Navigating the world of life insurance can feel overwhelming, with numerous policy types and complex terminology. Understanding your needs and choosing the right coverage is crucial for securing your family’s financial well-being. This guide provides a comprehensive overview of life insurance, helping you make informed decisions to protect your loved ones.

From exploring the differences between term and whole life insurance to determining the appropriate coverage amount based on your individual circumstances, we’ll break down the essential elements of life insurance planning. We’ll also guide you through the process of finding a reputable provider and understanding policy features, ensuring you feel confident and prepared every step of the way.

Types of Life Insurance

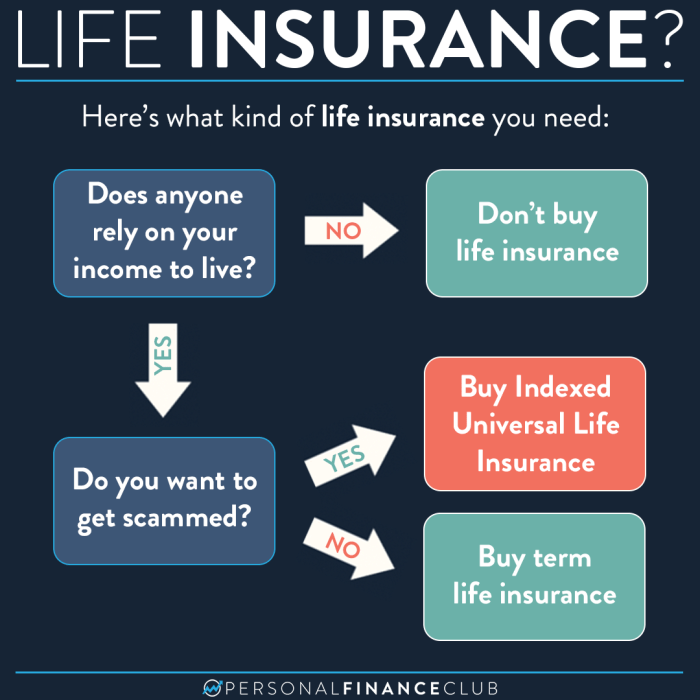

Choosing the right life insurance policy can feel overwhelming, given the variety of options available. Understanding the key differences between the main types is crucial for making an informed decision that aligns with your individual needs and financial goals. This section will Artikel the characteristics of term life, whole life, universal life, and variable life insurance, highlighting their advantages, disadvantages, and ideal applications.

Term Life Insurance

Term life insurance provides coverage for a specific period, or “term,” such as 10, 20, or 30 years. If the policyholder dies within the term, the death benefit is paid to the beneficiaries. If the policyholder survives the term, the coverage expires, and the policy doesn’t have any cash value.

Advantages: Term life insurance is generally the most affordable type of life insurance, making it a good option for those on a budget who need temporary coverage, such as during the years when children are young or a mortgage is outstanding.

Disadvantages: The coverage expires at the end of the term, leaving the policyholder without coverage unless they renew or purchase a new policy, which may be more expensive at an older age. There is no cash value accumulation.

Example: A young couple with a new mortgage might purchase a 30-year term life insurance policy to ensure their mortgage is paid off if one of them dies.

Whole Life Insurance

Whole life insurance provides lifelong coverage, as long as premiums are paid. It also builds cash value that grows tax-deferred over time. This cash value can be borrowed against or withdrawn.

Advantages: Whole life insurance offers lifelong coverage and a cash value component that can be used for various financial needs, such as retirement planning or education expenses.

Disadvantages: Whole life insurance premiums are significantly higher than term life insurance premiums. The cash value growth is generally slower than other investment options.

Example: An individual who wants lifelong coverage and a way to save for retirement might choose a whole life insurance policy.

Universal Life Insurance

Universal life insurance is a type of permanent life insurance that offers flexible premiums and death benefits. Policyholders can adjust their premium payments within certain limits and can also increase or decrease the death benefit. It also builds cash value, though the growth rate can vary.

Advantages: The flexibility in premiums and death benefits allows policyholders to adjust their coverage to meet changing financial needs.

Disadvantages: Universal life insurance can be more complex than term life insurance, and the cash value growth is subject to market fluctuations and the insurer’s performance. Premiums may increase if the cash value falls below a certain level.

Example: A self-employed individual with fluctuating income might find the flexibility of universal life insurance beneficial.

Variable Life Insurance

Variable life insurance is a type of permanent life insurance where the cash value grows based on the performance of the underlying investment options chosen by the policyholder. The death benefit can also increase or decrease depending on the investment performance.

Advantages: The potential for higher cash value growth than other types of life insurance.

Disadvantages: The cash value is subject to market risk, meaning it can lose value. It’s a more complex product requiring a good understanding of investments.

Example: An investor who is comfortable with risk and wants the potential for higher returns might consider variable life insurance.

Comparison of Life Insurance Types

| Feature | Term Life | Whole Life | Universal Life | Variable Life |

|---|---|---|---|---|

| Premium Cost | Low | High | Moderate to High | Moderate to High |

| Death Benefit | Fixed | Fixed | Adjustable | Adjustable |

| Cash Value | None | Yes, grows tax-deferred | Yes, grows at a variable rate | Yes, grows based on investment performance |

| Coverage Period | Specific term | Lifetime | Lifetime | Lifetime |

Determining Your Life Insurance Needs

Choosing the right amount of life insurance is crucial; it ensures your loved ones’ financial security in your absence. This involves a careful assessment of your current financial situation and future projections. Several factors play a significant role in determining your coverage needs.

Factors Influencing Life Insurance Coverage

This section details the key factors that influence the amount of life insurance coverage you should consider.

Income and Expenses

Your current income is a primary factor in determining life insurance needs. The amount of coverage should ideally replace a significant portion of your annual income, allowing your dependents to maintain their lifestyle. Simultaneously, consider your regular household expenses, including mortgage payments, utilities, groceries, and transportation costs. A comprehensive life insurance policy should cover these expenses for a specified period, allowing your family to adapt to the change. For example, a family with an annual income of $100,000 and significant mortgage payments might need a policy that provides a substantial death benefit to cover these expenses for several years.

Debts and Liabilities

Outstanding debts, such as mortgages, loans, and credit card balances, significantly impact your life insurance needs. The death benefit should ideally cover these debts to prevent your family from inheriting them. For instance, a family with a $300,000 mortgage and other outstanding debts would require sufficient coverage to settle these obligations upon the policyholder’s death.

Dependents

The number and ages of your dependents are critical factors. Young children require financial support for education, healthcare, and living expenses until they become self-sufficient. Elderly dependents might also need financial assistance. The longer the dependency period, the higher the life insurance coverage required. A family with three young children might need significantly more coverage than a couple without children.

Calculating Life Insurance Needs

There are two common methods to estimate your life insurance requirements.

Income Replacement Method

This method focuses on replacing a portion of your annual income for a specific period. The formula typically involves multiplying your annual income by a factor (e.g., 7-10) representing the number of years your family would need financial support. For example, if your annual income is $80,000 and you choose a factor of 8, your estimated life insurance need would be $640,000 ($80,000 x 8). This method doesn’t explicitly account for specific debts or other financial obligations.

Needs Analysis Method

The needs analysis method takes a more comprehensive approach. It considers all financial obligations, including debts, funeral expenses, future education costs for children, and ongoing living expenses. This method provides a more precise estimate of your life insurance needs by summing up all these individual financial needs. For example, if a family’s total needs add up to $750,000 after considering all expenses, then a policy with a $750,000 death benefit is necessary.

Step-by-Step Guide to Assessing Life Insurance Requirements

Following these steps helps you determine your personal life insurance needs.

Step 1: List all financial obligations

Compile a comprehensive list of all debts (mortgage, loans, credit cards), anticipated future expenses (children’s education, elder care), and ongoing living expenses.

Step 2: Estimate replacement income needs

Determine how many years your dependents will need financial support. Multiply your annual income by this number to estimate your income replacement needs.

Step 3: Calculate total needs

Add the total of your financial obligations from Step 1 and your income replacement needs from Step 2. This will give you an estimate of your total life insurance needs.

Step 4: Consider inflation

Adjust your calculated needs to account for future inflation. This ensures that the death benefit maintains its purchasing power over time.

Step 5: Review and Adjust Periodically

Regularly review your life insurance coverage to account for changes in your financial situation, family circumstances, and inflation. Significant life events, such as marriage, childbirth, or a major debt acquisition, require reassessment of your insurance needs.

Finding and Choosing a Life Insurance Policy

Securing the right life insurance policy involves careful consideration of several key factors. Understanding your needs and comparing different providers is crucial to making an informed decision that offers the best protection for your loved ones and aligns with your financial situation. This section will guide you through the process of finding and choosing a suitable policy.

Choosing a life insurance provider requires careful evaluation. Several factors influence this critical decision, impacting both the cost and quality of your coverage.

Key Factors in Selecting a Life Insurance Provider

Selecting a life insurance provider requires a thorough assessment of several crucial factors. Financial stability is paramount; you need assurance that the company can meet its obligations when the time comes. Examining a company’s ratings from independent agencies like A.M. Best provides valuable insight into its financial strength. Additionally, strong customer service is essential for a positive experience, especially during the claims process. Finally, carefully review the specific policy features offered, ensuring they align with your individual needs and budget. A comprehensive approach considering these elements will contribute to a confident and well-informed choice.

Comparing Quotes from Multiple Life Insurance Companies

Obtaining quotes from multiple insurers is a straightforward process, yet it’s vital to ensure a fair comparison. Most companies offer online quote tools, allowing for quick comparisons based on your age, health, and desired coverage. However, remember that these are just preliminary estimates. A more detailed application process will follow, and the final premium may vary slightly. It’s recommended to request detailed policy documents from at least three different companies to ensure a comprehensive understanding of coverage details, exclusions, and terms before making a decision. This allows for a side-by-side comparison of the various offerings and their respective benefits.

Questions to Ask Potential Life Insurance Providers

Before committing to a policy, asking pertinent questions is crucial. This ensures clarity on all aspects of the policy, preventing future misunderstandings. Inquiring about the provider’s financial strength and claims process helps assess their reliability. Understanding the policy’s terms, conditions, and any potential exclusions is also essential. Clarifying the renewal process and any potential premium increases provides long-term financial transparency. Finally, confirming the availability of various payment options and any additional rider options allows for customization to fit your specific requirements.

Steps in the Life Insurance Purchasing Process

Purchasing life insurance involves a series of steps. First, determine your life insurance needs by assessing your financial obligations and desired coverage. Next, obtain quotes from multiple insurance providers and compare policy features, premiums, and customer service ratings. Thoroughly review the policy documents and ask clarifying questions to ensure a complete understanding. Then, complete the application process, providing accurate and complete information. After the application is approved (which may include a medical exam), you’ll receive your policy. Finally, review your policy regularly and update it as your life circumstances change.

Understanding Policy Riders and Features

Life insurance policies offer a foundation of financial protection, but their coverage can be enhanced through the addition of riders. These optional add-ons modify the core policy, providing broader protection against specific events or circumstances. Understanding the available riders and their implications is crucial for tailoring a policy to your individual needs and risk profile.

Accidental Death Benefit Rider

This rider provides an additional death benefit payout if the insured dies as a result of an accident. The payout amount is typically a multiple of the policy’s face value (e.g., double or triple the face value). The benefit is paid in addition to the standard death benefit. The cost of this rider varies depending on factors such as age and health. For example, a young, healthy individual might find the cost relatively low, while an older person with pre-existing health conditions might face a higher premium. This rider is beneficial for individuals who want to ensure their family receives extra financial support in the event of an unexpected accidental death.

Terminal Illness Benefit Rider

The terminal illness benefit rider allows the insured to receive a portion or all of the death benefit while still alive if they are diagnosed with a terminal illness. This provides access to funds for medical expenses, end-of-life care, or other financial needs. The definition of “terminal illness” varies by insurer, but generally involves a life expectancy of less than a specified period (e.g., six to twelve months). The cost of this rider is generally higher than other riders due to the significant financial implications it presents to the insurance company. A situation where this rider would be particularly valuable is for an individual diagnosed with a terminal illness who requires extensive medical treatment and wishes to ensure their financial security during this difficult time and potentially lessen the financial burden on their family.

Waiver of Premium Rider

The waiver of premium rider eliminates the need to pay future premiums if the insured becomes totally and permanently disabled. The definition of disability is typically strict and requires documentation from a medical professional. This rider ensures that the life insurance policy remains in force even if the insured can no longer work due to a disabling event, providing continued protection for their beneficiaries. The cost of this rider is typically a small percentage of the premium. For example, a family with young children might find this rider invaluable as it ensures their children will still be provided for, even if a parent becomes disabled and unable to work.

| Rider | Description | Benefits | Potential Implications |

|---|---|---|---|

| Accidental Death Benefit | Pays additional death benefit if death is accidental. | Increased financial protection for beneficiaries in case of accidental death. | Increased premium cost. |

| Terminal Illness Benefit | Provides access to a portion or all of the death benefit if terminally ill. | Access to funds for medical expenses and end-of-life care. | Higher premium cost; specific definition of terminal illness applies. |

| Waiver of Premium | Waives future premiums if the insured becomes totally and permanently disabled. | Continued life insurance coverage without premium payments during disability. | Slightly increased premium cost. |

Managing and Maintaining Your Life Insurance Policy

Securing your life insurance policy is only the first step; ongoing management is crucial to ensure its continued effectiveness and to maximize its benefits for you and your loved ones. This involves understanding your policy, proactively managing premiums, and regularly reviewing your beneficiary designations. Effective policy maintenance protects your financial future and provides peace of mind.

Efficient Premium Payment Strategies

Regular and timely premium payments are essential to keep your life insurance policy active. Missing payments can lead to policy lapse, jeopardizing the financial security you’ve worked to establish. Several strategies can help ensure efficient and effective premium payments. These include setting up automatic payments from your bank account or credit card, which eliminates the risk of missed payments due to oversight. Budgeting for your premium as a regular household expense, similar to rent or utilities, can also help ensure timely payments. Additionally, exploring options like annual or semi-annual payments, if offered by your insurer, might provide a slight cost savings compared to monthly payments. Finally, consider using a dedicated savings account specifically for your life insurance premiums. This ensures the funds are readily available when payments are due.

Beneficiary Information Updates

Keeping your beneficiary information current is paramount. Life circumstances change – marriages, divorces, births, and deaths – and your beneficiary designations should reflect these changes. Failing to update this information can result in unintended consequences, potentially leaving your loved ones without the financial protection you intended to provide. Regularly reviewing and updating your beneficiary information, ideally annually or whenever a significant life event occurs, ensures your policy benefits reach the intended recipients. This simple act safeguards your family’s financial future.

Understanding Your Policy Documents

Your life insurance policy document is a legally binding contract. Understanding its contents is crucial for making informed decisions about your coverage. The policy should clearly Artikel the type of coverage, the death benefit amount, the premium payment schedule, and any exclusions or limitations. Carefully review the policy’s definitions of key terms, such as “beneficiary,” “death benefit,” and “premium,” to ensure a clear understanding of your rights and responsibilities. If any aspect of the policy is unclear, don’t hesitate to contact your insurer for clarification. Consider keeping a copy of your policy in a safe and easily accessible location.

Contacting Your Insurance Provider

Maintaining open communication with your insurance provider is vital. Whether you need to update your beneficiary information, change your payment method, or have questions about your policy’s terms, contacting your provider is straightforward. Most insurers offer various contact methods, including phone, email, and online portals. Utilize the method most convenient for you. When contacting your insurer, be prepared to provide your policy number and any relevant personal information. Keep a record of all communication with your insurer, including dates, times, and the subject of the conversation. This record can be helpful in case of any future disputes or misunderstandings.

Life Insurance and Estate Planning

Life insurance plays a crucial role in comprehensive estate planning, offering a powerful tool to protect your family’s financial future and ensure a smooth transition of assets after your passing. It provides a financial safety net, mitigating potential disruptions and ensuring your wishes are carried out effectively. Understanding how life insurance integrates with your overall estate plan is essential for securing your legacy.

Life insurance can be a valuable asset in managing the complexities of estate administration. It offers a readily available source of funds to address various financial obligations and ensure the well-being of your loved ones.

Estate Tax Coverage and Expense Management

Life insurance proceeds can be strategically utilized to cover estate taxes, potentially preventing the forced liquidation of assets to meet these obligations. This is particularly important for high-net-worth individuals whose estates might otherwise face significant tax burdens. Furthermore, life insurance can provide funds to cover funeral expenses, outstanding debts, and other administrative costs associated with settling an estate, minimizing financial strain on heirs. For example, a policy with a death benefit of $500,000 could easily cover substantial estate taxes and administrative expenses, ensuring that the remaining assets are passed on intact to beneficiaries.

Benefits for Heirs and Beneficiaries

Life insurance provides significant benefits to heirs and beneficiaries, offering financial security and peace of mind during a challenging time. The death benefit can provide a lump sum payment, offering immediate financial relief for expenses such as mortgage payments, college tuition, or business debts. It can also provide ongoing income through annuities or structured settlements, ensuring long-term financial support for dependents. Consider a scenario where a parent leaves behind a young child; a life insurance policy could guarantee that the child receives a regular income stream for their education and living expenses until they reach adulthood. Alternatively, a life insurance policy could provide the funds for a surviving spouse to maintain their current lifestyle without significant financial adjustments.

Benefits of Integrating Life Insurance into an Estate Plan

A well-structured estate plan incorporating life insurance offers several key advantages:

- Liquidity for Estate Settlement: Provides immediate funds to pay estate taxes, debts, and administrative costs, preventing forced asset sales.

- Financial Security for Heirs: Offers a financial safety net for dependents, ensuring their financial well-being after the death of a loved one.

- Protection Against Unexpected Expenses: Covers unforeseen costs associated with death, such as funeral expenses and medical bills.

- Legacy Preservation: Helps maintain family businesses or other significant assets by providing funds to prevent forced sales.

- Tax Advantages: Death benefits from life insurance policies are generally tax-free to beneficiaries, maximizing the amount received.

- Flexibility and Control: Allows for the customization of beneficiary designations and payout options to align with individual needs and wishes.

Illustrative Example: A Young Family’s Needs

Let’s consider the life insurance needs of a young family – Sarah and Mark, both 30 years old, with two young children, ages 3 and 5, and a $300,000 mortgage on their home. Their primary concern is ensuring their children’s financial security and paying off their mortgage should either parent pass away.

This example illustrates how different life insurance options can address the varying financial needs of a young family. We’ll examine the costs and benefits of term life insurance and whole life insurance in this scenario.

Term Life Insurance for the Young Family

Term life insurance offers a death benefit for a specific period, typically 10, 20, or 30 years. For Sarah and Mark, a 20-year term policy would likely cover the mortgage and provide for their children until they reach adulthood. The premiums are generally lower than those for permanent life insurance, making it an affordable option for young families with limited budgets.

A 20-year, $500,000 term life insurance policy might cost Sarah and Mark approximately $50-$100 per month, depending on their health and other factors. The benefit would cover the mortgage, provide funds for the children’s education and living expenses, and offer financial stability for the surviving spouse. If either parent dies within the 20-year term, the death benefit would be paid out. After 20 years, the policy would expire unless renewed, often at a higher premium.

Whole Life Insurance for the Young Family

Whole life insurance provides a lifelong death benefit and builds cash value that grows tax-deferred. While more expensive than term life insurance, it offers long-term financial security and potential benefits beyond the death benefit. For Sarah and Mark, a whole life policy could provide a legacy for their children, ensuring financial support even after the policy’s death benefit is paid out.

A $500,000 whole life insurance policy would likely cost Sarah and Mark significantly more than the term life policy – perhaps $500-$1000 per month or more, depending on the policy features and the insurer. The higher cost reflects the guaranteed lifelong coverage and the cash value accumulation. The cash value can be borrowed against or withdrawn, offering financial flexibility. However, borrowing against the cash value reduces the death benefit.

Cost and Benefit Comparison

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Premium Cost | Lower (e.g., $50-$100/month) | Higher (e.g., $500-$1000/month) |

| Death Benefit | Fixed amount for a specific term | Fixed amount for life |

| Cash Value | None | Accumulates tax-deferred |

| Flexibility | Less flexible | More flexible (borrowing, withdrawals) |

| Suitability for Young Families | Affordability and sufficient coverage for immediate needs | Long-term security and legacy planning |

Financial Protection Illustration

Imagine a scenario where Mark unexpectedly passes away. With a $500,000 term life insurance policy, Sarah receives a lump sum payment. This payment can be used to pay off the $300,000 mortgage, leaving a significant amount to cover living expenses, children’s education, and other future needs. A whole life policy would provide the same death benefit, but the cash value component would offer additional financial resources over time, potentially assisting with college tuition or other long-term goals. The absence of the cash value component in the term life policy necessitates a more detailed financial plan for long-term security. This illustrates the differences in financial security and long-term planning offered by each type of policy.

Closure

Securing your family’s future through life insurance is a significant step towards financial responsibility. By understanding the various policy types, assessing your individual needs, and carefully selecting a provider, you can create a robust financial safety net. Remember, regular review and adjustments are key to ensuring your life insurance coverage remains aligned with your evolving circumstances and goals. Take control of your financial future and protect what matters most.

Detailed FAQs

How often should I review my life insurance policy?

It’s recommended to review your life insurance policy at least annually, or whenever there’s a significant life change (marriage, birth of a child, job change, etc.).

What is a beneficiary, and how do I designate one?

A beneficiary is the person or entity who receives the death benefit from your life insurance policy. The process for designating a beneficiary varies by insurer, but usually involves completing a form provided by your insurance company.

Can I change my beneficiary at any time?

Yes, you can typically change your beneficiary at any time by contacting your insurance provider and completing the necessary paperwork.

What happens if I miss a premium payment?

Missing a premium payment can lead to your policy lapsing, meaning the coverage ends. Most insurers offer grace periods, but it’s crucial to contact them immediately if you anticipate difficulty making a payment.