues from becoming major problems.

- Roof Inspection and Repairs: Regularly inspect your roof for leaks, missing shingles, or damage from weather. Addressing these issues promptly prevents water damage, a major cause of costly repairs and insurance claims. Consider replacing damaged sections or the entire roof if necessary. A well-maintained roof is a significant factor in lowering insurance risk.

- Foundation and Undercarriage Checks: Older mobile homes are susceptible to foundation issues. Regularly check for cracks, settling, or damage to the undercarriage. Addressing these problems early can prevent more extensive and costly repairs down the line. Proper support and leveling are crucial for structural integrity.

- Plumbing and Electrical System Maintenance: Regularly inspect plumbing for leaks and ensure proper drainage. Check electrical wiring and outlets for damage or loose connections. These systems are prone to failure and can cause significant damage if not maintained properly, leading to increased insurance premiums.

- HVAC System Servicing: Regular servicing of your heating, ventilation, and air conditioning (HVAC) system is crucial. A well-maintained system operates efficiently, reducing energy costs and the risk of breakdowns. Regular filter changes and professional servicing are essential.

- Exterior and Interior Inspections: Regularly inspect the exterior for damage to siding, windows, and doors. Check for signs of pest infestation, such as termites or carpenter ants. Inside, look for signs of water damage, mold, or structural issues.

Impact of Home Improvements on Insurance Premiums

Investing in home improvements can positively impact your insurance premiums. Upgrades that enhance the safety and structural integrity of your mobile home are often viewed favorably by insurance companies. These improvements demonstrate a commitment to responsible homeownership and lower the perceived risk.

- Roof Replacement: Replacing an old, damaged roof with a new, high-quality roof significantly reduces the risk of water damage and can lead to lower premiums.

- Foundation Repair: Repairing foundation issues improves the structural integrity of your home and reduces the risk of damage from settling or shifting. This can lead to a reduction in insurance costs.

- Upgraded Appliances: Replacing older, inefficient appliances with newer, energy-efficient models can reduce the risk of electrical fires and malfunctions, potentially lowering your premiums.

- Improved Security Systems: Installing a security system, including smoke detectors and carbon monoxide detectors, demonstrates a proactive approach to safety and can result in lower insurance rates.

Preventative Measures to Minimize Potential Damage

Taking preventative measures can significantly reduce the likelihood of damage and subsequent insurance claims. These measures demonstrate responsible homeownership and can positively influence your insurance premiums.

- Regular Cleaning of Gutters and Downspouts: Clogged gutters can lead to water damage, so regular cleaning is essential.

- Trimming Trees and Shrubs Away from the Home: Overgrown vegetation can damage the roof or siding during storms.

- Properly Storing Flammable Materials: Storing flammable materials safely reduces the risk of fire.

- Regularly Inspecting Electrical Wiring and Appliances: This helps to prevent electrical fires and malfunctions.

- Protecting Against Pests: Regular pest control helps prevent damage to the structure and contents of your home.

End of Discussion

Protecting your older mobile home requires careful consideration of various factors and a proactive approach to insurance. By understanding the specific challenges associated with insuring older mobile homes, comparing providers, and implementing preventative maintenance, you can secure affordable and comprehensive coverage. Remember, a well-informed decision ensures your investment is adequately protected, providing financial security and peace of mind for years to come.

FAQ

What is the difference between insuring a mobile home and a traditional house?

Mobile homes are considered personal property, not real estate, impacting insurance coverage and claims processes. Insurance policies differ in terms of coverage for the structure itself and its contents.

How can I lower my mobile home insurance premiums?

Regular maintenance, installing safety features (smoke detectors, etc.), improving your home’s security, and bundling insurance policies can all help reduce premiums.

What should I do if my claim is denied?

Review your policy carefully, gather all supporting documentation, and contact your insurance provider immediately to discuss the denial and appeal the decision if necessary.

Are there any government programs that assist with mobile home insurance?

Some states or local governments may offer assistance programs or subsidies for low-income homeowners. Check with your local housing authority or state insurance department.