Finding the right home insurance can feel like navigating a maze, but understanding the process is key to securing your most valuable asset. This guide demystifies the world of home insurance quotes, providing you with the knowledge and tools to make informed decisions and find the best coverage for your needs. From understanding the factors that influence premiums to comparing quotes effectively, we’ll walk you through each step, empowering you to confidently protect your home.

We’ll explore the various types of home insurance policies available, the key factors that impact your quote, and the steps involved in obtaining and comparing quotes from different providers. By the end, you’ll be equipped to navigate the online quote process with ease and confidence, ensuring you get the best possible coverage at a competitive price.

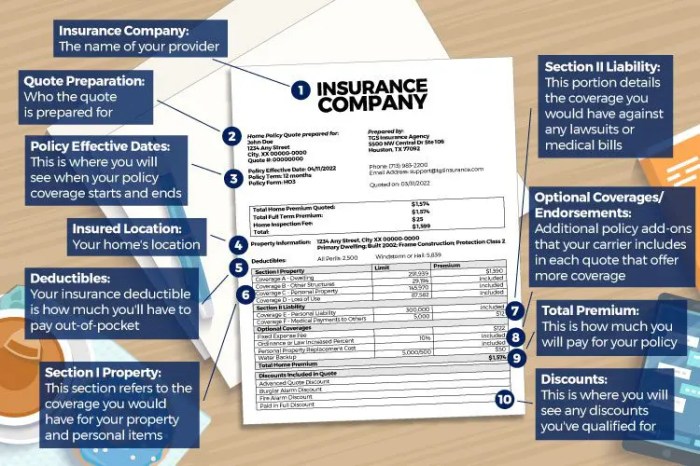

Visual Representation of Key Information

Understanding the factors that influence your home insurance premium can be simplified through clear visual aids. Effective visualizations help demystify the often-complex calculations behind your quote, promoting transparency and informed decision-making. Below are examples of how key information can be visually represented.

Factors Contributing to Home Insurance Cost

This illustration would utilize a circular graph (pie chart). The circle represents the total premium cost. Each segment would represent a different contributing factor, sized proportionally to its influence on the overall cost. The largest segment, perhaps in a shade of dark blue, would represent the dwelling coverage, reflecting its significant portion of the total cost. A smaller, lighter blue segment could represent liability coverage. Other segments, using different colors such as green for personal property, orange for additional living expenses, and a muted yellow for other coverages (e.g., medical payments), would visually depict their relative contribution. A key would be included, clearly labeling each segment and its corresponding percentage of the total premium. This visual immediately shows the relative importance of each coverage area in determining the overall premium.

Sample Home Insurance Policy Coverage Breakdown

This visualization would be a bar chart. The horizontal axis would list the different types of coverage included in the policy (e.g., dwelling, liability, personal property, loss of use, etc.). The vertical axis would represent the dollar amount of coverage for each type. Each coverage type would be represented by a differently colored bar. For instance, dwelling coverage might be represented by a deep green bar, liability coverage by a medium blue bar, personal property coverage by a light orange bar, and loss of use coverage by a light grey bar. The length of each bar would directly correspond to the monetary value of coverage. This chart provides a quick and easy understanding of the specific coverage amounts offered within the policy, allowing for a clear comparison of the level of protection provided in each area. A legend clearly indicating the color-coding of each coverage type would accompany the chart. For example, a policy with $250,000 dwelling coverage, $100,000 liability, $50,000 personal property, and $20,000 loss of use would have bars of proportionate lengths, clearly illustrating the coverage breakdown.

Final Thoughts

Securing a home insurance quote is a crucial step in protecting your biggest investment. By understanding the factors that influence premiums, navigating the online quote process efficiently, and comparing quotes effectively, you can confidently choose a policy that provides adequate coverage at a fair price. Remember to read the fine print, ask questions, and don’t hesitate to seek professional advice if needed. Your peace of mind is worth it.

Popular Questions

What is the difference between actual cash value (ACV) and replacement cost coverage?

ACV covers the current market value of your belongings, minus depreciation. Replacement cost covers the full cost of replacing damaged items, regardless of depreciation.

How often should I review my home insurance policy?

It’s advisable to review your policy annually or whenever there are significant changes in your home’s value, possessions, or risk factors.

Can I get a home insurance quote without providing my social security number?

While some providers may request it for underwriting, you can often get a preliminary quote without providing your SSN. However, you’ll need it to finalize the policy.

What happens if I make a claim and my premium increases?

Premium increases after a claim are common, but the extent depends on the insurer and the claim’s nature. Your insurer should explain any premium adjustments.

What is an umbrella insurance policy, and should I consider it?

Umbrella insurance provides extra liability coverage beyond your home and auto policies. It’s beneficial if you have significant assets or a higher risk of liability lawsuits.