Understanding insurance costs is crucial for any business, regardless of size or industry. The price of protecting your operations can significantly impact your bottom line, influencing everything from expansion plans to day-to-day operations. This guide delves into the multifaceted world of business insurance costs, exploring the factors that contribute to premiums, different types of coverage available, and strategies to effectively manage expenses.

From the impact of industry type and business size to the role of location and claims history, we’ll examine the key elements influencing your insurance premiums. We’ll also cover various insurance types, including general liability, professional liability, workers’ compensation, and commercial auto insurance, detailing their costs and coverage specifics. Finally, we’ll provide practical strategies for reducing your insurance expenses and navigating the complexities of policy details.

Factors Influencing Business Insurance Costs

Several key factors significantly impact the cost of business insurance premiums. Understanding these elements allows businesses to make informed decisions about their coverage and potentially reduce their expenses. This section will explore the primary drivers of insurance costs, providing insights into how various aspects of a business influence its premiums.

Industry Type and Insurance Premiums

The type of industry a business operates in is a major determinant of its insurance costs. High-risk industries, such as construction or manufacturing, typically face higher premiums due to the increased likelihood of accidents, injuries, and property damage. Conversely, businesses in lower-risk sectors, like administrative services or retail, may qualify for lower premiums. For example, a construction company will pay significantly more for general liability insurance than a software development firm because of the inherent dangers associated with construction work. The higher potential for claims translates directly into higher premiums.

Business Size and Insurance Costs

The size of a business also plays a crucial role in determining insurance costs. Larger businesses, with more employees and extensive operations, generally require broader coverage and higher limits of liability, leading to higher premiums. Smaller businesses, on the other hand, often have simpler operations and fewer employees, resulting in lower insurance costs. A large manufacturing plant with hundreds of employees will naturally require more extensive workers’ compensation insurance than a small bakery with only a few employees. The scale of operations directly impacts the potential for losses and, consequently, insurance costs.

Location and Insurance Rates

Geographic location is another significant factor influencing insurance rates. Areas with higher crime rates, natural disaster risks (e.g., hurricanes, earthquakes), or a higher frequency of accidents will typically have higher insurance premiums. A business located in a high-crime area might face higher premiums for property insurance due to increased risk of theft or vandalism. Similarly, a business situated in a hurricane-prone region will pay more for property and business interruption insurance than a business in a less vulnerable location. Insurance companies assess risk based on historical data for specific locations.

Claims History and Future Premiums

A business’s claims history significantly affects its future insurance premiums. A history of frequent or substantial claims will likely result in higher premiums, reflecting the increased risk associated with that business. Conversely, a clean claims history, demonstrating responsible risk management, can lead to lower premiums and potentially discounts. For instance, a business with multiple workers’ compensation claims in a year might see a substantial increase in its premiums the following year. Insurance companies use claims data to assess risk and price policies accordingly.

Comparison of Insurance Costs Across Business Structures

The following table compares average annual premiums and common coverage types for different business structures. Note that these are averages and actual costs will vary based on the factors discussed above.

| Business Structure | Average Annual Premium (Estimate) | Common Coverage Types | Factors Affecting Cost |

|---|---|---|---|

| Sole Proprietorship | $500 – $1500 | General Liability, Professional Liability (if applicable) | Personal assets at risk, limited employees |

| Partnership | $1000 – $3000 | General Liability, Professional Liability (if applicable), Business Property | Number of partners, business operations, location |

| LLC | $1500 – $4000 | General Liability, Professional Liability (if applicable), Business Property, Workers’ Compensation (if employees) | Number of members, business activities, location, employee count |

| Corporation | $3000 – $10000+ | General Liability, Professional Liability (if applicable), Business Property, Workers’ Compensation (if employees), Directors & Officers Liability | Size of corporation, revenue, number of employees, industry, location, risk profile |

Types of Business Insurance and Their Costs

Understanding the various types of business insurance and their associated costs is crucial for effective risk management and financial planning. The cost of insurance can vary significantly depending on factors like industry, location, and the specific coverage needed. This section will explore some common types of business insurance and the elements that influence their premiums.

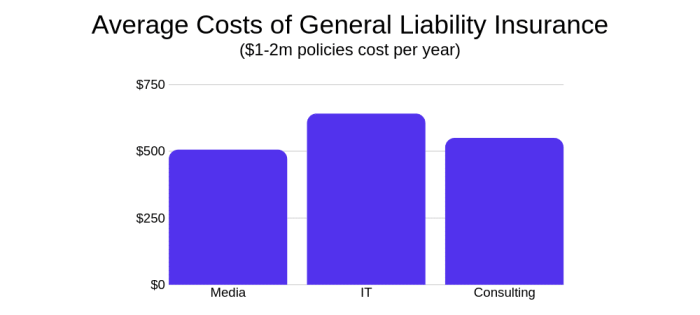

General Liability Insurance Coverage and Cost

General liability insurance protects your business from financial losses due to third-party claims of bodily injury or property damage caused by your business operations or employees. It also covers advertising injury, such as copyright infringement or defamation. The cost of general liability insurance is typically determined by factors such as the size of your business, your industry, your location, your claims history, and the coverage limits you choose. A small business might pay between $500 and $1,500 annually for a basic policy, while larger businesses with higher risk profiles could pay significantly more. For example, a construction company would likely pay more than a consulting firm due to the inherently higher risk of accidents on a construction site.

Factors Determining Professional Liability Insurance Costs

Professional liability insurance, also known as errors and omissions (E&O) insurance, protects professionals from claims of negligence or mistakes in their professional services. The cost of E&O insurance varies widely depending on the profession, the level of risk involved, the size of the business, the claims history, and the coverage limits selected. For instance, a doctor’s E&O insurance will typically be far more expensive than that of a freelance writer, reflecting the higher potential for significant financial losses from malpractice. Factors such as the number of claims filed against the professional in the past and the potential severity of those claims also heavily influence premium costs. A higher number of claims or higher potential payouts directly translate to higher premiums.

Components Influencing Workers’ Compensation Insurance Premiums

Workers’ compensation insurance protects employees who are injured or become ill on the job. The premiums for this insurance are determined by several factors, including the business’s industry classification (some industries have inherently higher risk profiles), payroll, the number of employees, the company’s safety record (fewer accidents lead to lower premiums), and the state where the business operates (states have varying regulations and rates). Businesses with a history of workplace accidents will generally pay higher premiums than those with strong safety records. Furthermore, the type of work performed also influences premiums; a construction company will typically pay more than an office-based business.

Commercial Auto Insurance Costs for Different Vehicle Types and Usage

Commercial auto insurance covers vehicles used for business purposes. The cost varies based on the type of vehicle (a large truck will cost more to insure than a sedan), the vehicle’s usage (frequent long-distance travel increases risk and cost), the driver’s driving record, the location of the business, and the coverage limits selected. A business using multiple vehicles for deliveries will face higher premiums than a business using only one vehicle for occasional errands. Similarly, a business operating in an urban area with high traffic density might pay more than a business in a rural area.

Other Important Types of Business Insurance

Several other types of business insurance can be crucial, depending on the specific needs of the business.

- Cyber Liability Insurance: Protects against data breaches and cyberattacks. Cost is influenced by the amount of sensitive data stored and the company’s cybersecurity practices.

- Product Liability Insurance: Covers claims related to injuries or damages caused by defective products. Premiums are based on the type of product, the manufacturing process, and the potential for harm.

- Directors and Officers (D&O) Liability Insurance: Protects company directors and officers from lawsuits related to their management decisions. Cost is determined by factors such as the company’s size, industry, and risk profile.

- Business Interruption Insurance: Covers lost income due to unforeseen events like natural disasters or fires. The cost depends on the business’s revenue, the potential duration of the interruption, and the level of coverage desired.

Strategies for Reducing Business Insurance Costs

Minimizing business insurance costs is crucial for maintaining profitability and financial stability. A proactive approach to risk management and strategic insurance planning can significantly reduce premiums without compromising necessary coverage. This section explores several effective strategies to achieve substantial savings.

Improving Workplace Safety to Reduce Workers’ Compensation Premiums

A strong safety culture directly impacts workers’ compensation insurance costs. Lower incident rates translate to lower premiums. Implementing robust safety programs, providing comprehensive employee training, and maintaining a safe work environment are essential. This involves regular safety inspections, providing appropriate personal protective equipment (PPE), and addressing potential hazards promptly. For example, a construction company implementing a rigorous fall protection program, including regular equipment checks and employee training, can significantly reduce the likelihood of workplace accidents and subsequently lower their workers’ compensation premiums. Detailed record-keeping of safety measures and incidents is also crucial for demonstrating a commitment to safety to insurers.

Mitigating Risk to Lower General Liability Insurance Costs

General liability insurance protects businesses from claims related to property damage, bodily injury, and advertising injury. Risk mitigation strategies, such as thorough risk assessments, implementation of safety protocols, and adequate security measures, can significantly reduce the likelihood of incidents leading to claims. For instance, a retail store installing security cameras and employing security personnel can deter theft and vandalism, reducing the risk of liability claims. Similarly, a restaurant maintaining rigorous food safety standards minimizes the risk of foodborne illnesses and related lawsuits. Regular maintenance of facilities and equipment also plays a significant role in preventing accidents and reducing liability risks.

Bundling Insurance Policies to Achieve Savings

Bundling multiple insurance policies, such as general liability, property, and workers’ compensation, with a single insurer often results in significant discounts. Insurers often offer bundled packages at a lower overall cost compared to purchasing each policy individually. This is because administrative costs are reduced for the insurer, and the bundled approach encourages long-term customer loyalty. The exact savings vary depending on the insurer and the specific policies bundled, but significant reductions of 10-20% or more are common. For example, a small business owner bundling their commercial auto, general liability, and property insurance could save hundreds or even thousands of dollars annually.

Negotiating Lower Premiums with Insurance Providers

Negotiating lower premiums requires preparation and a clear understanding of your business’s risk profile. Demonstrating a strong safety record, implementing risk mitigation strategies, and shopping around for competitive quotes are crucial. Businesses with a history of low claims can leverage this to negotiate favorable rates. Consider presenting data illustrating your safety record and risk management practices to insurers to support your request for a lower premium. Furthermore, exploring different insurance providers and comparing quotes can reveal significant price variations. Being prepared to switch providers if necessary can often incentivize existing insurers to offer more competitive rates.

A Step-by-Step Guide for Effectively Shopping for Business Insurance

Effectively shopping for business insurance involves a systematic approach.

- Assess your needs: Identify the types of insurance coverage your business requires based on its operations, industry, and risk profile.

- Obtain multiple quotes: Contact several insurance providers to obtain quotes for comparable coverage. Clearly Artikel your business’s specific needs and risk factors.

- Compare policy details: Carefully review the policy details, including coverage limits, deductibles, and exclusions, to ensure they meet your business’s requirements.

- Negotiate premiums: Use the quotes obtained to negotiate lower premiums with insurers, highlighting your business’s strong safety record and risk management practices.

- Review and select: Choose the policy that best balances coverage, cost, and the insurer’s reputation and financial stability.

Understanding Insurance Policy Details and Costs

Navigating the complexities of business insurance often involves understanding key policy details that directly impact costs. This section clarifies crucial terms and concepts, enabling you to make informed decisions about your coverage. A thorough understanding of these elements is vital for effective risk management and financial planning.

Deductibles, Premiums, and Co-pays in Business Insurance

Deductibles, premiums, and co-pays are fundamental components of most insurance policies, including those for businesses. The interplay between these elements significantly affects the overall cost and your out-of-pocket expenses in the event of a claim. A higher deductible typically translates to a lower premium, while a lower deductible results in a higher premium. Co-pays, less common in business insurance compared to health insurance, might apply to specific types of coverage, such as workers’ compensation. For example, a business might have a deductible of $5,000 for property damage claims, meaning they would be responsible for the first $5,000 of any such claim before the insurance coverage kicks in. The premium, the regular payment to maintain coverage, would be lower if the deductible were higher.

Impact of Policy Limits on Overall Cost and Risk Exposure

Policy limits define the maximum amount an insurance company will pay for a covered loss. These limits directly influence both the cost of the policy and the level of risk the business retains. Higher policy limits offer greater protection but come with higher premiums. Conversely, lower limits reduce premiums but increase the business’s financial exposure if a loss exceeds the policy limit. For instance, a business with a $1 million liability limit on its general liability policy will pay a higher premium than a business with a $500,000 limit. However, if a lawsuit exceeds $1 million, the business with the lower limit would face significant financial consequences.

Comparison of Occurrence and Claims-Made Coverage

Two common types of coverage are occurrence and claims-made policies. Occurrence policies cover incidents that occur during the policy period, regardless of when the claim is filed. Claims-made policies only cover claims filed during the policy period, even if the incident occurred earlier. Occurrence policies generally have higher premiums but provide broader protection. Claims-made policies typically have lower premiums but require careful consideration of tail coverage to protect against claims filed after the policy expires. A small business might opt for a claims-made policy to save on premiums, but they need to understand the need for tail coverage, which extends the policy’s coverage period for claims made after the policy’s expiration. This added coverage, however, comes at an additional cost.

Interpreting Insurance Policy Coverage Details to Understand Cost Implications

Understanding your policy’s coverage details is crucial for managing costs. Carefully review the policy wording, paying close attention to exclusions, limitations, and conditions. These factors can significantly impact the amount the insurer will pay in the event of a claim. For example, a policy might exclude coverage for certain types of damage or specify a limit on the amount payable for specific types of losses. A thorough understanding of these details allows businesses to accurately assess their risk and make informed decisions about coverage levels and premiums.

Common Insurance Policy Terms and Their Effect on Cost

| Term | Definition | Impact on Cost | Example |

|---|---|---|---|

| Premium | The regular payment made to maintain insurance coverage. | Higher coverage or lower deductible increases premium; lower coverage or higher deductible decreases premium. | A monthly payment of $500 for general liability insurance. |

| Deductible | The amount the insured must pay out-of-pocket before the insurance coverage begins. | Higher deductible lowers premium; lower deductible raises premium. | A $10,000 deductible for property damage claims. |

| Policy Limit | The maximum amount the insurer will pay for a covered loss. | Higher limits increase premiums; lower limits decrease premiums. | A $1 million liability limit on a general liability policy. |

| Co-pay (less common in business insurance) | A fixed amount the insured pays for a covered service. | Can increase or decrease overall cost depending on frequency of claims. | A $500 co-pay for a specific type of claim under a workers’ compensation policy. |

The Role of Insurance Brokers in Managing Costs

Navigating the complex world of business insurance can be challenging, especially when trying to balance comprehensive coverage with cost-effectiveness. This is where the expertise of an insurance broker becomes invaluable. Brokers act as advocates for businesses, leveraging their market knowledge and negotiating skills to secure optimal insurance solutions at competitive rates.

Insurance brokers offer a wide range of services designed to simplify the insurance process and help businesses manage their costs effectively. Their in-depth understanding of the insurance market allows them to identify suitable policies and negotiate favorable terms, ultimately saving businesses both time and money.

Benefits of Using an Insurance Broker

Employing an insurance broker provides numerous advantages in securing the right business insurance. Brokers possess extensive knowledge of various insurance providers and policy options, enabling them to tailor solutions to specific business needs. This expertise translates into better coverage at potentially lower premiums compared to navigating the insurance market independently. Furthermore, brokers handle the often-complex paperwork and administrative tasks associated with insurance policies, freeing up valuable time for business owners to focus on their core operations.

Broker Services in Navigating Business Insurance Complexities

Insurance brokers perform a variety of crucial services that simplify the complexities of business insurance. They begin by conducting a thorough risk assessment, identifying potential exposures and vulnerabilities. Based on this assessment, they recommend suitable insurance coverages, explaining the various policy options and their implications. Brokers also handle the entire application process, including negotiating premiums and terms with insurers. Beyond this, they provide ongoing support, assisting with claims management and policy renewals. They act as a single point of contact, streamlining communication with insurers and simplifying the overall insurance management process.

Broker Assistance in Understanding and Managing Insurance Costs

Insurance brokers play a crucial role in helping businesses understand and manage their insurance costs. They analyze the business’s risk profile and financial capacity to determine the appropriate level of coverage without unnecessary expenses. They can identify potential cost-saving measures, such as implementing risk mitigation strategies or exploring alternative insurance products. Brokers also monitor the insurance market for changes in rates and coverage options, alerting businesses to opportunities for cost reduction and improved protection. They provide regular reviews of insurance policies to ensure continued suitability and cost-effectiveness.

Broker Assistance in Negotiating Lower Premiums and Broader Coverage

Brokers leverage their established relationships with multiple insurance providers to negotiate favorable terms. Their experience and market knowledge enable them to secure lower premiums and broader coverage than businesses might achieve independently. For example, a broker might negotiate a group discount for a business with multiple locations or leverage their relationship with an insurer to secure a preferred rate for a specific type of coverage. Their ability to compare quotes from multiple insurers ensures that businesses receive the best possible value for their insurance investment.

Illustrative Scenario: Avoiding Costly Mistakes

Imagine a small manufacturing company that initially secured a basic liability policy without fully understanding its coverage limitations. An insurance broker, upon reviewing their policy, identified a significant gap in coverage related to product liability. This gap could have resulted in substantial financial losses if a product defect caused injury or damage. The broker then helped the company secure a more comprehensive policy with enhanced product liability coverage, preventing a potentially catastrophic financial event. The additional premium for the broader coverage was significantly less than the potential cost of a lawsuit resulting from inadequate insurance.

Closing Summary

Successfully managing business insurance costs requires a proactive approach. By understanding the factors influencing premiums, choosing appropriate coverage, and implementing cost-saving strategies, businesses can effectively protect their assets and minimize financial risk. This guide provides a solid foundation for navigating the complexities of business insurance, empowering you to make informed decisions and secure optimal protection for your enterprise. Remember to consult with an insurance broker to tailor a policy to your specific needs and budget.

FAQ Guide

What is the difference between occurrence and claims-made policies?

Occurrence policies cover claims arising from incidents that occurred during the policy period, regardless of when the claim is filed. Claims-made policies only cover claims filed during the policy period, even if the incident occurred earlier. Claims-made policies generally have lower premiums but require tail coverage for incidents occurring before the policy but claimed after its expiration.

How often should I review my business insurance policy?

It’s recommended to review your business insurance policy annually, or even more frequently if your business experiences significant changes (e.g., expansion, new employees, new equipment). This ensures your coverage remains adequate and reflects your current needs and risk profile.

Can I get insurance if my business has a history of claims?

Yes, but it might be more expensive. Insurers assess risk based on claims history, so a history of claims may lead to higher premiums or even difficulty obtaining coverage. Being upfront about your claims history is crucial for securing appropriate insurance.