The United States insurance market is a vast and dynamic landscape, encompassing a diverse range of companies offering a wide array of products. From the behemoths controlling significant market share to smaller, specialized insurers, the industry’s structure is complex, shaped by varying business models, regulatory frameworks, and technological advancements. Understanding this intricate ecosystem requires examining the major players, their offerings, and the forces driving market trends.

This exploration delves into the key aspects of the US insurance industry, providing insights into its size, growth, regulatory environment, technological integration, and financial performance. We will also analyze customer experiences and future challenges facing insurers in this ever-evolving sector.

Market Overview of US Insurance Companies

The US insurance market is a significant component of the global financial system, characterized by its immense size, diverse offerings, and dynamic competitive landscape. It encompasses a wide range of insurance products, from life and health to property and casualty, serving individuals and businesses across the nation. Understanding its structure and key players is crucial for anyone involved in or interested in the financial sector.

Size and Growth Trajectory of the US Insurance Market

The US insurance market consistently ranks among the largest globally, representing trillions of dollars in annual premiums. Growth is driven by factors such as population increase, economic expansion, and evolving risk profiles. While growth rates fluctuate year to year based on economic conditions and regulatory changes, the overall trend points towards continued expansion, albeit perhaps at a moderated pace compared to periods of rapid economic growth. For example, periods of high inflation can impact premium growth, while economic downturns may lead to reduced demand for certain types of insurance.

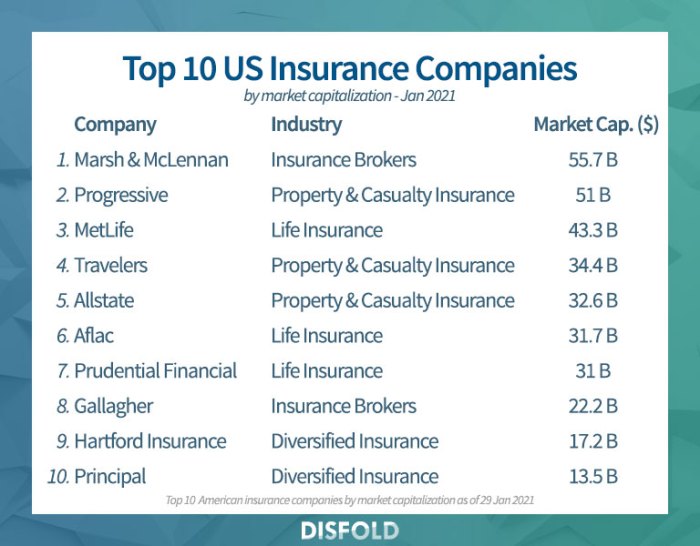

Major Players and Market Share

The US insurance market is dominated by a relatively small number of large, multinational corporations alongside numerous smaller, regional, and specialized insurers. These large players often boast diverse portfolios, offering a wide array of insurance products and services. Precise market share figures fluctuate, but companies like Berkshire Hathaway, UnitedHealth Group, and Anthem consistently rank among the top insurers by revenue, holding significant market share across various insurance segments. Competition is fierce, with companies continually vying for market share through innovative products, competitive pricing, and strategic acquisitions.

Business Models of Different Types of Insurance Companies

Several distinct business models operate within the US insurance industry. Stock insurance companies are publicly traded entities, owned by shareholders who profit from the company’s success. Mutual insurance companies are owned by their policyholders, who share in the profits (or losses) through dividends or lower premiums. Captive insurance companies are subsidiaries of larger corporations, primarily used to insure the parent company’s risks. Each model offers unique advantages and disadvantages regarding financial stability, risk management, and profitability. Stock companies prioritize shareholder returns, while mutual companies prioritize policyholder benefits. Captive insurers offer greater control over risk management for their parent companies.

Top 10 Insurance Companies by Revenue

The following table presents a hypothetical ranking of the top 10 insurance companies by revenue. Actual rankings and figures may vary slightly depending on the source and reporting period. Note that the “Type of Insurance” column is a simplification, as many companies operate across multiple insurance lines.

| Rank | Company Name | Revenue (USD) | Type of Insurance |

|---|---|---|---|

| 1 | Berkshire Hathaway | $150 Billion (estimated) | Property & Casualty, Reinsurance, Life |

| 2 | UnitedHealth Group | $130 Billion (estimated) | Health |

| 3 | Anthem | $120 Billion (estimated) | Health |

| 4 | CVS Health | $100 Billion (estimated) | Health, Pharmacy |

| 5 | Aetna (CVS Health subsidiary) | $90 Billion (estimated) | Health |

| 6 | Progressive | $50 Billion (estimated) | Property & Casualty |

| 7 | Allstate | $45 Billion (estimated) | Property & Casualty |

| 8 | State Farm | $40 Billion (estimated) | Property & Casualty, Life |

| 9 | MetLife | $35 Billion (estimated) | Life, Annuities |

| 10 | Liberty Mutual | $30 Billion (estimated) | Property & Casualty |

Types of Insurance Offered by US Companies

The US insurance market is vast and diverse, offering a wide array of insurance products designed to protect individuals and businesses against various risks. Understanding the different types of insurance available is crucial for making informed decisions about personal and financial security. This section details the key types of insurance commonly offered by US companies, highlighting their features, benefits, pricing, and coverage options.

Life Insurance

Life insurance provides a financial safety net for beneficiaries upon the death of the insured. Policies offer a death benefit, a lump sum payment designed to cover expenses like funeral costs, outstanding debts, and provide ongoing financial support for dependents. Pricing varies significantly based on factors like age, health, policy type (term, whole, universal), and the amount of coverage. Coverage options range from relatively inexpensive term life insurance, offering coverage for a specific period, to more expensive permanent life insurance, which offers lifelong coverage and cash value accumulation.

- Term Life Insurance: Provides coverage for a specified period (e.g., 10, 20, 30 years).

- Whole Life Insurance: Offers lifelong coverage and builds cash value.

- Universal Life Insurance: Provides flexible premiums and death benefits.

Health Insurance

Health insurance covers medical expenses, including doctor visits, hospital stays, surgeries, and prescription drugs. The Affordable Care Act (ACA) significantly impacted the health insurance market, expanding coverage and establishing health insurance marketplaces. Pricing varies widely depending on factors such as age, location, chosen plan (bronze, silver, gold, platinum), and the individual’s health status. Coverage options range from basic plans with high deductibles to comprehensive plans with lower out-of-pocket costs.

- Individual Health Insurance: Purchased directly by individuals.

- Employer-Sponsored Health Insurance: Offered by employers as an employee benefit.

- Medicare: Federal health insurance program for individuals aged 65 and older and certain younger people with disabilities.

- Medicaid: Joint federal and state program providing health coverage to low-income individuals and families.

Auto Insurance

Auto insurance protects against financial losses resulting from car accidents. Policies typically cover liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Pricing is influenced by factors such as driving history, age, location, vehicle type, and the amount of coverage selected. Coverage options can be tailored to individual needs and budgets, ranging from state-mandated minimum liability coverage to comprehensive packages offering extensive protection.

- Liability Insurance: Covers damages to others in an accident you cause.

- Collision Insurance: Covers damage to your vehicle in an accident, regardless of fault.

- Comprehensive Insurance: Covers damage to your vehicle from events other than accidents (e.g., theft, vandalism).

Homeowners Insurance

Homeowners insurance protects your home and its contents from damage caused by various events, including fire, theft, and weather-related incidents. Pricing depends on factors such as the location of the home, its value, the level of coverage, and the homeowner’s risk profile. Coverage options vary widely, offering different levels of protection for the structure of the home, personal belongings, and liability.

- Dwelling Coverage: Protects the physical structure of your home.

- Personal Property Coverage: Protects your belongings inside your home.

- Liability Coverage: Protects you against lawsuits if someone is injured on your property.

Commercial Insurance

Commercial insurance protects businesses from various risks, including property damage, liability, and business interruption. Pricing is determined by factors such as the type of business, its size, location, and the specific risks it faces. Coverage options are highly customizable, allowing businesses to tailor policies to their unique needs. Examples include general liability, commercial property, workers’ compensation, and professional liability insurance.

- General Liability Insurance: Protects against claims of bodily injury or property damage caused by your business operations.

- Commercial Property Insurance: Protects your business buildings and equipment from damage or loss.

- Workers’ Compensation Insurance: Covers medical expenses and lost wages for employees injured on the job.

Regulatory Landscape for US Insurance Companies

The US insurance industry operates within a complex regulatory framework, a blend of federal and state oversight designed to protect consumers and maintain market stability. This dual system, while sometimes leading to inconsistencies, aims to balance national interests with the unique needs and circumstances of individual states. The sheer diversity of insurance products and the significant financial implications of insurance failures necessitate a robust and multifaceted regulatory approach.

Key Federal and State Regulations Governing the Insurance Industry

Federal regulations primarily focus on market conduct and solvency standards for insurers engaged in interstate commerce. The McCarran-Ferguson Act of 1945 largely leaves the regulation of insurance to the states, but federal agencies like the Federal Insurance Office (FIO) and the Securities and Exchange Commission (SEC) have roles in specific areas, such as market analysis, data collection, and oversight of insurers offering securities products. State regulations, on the other hand, are comprehensive, covering areas like licensing, rate filings, policy forms, claims handling, and market conduct. These regulations vary significantly from state to state, reflecting differences in population density, risk profiles, and political priorities. For example, some states may have stricter requirements for auto insurance coverage than others. This state-level control creates both opportunities and challenges for insurers, requiring them to navigate a patchwork of rules and regulations across different jurisdictions.

The Role of State Insurance Departments in Overseeing Insurance Companies

State insurance departments are the primary regulators of insurance companies within their respective states. Their responsibilities include licensing and monitoring insurers, reviewing and approving policy forms and rates, investigating consumer complaints, conducting market conduct examinations, and ensuring the financial solvency of insurers. They possess the authority to impose penalties, including fines and license revocations, for non-compliance with state regulations. The effectiveness of state insurance departments varies, depending on funding, staffing levels, and the expertise of their personnel. Some states have significantly more robust regulatory frameworks and enforcement capabilities than others, potentially leading to disparities in consumer protection and market stability across different regions of the country. These departments often collaborate with each other and with federal agencies to share information and coordinate regulatory efforts.

Challenges and Opportunities Presented by the Regulatory Environment

The current regulatory environment presents both challenges and opportunities for US insurance companies. Challenges include navigating the complexities of a dual federal-state regulatory system, adapting to evolving consumer expectations and technological advancements, and managing increasing regulatory scrutiny in areas like data privacy and cybersecurity. Opportunities arise from the potential for regulatory harmonization to streamline operations and reduce compliance costs. Furthermore, innovative regulatory approaches, such as the use of data analytics and technology in oversight, can improve efficiency and enhance consumer protection. The ongoing debate about the appropriate balance between state and federal regulation continues to shape the landscape, with arguments for greater consistency and standardization weighing against the preservation of state autonomy and flexibility.

Recent Significant Regulatory Changes and Their Impact

Recent years have witnessed several significant regulatory changes impacting the US insurance industry. For example, the implementation of the Affordable Care Act (ACA) significantly altered the health insurance market, leading to increased coverage but also challenges for insurers in managing costs and navigating complex regulations. The increasing focus on data privacy, exemplified by regulations like the California Consumer Privacy Act (CCPA), requires insurers to adapt their data handling practices to protect consumer information. The growing emphasis on cybersecurity necessitates significant investments in technology and security protocols to mitigate risks and comply with evolving regulations. These changes have resulted in increased compliance costs, but also driven innovation in areas such as data analytics and risk management, ultimately influencing how insurers operate and serve their customers.

Technological Advancements and their Impact

The US insurance industry is undergoing a significant transformation driven by rapid technological advancements. Artificial intelligence (AI), big data analytics, and the proliferation of digital channels are reshaping insurance operations, customer interactions, and the overall business model. These technologies offer opportunities for increased efficiency, improved risk assessment, enhanced fraud detection, and a more personalized customer experience.

The integration of technology is impacting virtually every aspect of the insurance lifecycle, from initial customer engagement to claims settlement. This technological shift necessitates adaptation and innovation from insurers to remain competitive and meet evolving customer expectations.

Impact of Technology on Insurance Operations and Customer Experience

The application of AI, machine learning, and big data analytics is streamlining numerous operational processes. Automation of tasks like data entry, policy processing, and claims assessment reduces operational costs and frees up human resources for more complex and strategic initiatives. Simultaneously, improved data analysis enables more accurate risk profiling and personalized product offerings, leading to enhanced customer satisfaction. For example, AI-powered chatbots provide 24/7 customer support, answering frequently asked questions and resolving simple issues instantly, improving response times and freeing up human agents to handle more complex inquiries. This leads to a more efficient and satisfying experience for the customer.

Technology’s Role in Risk Assessment, Fraud Detection, and Claims Processing

Big data analytics allows insurers to analyze vast datasets, identifying patterns and trends that improve risk assessment. This includes analyzing socio-economic factors, driving records, and even social media activity to better understand and predict the likelihood of claims. AI-powered algorithms are also significantly improving fraud detection capabilities by identifying anomalies and inconsistencies in claims data that might otherwise go unnoticed. In claims processing, AI can automate tasks like document verification and initial assessment, accelerating the settlement process and reducing processing times. For instance, image recognition technology can automatically assess damage to vehicles in auto insurance claims, speeding up the appraisal and payment process.

Utilizing Digital Channels to Reach and Serve Customers

Insurance companies are increasingly leveraging digital channels such as mobile apps, websites, and social media to engage with customers. These platforms offer convenient access to policy information, claims filing, and customer support. Personalized online portals allow customers to manage their policies, make payments, and access relevant information anytime, anywhere. This shift towards digital self-service empowers customers and streamlines interactions, creating a more efficient and user-friendly experience. Furthermore, targeted digital marketing campaigns enable insurers to reach specific demographics and tailor their messaging to individual needs and preferences.

Hypothetical Scenario: AI-Powered Predictive Maintenance in Home Insurance

Imagine a scenario where a home insurance company integrates AI-powered predictive maintenance into its offerings. Smart sensors installed in insured homes collect data on factors such as temperature fluctuations, water usage, and appliance performance. This data is fed into an AI algorithm that can predict potential issues, such as a failing heating system or a leaky pipe, before they cause significant damage. The insurer can then proactively contact the homeowner, recommending preventative maintenance or offering discounts on repairs, minimizing the risk of costly claims and strengthening customer relationships. This proactive approach not only reduces claims but also positions the insurer as a trusted partner in home maintenance, enhancing customer loyalty and potentially opening new revenue streams through partnerships with home repair services.

Financial Performance and Stability of US Insurers

The financial health of US insurance companies is a critical factor influencing the stability of the broader financial system and the security of policyholders. Analyzing key performance indicators and understanding the factors that impact their stability provides valuable insight into the industry’s overall resilience and capacity to meet its obligations. This section examines the financial performance and stability of major US insurers, considering profitability, solvency, and the influence of external factors.

Evaluating the financial performance of insurance companies requires a multifaceted approach. Profitability, measured through metrics like return on equity (ROE) and return on assets (ROA), reflects the efficiency and effectiveness of their operations. Solvency, on the other hand, focuses on their ability to meet long-term obligations, even during periods of economic downturn or unexpected events. This is often assessed through ratios like the debt-to-equity ratio and the company’s capital adequacy.

Factors Affecting Financial Stability

Several factors significantly influence the financial stability of insurance companies. Interest rate fluctuations directly impact investment income, a crucial component of insurers’ profitability. Economic downturns can lead to increased claims and reduced investment returns, impacting solvency. Catastrophic events, such as hurricanes or earthquakes, can cause massive payouts, potentially straining even the most financially sound companies. Furthermore, regulatory changes and evolving risk landscapes, including cybersecurity threats and climate change-related risks, also present significant challenges to their financial stability. For example, the increased frequency and severity of hurricanes in recent years have significantly impacted the profitability of property insurers operating in coastal regions. The 2008 financial crisis demonstrated the vulnerability of insurers to broader economic shocks, highlighting the interconnectedness of the financial system.

Financial Strength Ratings

Various rating agencies, such as A.M. Best, Moody’s, and Standard & Poor’s, assess the financial strength of insurance companies. These ratings provide an independent evaluation of an insurer’s ability to meet its policy obligations. Higher ratings indicate greater financial strength and stability. Consumers and investors rely on these ratings to make informed decisions about which insurers to choose or invest in. For instance, an insurer with a high rating from multiple agencies is generally considered a safer bet than one with lower or inconsistent ratings. The rating agencies consider a wide range of factors, including underwriting performance, investment portfolio quality, and overall financial strength.

Financial Ratios of Major Insurance Companies

The following table presents a simplified illustration of financial ratios for three hypothetical major US insurance companies. Note that actual figures vary significantly and are subject to change. This data is for illustrative purposes only and should not be used for investment decisions.

| Company | Return on Equity (ROE) | Debt-to-Equity Ratio | Combined Ratio |

|---|---|---|---|

| Company A | 12% | 0.5 | 95% |

| Company B | 8% | 0.8 | 102% |

| Company C | 15% | 0.3 | 92% |

Note: ROE represents the return on shareholder equity, the debt-to-equity ratio shows the proportion of debt financing to equity financing, and the combined ratio is a measure of underwriting profitability (a ratio below 100% indicates underwriting profit).

Customer Experience and Satisfaction

Customer satisfaction is paramount for the success of any insurance company in the highly competitive US market. Positive experiences foster loyalty, attract new customers, and ultimately contribute to a company’s bottom line. Conversely, negative experiences can lead to customer churn and reputational damage. Understanding the factors influencing customer satisfaction, addressing common complaints, and implementing effective customer service strategies are crucial for sustained growth and profitability.

Several key factors contribute to positive customer experiences in the insurance industry. Prompt and efficient claims processing is consistently ranked as a top priority. Clear and concise communication, readily available information, and easily accessible customer service channels are also highly valued. Furthermore, personalized service, demonstrating empathy and understanding during challenging times, significantly enhances customer satisfaction. A transparent and straightforward pricing structure, free from hidden fees or confusing jargon, also contributes to a positive perception of the company.

Factors Contributing to Customer Satisfaction

A comprehensive understanding of what drives customer satisfaction is crucial for insurers. Research consistently shows that ease of doing business, including straightforward online portals and responsive customer service representatives, plays a significant role. The ability to quickly and easily file a claim, receive updates on its progress, and ultimately get fairly compensated is paramount. Furthermore, proactive communication, such as reminders for renewal dates or educational materials about policy coverage, helps foster a sense of partnership and trust.

Common Customer Complaints and Challenges

Despite industry efforts to improve customer service, several persistent complaints remain. Lengthy claims processing times are a major source of frustration. Difficulty in understanding policy terms and conditions, particularly regarding exclusions and limitations, also frequently leads to dissatisfaction. Inconsistent communication, including delayed responses or a lack of clarity, further exacerbates negative experiences. High premiums, especially in the absence of clear justification, are another common complaint, often leading customers to seek more affordable alternatives.

Comparison of Customer Service Strategies

Different insurance companies employ varying customer service strategies. Some companies heavily invest in advanced technology, such as AI-powered chatbots and online self-service portals, to provide quick and convenient access to information and support. Others prioritize a more personalized approach, with dedicated customer service representatives available via phone or in-person appointments. Some insurers combine these approaches, offering multiple channels for customer interaction. The most effective strategy often depends on the specific target market and the company’s overall brand identity. For example, a company targeting younger demographics might emphasize digital channels, while one focusing on an older demographic might prioritize phone support.

Importance of Transparency and Communication in Building Trust

Transparency and effective communication are foundational to building trust with customers. Openly addressing potential issues, providing clear and accurate information about policy terms and conditions, and maintaining consistent communication throughout the claims process all contribute to a positive customer experience. Proactive communication, such as providing regular updates and proactively addressing potential concerns, demonstrates a commitment to customer satisfaction and fosters a sense of partnership. When issues arise, handling them promptly and fairly, and showing empathy and understanding, is crucial in repairing any damage to the customer relationship. A commitment to transparency builds credibility and strengthens the insurer-customer bond, fostering long-term loyalty.

Future Trends and Challenges

The US insurance market is undergoing a period of significant transformation, driven by technological advancements, evolving customer expectations, and emerging societal risks. Understanding these trends and the challenges they present is crucial for insurers to maintain competitiveness and relevance in the coming decade. Failure to adapt could lead to market share loss and even insolvency for some players.

Insurtech’s Disruptive Influence

Insurtech, the convergence of insurance and technology, is fundamentally reshaping the industry. Companies are leveraging artificial intelligence (AI), machine learning (ML), and big data analytics to improve underwriting, claims processing, and customer service. For example, AI-powered chatbots are providing 24/7 customer support, while predictive analytics are enabling more accurate risk assessment and personalized pricing. However, this rapid technological change presents challenges. Insurers must invest heavily in new technologies and talent acquisition to remain competitive, while also addressing concerns around data security and regulatory compliance related to AI and data usage. Some innovative approaches include partnerships between established insurers and agile insurtech startups, allowing for the rapid integration of new technologies without requiring complete internal overhauls. This collaborative approach allows established companies to leverage the innovation of smaller firms while mitigating the risks associated with complete internal disruption.

Climate Change and its Impact on Risk Assessment

The increasing frequency and severity of climate-related events, such as hurricanes, wildfires, and floods, are significantly impacting the insurance industry. Insurers face escalating claims costs and increased uncertainty in risk assessment. For instance, the rising sea levels are increasing the risk of coastal property damage, requiring insurers to reassess premiums and potentially withdraw coverage in high-risk areas. To address this, insurers are incorporating climate data and modeling into their risk assessments, developing more sophisticated catastrophe models, and exploring parametric insurance products that provide payouts based on pre-defined weather events, rather than on individual losses. This shift necessitates a move towards more dynamic and adaptive pricing models that can reflect the changing risk landscape. For example, insurers might use real-time weather data to adjust premiums dynamically, charging higher premiums during periods of high risk.

Cybersecurity Threats and Data Breaches

The increasing reliance on digital technologies has heightened the vulnerability of insurance companies to cyberattacks and data breaches. A successful breach can lead to significant financial losses, reputational damage, and regulatory penalties. Examples of successful cyberattacks against insurance companies have resulted in millions of dollars in losses and significant reputational damage. Insurers are responding by investing heavily in cybersecurity infrastructure, implementing robust data encryption protocols, and enhancing employee training on cybersecurity best practices. Furthermore, the development and implementation of comprehensive incident response plans are becoming increasingly critical to minimize the impact of successful attacks. This includes not only technical measures but also a focus on public relations and communication strategies to manage the fallout from a breach.

Reshaping the Insurance Landscape in the Next 5-10 Years

The confluence of these trends is likely to reshape the insurance landscape significantly over the next 5-10 years. We can expect to see a greater emphasis on data-driven decision-making, personalized insurance products, and the rise of new business models, such as usage-based insurance and on-demand coverage. The increasing importance of sustainability and ESG (environmental, social, and governance) factors will also drive changes in underwriting practices and investment strategies. Insurers that fail to adapt to these changes risk being left behind, while those that embrace innovation and prioritize customer experience will be well-positioned to thrive in the evolving market. For example, the rise of autonomous vehicles will significantly alter the auto insurance market, potentially leading to lower premiums due to reduced accident rates, but also creating new risks that insurers will need to assess and manage.

End of Discussion

The US insurance market presents a compelling picture of growth, innovation, and regulatory complexities. While technological advancements are reshaping operations and customer experiences, insurers continue to navigate a challenging regulatory landscape and adapt to emerging trends like Insurtech and climate change. The industry’s future hinges on its ability to maintain financial stability, enhance customer satisfaction, and embrace innovation to meet the evolving needs of a dynamic market.

Expert Answers

What is the difference between a stock and mutual insurance company?

Stock insurance companies are publicly traded and owned by shareholders, prioritizing profit. Mutual insurance companies are owned by their policyholders, focusing on member benefits.

How are insurance rates determined?

Rates are calculated based on numerous factors including risk assessment, claims history, demographics, and the type and amount of coverage.

What is the role of a state insurance department?

State insurance departments regulate and oversee insurance companies within their jurisdiction, ensuring solvency and consumer protection.

What is Insurtech?

Insurtech refers to the use of technology to improve insurance operations, customer experience, and product offerings.