Navigating the world of homeowner’s insurance can feel like traversing a maze. Understanding insurance home quotes is crucial for protecting your most valuable asset – your home. This guide demystifies the process, providing a clear path to securing the right coverage at the best possible price. We’ll explore the intricacies of different policy types, the factors influencing costs, and the steps involved in obtaining and comparing quotes, empowering you to make informed decisions.

From deciphering policy jargon to identifying reputable providers, we’ll equip you with the knowledge to confidently navigate the insurance landscape. This comprehensive guide will illuminate the often-opaque world of home insurance, enabling you to secure the peace of mind that comes with knowing your home is adequately protected.

Understanding “Insurance Home Quotes”

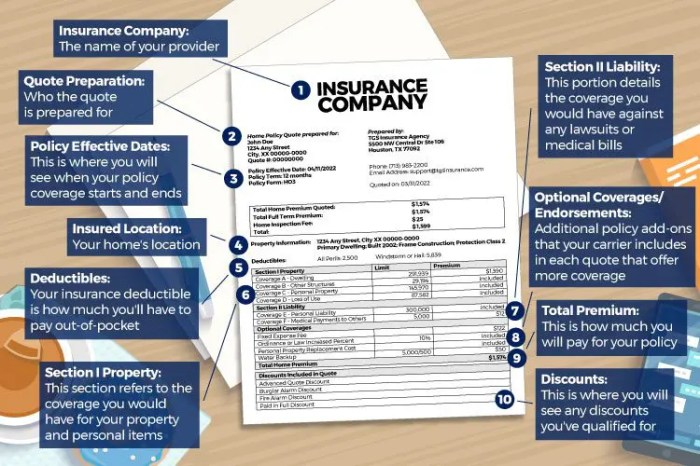

Home insurance quotes are estimates of the cost of insuring your home and its contents against various risks. Understanding these quotes is crucial for securing adequate protection at a reasonable price. This section will clarify the meaning of home insurance quotes, the coverage they offer, factors influencing their cost, and different policy types available.

Home Insurance Quote Definition

A home insurance quote provides a detailed breakdown of the potential cost for a homeowner’s insurance policy based on your specific circumstances. It Artikels the coverage options, premiums, and deductibles. It’s important to remember that a quote is not a binding contract; it’s an offer from the insurance company, which you can accept or decline. Multiple quotes from different insurers are recommended to ensure you find the best coverage at the most competitive price.

Types of Home Insurance Coverage

Home insurance policies typically bundle several types of coverage. These commonly include dwelling coverage (repair or replacement of the house itself), personal liability coverage (protection against lawsuits arising from accidents on your property), additional living expenses (covering temporary housing if your home is uninhabitable due to a covered event), and personal property coverage (protecting your belongings). Some policies also offer specialized coverages like flood insurance (separate from standard policies) or earthquake insurance (often an add-on).

Factors Influencing Home Insurance Costs

Several factors significantly influence the cost of your home insurance quote. These include your home’s location (risk of natural disasters, crime rates), the age and condition of your home (older homes may require more maintenance and repairs), the value of your home and its contents, the amount of coverage you choose, your credit score (reflecting your financial responsibility), and your claims history (past claims may lead to higher premiums). For example, a home in a hurricane-prone area will generally command a higher premium than one in a low-risk area. Similarly, a homeowner with a history of filing claims will likely pay more than one with a clean record.

Comparison of Home Insurance Policies

| Policy Type | Coverage Details | Typical Exclusions | Average Cost Factors |

|---|---|---|---|

| Basic Homeowners Insurance | Covers dwelling, personal liability, and personal property; limited additional living expenses. | Floods, earthquakes, intentional acts, normal wear and tear. | Home value, location, coverage limits, claims history, credit score. |

| Broad Homeowners Insurance | Similar to basic, but with broader coverage for personal property and additional perils. | Floods, earthquakes, intentional acts, normal wear and tear. | Home value, location, coverage limits, claims history, credit score; higher than basic. |

| Comprehensive Homeowners Insurance | Most extensive coverage, including replacement cost coverage for dwelling and personal property, higher liability limits, and broader peril coverage. | Floods, earthquakes, intentional acts, normal wear and tear (unless specifically added). | Home value, location, coverage limits, claims history, credit score; significantly higher than basic and broad. |

| Renters Insurance | Covers personal property and liability for renters. | Damage to the building itself, floods, earthquakes (unless added). | Value of personal belongings, location, coverage limits, claims history, credit score. |

Key Factors Affecting Home Insurance Quote Prices

Securing affordable home insurance requires understanding the factors influencing premium costs. Insurance companies utilize a complex formula considering various aspects of your property and personal circumstances to determine your risk profile. This ultimately translates into the price you pay for your policy. A thorough understanding of these factors can empower you to make informed decisions and potentially lower your premiums.

Several key elements significantly impact your home insurance quote. These factors are carefully weighed by insurers to assess the likelihood of claims and the potential cost of those claims. This assessment forms the basis of your premium calculation.

Location

Your home’s location is a paramount factor in determining insurance costs. Areas prone to natural disasters, such as hurricanes, earthquakes, wildfires, or floods, command higher premiums due to the increased risk of damage. For example, a home situated in a coastal region susceptible to hurricanes will typically incur significantly higher premiums than a similar home located in an inland area with minimal natural disaster risk. Furthermore, the crime rate in your neighborhood also plays a role; higher crime rates often translate to increased premiums due to the higher likelihood of theft or vandalism claims. The proximity to fire hydrants and the quality of local fire services can also affect your rates.

Home Value and Coverage Levels

The value of your home directly impacts your insurance premium. Higher-valued homes generally require higher coverage amounts, leading to increased premiums. This is because the insurer’s potential payout in the event of a total loss is significantly greater. Similarly, the level of coverage you choose influences the cost. Comprehensive coverage, encompassing a wider range of perils and providing higher limits, will naturally result in a higher premium compared to a basic policy with lower limits. For instance, opting for replacement cost coverage (covering the cost to rebuild your home to current standards) will be more expensive than actual cash value coverage (covering the depreciated value of your home).

Homeowner’s Credit Score and Claims History

Your credit score is often a significant factor in determining your insurance premium. Insurers view a good credit score as an indicator of responsible financial behavior, associating it with a lower risk of claims. Individuals with poor credit scores may face higher premiums due to the perceived increased risk. Similarly, your claims history significantly impacts your premiums. Filing multiple claims in the past can indicate a higher risk profile, resulting in higher premiums. Conversely, a clean claims history can lead to lower premiums as it demonstrates a reduced likelihood of future claims. Insurers often utilize scoring models that incorporate both credit and claims history to refine their risk assessment.

Prioritization of Factors Impacting Premiums

The relative impact of these factors can vary depending on the insurer and specific circumstances. However, a general prioritization might look like this:

- Location: This is often the most significant factor, particularly the risk of natural disasters and crime.

- Home Value and Coverage Levels: Directly proportional to the potential payout in case of damage or loss.

- Homeowner’s Credit Score: A significant factor for many insurers, reflecting perceived risk.

- Claims History: A substantial factor, demonstrating past risk behavior.

Illustrating Home Insurance Concepts

Understanding the intricacies of homeowners insurance can seem daunting, but a clear grasp of its components and processes can provide significant peace of mind. This section will demystify homeowners insurance by detailing a typical policy, outlining a damage claim scenario, and providing a textual representation of the coverage areas.

A Typical Homeowners Insurance Policy

A standard homeowners insurance policy typically bundles several types of coverage to protect your property and your liability. These components work together to offer comprehensive protection against various risks. The specific details and limits of coverage will vary depending on the insurer, the policyholder’s location, and the specifics of the property being insured. Key components usually include dwelling coverage (covering the physical structure of your home), other structures coverage (covering detached structures like garages or sheds), personal property coverage (covering your belongings inside and sometimes outside your home), loss of use coverage (providing temporary living expenses if your home becomes uninhabitable due to a covered event), personal liability coverage (protecting you from financial responsibility for injuries or damages caused to others), and medical payments coverage (covering medical expenses for others injured on your property).

Home Damage Claim Scenario

Imagine a severe thunderstorm causes significant damage to your roof. After securing your home and ensuring the safety of your family, you would immediately contact your insurance company to report the claim. The insurer will typically assign an adjuster to assess the damage. This adjuster will inspect your property, taking photos and documenting the extent of the damage. They may also obtain estimates from contractors to repair the roof. The appraisal process involves comparing the adjuster’s assessment with the contractor’s estimates to determine the fair cost of repairs. Once the appraisal is complete, the insurance company will issue a settlement based on your policy’s coverage limits and deductible. The settlement may be paid directly to you to cover repairs, or it may be paid directly to the contractor if you choose to work with a pre-approved contractor from the insurer’s list.

Visual Representation of Home Insurance Coverage

Imagine a house represented by a simple square: [—-] representing the walls. The roof is represented by a triangle above: /\/\.

* Dwelling Coverage: This covers the entire square [—-] representing the house’s structure – walls, foundation, roof, etc.

* Other Structures Coverage: This covers a separate small square next to the main house: [–]. This represents a detached garage or shed.

* Personal Property Coverage: This covers the contents *inside* the main square [—-]. This includes furniture, appliances, clothing, and other belongings.

* Liability Coverage: This extends beyond the house, representing protection against claims if someone is injured on your property. Imagine a circle around the house.

* Loss of Use Coverage: This represents temporary alternative housing should your home become uninhabitable due to covered damage. Imagine a small temporary house symbol near the damaged house.

Conclusive Thoughts

Ultimately, securing suitable insurance home quotes involves a thorough understanding of your needs, a diligent comparison of providers, and a clear grasp of policy terms. By following the steps Artikeld in this guide, you can confidently navigate the process, ensuring your home is protected against unforeseen circumstances. Remember, the right insurance policy provides more than just financial security; it offers peace of mind, allowing you to focus on what truly matters – enjoying your home and the life within its walls.

Question & Answer Hub

What is the difference between actual cash value (ACV) and replacement cost coverage?

ACV coverage pays for the current value of your damaged property, minus depreciation. Replacement cost coverage pays for the cost to replace your damaged property with new, similar items, regardless of depreciation.

How often should I review my home insurance policy?

It’s recommended to review your policy annually, or whenever there are significant changes to your home or possessions (e.g., renovations, major purchases).

Can I get insurance quotes without providing my personal information?

While some initial information is generally required to get a basic quote, you don’t typically need to provide highly sensitive data upfront. Be wary of sites requesting excessive personal details before providing a quote.

What happens if I file a claim and my insurer disputes the amount?

If you disagree with your insurer’s assessment, you can typically appeal their decision. Many policies provide a process for dispute resolution, potentially involving mediation or arbitration.

What factors affect my eligibility for home insurance?

Factors such as your credit score, claims history, the age and condition of your home, and its location all influence your eligibility and premium cost.