The rise of digital insurance disruptors like Lemonade has challenged traditional models. This article examines whether Lemonade renters insurance lives up to its innovative reputation, exploring its coverage, customer experiences, financial stability, and regulatory compliance. We’ll delve into the details to help you decide if Lemonade is the right choice for your needs.

We’ll compare Lemonade’s offerings to established insurers, analyzing its pricing, policy features, and claims process. We’ll also consider the perspectives of actual Lemonade customers, examining both positive and negative experiences to provide a balanced assessment of the company’s strengths and weaknesses. Ultimately, this analysis aims to empower you with the information necessary to make an informed decision about your renters insurance.

Lemonade Renters Insurance

Lemonade is a relatively new player in the insurance industry, disrupting the traditional model with its tech-forward approach and focus on customer experience. Its renters insurance offering is a key part of its broader strategy to make insurance more accessible and efficient.

Lemonade’s business model and operations significantly differ from traditional insurers. This section details Lemonade’s history, operational model, technological integration, and marketing strategies.

Company History and Market Entry

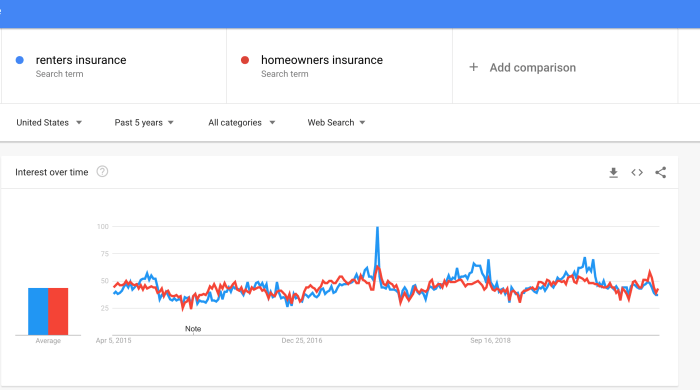

Founded in 2015, Lemonade initially focused on renters insurance before expanding into other lines of insurance, such as homeowners and pet insurance. The company’s rapid growth is largely attributed to its innovative use of technology and its appealing brand image. Lemonade leveraged its technology to streamline the claims process and offer lower premiums, quickly gaining traction in a market dominated by established players. Its initial entry into the renters insurance market was strategically targeted towards millennials and Gen Z, demographics known for their tech-savviness and preference for digital interactions.

Lemonade’s Business Model

Unlike traditional insurance companies, Lemonade operates on a subscription-based model with a focus on AI-powered automation. Instead of relying on extensive agent networks and paperwork, Lemonade utilizes chatbots and AI to handle customer interactions, policy purchases, and claims processing. This streamlined approach allows for faster processing times and lower overhead costs, ultimately translating to lower premiums for customers. A significant portion of Lemonade’s profits are also channeled into charitable causes, a unique aspect of its business model. This creates a strong brand image and differentiates it from competitors focused solely on profit maximization.

Technology in Operations and Customer Service

Lemonade’s core strength lies in its technological infrastructure. Its AI-powered chatbot, Maya, handles most customer inquiries and claims processing. This automated system allows for 24/7 availability and instant responses, significantly improving customer service efficiency. Lemonade also utilizes machine learning algorithms to assess risk and personalize premiums, ensuring fairer pricing for customers. The entire process, from policy purchase to claim settlement, is largely digitized, eliminating the need for extensive paperwork and human intervention. This reduces processing times and minimizes potential errors, enhancing customer satisfaction.

Marketing Strategies and Brand Image

Lemonade’s marketing emphasizes its unique selling points: speed, simplicity, and social good. The company’s advertising campaigns often highlight the ease and convenience of its digital platform and the charitable giving aspect of its business model. Lemonade cultivates a modern, transparent, and socially responsible brand image, appealing to a younger, tech-savvy demographic. Its marketing strategies effectively utilize digital channels, social media, and influencer collaborations to reach its target audience. The company’s focus on a positive brand image, coupled with its efficient service, has contributed significantly to its success in a competitive market.

Policy Coverage and Features

Lemonade renters insurance offers a range of coverage options, comparable to other major providers but with a distinct focus on digital convenience and a streamlined claims process. Understanding the specifics of their coverage, compared to competitors, is crucial for determining if it’s the right fit for your needs.

Coverage Comparison with Other Providers

The following table compares Lemonade’s renters insurance with two other major providers, State Farm and Allstate. Note that specific coverage amounts and deductibles can vary based on location, individual circumstances, and chosen policy details. This table provides a general comparison for illustrative purposes.

| Feature | Lemonade | State Farm | Allstate |

|---|---|---|---|

| Personal Property Coverage (Example Amount) | $100,000 | $100,000 – $250,000 (variable) | $100,000 – $200,000 (variable) |

| Liability Coverage (Example Amount) | $100,000 | $100,000 – $500,000 (variable) | $100,000 – $300,000 (variable) |

| Additional Living Expenses (Example Amount) | $20,000 | Variable, dependent on policy | Variable, dependent on policy |

| Standard Deductible (Example) | $1,000 | $250 – $1,000 (variable) | $250 – $1,000 (variable) |

| Add-ons (Examples) | Identity theft protection, flood insurance (separate purchase) | Umbrella liability, valuable items coverage | Earthquake coverage, water backup coverage |

Types of Coverage Offered by Lemonade

Lemonade’s renters insurance typically includes three main types of coverage: personal property, liability, and additional living expenses. Personal property coverage protects your belongings from damage or theft. Liability coverage protects you financially if someone is injured on your property or if you accidentally damage someone else’s property. Additional living expenses cover temporary housing and other necessary costs if your rental unit becomes uninhabitable due to a covered event.

Unique Features and Benefits

Lemonade distinguishes itself through its use of AI-powered chatbots for instant communication and its highly efficient claims process. The chatbot can answer questions, provide policy information, and even guide you through the initial stages of a claim. Lemonade’s claims process is known for its speed and ease of use, often resolving claims within minutes or hours, rather than days or weeks.

Hypothetical Scenario and Claims Process

Imagine a fire damages your apartment, destroying many of your belongings. You immediately contact Lemonade through their app. The AI chatbot guides you through the initial steps, requesting photos and a brief description of the damage. You upload photos of the damaged items. Lemonade’s algorithms assess the claim, and if approved, you receive payment quickly, often directly to your bank account, to replace your lost belongings. This process eliminates much of the paperwork and delays often associated with traditional insurance claims.

Customer Reviews and Ratings

Lemonade renters insurance has garnered a significant online presence, resulting in a substantial volume of customer reviews across various platforms. Analyzing these reviews provides valuable insight into customer experiences and overall satisfaction with the company’s services. This section summarizes the common themes and sentiments expressed in these reviews, offering a balanced perspective on Lemonade’s strengths and weaknesses.

Lemonade’s customer reviews are diverse, reflecting the varied experiences of its policyholders. Reviews are readily available on platforms such as Trustpilot, Yelp, and the Apple App Store, offering a broad spectrum of opinions. By categorizing these reviews based on positive and negative feedback, we can better understand the overall customer perception of Lemonade.

Positive Customer Experiences

Positive reviews frequently highlight Lemonade’s user-friendly mobile app, quick claims processing, and excellent customer service responsiveness. Many users praise the ease of obtaining a quote and purchasing a policy, emphasizing the streamlined and efficient digital process. The speed and simplicity of claims handling are frequently cited as major advantages, with numerous anecdotes describing swift payouts and minimal bureaucratic hurdles. The chatbot feature is also frequently praised for its accessibility and helpfulness in answering basic questions. Users appreciate the transparent and straightforward communication throughout the entire process.

Negative Customer Experiences

Conversely, negative reviews often center on issues related to claims denials, perceived lack of flexibility in policy adjustments, and occasional difficulties in contacting customer support representatives outside of the app’s chatbot system. Some users report challenges in understanding the policy’s fine print or navigating specific aspects of their coverage. While the app is generally praised, some users experience technical glitches or find the app’s functionality insufficient for certain needs. The lack of a traditional phone support option for complex issues is a recurring criticism.

Common Themes and Recurring Issues

A common thread in both positive and negative reviews revolves around the technology-driven nature of Lemonade’s services. While many appreciate the convenience and efficiency of the app, others find the reliance on technology frustrating when encountering technical issues or needing personalized assistance beyond the chatbot’s capabilities. Another recurring theme is the balance between simplicity and comprehensive coverage. While the streamlined process is appealing, some users express concern about potential limitations in coverage compared to traditional insurance providers. Claims handling, while often praised for speed, sometimes faces criticism regarding the clarity of the claims process and the reasons behind denials.

Overall Sentiment Towards Customer Service and Claims Handling

The overall sentiment towards Lemonade’s customer service is mixed. While many users appreciate the quick response times and ease of communication through the app, others express frustration with the limited options for contacting human representatives and the perceived lack of personal touch. Regarding claims handling, the speed and efficiency are often lauded, but the occasional occurrence of denials and the need for greater transparency in the decision-making process lead to some negative feedback.

Summary of Frequently Praised and Criticized Aspects

- Frequently Praised: User-friendly app, quick claims processing, transparent communication, efficient digital process, helpful chatbot.

- Frequently Criticized: Claims denials, limited customer support options beyond the chatbot, lack of flexibility in policy adjustments, technical glitches, difficulty understanding policy details.

Financial Stability and Security

Lemonade, as a relatively newer player in the insurance market, presents a unique case study in financial stability. Understanding its financial performance and the associated risks is crucial for potential customers and investors alike. This section examines Lemonade’s financial health, comparing it to established insurers and outlining potential considerations.

Lemonade’s financial performance is characterized by rapid growth, but also significant losses in its early years. While revenue has steadily increased, the company has yet to achieve profitability. This is partly due to significant investments in technology and marketing, a common strategy for disruptive tech companies aiming to capture market share. Key performance indicators like the loss ratio (the percentage of premiums paid out in claims) are important metrics to watch, as a high loss ratio can indicate financial strain. Publicly available financial statements, such as those filed with the Securities and Exchange Commission (SEC) if Lemonade is a publicly traded company, provide a detailed view of its financial health. Analyzing trends in revenue, expenses, and the loss ratio provides a comprehensive understanding of its financial trajectory.

Lemonade’s Claims Paying Ability and Financial Ratings

Lemonade’s ability to pay claims rests on several factors, including its premiums collected, its investment income, and its reinsurance arrangements. Reinsurance is a crucial element, as it transfers a portion of the risk to other insurance companies. Independent rating agencies, such as AM Best, A.M. Best, Standard & Poor’s, or Moody’s, assess the financial strength and claims-paying ability of insurance companies. These ratings provide an objective evaluation of Lemonade’s financial stability, offering a valuable benchmark for comparison with established insurers. The absence or presence of a rating, and the specific rating itself, are important indicators of the company’s perceived risk profile. For example, a higher rating (e.g., A+ versus B+) suggests a greater likelihood of meeting its financial obligations.

Comparison with Established Renters Insurance Providers

Comparing Lemonade’s financial strength to established providers requires analyzing several key metrics. Factors such as the company’s size, market share, length of operation, and financial ratings from independent agencies all play a significant role. Established companies generally possess larger reserves and a longer track record, which can contribute to greater financial stability. However, Lemonade’s innovative business model and technological focus could offer advantages in terms of efficiency and cost management in the long run. A direct comparison requires examining publicly available financial data from both Lemonade and its competitors, allowing for a side-by-side analysis of key metrics such as loss ratios, reserve levels, and overall financial strength ratings.

Potential Risks Associated with Lemonade

Investing in or relying on Lemonade for insurance coverage involves certain risks. As a relatively young company, its long-term financial performance remains uncertain. The success of its disruptive business model depends on factors such as technological advancements, regulatory changes, and competition from established insurers. Further, changes in the economy or unexpected catastrophes could significantly impact Lemonade’s financial stability and its ability to meet its obligations. A thorough understanding of these potential risks is crucial before making any decisions regarding Lemonade’s insurance products or investments.

Comparison with Traditional Insurers

Lemonade’s approach to renters insurance differs significantly from that of traditional insurance companies, primarily in its pricing structure, claims process, and overall customer experience. Understanding these differences is crucial for renters deciding which type of insurer best suits their needs and risk tolerance. This comparison will examine Lemonade’s offerings alongside those of two established players in the market, allowing for a clearer understanding of the advantages and disadvantages of each.

Lemonade often boasts a simpler, more streamlined process, while traditional insurers may offer more comprehensive coverage options but with potentially more complex procedures. Price comparisons are crucial, and considering the specific coverage details is equally important to ensure an apples-to-apples evaluation.

Pricing Comparison with Traditional Insurers

Comparing Lemonade’s pricing to traditional insurers requires considering several factors, including coverage amounts, location, and the renter’s risk profile. However, a general comparison can be illustrative. The following table presents a hypothetical comparison based on average premiums for a standard renters insurance policy in a mid-sized city.

| Insurer | Average Monthly Premium | Deductible Options | Coverage Highlights |

|---|---|---|---|

| Lemonade | $15 – $25 | $500, $1000 | AI-powered claims, instant payouts, transparent pricing |

| State Farm | $18 – $30 | $500, $1000, $2500 | Wide range of coverage options, established reputation, extensive agent network |

| Allstate | $20 – $35 | $500, $1000, $2500 | Bundling options with other insurance products, various discounts available, strong financial backing |

Note: These are hypothetical examples and actual premiums will vary depending on individual circumstances.

Advantages and Disadvantages of Choosing Lemonade over Traditional Insurers

The decision of whether to choose Lemonade or a traditional insurer hinges on individual priorities. Each option presents unique benefits and drawbacks.

Advantages of Lemonade: Lemonade’s AI-powered claims process often results in faster payouts, its pricing is generally transparent, and the app-based experience is user-friendly. The focus on simplicity and ease of use appeals to many renters.

Disadvantages of Lemonade: Lemonade might offer fewer customization options compared to traditional insurers. The scope of coverage might also be less extensive in some cases. While the AI is generally helpful, complex claims may still require human intervention.

Renters Who Benefit Most from Lemonade and Traditional Options

Certain renter profiles will find Lemonade’s services particularly advantageous, while others may prefer the more traditional approach.

Renters who benefit from Lemonade: Tech-savvy renters who value convenience, speed, and transparency in their insurance experience, and those comfortable with a potentially less comprehensive coverage option, are well-suited to Lemonade. Renters with simpler insurance needs and a low risk tolerance for claims delays might also find it appealing.

Renters who benefit from Traditional Insurers: Renters who require highly customized coverage options, prefer personal interaction with insurance agents, or need a wider range of coverage features beyond the basics should consider a traditional insurer. Renters with a history of claims or those anticipating more complex claims might find the support offered by traditional insurers more beneficial.

Scenario Where a Traditional Insurer Might Be a Better Choice

Imagine a renter who owns a valuable collection of antique furniture and musical instruments. While Lemonade provides basic coverage for personal property, a traditional insurer might offer specialized coverage options or higher coverage limits to adequately protect these high-value items. The detailed assessment and personalized service offered by a traditional agent would be more beneficial in this scenario to ensure comprehensive protection.

Regulatory Compliance and Licensing

Lemonade, as a digital insurance provider, operates within a complex regulatory framework that varies significantly across different states and jurisdictions. Securing and maintaining the necessary licenses and adhering to state-specific regulations is crucial for its operational legitimacy and continued growth. Understanding this regulatory landscape is vital for assessing the company’s overall stability and its commitment to consumer protection.

Lemonade’s regulatory approvals and licensing are obtained on a state-by-state basis. The company must meet specific capital requirements, demonstrate its operational soundness, and comply with individual state insurance regulations before it can offer its renters insurance products in each state. This process involves rigorous application reviews, background checks, and ongoing compliance monitoring by the respective state insurance departments. The regulatory landscape for renters insurance generally involves requirements around policy forms, rate filings, claims handling procedures, and consumer protection measures, all of which Lemonade must navigate and meet consistently.

State-Specific Licensing and Compliance

Lemonade holds licenses to offer renters insurance in numerous states across the United States. The specific requirements for licensing vary, but generally involve demonstrating financial solvency, submitting detailed policy forms for approval, and agreeing to abide by state-specific consumer protection laws and regulations. Maintaining these licenses necessitates ongoing compliance with evolving regulations and periodic audits by state insurance departments. For example, a change in state law concerning data privacy might require Lemonade to update its systems and procedures to ensure continued compliance. Similarly, changes to claim handling requirements would necessitate adjustments to Lemonade’s internal processes and technology.

Regulatory Scrutiny and Legal Challenges

While Lemonade has generally operated within the regulatory framework, like any insurance company, it has faced scrutiny and potential legal challenges. These can range from investigations into specific claims handling practices to disputes over policy interpretations. The specifics of these instances are often confidential due to legal proceedings or settlements. However, it’s important to note that navigating regulatory scrutiny and legal challenges is a common aspect of operating within the insurance industry, and how a company responds to such challenges is an important measure of its overall stability and commitment to compliance.

Consumer Protection Measures

Lemonade’s operational model incorporates several features designed to enhance consumer protection. Its transparent and user-friendly platform aims to simplify the insurance process, making it easier for consumers to understand their policy coverage and file claims. The company’s use of AI-powered chatbots for initial customer interactions and claims processing aims to improve efficiency and responsiveness. Furthermore, Lemonade actively participates in state-level consumer protection initiatives and strives to maintain a high level of customer satisfaction. The company’s public commitment to transparency and its readily available customer service channels contribute to its efforts in adhering to consumer protection laws.

Last Recap

Lemonade’s innovative approach to renters insurance offers a compelling alternative to traditional providers, leveraging technology for streamlined processes and potentially lower costs. However, potential customers should carefully weigh the advantages of its user-friendly platform and AI-driven features against factors such as financial stability, policy coverage specifics, and customer service experiences. Thorough research and comparison shopping remain crucial before committing to any renters insurance provider, including Lemonade.

Question Bank

Does Lemonade offer liability coverage?

Yes, Lemonade renters insurance includes liability coverage, protecting you against claims of bodily injury or property damage caused by you or your guests.

What is Lemonade’s claims process like?

Lemonade uses a mobile app and AI-powered chatbot for claims reporting. The process is often described as fast and easy, though experiences can vary.

Is Lemonade available in all states?

No, Lemonade’s availability varies by state. Check their website to see if they operate in your area.

How does Lemonade’s pricing compare to other companies?

Lemonade’s pricing is generally competitive, often lower than some traditional insurers, but it varies depending on location and coverage selected. Direct comparison with quotes from other insurers is recommended.