Navigating the world of home and auto insurance can feel like traversing a complex maze. Finding the right coverage at the best price requires understanding a variety of factors, from your credit score to the features of your home. This guide unravels the intricacies of obtaining insurance quotes, empowering you to make informed decisions and protect your most valuable assets.

We’ll explore the key elements influencing insurance premiums, delve into the online quote process, and compare different coverage options. Understanding these aspects will allow you to confidently compare quotes, negotiate favorable rates, and ultimately secure comprehensive protection for your home and vehicle.

Understanding the Market for Home and Auto Insurance Quotes

The market for home and auto insurance quotes is a dynamic landscape shaped by consumer needs, insurer strategies, and technological advancements. Understanding this market requires examining the typical customer, the factors influencing their decisions, the pricing approaches of various insurers, and the role of online comparison tools.

The Typical Home and Auto Insurance Customer and Key Influencing Factors

The Typical Customer Profile

The typical customer seeking home and auto insurance quotes is a homeowner or renter with one or more vehicles. They are often juggling multiple financial responsibilities and prioritize value for money, seeking adequate coverage at a competitive price. Demographic factors such as age, location, credit score, and driving history significantly influence their risk profile and, consequently, the premiums they face. For example, a young driver with a poor driving record will generally pay more for auto insurance than an older driver with a clean record. Similarly, homeowners in high-risk areas (prone to natural disasters or burglaries) will typically pay more for home insurance than those in lower-risk areas.

Factors Influencing Insurer Choice

Several key factors influence a customer’s choice of insurer. Price is a major consideration, but it’s not the only one. Customers also value factors such as the insurer’s reputation, customer service quality, claims handling process, policy coverage options, and the availability of discounts. A strong brand reputation built on trust and reliability can sway customers even if the price isn’t the absolute lowest. Similarly, a seamless and efficient claims process can be a significant differentiator, particularly during stressful times.

Insurance Provider Pricing Strategies

Insurance providers employ diverse pricing strategies to balance profitability and competitiveness. Some insurers focus on attracting price-sensitive customers with low premiums, potentially sacrificing profit margins. Others target higher-value customers willing to pay more for comprehensive coverage and superior customer service. Actuarial analysis plays a crucial role, with insurers using sophisticated models to assess risk and set premiums accordingly. This involves considering factors like location, property value, vehicle type, driving history, and credit score. For example, a company specializing in insuring luxury vehicles might charge higher premiums due to the increased repair costs associated with those vehicles. Conversely, insurers offering discounts for bundling home and auto insurance, or for safety features in vehicles, aim to incentivize customer loyalty and attract a broader customer base.

The Role of Online Comparison Tools

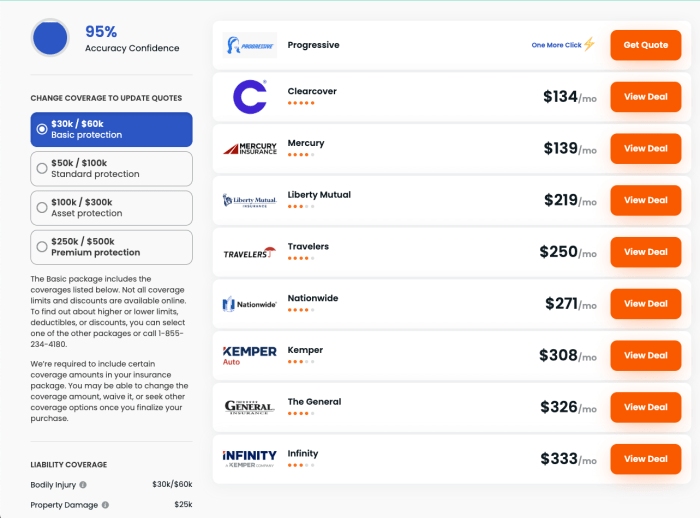

Online comparison tools have revolutionized the insurance market, empowering consumers with greater transparency and control. These tools allow customers to quickly compare quotes from multiple insurers side-by-side, facilitating informed decision-making. The ease of access and convenience offered by these platforms have increased competition among insurers, leading to potentially lower premiums for consumers. However, it is important to remember that online comparison tools often present only a limited snapshot of available policies, and customers should carefully review the details of each policy before making a final decision. For instance, while one insurer might offer a lower initial premium, another might offer more comprehensive coverage or better customer service, which may be worth the extra cost.

Factors Affecting Home and Auto Insurance Premiums

Several key factors influence the premiums you pay for home and auto insurance. Understanding these factors can help you make informed decisions and potentially lower your costs. This section will detail the impact of location, credit score, driving history, and home features on your insurance premiums.

Location’s Impact on Insurance Premiums

Your location significantly impacts both home and auto insurance premiums. Insurers consider the risk of theft, vandalism, accidents, and natural disasters in your area. For home insurance, areas prone to hurricanes, earthquakes, wildfires, or floods will generally have higher premiums. Similarly, for auto insurance, cities with high rates of accidents or theft will lead to higher premiums. For example, a home in a high-crime area with a history of burglaries will cost more to insure than a similar home in a safer neighborhood. Likewise, someone living in a city with congested traffic and frequent accidents will likely pay more for auto insurance than someone in a rural area with fewer traffic incidents.

Credit Score’s Influence on Insurance Rates

Many insurance companies use credit-based insurance scores to assess risk. A higher credit score generally indicates a lower risk to the insurer, resulting in lower premiums. Conversely, a lower credit score suggests a higher risk and may lead to higher premiums. This is because individuals with poor credit history may be perceived as more likely to file claims. The exact impact of credit score varies by insurer and state, but it’s a significant factor for many. For instance, a person with an excellent credit score might qualify for discounts, while someone with poor credit might face significantly higher premiums.

Driving History’s Effect on Auto Insurance Costs

Your driving history is a major determinant of your auto insurance premiums. A clean driving record with no accidents or traffic violations will usually result in lower premiums. Conversely, accidents, speeding tickets, DUIs, or other violations will increase your premiums. The severity of the incident also matters; a major accident will have a more significant impact than a minor fender bender. For example, a driver with multiple speeding tickets and a DUI conviction will pay substantially more for insurance than a driver with a perfect record.

Home Features Affecting Home Insurance Premiums

Certain home features influence the cost of your home insurance. These features can either increase or decrease your premium depending on their impact on risk.

| Home Feature | Impact on Premium | Example | Mitigation Strategy |

|---|---|---|---|

| Security System | Reduces Premium | Monitored alarm system with fire and burglar protection | Install a monitored security system |

| Roof Condition | Increases Premium (poor condition); Reduces (new/well-maintained) | Old, damaged roof needing replacement vs. a new roof with proper materials | Regular roof inspections and timely repairs or replacements |

| Fire Protection Systems | Reduces Premium | Sprinkler system, fire-resistant materials | Install and maintain fire suppression systems |

| Location of Home | Increases Premium (high-risk area) | Home located in a flood zone or wildfire-prone area | Consider mitigation measures like flood barriers or landscaping changes (for wildfire) |

The Online Quote Process

Obtaining home and auto insurance quotes online has become increasingly popular due to its convenience and speed. This section details the process, highlighting key aspects of the online experience and comparing it to traditional methods.

The online quote process streamlines the traditional method of contacting multiple insurance agents individually. It allows consumers to compare quotes from various providers simultaneously, empowering them to make informed decisions based on price and coverage options.

Step-by-Step Guide to Obtaining Online Quotes

This guide Artikels the typical steps involved in securing home and auto insurance quotes online. Each step is crucial in ensuring you receive accurate and relevant quotes.

- Visit Insurance Company Websites or Comparison Sites: Begin by navigating to the websites of individual insurance companies or using comparison websites that aggregate quotes from multiple providers. Comparison sites often provide a more streamlined process, allowing you to input your information once and receive multiple quotes simultaneously.

- Provide Necessary Information: You will be asked to provide personal and property-related details. This typically includes your address, driver’s license information (for auto insurance), details about your home (square footage, age, security features), and details about your vehicles (make, model, year). Accuracy is crucial; incorrect information can lead to inaccurate quotes.

- Review and Customize Coverage Options: Once you’ve entered your information, you’ll typically see a range of coverage options. Carefully review these options, understanding the level of protection each provides. You may be able to adjust coverage limits to find a balance between cost and protection.

- Compare Quotes: After reviewing coverage options, you will receive multiple quotes, allowing you to compare premiums and coverage details. Focus on comparing apples to apples—ensure the coverage levels are similar before comparing prices.

- Select a Policy and Purchase: Once you’ve chosen the policy that best suits your needs and budget, you can usually purchase the policy online. This often involves providing payment information and electronically signing the policy documents.

Online Quote System User Interface Mockup

Imagine a clean, intuitive website. The homepage features a prominent call to action button, “Get a Quote Now,” with clear sections for home and auto insurance. Upon clicking, users are guided through a series of short forms, each section clearly labeled and focusing on a specific aspect of their insurance needs. Progress bars visually indicate completion status. A persistent FAQ section answers common questions, and a live chat option provides immediate assistance. The final screen displays a clear comparison of quotes, highlighting key differences in coverage and price. The design emphasizes simplicity, clarity, and ease of navigation, avoiding cluttered layouts or overwhelming information.

Information Requested During the Online Quote Process

Insurance companies require specific information to assess risk and determine premiums. The information requested typically falls into several categories:

- Personal Information: Name, address, date of birth, contact details.

- Home Information (for Home Insurance): Address, year built, square footage, type of construction, security systems, claims history.

- Auto Information (for Auto Insurance): Make, model, year, VIN, driving history (accidents, tickets), driver’s license information, usage (commute, pleasure).

- Financial Information: Payment method, credit card or bank account details.

Advantages and Disadvantages of Online vs. Offline Quote Methods

| Feature | Online Quotes | Offline Quotes (through agents) |

|---|---|---|

| Convenience | High: Access anytime, anywhere. | Low: Requires scheduling appointments and potentially multiple visits. |

| Speed | High: Quotes often available instantly. | Low: Can take several days or weeks to receive quotes from multiple agents. |

| Cost | Potentially lower: Direct interaction with insurers can sometimes result in lower premiums. | Potentially higher: Agent fees or commissions may increase overall cost. |

| Personalization | Low: Limited opportunity for personalized advice. | High: Agents can provide tailored advice and explain complex policy details. |

| Transparency | High: Easy to compare multiple quotes side-by-side. | Low: Comparing quotes from different agents can be more challenging. |

Epilogue

Securing affordable and adequate insurance for your home and auto is a crucial step in financial planning. By understanding the factors affecting premiums, utilizing online comparison tools effectively, and carefully reviewing policy documents, you can confidently navigate the insurance market and obtain the best coverage to suit your individual needs. Remember, proactive planning translates to peace of mind.

FAQ Overview

What is the difference between liability and comprehensive auto insurance?

Liability coverage protects you against financial responsibility for accidents you cause, while comprehensive coverage protects your vehicle against damage from non-collision events (e.g., theft, vandalism, weather).

How often should I review my insurance policies?

It’s advisable to review your policies annually, or whenever there’s a significant life change (e.g., marriage, new home, new car) to ensure your coverage remains adequate and reflects your current circumstances.

Can I get discounts on my insurance premiums?

Yes, many insurers offer discounts for various factors, including bundling home and auto insurance, maintaining a good driving record, installing security systems in your home, and having a high credit score.

What information do I need to provide when getting an online quote?

Typically, you’ll need information about your home (address, value, features), your vehicle(s) (make, model, year), your driving history, and your personal details (name, address, contact information).