Navigating the world of homeownership often leaves prospective buyers grappling with the complexities of insurance and warranties. Two key components of protecting your investment, home warranties and home insurance policies, often overlap in the minds of consumers, leading to confusion about their distinct roles and benefits. This exploration delves into the core differences between these two vital safeguards, offering clarity on their respective coverages, costs, and ultimately, which best aligns with your individual circumstances.

Understanding the nuances of home warranties and home insurance is crucial for making informed decisions about protecting your property and finances. This guide aims to provide a comprehensive comparison, empowering homeowners to choose the most suitable protection plan, or even a combination of both, to secure their peace of mind.

Defining Home Warranty and Home Insurance

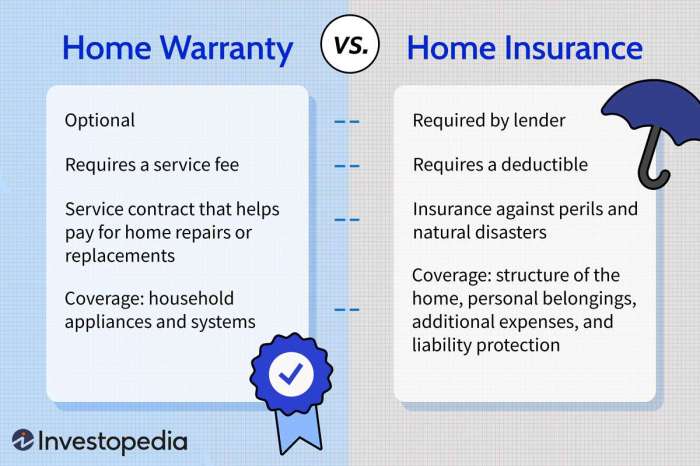

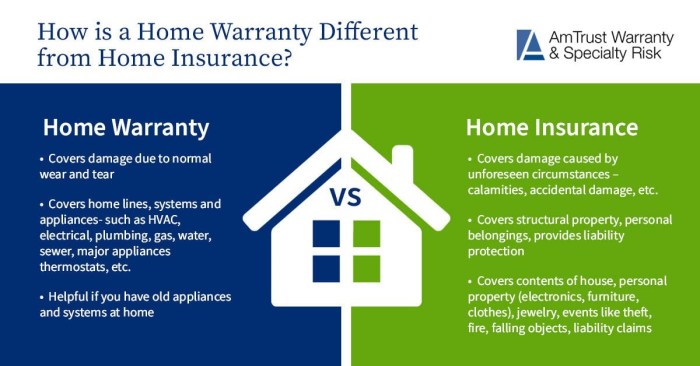

Home warranties and home insurance policies, while both designed to protect your home investment, serve vastly different purposes and offer distinct types of coverage. Understanding these key differences is crucial for making informed decisions about protecting your property. This section will clarify the distinctions between these two important financial tools.

Home insurance is a legally mandated contract (in many areas) that protects homeowners from financial losses due to unforeseen events, while a home warranty is a service contract that covers the repair or replacement of specific home systems and appliances.

Home Insurance Coverage Areas

Home insurance policies typically cover damage or loss to your home’s structure and personal belongings resulting from covered perils. These perils often include fire, windstorms, hail, vandalism, and theft. Liability coverage is also a standard component, protecting you from financial responsibility for injuries or damages caused to others on your property. Additional coverage options might include flood insurance (often purchased separately) and earthquake insurance, depending on your location and risk profile. For example, a homeowner whose house is damaged by a fire would be covered for repairs under their home insurance policy. Similarly, if a guest is injured on the property, the liability portion of the insurance would assist with medical expenses.

Home Warranty Coverage Areas

A home warranty, conversely, focuses on the repair or replacement of specific home systems and appliances. Commonly covered items include heating and air conditioning systems, plumbing, electrical systems, and major appliances like refrigerators, ovens, and dishwashers. Coverage typically involves a service fee for each repair call, with the warranty company covering the cost of parts and labor (up to a certain limit). A homeowner experiencing a malfunctioning refrigerator covered under their home warranty would contact the warranty provider, pay the service fee, and have the appliance repaired or replaced, depending on the terms of the contract. In contrast to home insurance, which deals with sudden and unforeseen events, a home warranty deals with the breakdown or failure of systems and appliances over time.

Key Differences in Repairs and Replacements

The core difference lies in *what* is covered. Home insurance covers unexpected damage caused by external factors or accidents, while a home warranty covers the breakdown or failure of pre-existing systems and appliances due to normal wear and tear. Home insurance would cover damage from a storm, whereas a home warranty would cover a failing water heater. Repair or replacement under a home warranty is generally limited to the specific items listed in the contract, whereas home insurance coverage extends to the broader structure and contents of the home, contingent upon the policy details and the cause of the damage. It’s important to note that a home warranty usually won’t cover pre-existing conditions or damage that wasn’t disclosed before the contract began.

Examples of Situations Where Each Would Apply

Consider a scenario where a tree falls on a house during a storm. Home insurance would cover the damage to the roof and structure. However, if the home’s air conditioning unit breaks down due to normal wear and tear, a home warranty would likely cover the repair or replacement, depending on the specifics of the contract. Another example: a burst pipe resulting from a sudden freeze would be covered under the home insurance policy (as it’s a sudden and accidental event). Conversely, a slow leak in a pipe caused by gradual corrosion would typically fall under the purview of a home warranty, subject to the warranty’s terms and conditions.

Cost Comparison

Choosing between a home warranty and home insurance involves careful consideration of costs. While both protect your home, they do so in fundamentally different ways, leading to vastly different price points and financial implications. Understanding these differences is crucial for making an informed decision.

The annual cost of each varies significantly based on several factors. A simple comparison, however, provides a starting point for understanding the financial commitment involved.

Average Annual Costs and Key Differences

The following table presents a general comparison of average annual costs. Keep in mind that these are estimates and actual costs will vary widely depending on location, coverage level, and the age and condition of your home. It’s crucial to obtain personalized quotes from multiple providers.

| Coverage Type | Average Annual Cost | Deductible | Limitations |

|---|---|---|---|

| Home Warranty | $300 – $700 | $50 – $100 per service call | Specific appliances and systems; exclusions for pre-existing conditions; limited coverage amounts. |

| Home Insurance | $1,000 – $2,500+ | $500 – $2,000+ (depending on policy) | Covers structural damage, liability, and personal belongings; exclusions for specific events (e.g., flood, earthquake); coverage limits apply. |

Factors Influencing Price

Several factors influence the price of both home warranties and home insurance. Understanding these factors allows for a more accurate cost projection and informed decision-making.

Home Warranty Factors: The cost of a home warranty is influenced by the age and condition of your home’s systems and appliances, the level of coverage you choose (e.g., basic, comprehensive), the location of your home (due to varying service call costs), and the reputation and pricing structure of the warranty provider. A newer home with well-maintained systems will generally command a lower premium than an older home requiring more frequent repairs.

Home Insurance Factors: Home insurance premiums are determined by a much broader range of factors. These include the location of your home (risk of natural disasters, crime rates), the age and construction of your home, its replacement cost, the value of your personal belongings, your claims history, and the coverage level you select. Homes in high-risk areas or those with older plumbing or electrical systems will generally incur higher premiums.

Long-Term Financial Implications

The long-term financial implications of choosing a home warranty versus home insurance are significant and should be carefully considered.

Home Warranty: A home warranty offers protection against the unexpected costs of appliance and system repairs, potentially saving you money on smaller, more frequent repairs. However, the cumulative cost over several years could exceed the cost of a single major repair covered by home insurance. The limited coverage and deductibles mean you’ll still incur some out-of-pocket expenses.

Home Insurance: Home insurance provides broader protection against major events, such as fire, theft, or significant structural damage. While the annual premiums are higher, this protection can prevent catastrophic financial losses. However, home insurance deductibles can be substantial, requiring significant upfront costs in the event of a claim.

Cost-Benefit Analysis Scenarios

Consider these scenarios to illustrate the cost-benefit analysis:

Scenario 1: Older Home with Frequent Minor Repairs: For an older home prone to frequent minor repairs (e.g., leaky faucet, malfunctioning garbage disposal), a home warranty might be more cost-effective in the short term. The cumulative cost of these repairs without a warranty could exceed the annual warranty premium. However, major damage not covered by the warranty could still lead to significant out-of-pocket expenses.

Scenario 2: Newly Built Home in a Low-Risk Area: For a new home in a low-risk area, a home warranty might be unnecessary. The likelihood of major system failures is low, and the cost of the warranty could be better allocated towards building an emergency fund for unexpected repairs.

Scenario 3: Home in a High-Risk Area: For a home in a high-risk area (e.g., prone to hurricanes or wildfires), comprehensive home insurance is paramount. The potential for catastrophic damage far outweighs the cost of the higher premiums. A home warranty might be considered as supplemental coverage but shouldn’t replace comprehensive home insurance.

Coverage Details

Understanding the specifics of what’s covered and excluded under both home warranties and home insurance is crucial for making an informed decision. While both offer protection, their scope and the claims processes differ significantly. This section details those differences to help clarify which option best suits your needs.

Commonly Covered Systems and Appliances in Home Warranties

Home warranty plans typically cover a range of home systems and appliances. The specific items included vary depending on the plan chosen (basic, mid-range, or comprehensive), but common inclusions frequently encompass major home systems and essential appliances. This coverage is generally for repairs or replacements due to normal wear and tear, not pre-existing conditions or damage from neglect.

- Heating and Cooling Systems: Furnaces, air conditioners, heat pumps, and related components like ductwork (often with limitations).

- Plumbing Systems: Water heaters, toilets, sinks, garbage disposals, and main water lines (usually excluding sewer lines).

- Electrical Systems: Electrical panels, wiring, and outlets (typically limited to specific issues).

- Major Appliances: Refrigerators, ovens, dishwashers, washing machines, and dryers.

Typical Exclusions in Home Warranties and Home Insurance Policies

Both home warranties and home insurance policies contain exclusions. Understanding these limitations is vital to avoid disappointment when filing a claim. Exclusions often involve pre-existing conditions, damage caused by neglect or improper maintenance, and certain types of wear and tear considered beyond normal use.

- Home Warranties: Common exclusions include cosmetic damage, damage from pest infestations, normal wear and tear beyond a certain threshold, pre-existing conditions, and damage caused by improper maintenance. Sewer lines and some aspects of plumbing are often excluded in basic plans.

- Home Insurance: Exclusions vary significantly but typically include damage from normal wear and tear, intentional acts, and certain types of events (like flooding in many cases, unless flood insurance is added separately). Maintenance issues are generally not covered.

Claim Processes: Home Warranty vs. Home Insurance

The claim processes for home warranties and home insurance differ considerably. Home warranty claims typically involve contacting the warranty company, scheduling a service appointment with a pre-approved contractor, and awaiting repair or replacement. Home insurance claims usually involve reporting the damage to your insurance provider, potentially undergoing an inspection, and receiving reimbursement for repairs or replacement costs after deductibles are met. The process for home insurance claims is often more complex and may involve dealing with adjusters and potentially lengthy processing times.

Waiting Periods and Repair Limitations

The following table Artikels typical waiting periods and limitations for repairs under home warranties and home insurance policies. Specifics will vary greatly depending on the individual policy and provider.

| Feature | Home Warranty | Home Insurance |

|---|---|---|

| Waiting Period (after claim) | Often 24-72 hours for scheduling, plus additional time for repairs | Varies greatly depending on the type of claim and the insurance company; often involves immediate reporting and then a process that may take days or weeks |

| Repair Limitations | Usually limited to repair or replacement of the covered item; may not cover consequential damages | Covers damages resulting from covered perils; may include additional living expenses in some cases |

| Contractor Selection | Typically uses a pre-approved network of contractors | Homeowner generally chooses the contractor, but approval might be required by the insurance company |

Final Conclusion

Ultimately, the choice between a home warranty and home insurance, or the strategic combination of both, hinges on a careful assessment of individual needs and risk tolerance. While home insurance provides essential protection against major unforeseen events, a home warranty can offer supplemental coverage for specific appliances and systems, mitigating the financial burden of smaller, yet still costly, repairs. By understanding the unique strengths of each, homeowners can create a tailored protection plan that provides optimal coverage and financial security.

Answers to Common Questions

What is the difference between a deductible and a premium?

A premium is the regular payment you make for your insurance or warranty coverage. A deductible is the amount you pay out-of-pocket before your insurance or warranty coverage kicks in.

Can I file a claim for damage caused by a natural disaster with a home warranty?

No. Home warranties typically do not cover damage caused by natural disasters such as floods, earthquakes, or hurricanes. This is usually covered under a home insurance policy.

How long does it typically take to get a claim approved for a home warranty?

The processing time varies depending on the warranty provider and the complexity of the claim, but it generally takes a few days to a few weeks.

Are there any age restrictions on appliances covered by a home warranty?

Yes, most home warranties have age limits on the appliances they cover. Appliances that exceed a certain age (often 10-15 years) may not be eligible for coverage.

What if my home warranty company goes out of business?

This is a significant risk. Before purchasing a home warranty, research the company’s financial stability and reputation. Consider purchasing a warranty from a well-established company with a strong track record.