Navigating the world of insurance can be daunting, especially in a bustling metropolis like Dallas. This comprehensive guide unravels the complexities of securing the right insurance coverage, from understanding the various types available to comparing providers and navigating the claims process. We’ll explore the factors influencing costs, empowering you to make informed decisions about protecting your assets and well-being.

Dallas presents a diverse insurance landscape, reflecting the city’s dynamic economy and population. Understanding the nuances of this market is crucial for obtaining optimal coverage at competitive prices. This guide aims to equip you with the knowledge and tools necessary to confidently navigate this landscape and find the perfect insurance solution tailored to your specific needs.

Types of Insurance in Dallas

Dallas, a major metropolitan area, offers a wide array of insurance options to cater to the diverse needs of its residents and businesses. Understanding the different types of insurance available and their associated costs is crucial for making informed decisions about financial protection. This section will explore common insurance types in Dallas, detailing their key features, average costs, and prominent providers.

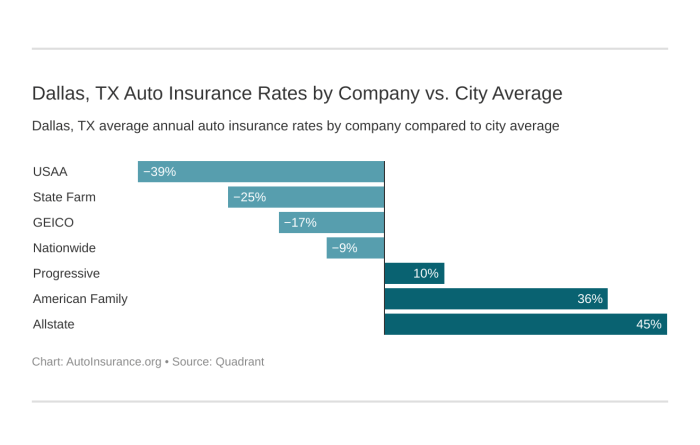

Auto Insurance in Dallas

Auto insurance is mandatory in Texas, and Dallas residents face varying premiums based on factors such as driving history, vehicle type, and coverage levels. Comprehensive coverage protects against damage from various causes, while liability coverage protects against claims from accidents you cause. Uninsured/underinsured motorist coverage protects you if involved in an accident with an at-fault driver lacking sufficient insurance.

| Insurance Type | Key Features | Average Cost | Providers |

|---|---|---|---|

| Auto Insurance | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist | $1,200 – $2,000 annually (varies widely) | State Farm, Geico, Progressive, Allstate, Farmers |

Homeowners Insurance in Dallas

Homeowners insurance protects your property and personal belongings from damage or loss due to various perils, including fire, theft, and weather events. Coverage amounts and premiums vary based on factors such as location, home value, and coverage options. Higher-value homes in desirable neighborhoods may command higher premiums.

| Insurance Type | Key Features | Average Cost | Providers |

|---|---|---|---|

| Homeowners Insurance | Dwelling coverage, personal property coverage, liability coverage | $1,500 – $3,000 annually (varies widely) | State Farm, Allstate, Farmers, USAA, Liberty Mutual |

Renters Insurance in Dallas

Renters insurance protects your personal belongings in a rental property from damage or loss. It also provides liability coverage if someone is injured on your property. While not mandatory, it’s a cost-effective way to protect your assets. Premiums are generally lower than homeowners insurance.

| Insurance Type | Key Features | Average Cost | Providers |

|---|---|---|---|

| Renters Insurance | Personal property coverage, liability coverage, additional living expenses | $150 – $300 annually (varies widely) | State Farm, Lemonade, Allstate, Liberty Mutual |

Health Insurance in Dallas

Health insurance is crucial for covering medical expenses. Options include plans offered through the Affordable Care Act (ACA) marketplace, employer-sponsored plans, and private plans. Costs vary significantly based on plan type, coverage, and individual health needs. The ACA marketplace offers subsidies to help individuals afford coverage.

| Insurance Type | Key Features | Average Cost | Providers |

|---|---|---|---|

| Health Insurance | Hospitalization, doctor visits, prescription drugs (coverage varies by plan) | Highly variable, depending on plan and individual circumstances | Blue Cross Blue Shield of Texas, UnitedHealthcare, Humana, Aetna |

Business Insurance in Dallas

Businesses in Dallas require various insurance types to protect against risks such as liability, property damage, and employee-related issues. Types include general liability, commercial property, workers’ compensation, and professional liability (errors and omissions) insurance. Premiums depend on the size and nature of the business, as well as the level of coverage.

| Insurance Type | Key Features | Average Cost | Providers |

|---|---|---|---|

| Business Insurance (various types) | General liability, property, workers’ compensation, professional liability | Highly variable, depending on business type and coverage | The Hartford, Travelers, Chubb, CNA |

Top Insurance Providers in Dallas

Choosing the right insurance provider in a large metropolitan area like Dallas can be a significant decision. This section will profile five leading insurance providers, examining their strengths, weaknesses, and market presence to aid in your selection process. Market share data fluctuates, and precise figures require continuous updates from industry reports, but a general overview based on reputation and observed market presence is presented here.

Leading Insurance Providers in Dallas: An Overview

Dallas boasts a competitive insurance market, with numerous companies vying for clients. The following profiles highlight five prominent players, offering insights into their service offerings and overall standing. It’s crucial to remember that individual experiences can vary.

State Farm

State Farm consistently ranks among the largest insurance providers nationwide, and its presence in Dallas is substantial. Strengths include a vast agent network providing convenient local service, extensive coverage options, and generally competitive pricing. Weaknesses might include a less flexible approach to claims compared to some competitors, and a potentially less personalized experience due to its sheer scale. State Farm’s broad reach and established reputation contribute to its significant market share.

Farmers Insurance

Farmers Insurance, another national giant, maintains a strong foothold in Dallas. Its strengths lie in its independent agent model, which allows for more personalized service and tailored insurance solutions. However, this model can sometimes lead to pricing inconsistencies across agents. Farmers’ wide range of coverage options and reputation for reliable claims handling are major selling points.

Allstate

Allstate is known for its extensive advertising and widespread recognition. In Dallas, it offers a balance between national reach and local representation. Strengths include strong brand recognition, a wide range of products, and readily available customer service. Potential weaknesses could be higher premiums in certain cases compared to competitors and a potentially less personalized experience than smaller, independent providers.

USAA

USAA is a highly-rated provider, but its services are exclusively available to military personnel and their families. Its strengths are undeniable: exceptional customer service, competitive pricing, and a strong commitment to its members. However, its limited eligibility restricts its overall market share in the broader Dallas community. For eligible customers, USAA is often considered a top choice.

Geico

Geico, known for its advertising campaigns and often competitive pricing, has a considerable presence in Dallas. Strengths include straightforward online processes, generally competitive rates, and efficient claims handling. Weaknesses can include less personalized service compared to agent-based models, and potentially limited coverage options in certain niche areas.

Comparative Table of Top Insurance Providers

| Provider | Customer Rating (Average) | Auto Insurance | Home Insurance | Life Insurance | Other Coverages |

|---|---|---|---|---|---|

| State Farm | 4.2/5 | Yes | Yes | Yes | Renters, Business |

| Farmers Insurance | 4.0/5 | Yes | Yes | Yes | Umbrella, Motorcycle |

| Allstate | 3.8/5 | Yes | Yes | Yes | Boat, RV |

| USAA | 4.5/5 | Yes | Yes | Yes | Financial Products |

| Geico | 3.9/5 | Yes | Yes | No | Motorcycle, Renters |

*(Note: Customer ratings are approximate averages based on various online reviews and may vary depending on the source and time of review.)*

Cost of Insurance in Dallas

Understanding the cost of insurance in Dallas requires considering several interconnected factors. Premiums aren’t uniform; they fluctuate based on individual circumstances and the specific type of insurance sought. This section will detail the key elements influencing insurance expenses in the Dallas area.

The price of insurance in Dallas, like any other major city, is a complex calculation. Several factors significantly influence the final premium a person or business pays. These factors interact in intricate ways, making it difficult to predict a precise cost without a detailed assessment of individual circumstances.

Factors Influencing Insurance Costs

The cost of insurance in Dallas is determined by a combination of individual characteristics and market conditions. Understanding these factors is crucial for making informed decisions about insurance coverage.

- Location within Dallas: Premiums can vary significantly depending on the specific neighborhood or zip code. Areas with higher crime rates or a greater frequency of accidents tend to have higher insurance costs. For example, insurance in a densely populated urban area might be more expensive than in a quieter suburban neighborhood.

- Age and Driving History: Younger drivers, particularly those with limited driving experience or a history of accidents or traffic violations, generally face higher auto insurance premiums. Insurance companies consider age a strong indicator of risk. Similarly, older individuals may see adjustments in health insurance premiums based on age-related health risks.

- Health Conditions (for Health Insurance): Pre-existing health conditions significantly impact the cost of health insurance. Individuals with chronic illnesses or conditions requiring ongoing treatment typically pay higher premiums. The severity and management of these conditions influence the premium cost.

- Credit Score (for various insurance types): Surprisingly, your credit score can influence the cost of various insurance types, including auto and homeowners insurance. A lower credit score is often associated with a higher risk profile, leading to increased premiums. This is because a poor credit score can indicate a higher likelihood of claims.

- Type of Coverage and Deductibles: The level of coverage chosen directly impacts the cost. Comprehensive coverage naturally costs more than basic coverage. Similarly, higher deductibles (the amount you pay out-of-pocket before insurance kicks in) typically result in lower premiums, but higher out-of-pocket expenses in case of a claim.

Visual Representation of Cost Factors

Imagine a three-dimensional graph. The vertical axis represents the cost of insurance. The horizontal axes represent two key factors: age and location (represented by a spectrum from urban to suburban). Each point on the graph represents a specific combination of age and location, with the height indicating the corresponding insurance cost. The graph would show a general upward trend as you move towards older ages and more urban locations, although the exact relationship would be complex and not perfectly linear, reflecting the interaction of various factors. The graph would also have different “surfaces” representing different insurance types (auto, home, health), each with its own cost profile.

Finding the Right Insurance in Dallas

Securing the right insurance in Dallas requires a strategic approach. Navigating the diverse market and understanding your specific needs are key to finding a policy that offers comprehensive coverage at a competitive price. This section Artikels a step-by-step process to guide you through this important decision.

Steps to Finding Suitable Insurance

Finding the right insurance involves careful planning and research. A systematic approach ensures you consider all relevant factors and make an informed choice. The following steps will help you navigate the process effectively.

- Assess Your Needs: Begin by identifying your insurance requirements. Consider the types of coverage you need (auto, home, health, etc.), the level of coverage desired, and any specific circumstances relevant to your situation, such as owning a high-value home or having a history of accidents.

- Gather Quotes: Obtain quotes from multiple insurance providers. Don’t limit yourself to just one or two; compare at least three to five quotes to ensure you’re getting a competitive price. Use online comparison tools or contact providers directly.

- Review Policy Details: Carefully examine each policy’s details, including coverage limits, deductibles, exclusions, and premiums. Pay close attention to the fine print to understand exactly what is and isn’t covered.

- Compare and Contrast: Create a comparison chart to easily visualize the different quotes. Consider the overall cost, coverage levels, and the reputation of the insurance provider. Prioritize policies that best meet your needs and budget.

- Verify Provider Reputation: Research the financial stability and customer service ratings of the providers you are considering. Check online reviews and ratings from independent sources.

- Choose and Purchase: Once you’ve identified the best policy for your needs, complete the application process and purchase the insurance.

Crucial Questions for Insurance Providers

Before committing to a policy, it’s essential to ask pertinent questions to ensure clarity and transparency. These questions will help you make an informed decision based on a complete understanding of the policy’s terms and conditions.

- What are the specific coverage limits and exclusions of the policy?

- What is the process for filing a claim, and what documentation is required?

- What are the payment options available, and what are the penalties for late payments?

- What is the provider’s customer service process, and how can I contact them if I have questions or need assistance?

- What is the provider’s financial stability rating, and what is their history of claims processing?

- Are there any discounts available, such as multi-policy discounts or safe driver discounts?

Importance of Comparing Quotes

Comparing quotes from multiple insurance providers is paramount to securing the best possible policy at the most competitive price. Simply choosing the first quote you receive could result in overpaying for coverage. By comparing, you gain a clear understanding of the market value of insurance and can identify the best deal that aligns with your budget and needs. For example, one provider might offer a lower premium but with significantly lower coverage limits, while another might have a slightly higher premium but with more comprehensive coverage. Comparing allows you to weigh these factors and make an informed decision.

Flowchart for Finding and Selecting Insurance

The flowchart begins with “Assess Your Insurance Needs.” This leads to “Research and Obtain Quotes from Multiple Providers.” Next, “Compare Quotes Based on Price, Coverage, and Provider Reputation” follows. Then, “Verify Provider’s Financial Stability and Customer Reviews” is the next step. Following this is a decision point: “Is the best policy found?” If yes, the process ends with “Purchase the Policy.” If no, the process loops back to “Research and Obtain Quotes from Multiple Providers” to continue the search.

Insurance Regulations in Dallas

Dallas, like all cities in Texas, operates under the overarching regulations established by the Texas Department of Insurance (TDI). Understanding these regulations is crucial for both insurance providers and consumers in the Dallas area to ensure fair practices and consumer protection. While Dallas itself doesn’t have unique city-level insurance regulations, the application and enforcement of state-wide rules significantly impact the insurance landscape within the city.

The Role of the Texas Department of Insurance

The Texas Department of Insurance holds primary responsibility for overseeing the insurance industry within the state, including Dallas. The TDI’s role encompasses licensing and monitoring insurance companies, agents, and adjusters; establishing and enforcing regulations to protect consumers; investigating complaints; and ensuring the solvency of insurance providers. Their actions directly influence the availability, affordability, and quality of insurance products offered in Dallas. The TDI uses a combination of proactive oversight and reactive investigation to maintain a stable and fair insurance market. This includes regular audits of insurance companies, market analysis to identify potential problems, and prompt responses to consumer complaints.

Comparison of Insurance Regulations Across Major Texas Cities

While Texas maintains a unified regulatory framework for insurance, the practical application and enforcement may vary slightly across major cities like Dallas, Houston, Austin, and San Antonio. These variations primarily stem from differences in population density, economic activity, and the specific types of insurance claims prevalent in each area. For example, the frequency of property damage claims due to severe weather might lead to a greater focus on regulatory scrutiny of homeowners’ insurance in areas prone to such events. However, the core regulatory principles and the primary enforcement agency (TDI) remain consistent across all Texas cities. Differences are primarily in the volume and types of cases handled by the TDI’s regional offices.

Key Insurance Regulations in Texas (Applicable to Dallas)

The following table Artikels some key insurance regulations in Texas, relevant to consumers in Dallas. It is important to note that this is not an exhaustive list, and specific regulations are subject to change. Always refer to the TDI website for the most up-to-date information.

| Regulation | Description | Impact on Consumers | Enforcement Agency |

|---|---|---|---|

| Texas Insurance Code | The comprehensive body of laws governing the insurance industry in Texas. | Provides a legal framework for consumer protection and fair insurance practices. | Texas Department of Insurance (TDI) |

| Unfair Claims Settlement Practices Act | Prohibits insurance companies from engaging in unfair or deceptive claims settlement practices. | Protects consumers from unfair delays, denials, or lowball settlements. | Texas Department of Insurance (TDI) |

| Consumer Protection Laws | Various laws designed to protect consumers from fraud, misrepresentation, and other unfair practices in the insurance industry. | Provides legal recourse for consumers who have been wronged by insurance companies or agents. | Texas Department of Insurance (TDI), Attorney General’s Office |

| Licensing Requirements for Agents and Adjusters | Regulations governing the licensing and qualifications of insurance agents and adjusters. | Ensures that consumers are dealing with qualified and trustworthy professionals. | Texas Department of Insurance (TDI) |

Insurance Claims Process in Dallas

Filing an insurance claim in Dallas, like any other city, involves a series of steps designed to assess the validity of your claim and determine the appropriate compensation. The process can vary slightly depending on the type of insurance (auto, home, health, etc.) and the specific insurer, but the fundamental steps remain consistent. Understanding this process can significantly expedite the claim resolution.

The process generally begins with reporting the incident to your insurance provider as soon as reasonably possible. This initial report triggers the claims process and allows the insurer to start gathering information. Subsequent steps involve providing documentation, cooperating with investigations, and potentially negotiating a settlement. The complexity of the process can vary significantly based on the specifics of your claim.

Common Claim Scenarios and Procedures

Common claim scenarios in Dallas include auto accidents, home damage (from weather events like hailstorms or from fire), and health-related incidents. For auto accidents, you’ll need to report the accident to the police and your insurer, providing details of the accident, including the date, time, location, and the other party’s information. For home damage, you’ll need to document the damage with photos and videos, and you may need to secure the property to prevent further damage. For health claims, you will need to submit medical bills and documentation from your healthcare provider. Each scenario requires specific documentation to support the claim’s validity.

Required Documentation for Different Claim Types

The documentation required for a claim varies significantly based on the type of insurance. Auto insurance claims typically require a police report (if applicable), photos of vehicle damage, and information about all parties involved. Home insurance claims necessitate detailed descriptions of the damage, photos and videos of the affected areas, and possibly repair estimates. Health insurance claims often require copies of medical bills, doctor’s notes, and possibly diagnostic test results. Life insurance claims often require a death certificate and other supporting documentation. Providing complete and accurate documentation is crucial for a smooth and efficient claims process.

Steps in a Typical Insurance Claim Process

The following steps Artikel a typical insurance claim process. While the specifics might vary, these steps provide a general framework.

- Report the incident to your insurance company immediately. This is the crucial first step, initiating the claim process.

- Gather all necessary documentation. This includes police reports, medical records, photos, repair estimates, and any other relevant information.

- File your claim officially with your insurance provider, usually online or by phone.

- Cooperate fully with your insurance company’s investigation. This may involve providing additional information, attending interviews, or allowing inspections.

- Review the insurance adjuster’s assessment of your claim. This assessment will Artikel the company’s determination of liability and the amount of compensation they are willing to offer.

- Negotiate a settlement if necessary. If you disagree with the adjuster’s assessment, you have the right to negotiate a more favorable settlement.

- Receive your settlement payment. Once the settlement is agreed upon, you’ll receive your payment, either directly or through a check.

Closure

Securing adequate insurance in Dallas is a critical step in safeguarding your financial future. By understanding the different types of insurance, comparing providers, and familiarizing yourself with the claims process, you can make informed choices that provide peace of mind. Remember to carefully consider your individual needs and compare quotes from multiple providers before making a decision. This guide serves as a starting point; further research and consultation with insurance professionals are recommended for personalized advice.

Key Questions Answered

What is the average cost of car insurance in Dallas?

The average cost varies greatly depending on factors like age, driving history, and the type of vehicle. It’s best to obtain quotes from multiple providers for accurate pricing.

How do I file a homeowners insurance claim in Dallas?

Contact your insurance provider immediately after an incident. They will guide you through the process, which typically involves providing documentation such as photos and police reports.

What are the penalties for driving without insurance in Dallas?

Driving without insurance in Texas is illegal and can result in fines, license suspension, and even vehicle impoundment.

Can I get insurance if I have a pre-existing health condition?

Yes, but the cost and coverage may vary depending on the condition. The Affordable Care Act helps protect individuals with pre-existing conditions, though specific coverage details will vary by plan.