Navigating the complex world of insurance in the USA can be daunting. From understanding the various types of insurance companies – mutual, stock, and others – to deciphering regulations and choosing the right coverage, the process requires careful consideration. This guide provides a comprehensive overview of the US insurance landscape, equipping you with the knowledge to make informed decisions about your insurance needs.

We will explore the diverse range of insurance products available, the crucial role of financial stability ratings, and the impact of technology on the industry. We’ll also delve into the claims process, consumer considerations, and emerging trends shaping the future of insurance in the United States. Understanding these elements is key to securing the right protection for your assets and future.

Types of Insurance Companies in the USA

The US insurance market is diverse, encompassing various types of companies, each with its own structure, operations, and focus. Understanding these differences is crucial for consumers seeking the best coverage and for investors evaluating potential opportunities within the sector. This section will categorize major insurance company types, highlighting their key characteristics and market presence.

Categorization of Major Insurance Company Types

The following table provides a categorized list of major insurance company types operating in the USA. Market share figures are approximate and can fluctuate. Precise data requires ongoing research from industry-specific sources.

| Company Type | Description | Examples | Market Share (Approximate) |

|---|---|---|---|

| Stock Insurance Companies | Owned by shareholders; profits are distributed as dividends to shareholders. They are publicly traded companies. | Berkshire Hathaway, Progressive, Allstate | Significant; varies by line of insurance |

| Mutual Insurance Companies | Owned by policyholders; profits are returned to policyholders as dividends or lower premiums. | State Farm, Nationwide, Farmers Insurance | Significant; varies by line of insurance |

| Captive Insurance Companies | Subsidiaries of larger corporations, primarily insuring the parent company’s risks. | Many large corporations maintain their own captive insurers | Relatively small compared to stock and mutual companies, but significant for specific industries |

| Reciprocal Insurance Exchanges | Unincorporated groups of individuals or businesses that insure each other. | Various smaller, specialized exchanges exist | Small compared to stock and mutual companies |

| Lloyd’s of London (Technically not a US company, but operates here) | A market composed of individual and corporate members who underwrite insurance on a syndicated basis. | Lloyd’s syndicates operate in the US market | Small but significant for specialized and high-risk coverage |

Mutual vs. Stock Insurance Companies

Mutual and stock insurance companies represent the two dominant models in the US insurance market. They differ fundamentally in their ownership structure and how profits are handled.

Mutual Insurance Companies: Policyholders own mutual insurance companies. Profits are typically returned to policyholders through dividends, lower premiums, or contributions to policyholder surplus. This structure prioritizes policyholder interests. These companies are not publicly traded.

Stock Insurance Companies: Stock insurance companies are owned by shareholders. Profits are distributed to shareholders as dividends, and the company’s performance is directly reflected in its stock price. These companies are publicly traded, and their primary goal is to maximize shareholder value.

Comparison of Insurance Company Types for Consumers

The best type of insurance company for a consumer depends on individual priorities and risk tolerance.

| Company Type | Advantages | Disadvantages |

|---|---|---|

| Stock Insurance Companies | Often offer a wide range of products and services; publicly traded, providing transparency through financial reporting; potential for higher returns for investors. | Profit maximization is a primary goal, potentially leading to higher premiums; dividends go to shareholders, not policyholders. |

| Mutual Insurance Companies | Profits are returned to policyholders; often focus on long-term relationships with policyholders; potentially lower premiums. | May offer fewer product choices compared to stock companies; less transparency compared to publicly traded companies. |

| Captive Insurance Companies | Cost-effective insurance for the parent company; specialized risk management. | Limited availability to the general public. |

| Reciprocal Insurance Exchanges | Potential for lower costs due to shared risk; greater control for members. | Higher risk for individual members; limited access to broader resources. |

Regulation of Insurance Companies in the USA

The insurance industry in the United States operates under a complex framework of state and federal regulations designed to protect consumers and maintain the solvency of insurance companies. This regulatory environment ensures fair practices, prevents market manipulation, and promotes consumer confidence in the insurance market. The balance of power between state and federal oversight is a key characteristic of this system.

The primary responsibility for regulating insurance companies rests with individual states. This is a legacy of the McCarran-Ferguson Act of 1945, which largely exempted the insurance industry from federal regulation, leaving it primarily under the purview of state insurance departments. However, federal laws and agencies do play a significant role in certain areas, particularly in matters of interstate commerce and consumer protection.

Roles and Responsibilities of State and Federal Regulators

State insurance departments are responsible for licensing insurers, reviewing their financial stability, approving their rates and policy forms, and investigating consumer complaints. They have broad authority to enforce state insurance laws and take action against companies that violate those laws. Examples of state regulatory actions include imposing fines, revoking licenses, and ordering restitution to consumers. Federal regulators, such as the Federal Insurance Office (FIO) within the U.S. Department of the Treasury, have a more limited but increasingly important role. The FIO monitors the insurance industry, identifies systemic risks, and coordinates federal insurance policy. They do not directly regulate individual insurance companies but can influence state regulators and promote national consistency in certain areas.

Significant Insurance Regulations and Their Impact on Consumer Protection

Several significant insurance regulations directly impact consumer protection. The NAIC (National Association of Insurance Commissioners) Model Laws, while not binding on their own, heavily influence state-level regulations and promote consistency across states. These models often address issues such as unfair claims practices, consumer privacy, and policy disclosures. State-level laws mandating minimum coverage amounts for auto insurance or requiring specific disclosures in health insurance policies are further examples. These regulations ensure consumers are aware of their rights and are protected from deceptive or unfair practices. For example, laws prohibiting unfair claims handling practices help ensure that insurers fairly and promptly process claims. Similarly, regulations regarding policy disclosures require clear and concise explanation of policy terms and conditions, preventing consumers from being misled.

Common Insurance Regulatory Violations and Their Associated Penalties

Insurance companies face penalties for various regulatory violations. These violations can range from minor administrative infractions to serious offenses that threaten the solvency of the company. Common violations include:

- Failure to maintain adequate reserves: Insurers must maintain sufficient funds to cover potential claims. Failure to do so can result in significant fines and even insolvency proceedings.

- Unfair claims practices: Delaying or denying legitimate claims, misrepresenting policy terms, or engaging in other unfair practices can lead to fines, restitution to consumers, and reputational damage.

- Misrepresenting policy terms: Deceptively marketing or selling insurance policies can result in fines and legal action.

- Failing to comply with state licensing requirements: Operating without the proper licenses can lead to significant penalties.

- Data breaches and privacy violations: Failure to protect sensitive consumer data can result in substantial fines and legal action under state and federal laws such as HIPAA and various state breach notification laws.

Penalties for these violations vary by state and the severity of the offense. They can include fines ranging from thousands to millions of dollars, license revocations or suspensions, mandatory restitution to consumers, and even criminal charges in severe cases. For example, a significant fine coupled with a cease and desist order might be levied for widespread misrepresentation of policy terms, while a minor administrative violation might only result in a warning. The specific penalty will depend on the nature and extent of the violation, the insurer’s history, and the state’s regulatory approach.

Financial Stability and Ratings of US Insurance Companies

The financial health of insurance companies is paramount to the security of policyholders. A financially unstable insurer may be unable to pay claims when they are due, leaving policyholders with significant losses. Understanding the role of financial ratings agencies and the implications of different ratings is crucial for consumers making informed decisions about their insurance coverage.

Financial rating agencies play a critical role in assessing the financial strength and stability of insurance companies. These agencies, such as A.M. Best, Moody’s, Standard & Poor’s, and Fitch Ratings, employ sophisticated analytical models and rigorous reviews of insurers’ financial statements, investment portfolios, and business practices to determine their creditworthiness. These ratings provide a standardized measure of risk, allowing consumers and investors to compare insurers and gauge their ability to meet their obligations.

Insurance Rating Systems and Their Implications

Rating agencies utilize letter-based rating systems, with higher-ranked letters indicating greater financial strength. For example, A.M. Best’s rating scale ranges from A++ (Superior) to D (In Default), with each letter grade further subdivided by plus (+) and minus (-) symbols to denote finer distinctions in financial strength. Similar letter-based systems are used by Moody’s, Standard & Poor’s, and Fitch Ratings, though the specific letter designations and their interpretations may vary slightly between agencies. These ratings reflect a comprehensive assessment of an insurer’s ability to meet its financial obligations, including claims payments, operating expenses, and debt obligations. A high rating generally suggests a low probability of default, while a low rating signifies a higher risk of insolvency.

Impact of Financial Ratings on Insurance Premiums and Policy Availability

The financial rating of an insurance company significantly impacts both insurance premiums and the availability of insurance policies. Insurers with high ratings are typically perceived as less risky, leading to lower premiums for consumers. Conversely, insurers with lower ratings are considered higher risk, resulting in higher premiums to compensate for the increased likelihood of claims default. In some cases, insurers with very low ratings may face difficulty securing reinsurance, limiting their ability to underwrite new policies or leading to policy cancellations. This can result in reduced policy availability, particularly for high-risk individuals or businesses.

| Rating Agency (Example: A.M. Best) | Rating Category | Typical Impact on Premiums | Typical Impact on Policy Availability |

|---|---|---|---|

| A.M. Best | A++ to A+ (Superior) | Lower Premiums | Widely Available |

| A.M. Best | A to B++ (Excellent to Good) | Moderate Premiums | Generally Available |

| A.M. Best | B+ to B- (Fair to Poor) | Higher Premiums | Availability May Be Limited |

| A.M. Best | C or Below (Weak or In Default) | Significantly Higher Premiums (if available) | Likely Unavailable |

Insurance Products Offered by US Companies

US insurance companies offer a wide array of products designed to protect individuals and businesses from various financial risks. These products differ significantly in their coverage, exclusions, and pricing, reflecting the diverse needs and risk profiles of their policyholders. Understanding the key features of each product is crucial for making informed decisions about insurance coverage.

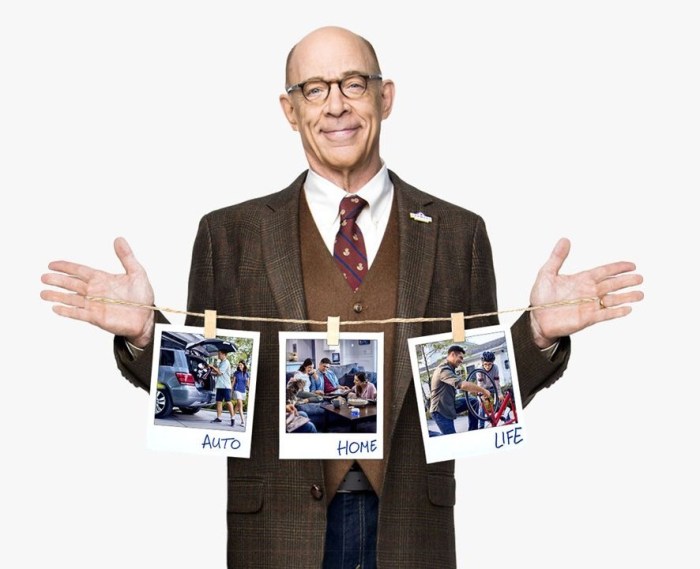

The most common types of insurance offered include auto, home, life, and health insurance, each with its own set of complexities and nuances. These core products often have variations and supplementary options available, creating a highly customizable landscape of insurance solutions.

Auto Insurance

Auto insurance protects policyholders against financial losses resulting from car accidents. Coverage typically includes liability, collision, comprehensive, and uninsured/underinsured motorist protection. Liability coverage pays for damages to other people’s property or injuries sustained by others in an accident where the policyholder is at fault. Collision coverage covers damage to the policyholder’s vehicle, regardless of fault. Comprehensive coverage protects against damage from events other than collisions, such as theft, vandalism, or natural disasters. Uninsured/underinsured motorist coverage protects the policyholder if they are involved in an accident with a driver who is uninsured or underinsured. Pricing factors include driving record, vehicle type, location, and coverage levels. Exclusions often involve intentional acts or damage caused by wear and tear.

Home Insurance

Home insurance, also known as homeowner’s insurance, protects homeowners from financial losses due to damage or destruction of their property. This typically includes coverage for the dwelling, personal belongings, and liability. Dwelling coverage protects the structure of the home itself, while personal property coverage protects the homeowner’s possessions inside the home. Liability coverage protects the homeowner from lawsuits if someone is injured on their property. Pricing is influenced by factors such as location, the age and condition of the home, and the amount of coverage. Common exclusions might include damage caused by floods, earthquakes, or acts of war, though these can often be added as separate endorsements for an additional premium.

Life Insurance

Life insurance provides a financial benefit to designated beneficiaries upon the death of the insured. The most common types are term life insurance and whole life insurance. Term life insurance provides coverage for a specific period, while whole life insurance provides lifelong coverage and often includes a cash value component. Pricing is determined by factors such as age, health, smoking status, and the amount of coverage. Exclusions typically involve death caused by suicide within a specific timeframe after policy inception.

Health Insurance

Health insurance helps cover the costs of medical care, including doctor visits, hospital stays, and prescription drugs. In the US, health insurance is often obtained through employers, the Affordable Care Act (ACA) marketplaces, or directly from insurance companies. Different plans offer varying levels of coverage and out-of-pocket costs. Pricing depends on factors such as age, location, the type of plan, and the deductible and copay amounts. Exclusions can vary significantly depending on the specific plan but often involve pre-existing conditions (though this is less common now with the ACA), experimental treatments, or cosmetic procedures.

Auto Insurance Coverage Comparison Across States

The availability and specifics of auto insurance coverage vary significantly across US states. This is largely due to differences in state regulations and the risk profiles of different regions. The following is a simplified comparison, and it’s crucial to consult individual state regulations and insurance providers for precise details.

Understanding that precise details change frequently, a generalized comparison of minimum coverage requirements might include:

- Bodily Injury Liability: Ranges from state minimums of $10,000 to $100,000 per person and $20,000 to $300,000 per accident. Some states have no-fault systems affecting liability coverage.

- Property Damage Liability: Minimums generally range from $5,000 to $25,000.

- Uninsured/Underinsured Motorist Coverage: Availability and minimums vary widely, with some states mandating it and others not.

- Collision and Comprehensive Coverage: These are generally optional but highly recommended.

It’s important to note that this is a simplified overview and specific coverage options and requirements will vary greatly depending on the state and the individual insurance company.

Claims Process and Customer Service

Navigating the insurance claims process can sometimes feel overwhelming, but understanding the typical steps and best practices can significantly ease the experience. A smooth claims process relies on clear communication and prompt action from both the policyholder and the insurance company.

The typical claims process involves several key steps, beginning with reporting the incident. This initial report triggers the investigation and assessment phase, leading to the determination of liability and coverage. Once approved, the claim proceeds to settlement, with payment issued to the policyholder or directly to service providers. Throughout this process, effective communication with the insurance company is paramount.

Steps Involved in Filing an Insurance Claim

Filing an insurance claim generally begins with promptly notifying your insurer of the incident. This often involves a phone call or online report, providing as much detail as possible. Next, the insurance company will initiate an investigation, possibly involving an adjuster who will assess the damage or loss. This assessment leads to a determination of coverage under your policy. If approved, the claim proceeds to settlement, where the insurer pays the agreed-upon amount, either to you or directly to the repair facility or healthcare provider, depending on the type of claim. Finally, the claim is closed once all payments are made and documentation is complete. This process varies slightly depending on the type of insurance (auto, home, health, etc.) and the specifics of the claim.

Factors Influencing Claim Processing Times and Outcomes

Several factors can influence how quickly a claim is processed and the ultimate outcome. The complexity of the claim is a significant factor; a simple claim for a minor car repair will generally be processed faster than a complex liability claim involving multiple parties. The availability of supporting documentation, such as police reports or medical records, also plays a crucial role. Furthermore, the accuracy and completeness of the information provided by the policyholder can significantly impact processing time. If the policyholder fails to provide necessary information promptly, the process can be delayed. Finally, the insurance company’s internal processes and workload can also affect processing speed. During peak seasons or periods of high claim volume, processing times may be longer.

Best Practices for Effective Communication with Insurance Companies

Effective communication is vital for a smooth claims process. Keep detailed records of all communication with the insurer, including dates, times, and the names of individuals you spoke with. Maintain clear and concise documentation of the incident, including photos or videos if applicable. Respond promptly to all requests for information from the insurance company. If you disagree with the insurer’s assessment, clearly articulate your concerns and supporting evidence. Be polite and professional in all interactions. Consider keeping a detailed log of every interaction, including dates, times, and names of individuals involved. If you are having difficulty resolving a claim, you may wish to contact your state’s insurance department for assistance.

The Impact of Technology on the Insurance Industry in the USA

The US insurance industry is undergoing a significant transformation driven by rapid technological advancements. Digital platforms, sophisticated data analytics, and the emergence of Insurtech companies are reshaping how insurance is sold, underwritten, and serviced, impacting both traditional players and consumers. This technological shift promises greater efficiency, personalized experiences, and innovative product offerings.

The integration of technology is streamlining numerous aspects of insurance operations. Digital platforms allow for online policy purchases, claims submissions, and customer service interactions, significantly improving accessibility and convenience for policyholders. Data analytics, powered by big data and machine learning, enables insurers to better assess risk, personalize pricing, and detect fraudulent claims more effectively. This leads to improved underwriting accuracy, more competitive pricing, and a reduction in operational costs.

Digital Platforms and Data Analytics in Insurance Operations

The use of digital platforms has revolutionized the customer journey. Consumers can now compare insurance quotes from multiple providers, purchase policies online, manage their accounts, and file claims through user-friendly websites and mobile apps. This self-service capability reduces the reliance on traditional call centers and allows for 24/7 access to insurance services. Concurrently, the application of data analytics is transforming risk assessment. Insurers leverage vast datasets – encompassing demographic information, driving records, telematics data, and social media activity – to develop more accurate risk profiles. This allows for more precise pricing, tailored insurance products, and proactive risk management strategies. For example, usage-based insurance (UBI) programs utilize telematics data from connected cars to monitor driving behavior and adjust premiums accordingly, rewarding safe drivers with lower rates.

The Impact of Insurtech Companies

Insurtech companies, startups leveraging technology to disrupt the traditional insurance industry, are introducing innovative products and services. These companies often focus on niche markets or utilize technology to streamline processes and reduce costs. For example, some Insurtech firms specialize in providing on-demand insurance, offering short-term or event-based coverage, while others leverage AI and machine learning to automate underwriting and claims processing. The competitive pressure exerted by Insurtechs is pushing traditional insurers to adopt new technologies and improve their efficiency to remain competitive. This ultimately benefits consumers through greater choice, more innovative products, and potentially lower premiums.

AI-Powered Claims Processing and Customer Service: A Hypothetical Scenario

Imagine a scenario where an insured individual files a car accident claim through a mobile app. An AI-powered system immediately analyzes the submitted information, including photos of the damage, police reports, and the driver’s statement. Using advanced image recognition and natural language processing, the AI assesses the damage, verifies the claim’s legitimacy, and automatically generates a preliminary estimate of the repair costs. If the claim is straightforward, the AI can automatically approve the payment, transferring funds to the insured’s account within hours. If the claim requires further investigation, the AI flags it for a human adjuster, providing them with a comprehensive summary of the evidence and potential next steps. Simultaneously, the AI monitors customer interactions through the app, identifying potential issues and proactively addressing them. For example, if a customer expresses frustration about the claim process, the AI can automatically escalate the issue to a human customer service representative and suggest personalized solutions. This AI-driven system significantly reduces processing times, improves accuracy, enhances customer satisfaction, and frees up human resources to focus on more complex claims.

Consumer Considerations When Choosing an Insurance Company

Choosing the right insurance company is a crucial decision, impacting your financial well-being in case of unforeseen events. A careful and informed approach is essential to ensure you secure adequate coverage at a competitive price from a reliable provider. Several key factors should guide your selection process.

Financial Stability of Insurance Companies

Assessing an insurer’s financial strength is paramount. A financially unstable company might struggle to pay claims when you need them most. You can check a company’s financial ratings from independent agencies like A.M. Best, Moody’s, Standard & Poor’s, and Fitch. These agencies assess insurers based on factors such as their reserves, underwriting performance, and overall financial health. Look for companies with high ratings, indicating a lower risk of insolvency. A company with a low rating might offer cheaper premiums, but the risk of them failing to pay out claims is significantly higher.

Customer Reviews and Complaints

Before committing to a particular insurance company, thoroughly investigate customer experiences. Websites like the Better Business Bureau (BBB) and various online review platforms offer valuable insights into a company’s customer service quality, claims handling efficiency, and overall responsiveness. Pay attention to recurring themes in customer feedback. Negative reviews highlighting frequent delays in claim processing, poor communication, or unfair claim denials should raise significant concerns. Positive reviews focusing on prompt claim settlements and excellent customer support are reassuring indicators of a reputable company.

Coverage Options and Policy Details

Carefully review the coverage options offered by different insurers. Ensure the policy adequately protects your assets and meets your specific needs. Compare deductibles, premiums, and coverage limits across various providers. Understand the terms and conditions of the policy, paying close attention to exclusions and limitations. Don’t hesitate to ask clarifying questions to the insurer’s representatives. A policy with seemingly low premiums but inadequate coverage might ultimately prove more costly in the event of a significant claim.

Checklist for Comparing Insurance Providers

It’s beneficial to use a checklist when comparing insurance providers. This ensures you systematically evaluate key aspects.

- Company Financial Rating: Check ratings from A.M. Best, Moody’s, S&P, and Fitch.

- Customer Reviews and Complaints: Research on BBB and online review sites.

- Coverage Options: Compare deductibles, premiums, and coverage limits.

- Policy Terms and Conditions: Understand exclusions and limitations.

- Claims Process: Inquire about the claims process and customer service.

- Price Comparison: Obtain quotes from multiple insurers.

- Discounts and Bundling Options: Explore potential savings through bundling or discounts.

Negotiating Insurance Premiums and Coverage

While it might seem daunting, negotiating insurance premiums and coverage is often possible. Shop around and obtain quotes from multiple insurers to leverage competitive pricing. Consider increasing your deductible to lower your premiums; however, carefully weigh the financial implications. Highlight your positive driving record or other risk-reducing factors. Ask about discounts for bundling policies (e.g., home and auto). Don’t be afraid to negotiate; insurers often have some flexibility in their pricing. Remember, clear communication and a willingness to compare options are key to securing the best possible deal.

Emerging Trends in the US Insurance Market

The US insurance market is in constant flux, driven by technological advancements, evolving consumer expectations, and shifts in the broader economic landscape. Several key trends are reshaping the industry, impacting both insurers and policyholders in profound ways. These trends represent both opportunities and challenges for the future of insurance in the United States.

The following sections detail some of the most significant emerging trends, analyzing their potential positive and negative implications.

Increased Use of Telematics in Auto Insurance

Telematics, the use of technology to collect and analyze data from vehicles, is revolutionizing auto insurance. Devices or smartphone apps track driving behavior, such as speed, braking, and mileage. This data allows insurers to offer usage-based insurance (UBI) programs, rewarding safe drivers with lower premiums. For example, a driver who consistently maintains a safe speed and avoids harsh braking may receive a significant discount on their premiums compared to a driver with a less favorable driving record. This trend offers insurers the ability to better assess risk and personalize premiums, while consumers benefit from potentially lower costs if they demonstrate safe driving habits. However, concerns exist regarding data privacy and the potential for algorithmic bias in assessing driver behavior. There’s also the possibility of increased premiums for drivers who are less technologically savvy or lack access to the necessary devices.

Growth of Niche Insurance Products

The insurance market is seeing a proliferation of niche products tailored to specific demographics or risk profiles. This includes specialized insurance for gig workers, pet insurance, cyber insurance for individuals, and insurance for specific high-value items like collectibles or musical instruments. For instance, the rise of the gig economy has created a demand for insurance products specifically designed to protect gig workers who lack the benefits offered by traditional employment. This trend provides consumers with more choices and potentially better coverage for their unique needs. However, the complexity of navigating these specialized markets and the potential for higher premiums due to smaller risk pools are significant drawbacks.

Artificial Intelligence (AI) and Machine Learning (ML) in Claims Processing

AI and ML are increasingly being used to streamline claims processing. These technologies can automate tasks such as fraud detection, damage assessment, and claims adjudication, leading to faster and more efficient claims handling. For example, AI-powered image recognition can expedite the assessment of vehicle damage after an accident, reducing the time it takes to process a claim. This trend benefits both insurers, who can reduce operational costs and improve efficiency, and consumers, who experience faster claim settlements. However, concerns remain about the potential for algorithmic bias and the need for human oversight to ensure fair and accurate claims processing. There is also a potential for job displacement within the claims processing sector.

Expansion of Insurtech Companies

Insurtech companies, which leverage technology to disrupt traditional insurance models, are rapidly expanding their market share. These companies often offer more streamlined processes, personalized products, and greater transparency. For example, many insurtech companies utilize online platforms and mobile apps to simplify the process of obtaining quotes and purchasing insurance policies. This trend increases competition within the insurance market, leading to innovation and potentially lower prices for consumers. However, the relative newness of many insurtech companies and the potential for financial instability among some players pose risks for consumers.

Ending Remarks

Choosing the right insurance company is a critical financial decision. By understanding the intricacies of the US insurance market, including the different types of companies, regulatory frameworks, and available products, consumers can make informed choices that best protect their interests. This guide serves as a valuable resource to navigate this complex landscape, empowering you to confidently secure the appropriate coverage for your needs and achieve financial security.

FAQ Compilation

What is the difference between a mutual and a stock insurance company?

Mutual insurance companies are owned by their policyholders, while stock insurance companies are owned by shareholders. This difference impacts how profits are distributed and the company’s overall priorities.

How can I file a complaint against an insurance company?

Contact your state’s Department of Insurance. They handle complaints and investigate potential violations of insurance regulations.

What factors affect my car insurance premiums?

Factors include your driving record, age, location, vehicle type, and the coverage you choose.

How important are insurance company ratings?

Ratings from agencies like A.M. Best reflect the financial strength and stability of an insurance company. Higher ratings generally indicate lower risk of insolvency.

What is telematics in insurance?

Telematics uses technology like GPS tracking in vehicles to monitor driving behavior and potentially offer discounts based on safe driving habits.