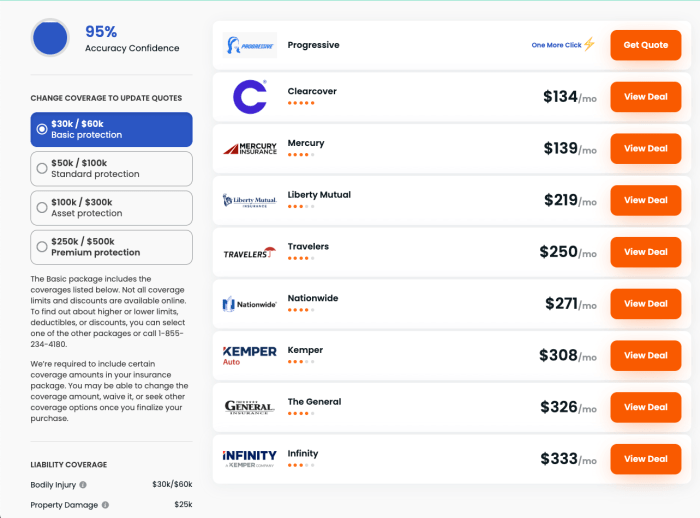

Securing adequate home and auto insurance is a crucial financial decision, impacting both personal safety and financial well-being. This exploration delves into the complexities of the insurance market, examining consumer behavior, influencing factors, and the advantages of bundling options. We’ll uncover the best strategies for obtaining competitive quotes, empowering you to make informed choices that best suit your needs.

The home and auto insurance market is a dynamic landscape, shaped by technological advancements, shifting consumer preferences, and evolving risk assessments. Understanding this landscape is key to finding the best coverage at the most favorable price. This analysis will examine various insurance providers, their policy offerings, and pricing strategies, providing a comprehensive overview to assist consumers in their search for the ideal insurance package.

Factors Affecting Insurance Premiums

Understanding the factors that influence your home and auto insurance premiums is crucial for securing the best coverage at a reasonable price. Several interconnected elements contribute to the final cost, and recognizing these can help you make informed decisions about your insurance needs and potentially lower your premiums.

Home Insurance Premium Determinants

Several key factors determine the cost of your home insurance. These factors are carefully assessed by insurance companies to accurately reflect the risk associated with insuring your property. The higher the perceived risk, the higher the premium.

- Location: Your home’s location significantly impacts premiums. Areas prone to natural disasters (earthquakes, hurricanes, wildfires) or high crime rates will generally have higher premiums due to the increased likelihood of claims.

- Home Value: The replacement cost of your home is a major factor. A more expensive home requires a higher premium to cover potential rebuilding costs.

- Coverage Amount: The amount of coverage you choose affects your premium. Higher coverage amounts naturally lead to higher premiums.

- Home Features: Features like security systems (alarm systems, fire sprinklers), updated plumbing and electrical systems, and building materials can influence premiums. These features can reduce the risk of damage and thus lower your premium.

- Claims History: Your past claims history is a significant factor. Multiple or large claims in the past can result in higher premiums.

Auto Insurance Premium Determinants

Similar to home insurance, several factors contribute to the cost of your auto insurance. These factors reflect the risk associated with insuring your vehicle and your driving habits.

- Vehicle Type: The make, model, and year of your vehicle influence premiums. Expensive, high-performance vehicles are typically more expensive to insure due to higher repair costs.

- Driving History: Your driving record is crucial. Accidents, speeding tickets, and DUI convictions will significantly increase your premiums.

- Age and Gender: Statistically, younger drivers and certain gender groups are considered higher-risk drivers, resulting in higher premiums.

- Location: Your location impacts premiums, similar to home insurance. Areas with higher accident rates or theft rates will have higher premiums.

- Coverage Levels: The level of coverage you choose (liability, collision, comprehensive) directly impacts your premium. More comprehensive coverage will cost more.

Comparison of Factors Affecting Home and Auto Insurance Premiums

Both home and auto insurance premiums are influenced by location, claims history, and the level of coverage selected. However, auto insurance considers factors like vehicle type and driving history, while home insurance focuses on the value and features of the property itself and its susceptibility to various risks.

Visual Representation of Factors and Premium Costs

Imagine a three-dimensional bar graph. The x-axis represents different factors (location risk, claims history, coverage level, etc.), the y-axis represents the magnitude of each factor (high, medium, low), and the z-axis represents the premium cost. Taller bars indicate higher premiums. For instance, a bar representing “high location risk” and “high claims history” would be significantly taller than a bar representing “low location risk” and “no claims history.” This visually demonstrates how the combination of different factors impacts the final premium cost for both home and auto insurance.

Impact of Risk Factors on Premium Calculations

Consider a hypothetical scenario: Two individuals, A and B, are seeking home insurance. Individual A lives in a high-risk wildfire zone, has a high-value home, and has filed two claims in the past five years. Individual B lives in a low-risk area, has a modest home, and has a clean claims history. Individual A’s premium will be considerably higher than Individual B’s due to the higher perceived risk. Similarly, a young driver with multiple speeding tickets will pay significantly more for auto insurance than an older driver with a clean driving record. Insurance companies use sophisticated algorithms that consider these risk factors to calculate premiums, aiming to fairly reflect the probability of future claims.

Final Summary

Ultimately, securing the best home and auto insurance involves careful consideration of multiple factors. By understanding the market, analyzing your personal needs, and effectively utilizing online resources, you can navigate the process confidently. Remember to compare quotes, understand the implications of bundling, and consider the long-term value of your insurance coverage. Empowered with knowledge, you can secure comprehensive protection at a price that aligns with your budget.

Essential Questionnaire

What is the difference between liability and comprehensive coverage?

Liability coverage protects you financially if you cause an accident, while comprehensive coverage protects your vehicle from damage not caused by accidents (e.g., theft, vandalism).

How often should I review my insurance policy?

It’s recommended to review your policy annually or whenever significant life changes occur (e.g., moving, getting married, purchasing a new car).

Can I get discounts on my insurance premiums?

Yes, many insurers offer discounts for things like bundling policies, safe driving records, security systems (for home insurance), and completing defensive driving courses.

What information do I need to get a quote?

Typically, you’ll need information about your vehicle(s), your home (address, value, features), your driving history, and your claims history.

What happens if I make a claim?

The claims process varies by insurer, but generally involves reporting the incident, providing necessary documentation, and cooperating with the adjuster’s investigation.