Securing the right insurance can feel overwhelming, but it doesn’t have to be. The convenience of obtaining a free insurance quote has revolutionized how people approach financial planning. This exploration delves into the user experience surrounding free insurance quotes, examining user motivations, competitor strategies, and best practices for creating a seamless and trustworthy process. We’ll cover everything from understanding user search intent to optimizing website design for maximum impact.

From analyzing user journeys and competitor approaches to crafting compelling content and addressing user concerns, we aim to provide a comprehensive guide to maximizing the effectiveness of free insurance quote offerings. This includes examining various insurance types, optimizing online forms, and building trust with potential customers.

Understanding User Search Intent Behind “Insurance Quote Free”

When a user searches for “insurance quote free,” they’re typically looking for a quick and easy way to compare prices and potentially save money on their insurance premiums. This seemingly simple search query reveals a complex set of motivations, expectations, and potential concerns. Understanding these nuances is crucial for providing a positive user experience and effectively meeting their needs.

The primary driver behind this search is cost-consciousness. Users are actively seeking the best value for their money and want to avoid overpaying for insurance coverage. This search indicates a proactive approach to managing personal finances, reflecting a desire for control and transparency in their insurance decisions.

Types of Insurance Sought

Users searching for “insurance quote free” may be seeking quotes for a variety of insurance types, depending on their individual circumstances and needs. Common types include auto insurance, home insurance, health insurance, life insurance, and renters insurance. The specific type of insurance sought will influence the details included in the quote request and the level of information the user will provide. For example, a user seeking auto insurance might provide details about their vehicle, driving history, and desired coverage levels, while someone seeking home insurance would provide information about their property and its value.

User Concerns and Expectations

Users searching for free insurance quotes often have several key concerns and expectations. They expect the quotes to be accurate and reflect their specific needs. Transparency is paramount; they want to understand what factors are influencing the price and avoid hidden fees or unexpected costs. Concerns about data privacy and the security of their personal information are also common, especially given the sensitive nature of the data involved in insurance applications. Furthermore, users expect a relatively straightforward and user-friendly quote generation process, minimizing the time and effort required to obtain the information they need. A negative experience, such as a complicated application process or confusing pricing structure, can quickly deter users from pursuing a quote further.

User Journey from Search to Quote

The user journey from the initial search to obtaining a quote involves several distinct steps. Understanding these steps and potential pain points allows for a more efficient and user-friendly experience.

| Step | User Actions | Potential Pain Points | Solutions |

|---|---|---|---|

| Search for “insurance quote free” | Enters search query into a search engine. | Overwhelming number of results; difficulty distinguishing legitimate sites from scams. | Clear and concise search engine optimization () and website design; prominent display of trust signals (e.g., customer reviews, security badges). |

| Selects a website/platform | Reviews search results and chooses a website offering free quotes. | Unclear pricing information; confusing website navigation; lack of transparency. | User-friendly website design; clear and concise pricing information; easy-to-understand explanations of coverage options. |

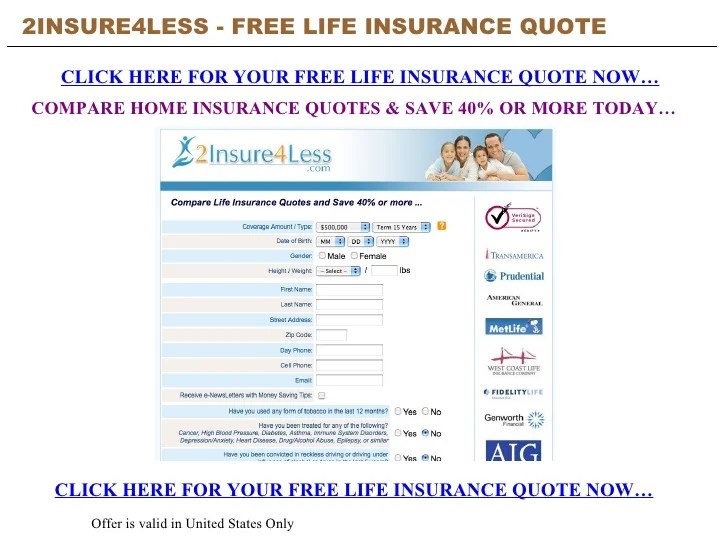

| Completes the quote request form | Provides personal information and details relevant to the type of insurance sought. | Lengthy forms; intrusive data requests; concerns about data security. | Short, concise forms; clear explanation of why data is requested; visible security measures (e.g., SSL encryption). |

| Receives and reviews the quote | Receives the generated quote and compares it to other offers. | Inaccurate or incomplete quotes; difficulty understanding the quote details; inability to compare apples-to-apples. | Accurate and detailed quotes; clear and concise explanation of coverage details; standardized comparison tools. |

Analyzing Competitor Strategies for Free Quotes

Understanding how competitors leverage free insurance quotes is crucial for optimizing a company’s own strategy. Analyzing their methods reveals best practices and potential areas for improvement. This analysis focuses on the methods employed, the advantages and disadvantages of each, and the effectiveness of their website designs in presenting quote options.

Different insurance providers utilize a variety of strategies to attract customers seeking free quotes. These range from streamlined online forms to more personalized phone consultations, each with its own set of benefits and drawbacks. Examining these approaches helps identify the most efficient and customer-friendly methods.

Quote Generation Methods: A Comparison

The primary methods used by insurance companies to generate free quotes are online forms, phone calls, and a combination of both. Online forms offer convenience and speed, while phone calls allow for more personalized interaction and clarification of complex information. A blended approach attempts to leverage the strengths of each.

- Online Forms: Advantages include 24/7 availability, quick quote generation, and the ability to gather comprehensive data efficiently. Disadvantages include potential for user errors in input, lack of immediate personalized assistance, and the inability to address complex situations requiring human intervention.

- Phone Calls: Advantages include personalized assistance, immediate clarification of doubts, and the ability to handle complex scenarios effectively. Disadvantages include limited availability (business hours only), potential for longer wait times, and higher operational costs for the insurance provider.

- Blended Approach: Advantages include combining the convenience of online forms with the personalized service of phone calls, offering a flexible approach to suit diverse customer preferences. Disadvantages involve higher implementation costs and the need for effective integration between online and offline systems.

Website Design for Free Quotes

Effective website design is crucial for converting potential customers into leads. A clear, concise, and user-friendly interface is essential for presenting free quote options. Ineffective designs often lead to customer frustration and lost opportunities.

Examples of effective designs include prominent placement of the “Get a Quote” button, clear instructions, and a straightforward form with minimal required fields. Ineffective designs often feature cluttered layouts, confusing navigation, and overly complex forms.

Competitor Analysis: Three Case Studies

The following bulleted list compares the approaches of three hypothetical insurance companies (Company A, Company B, and Company C) to free quote generation. Note that these are illustrative examples and not based on specific real-world companies.

- Company A: Primarily relies on online forms. Their website features a prominent “Get a Quote” button, a streamlined form with minimal fields, and clear instructions. They offer instant quotes. This approach prioritizes speed and efficiency but may lack personalized assistance.

- Company B: Employs a blended approach. They offer both online forms and a phone number for quotes. Their website clearly displays both options. This approach aims to cater to a wider range of customer preferences, balancing convenience and personalized service.

- Company C: Focuses heavily on phone calls. Their website features a prominent phone number and emphasizes the personalized service offered by their agents. This approach prioritizes customer interaction but may be less convenient for some users.

Content Creation for Free Quote Offers

Crafting compelling content for free insurance quotes requires a strategic approach that highlights the ease and value of obtaining a personalized estimate. This involves persuasive website copy, targeted email campaigns, and strong calls to action, all enhanced by visually appealing elements. The goal is to convert potential customers into quote requesters and, ultimately, policyholders.

Compelling Website Copy for Free Quotes

Effective website copy should immediately address the user’s need for a quick and easy quote. Avoid jargon and focus on the benefits of obtaining a free quote, such as saving time and money, comparing options, and understanding coverage options. For example, the headline could be “Get Your Free Insurance Quote in Minutes!” followed by a concise explanation of the process and the types of insurance offered. Body copy should emphasize the no-obligation nature of the quote and the simplicity of the request form. Testimonials from satisfied customers can further build trust and credibility. A clear and prominent call to action, such as a large button labeled “Get My Free Quote Now,” should guide users towards the next step.

Sample Email Sequence Promoting Free Quotes

A multi-email sequence can nurture leads and increase the likelihood of quote requests. This sequence should focus on different aspects of the insurance offering and progressively increase the urgency to obtain a quote.

Subject: Get a Free Insurance Quote Today!

Body: Hi [Name], Are you looking for affordable insurance? Get a free, no-obligation quote in minutes. Click here to get started: [link to quote form]

Subject: Don’t Delay, Get Your Free Quote!

Body: Hi [Name], We understand that insurance can be confusing. Let us simplify the process with a free, personalized quote tailored to your needs. Click here to request your quote: [link to quote form]

Subject: Last Chance: Free Insurance Quote!

Body: Hi [Name], This is your last reminder to get your free insurance quote before [date]. Don’t miss out on potential savings! Get your quote here: [link to quote form]

Strong Calls to Action for Free Quote Requests

Strong calls to action (CTAs) are crucial for driving conversions. They should be clear, concise, and visually prominent. Effective examples include: “Get Your Free Quote Now,” “Request a Free Quote,” “See Your Personalized Quote,” “Get Started – It’s Free!” The use of action verbs and a sense of urgency is key. Consider A/B testing different CTAs to determine which performs best.

Use of Visual Elements to Enhance Free Quote Offers

Visual elements significantly enhance the appeal of free quote offers. For example, a hero image could depict a happy family protected by an insurance umbrella, symbolizing security and peace of mind. The image should be bright, cheerful, and high-quality. Infographics can visually explain the benefits of insurance and the simplicity of the quote process. A simple infographic could show three steps to getting a quote, using icons and minimal text. The color scheme should be consistent with the brand and evoke feelings of trust and reliability. Finally, a short video showcasing satisfied customers sharing their positive experiences can add a personal touch and build credibility.

Addressing User Concerns about Free Quotes

Obtaining a free insurance quote is a common first step for many, but several misconceptions and potential obstacles can create hesitation or distrust. Understanding these concerns and proactively addressing them is crucial for building confidence and encouraging users to proceed. This section will explore common anxieties and Artikel strategies for fostering a transparent and trustworthy quote process.

Many users believe that a free insurance quote implies a commitment or obligation. This is often not the case. A free quote simply provides an estimate of potential costs based on the information provided. It is not a binding contract, and users are under no obligation to purchase a policy. Another common misconception is that free quotes are somehow less accurate or comprehensive than paid quotes. While the level of detail may vary, reputable providers strive to provide accurate estimates based on the information supplied. Finally, some users fear hidden fees or unexpected charges associated with the quote request itself. Transparency in the process is key to dispelling this fear.

Common Misconceptions about Free Insurance Quotes

The belief that a free quote automatically leads to unwanted sales calls or emails is a significant concern. Users often worry about their personal information being used inappropriately or shared with third parties. This fear is valid and requires proactive measures to assure users of data privacy and security. Furthermore, some users are skeptical about the accuracy of online quote tools, believing they might provide inaccurate or incomplete estimates. They may worry that crucial details are missed, leading to a misleading price. Addressing these concerns requires clear and concise explanations of the quote generation process, emphasizing the importance of accurate information input and highlighting any limitations.

Obstacles Users Encounter When Requesting a Free Quote

Complex forms and lengthy questionnaires can deter users from completing a quote request. Overly complicated forms with confusing terminology or unclear instructions can frustrate users and lead them to abandon the process. Lack of clarity regarding the next steps after submitting a quote request is another significant obstacle. Users may be uncertain about the timeframe for receiving a response or the process for discussing the quote with an agent. Insufficient information about what data is required can also lead to user frustration and incomplete quote requests. For example, a form requesting specific details without clear explanations of why they are needed could lead to user distrust and abandonment.

Strategies for Building Trust and Transparency in the Quote Process

Building trust hinges on clear communication and data privacy assurances. A simple, user-friendly interface with clear instructions and easily understandable language is essential. Transparency about data usage is paramount; users should be clearly informed about how their information will be used and protected. Providing a readily available FAQ section that addresses common concerns, such as data privacy and the non-binding nature of quotes, can also significantly enhance trust. Additionally, displaying security badges and certifications (e.g., encryption protocols used) can reassure users about the security of their information.

Best Practices for Handling User Inquiries and Addressing Concerns about Hidden Fees or Obligations

Prompt and helpful responses to user inquiries are crucial. Providing clear, concise answers to questions about hidden fees, obligations, and data privacy will build confidence. A dedicated customer support team readily available via phone, email, or chat can address user concerns effectively. Proactive communication about the quote process, including expected timelines and next steps, will minimize uncertainty and build trust. Clearly stating that there are no hidden fees associated with obtaining a quote and outlining any potential costs only arise after accepting a policy will address fears about unexpected charges. For instance, a clear statement like “There are absolutely no hidden fees or obligations associated with requesting a quote. The price you see is the price you get before you commit to a policy” can be extremely reassuring.

Improving the User Experience for Free Quote Requests

A seamless and efficient free quote request process is crucial for converting potential customers into paying clients. A frustrating experience can lead to abandonment, costing businesses valuable leads. Optimizing the user experience involves streamlining the process, simplifying forms, and understanding the needs of the target audience. This section details strategies to enhance the free quote request process and improve conversion rates.

Step-by-Step Guide for Simplifying the Free Quote Request Process

A clear and concise step-by-step guide can significantly improve the user experience. Each step should be easily understandable and visually appealing. Ambiguity leads to user frustration and abandonment. A well-designed guide instills confidence and encourages completion.

- Landing Page: The landing page should clearly state the purpose – obtaining a free quote – and provide a prominent, easily accessible button or link to initiate the process.

- Form Completion: The form itself should be short, focusing only on essential information. Use clear labels and avoid jargon.

- Progress Indicators: Visual progress indicators, such as progress bars, show users how far along they are in the process, keeping them engaged and motivated.

- Real-time Feedback: Provide real-time feedback to the user as they fill out the form, such as validation messages to ensure data accuracy.

- Confirmation: Upon completion, provide a clear confirmation message, including a reference number and expected timeframe for receiving the quote.

Improvements to Online Forms to Reduce Friction and Improve Completion Rates

Online forms are often the biggest hurdle in the quote request process. Optimizing these forms is key to increasing completion rates. Reducing the number of fields, using clear and concise language, and employing smart form design principles are critical steps.

- Minimize Fields: Only request essential information. Avoid unnecessary fields that don’t directly impact the quote generation.

- Smart Form Design: Use conditional logic to show or hide fields based on previous answers. For example, if a user selects “car insurance,” fields related to home insurance can be hidden.

- Input Validation: Implement real-time input validation to prevent errors and provide immediate feedback to the user.

- Progressive Profiling: Gather information incrementally over multiple interactions rather than overwhelming the user with a single, long form.

- Clear Call to Action: Use a clear and concise call to action button, such as “Get My Free Quote Now,” to encourage completion.

User Persona: The Typical Free Quote Seeker

A representative user persona helps in understanding user needs and pain points. Consider “Sarah,” a 32-year-old working professional who needs car insurance. Sarah is busy and values her time. She wants a quick, easy, and transparent process. Her pain points include lengthy forms, unclear instructions, and lack of immediate feedback. Understanding Sarah’s needs allows for the design of a user-friendly quote request process.

Mobile Optimization for Free Quote Requests

Mobile optimization is paramount, as a significant portion of users access the internet via smartphones. A mobile-friendly design ensures a positive user experience across all devices.

- Responsive Design: The website should adapt seamlessly to different screen sizes and orientations.

- Simplified Navigation: Navigation should be intuitive and easy to use on smaller screens.

- Touch-Friendly Elements: Buttons and other interactive elements should be large enough to easily tap with fingers.

- Fast Loading Speed: Pages should load quickly to avoid user frustration.

- Optimized Forms: Forms should be designed for ease of use on mobile devices, with auto-fill features where possible.

Closing Summary

Ultimately, offering free insurance quotes is about more than just generating leads; it’s about building trust and providing a valuable service. By understanding user needs, streamlining the quote process, and addressing potential concerns with transparency, insurance providers can create a positive experience that fosters customer loyalty and drives business growth. A well-executed free quote strategy can be a powerful tool for attracting new customers and establishing a strong brand reputation.

Query Resolution

What types of insurance typically offer free quotes?

Many insurance types offer free quotes, including auto, home, health, life, and renters insurance.

Are there any hidden fees associated with free quotes?

Reputable companies clearly Artikel all costs upfront. Be wary of offers that seem too good to be true.

How accurate are free online quotes?

Online quotes provide estimates. Final pricing depends on a more detailed application.

What information is needed to get a free quote?

Generally, basic personal and property information is required. Specifics vary by insurer and insurance type.

Can I compare multiple free quotes simultaneously?

Yes, using comparison websites or requesting quotes from multiple insurers directly allows for comparison.