Navigating the world of Kentucky automobile insurance can feel like driving through a maze, especially with the diverse range of policies, regulations, and factors influencing premiums. This guide aims to illuminate the path, providing a clear understanding of the Kentucky insurance market, its intricacies, and how to make informed decisions to protect yourself and your vehicle.

From understanding the minimum liability requirements and the impact of your driving history on rates, to navigating the claims process and choosing the right coverage, we’ll explore all aspects of Kentucky auto insurance. We’ll also delve into the crucial role of uninsured/underinsured motorist coverage and offer practical advice on obtaining competitive quotes and comparing policies effectively.

Kentucky’s Insurance Market Overview

Kentucky’s automobile insurance market is a significant segment of the state’s economy, reflecting the number of vehicles registered and driven within its borders. Understanding its size, key players, and policy offerings is crucial for both consumers and industry professionals. This overview provides a snapshot of the market’s current state.

Market Size and Scope

The Kentucky automobile insurance market is characterized by a substantial number of insured vehicles and a diverse range of insurance providers. Precise figures fluctuate yearly, but data from the Kentucky Department of Insurance (KDI) and industry reports consistently show a large market share dedicated to auto insurance. This is driven by the state’s population density, economic activity, and the mandatory nature of minimum liability insurance coverage. The market’s overall size is influenced by factors like population growth, vehicle sales, and changes in insurance regulations.

Key Players in the Kentucky Auto Insurance Market

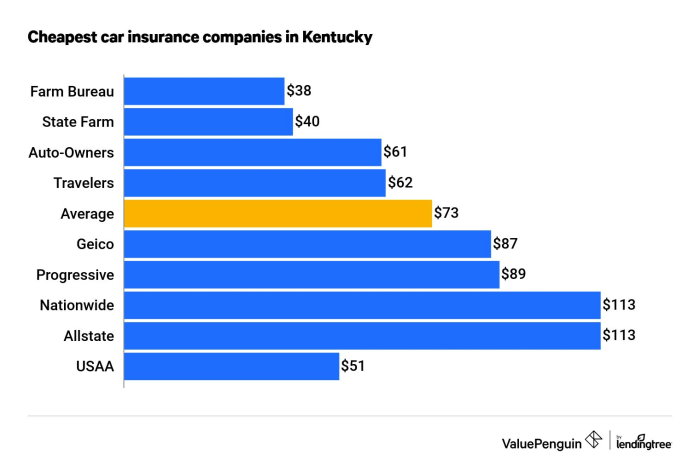

Several major insurance companies dominate the Kentucky auto insurance market. These include national players like State Farm, Geico, Progressive, and Allstate, along with regional and smaller, independent insurers. The competitive landscape ensures a variety of policy options and pricing strategies for consumers. The presence of both large national carriers and smaller regional companies creates a dynamic market environment. Competition among these companies influences premiums and the range of services offered.

Types of Auto Insurance Policies Offered in Kentucky

Kentucky law mandates minimum liability coverage for bodily injury and property damage. Beyond this minimum, drivers can choose from various optional coverages. These include collision coverage (repairing damage to your vehicle in an accident, regardless of fault), comprehensive coverage (covering damage from events like theft, fire, or vandalism), uninsured/underinsured motorist coverage (protecting you if involved in an accident with an uninsured or underinsured driver), and medical payments coverage (covering medical expenses for you and your passengers, regardless of fault). The availability and cost of these optional coverages vary based on individual risk factors and the insurer.

Average Premiums and Claims in Kentucky

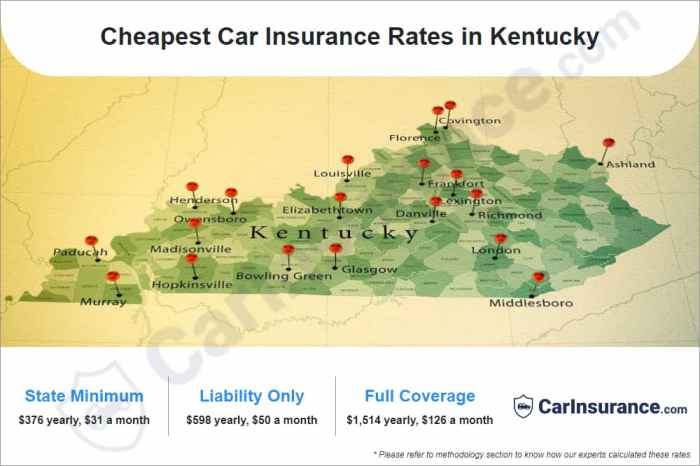

Average auto insurance premiums in Kentucky vary significantly based on factors such as driver age, driving history, vehicle type, location, and the coverage level selected. Data from the KDI and industry analysis often reveal Kentucky’s average premiums compared to national averages. Similarly, claims data shows the frequency and severity of accidents in the state, impacting the overall cost of insurance. These statistics provide valuable insights into the cost of car insurance in Kentucky and help consumers make informed decisions.

| Category | Market Size (Approximate) | Key Players (Examples) | Average Premiums & Claims (Approximate) |

|---|---|---|---|

| Market Scope | Millions of insured vehicles; significant portion of state’s insurance market | State Farm, Geico, Progressive, Allstate, regional insurers | Data varies annually; consult KDI reports for current figures |

Factors Affecting Kentucky Auto Insurance Rates

Several interconnected factors influence the cost of auto insurance in Kentucky. Understanding these elements allows drivers to make informed decisions and potentially lower their premiums. These factors range from personal characteristics to vehicle specifics and geographical location.

Driver Demographics

Age and gender significantly impact insurance rates. Younger drivers, particularly those under 25, generally pay higher premiums due to statistically higher accident rates among this group. Insurance companies view them as higher risk. Similarly, gender can play a role, although this varies between insurance companies and is subject to legal and regulatory scrutiny. Historically, male drivers in certain age brackets have been associated with higher accident rates than their female counterparts, resulting in potentially higher premiums for men. Driving history is paramount; a clean record with no accidents or violations translates to lower premiums, while accidents and traffic violations increase rates considerably, reflecting the increased risk associated with a less-than-perfect driving record. A history of at-fault accidents significantly increases premiums more than minor violations.

Vehicle Type and Value

The type and value of the vehicle insured are key determinants of premium costs. Generally, more expensive vehicles cost more to insure due to higher repair and replacement costs. Sports cars and high-performance vehicles often command higher premiums than sedans or economy cars due to their increased risk profile in accidents and their potential for more expensive repairs. The vehicle’s safety features also play a role; cars with advanced safety technology might qualify for discounts.

Location

Geographic location within Kentucky heavily influences insurance rates. Urban areas tend to have higher premiums than rural areas due to factors such as higher traffic density, increased risk of theft, and higher frequency of accidents. The specific neighborhood within a city can also impact rates; areas with high crime rates or a high number of accidents will typically result in higher premiums. Rural areas generally experience lower rates due to lower traffic congestion and fewer accidents.

Driving Record

A driver’s driving record is a critical factor. Accidents, particularly those where the driver is at fault, lead to significantly higher premiums. The severity of the accident also plays a role; a major accident will increase premiums more than a minor fender bender. Traffic violations, such as speeding tickets or reckless driving citations, also increase rates. The number of violations and their severity directly impact the premium. Multiple violations within a short period indicate a higher risk profile.

Rating Factors Used by Insurance Companies

Insurance companies employ various rating factors to assess risk and determine premiums. These factors are often combined using complex algorithms. While driver demographics, vehicle details, and location are key, other factors might include credit score (in states where it’s permissible), the type of coverage selected (liability, collision, comprehensive), and the driver’s use of the vehicle (commute vs. occasional use). Some companies may also offer discounts for safe driving habits, such as completing defensive driving courses or having telematics devices installed in the vehicle to monitor driving behavior. The specific weighting given to each factor varies among insurance companies.

State Regulations and Laws

Navigating the world of Kentucky auto insurance requires understanding the state’s specific regulations and laws. These rules dictate minimum coverage requirements, the claims process, and dispute resolution methods, ensuring a degree of fairness and protection for both drivers and insurance companies. Failure to comply can lead to significant penalties.

Minimum Liability Coverage Requirements

Kentucky mandates minimum liability insurance coverage for all drivers. This means you must carry a minimum amount of insurance to protect yourself financially if you cause an accident resulting in injury or property damage to others. The current minimums are $25,000 for bodily injury to one person, $50,000 for bodily injury to multiple people in a single accident, and $10,000 for property damage. It is crucial to understand that these are minimums; higher coverage limits offer greater protection against significant financial losses in the event of a serious accident. Many drivers choose to purchase higher liability limits than the state minimum to safeguard their assets.

Filing an Auto Insurance Claim in Kentucky

The process of filing an auto insurance claim in Kentucky typically involves several steps. First, report the accident to the police, particularly if there are injuries or significant property damage. Next, promptly notify your insurance company of the accident, providing all relevant details, including the date, time, location, and parties involved. Your insurance company will then guide you through the claims process, which may involve submitting a claim form, providing supporting documentation (such as police reports and medical records), and cooperating with an adjuster’s investigation. The adjuster will assess the damages and determine the extent of your insurance coverage. Be prepared to provide comprehensive information and documentation to expedite the process.

Resolving Disputes with Insurance Companies

Disputes with insurance companies can arise from various issues, such as claim denials, disagreements over the value of damages, or delays in processing claims. Kentucky offers several avenues for resolving these disputes. Initially, attempt to resolve the issue directly with your insurance company. If this fails, you can file a complaint with the Kentucky Department of Insurance (KDI). The KDI can investigate your complaint and mediate a settlement between you and the insurance company. If mediation is unsuccessful, you may have the option of pursuing legal action, such as filing a lawsuit against the insurance company. It’s advisable to seek legal counsel if you are unable to resolve the dispute through informal means.

Key Legal Aspects of Kentucky Auto Insurance

Understanding the key legal aspects of Kentucky auto insurance is essential for every driver. Here’s a summary:

- Minimum Liability Coverage: $25,000/$50,000/$10,000 (bodily injury/property damage).

- Uninsured/Underinsured Motorist Coverage: Highly recommended to protect against accidents involving uninsured or underinsured drivers.

- Financial Responsibility: Kentucky requires proof of insurance to legally operate a vehicle.

- No-Fault Insurance: Kentucky is an at-fault state, meaning the at-fault driver’s insurance is responsible for damages.

- Compulsory Insurance: Carrying auto insurance is mandatory in Kentucky.

- Dispute Resolution: Options include direct negotiation with the insurer, filing a complaint with the KDI, or pursuing legal action.

Finding and Choosing Auto Insurance in Kentucky

Finding the right auto insurance in Kentucky involves careful comparison and understanding of your needs. The process can seem daunting, but with a systematic approach, you can secure a policy that provides adequate coverage at a competitive price. This section will guide you through the steps involved in finding and selecting the best auto insurance for your circumstances.

Obtaining Quotes from Multiple Insurers

To ensure you’re getting the best possible rate, it’s crucial to obtain quotes from several different insurance companies. This allows you to compare prices and coverage options side-by-side. Start by identifying several reputable insurers operating in Kentucky. You can find this information online through comparison websites or by directly visiting the websites of individual companies. Then, use each company’s online quoting tool, providing accurate information about your vehicle, driving history, and desired coverage levels. Remember to request quotes for similar coverage levels across all companies to ensure a fair comparison. Be prepared to provide documentation such as your driver’s license and vehicle registration information.

Comparing Insurance Policies and Features

Once you have several quotes, carefully compare the policies. Don’t focus solely on price; consider the coverage offered. Pay close attention to liability limits, collision and comprehensive coverage, uninsured/underinsured motorist protection, and any additional features like roadside assistance or rental car reimbursement. A lower premium might not be worthwhile if the coverage is insufficient. Consider your individual risk tolerance and financial situation when making this assessment. For example, a driver with a history of accidents might prioritize higher liability limits, while a driver with an older vehicle might opt for lower collision coverage.

Understanding Policy Terms and Conditions

Before committing to a policy, thoroughly read the terms and conditions. Understand what is and isn’t covered, the deductibles applicable, and any exclusions. Pay close attention to the definitions of key terms, such as “accident,” “damage,” and “covered person.” Don’t hesitate to contact the insurer directly if anything is unclear. Misunderstanding your policy can lead to unexpected costs and disputes later. For instance, a policy might exclude coverage for certain types of damage or accidents, or it might have specific requirements for filing a claim.

Comparison of Policy Features and Costs

| Insurer | Liability Coverage (Limits) | Collision Deductible | Annual Premium |

|---|---|---|---|

| Example Insurer A | $100,000/$300,000 | $500 | $800 |

| Example Insurer B | $250,000/$500,000 | $1000 | $950 |

| Example Insurer C | $100,000/$300,000 | $250 | $1050 |

*Note: These are hypothetical examples and actual premiums will vary based on individual factors.*

Benefits of Seeking Advice from an Independent Insurance Agent

An independent insurance agent can be a valuable resource in the process of finding and choosing auto insurance. These agents work with multiple insurance companies, allowing them to compare policies and find the best fit for your specific needs. They can provide unbiased advice, explain complex policy terms, and help you navigate the process. Their expertise can save you time and potentially money by ensuring you have the appropriate coverage at a competitive price. Furthermore, they can assist with filing claims and managing your policy throughout the year. The guidance of an independent agent can significantly simplify the often confusing world of auto insurance.

Common Kentucky Auto Insurance Claims

Understanding the types of auto insurance claims most frequently filed in Kentucky is crucial for both drivers and insurance providers. This knowledge allows for better risk assessment, more effective claim processing, and ultimately, a smoother experience for everyone involved. The following sections detail common claim types, their handling procedures, and illustrative scenarios.

Collision Claims

Collision claims arise from accidents involving another vehicle or a fixed object, regardless of fault. The process typically involves reporting the accident to the police and your insurance company, providing detailed information about the incident, and cooperating with any investigations. Your insurer will then assess the damage to your vehicle and determine the payout based on your policy coverage and the extent of the damage. This may include repair costs, replacement costs, or a combination of both, minus your deductible.

- Scenario 1: A driver rear-ends another vehicle at a stoplight, causing damage to both cars. This would be a collision claim for both parties involved, and liability would need to be determined to assess fault.

- Scenario 2: A driver loses control of their vehicle and crashes into a tree. This is a collision claim, even though no other vehicle was involved. The driver’s collision coverage would handle the damages.

Comprehensive Claims

Comprehensive coverage protects against damage to your vehicle caused by events other than collisions. This includes things like theft, vandalism, fire, hail, or damage from animals. The claims process is similar to collision claims, starting with reporting the incident to your insurer. They will then assess the damage and determine the payout based on your policy and the extent of damage, minus your deductible.

- Scenario 1: A driver’s car is damaged by a falling tree branch during a storm. This is a comprehensive claim.

- Scenario 2: A vehicle is stolen and later recovered with significant damage. This is also a comprehensive claim. The insurance company will cover the cost of repairs or replacement, less the deductible.

Liability Claims

Liability claims arise when you are at fault for causing an accident that results in damage to another person’s property or injuries to another person. Your liability coverage pays for the damages caused to others, including medical bills, property repairs, and lost wages. The claims process involves investigating the accident to determine fault, assessing the damages, and negotiating a settlement with the injured party or their insurance company. Failure to cooperate with the investigation can impact the outcome of the claim.

- Scenario 1: A driver runs a red light and hits another vehicle, causing injuries to the other driver. This is a liability claim, and the at-fault driver’s liability insurance will cover the medical expenses and other damages of the other driver.

- Scenario 2: A driver backs into a parked car, causing significant damage. This is a liability claim, and the at-fault driver’s liability insurance will cover the cost of repairing the damaged vehicle.

Uninsured/Underinsured Motorist Coverage in Kentucky

Driving in Kentucky, like anywhere, carries inherent risks. One significant risk is the potential for an accident with an uninsured or underinsured driver. Uninsured/underinsured motorist (UM/UIM) coverage is a crucial safety net, protecting you and your passengers from the financial burden of such an incident. This coverage compensates you for injuries and vehicle damage caused by a driver who lacks sufficient insurance or no insurance at all.

Importance of Uninsured/Underinsured Motorist Coverage in Kentucky

UM/UIM coverage is essential because Kentucky, like many states, has drivers who operate vehicles without the legally required minimum insurance or with insufficient coverage to cover significant damages. If you’re involved in an accident with an uninsured driver, your own health insurance might only cover medical bills, leaving you responsible for vehicle repair costs, lost wages, and other expenses. UM/UIM coverage steps in to fill this gap, providing compensation for your losses even when the at-fault driver is uninsured or their insurance limits are inadequate to cover your damages. It’s a critical component of a comprehensive auto insurance policy.

Typical Coverage Limits in Kentucky

Kentucky law doesn’t mandate specific UM/UIM coverage limits, meaning you can choose the coverage amount that best suits your needs and financial situation. However, it’s generally advisable to select limits that are at least equal to your bodily injury liability coverage. Many drivers opt for limits ranging from $25,000 to $100,000 per person and $50,000 to $300,000 per accident for bodily injury, and similar limits for property damage. Higher limits offer greater protection in the event of serious injuries or significant property damage. Consider your assets and potential liabilities when choosing your coverage limits.

Claims Process with an Uninsured Driver

Filing a claim with your insurance company after an accident involving an uninsured driver generally involves these steps: First, report the accident to the police and obtain a copy of the accident report. Next, gather as much information as possible from the other driver, including their name, contact information, driver’s license number, license plate number, and insurance information (if available). Take photos of the damage to both vehicles and document any injuries sustained. Then, contact your insurance company to report the accident and initiate the claims process. They will investigate the accident, assess the damages, and handle the settlement with you, whether it involves medical expenses, vehicle repair, or lost wages.

Protecting Yourself from Uninsured Drivers

Beyond purchasing adequate UM/UIM coverage, several proactive measures can help protect you from uninsured drivers. Always drive defensively, paying close attention to your surroundings and anticipating the actions of other drivers. Maintain a safe following distance and avoid driving in areas known for a high concentration of uninsured drivers. Consider installing a dashcam to provide visual evidence in case of an accident. Regularly review and update your insurance policy to ensure your UM/UIM coverage limits remain appropriate for your needs.

Scenario: Uninsured Motorist Coverage in Action

Imagine Sarah, a Kentucky resident, is stopped at a red light. An uninsured driver runs a red light, rear-ending Sarah’s car. The impact causes significant damage to Sarah’s vehicle and results in whiplash and other injuries requiring extensive medical treatment and physical therapy. The uninsured driver admits fault, but has no insurance to cover Sarah’s medical bills, lost wages, or vehicle repairs. Fortunately, Sarah has UM/UIM coverage with limits of $100,000/$300,000. Her insurance company steps in, covers her medical expenses, lost wages, and the cost of repairing her vehicle, up to her policy limits. Without UM/UIM coverage, Sarah would be solely responsible for these substantial costs.

Outcome Summary

Securing adequate auto insurance in Kentucky is not merely a legal requirement; it’s a vital step in safeguarding your financial well-being and ensuring peace of mind on the road. By understanding the factors that influence your premiums, comparing policies diligently, and being aware of your rights as a policyholder, you can navigate the Kentucky insurance landscape confidently and make choices that best suit your individual needs. Remember to regularly review your coverage to ensure it remains aligned with your circumstances.

Questions and Answers

What happens if I’m in an accident with an uninsured driver in Kentucky?

If you’re involved in an accident with an uninsured driver, your uninsured/underinsured motorist (UM/UIM) coverage will help cover your medical bills and vehicle repairs. Filing a claim with your own insurance company is the first step.

How often should I review my auto insurance policy?

It’s advisable to review your auto insurance policy at least annually, or whenever there’s a significant life change (e.g., new car, change in driving habits, marriage, etc.). This ensures your coverage remains appropriate for your current needs.

Can I get discounts on my Kentucky auto insurance?

Yes, many insurers offer discounts for various factors, including safe driving records, bundling insurance policies (home and auto), completing defensive driving courses, and installing anti-theft devices.

What is the process for canceling my auto insurance policy in Kentucky?

Contact your insurance company directly to cancel your policy. Be aware of any cancellation fees or penalties that may apply, as Artikeld in your policy documents.