Homeownership is a significant milestone, and securing adequate insurance is paramount. Progressive, a well-known name in auto insurance, also offers comprehensive home insurance policies. This guide delves into the intricacies of Progressive’s home insurance offerings, exploring coverage options, pricing comparisons, claims processes, and customer experiences. We aim to provide a clear and concise understanding of what Progressive home insurance entails and whether it aligns with your needs.

We’ll examine the key features and benefits, comparing them to competitors and highlighting situations where Progressive’s policy might prove particularly advantageous. We’ll also analyze customer reviews to offer a balanced perspective, considering both positive and negative feedback to paint a realistic picture of the company’s performance.

Understanding “Home Progressive Insurance”

Progressive offers home insurance designed to protect homeowners from various financial risks associated with property damage and liability. It’s a comprehensive policy aiming to provide peace of mind and financial security in the event of unforeseen circumstances. Understanding its core components is crucial for choosing the right coverage.

Core Components of Progressive Home Insurance

Progressive’s home insurance policies typically include several key coverage components. These components work together to protect your home and belongings against a range of potential risks. The specific details and coverage limits will vary depending on your policy and chosen options. Generally, you can expect coverage for dwelling protection (the structure of your home), personal property (your belongings), liability protection (covering injuries or damages you cause to others), and additional living expenses (covering temporary housing if your home becomes uninhabitable). Some policies may also offer optional add-ons for specific needs.

Typical Coverage Options in a Progressive Home Insurance Policy

A typical Progressive home insurance policy provides coverage for several scenarios. Dwelling coverage protects the physical structure of your home against damage from events like fire, windstorms, or vandalism. Personal property coverage protects your belongings inside and sometimes outside your home from similar events. Liability coverage protects you financially if someone is injured on your property or if you accidentally damage someone else’s property. Additional living expenses coverage helps cover temporary housing, meals, and other necessary expenses if your home becomes uninhabitable due to a covered event. Optional add-ons might include coverage for specific valuables, flood insurance (often purchased separately), or identity theft protection.

Progressive Home Insurance Pricing Compared to Competitors

Progressive’s home insurance pricing is competitive within the market, but it’s difficult to provide a direct comparison without specific details about your location, home value, and coverage needs. Factors such as your credit score, claims history, and the level of coverage you select significantly influence the final premium. To get an accurate comparison, it’s best to obtain quotes from several major insurers, including Progressive, State Farm, Allstate, and others, using online comparison tools or contacting agents directly. Remember that the lowest price isn’t always the best option; consider the overall coverage and customer service offered.

Situations Where Progressive Home Insurance is Beneficial

Progressive home insurance offers significant benefits in several situations. For example, if a fire damages your home, the dwelling coverage will help pay for repairs or rebuilding. If a tree falls on your car parked in your driveway, your comprehensive auto coverage (if included) may cover the damage. If a guest is injured on your property, liability coverage will help cover medical expenses and legal costs. If a hailstorm damages your roof, the dwelling coverage will help pay for repairs. In the event of a major disaster, such as a hurricane or tornado, comprehensive coverage will be crucial in helping you recover financially. The peace of mind knowing you have financial protection against these events is invaluable.

Policy Features and Benefits

Progressive home insurance offers a range of features and benefits designed to provide comprehensive protection for your property and peace of mind. Understanding these features is crucial to selecting the right coverage for your individual needs and budget. This section details the claims process, customer service, available discounts, and a comparison with a competitor.

The Progressive Home Insurance Claims Process

Filing a claim with Progressive is generally straightforward. Policyholders can typically initiate a claim online through their account, by phone, or through the Progressive mobile app. The process usually involves providing details about the incident, such as the date, time, and circumstances. A claims adjuster will then be assigned to investigate the claim, assess the damages, and determine the appropriate payout. Progressive aims to provide timely and efficient claim resolution, although the specific timeframe can vary depending on the complexity of the claim. Documentation such as photos of the damage and receipts for repairs are often required to support the claim.

Progressive Home Insurance Customer Service

Progressive strives to provide excellent customer service to its home insurance policyholders. Multiple channels are available for contacting customer support, including phone, email, and online chat. The company employs a team of trained representatives who can answer questions about policies, claims, and other related matters. Customer reviews regarding Progressive’s customer service are varied, with some praising the responsiveness and helpfulness of representatives while others citing instances of long wait times or difficulty resolving issues. Overall, accessibility and responsiveness are key features Progressive emphasizes.

Discounts and Special Offers for Progressive Home Insurance

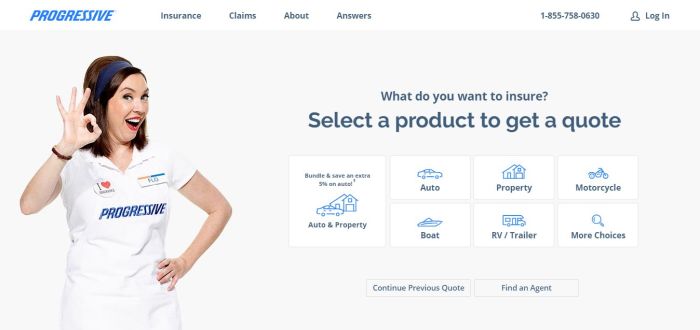

Progressive frequently offers various discounts to reduce the cost of home insurance premiums. These discounts can be based on several factors, including: home security features (such as alarm systems), bundling home and auto insurance, claims-free history, and being a homeowner who is also a Progressive auto insurance customer. Specific discounts and their availability can vary by state and individual circumstances. It is advisable to contact Progressive directly or check their website for the most up-to-date information on available discounts in your area. Specific promotional offers may also be available periodically.

Comparison of Progressive Home Insurance with a Competitor

| Feature | Progressive | State Farm | Notes |

|---|---|---|---|

| Coverage Options | Comprehensive coverage options including dwelling, liability, and personal property | Similar comprehensive coverage options | Both offer a wide range of coverage choices, but specific details may vary. |

| Claims Process | Online, phone, and mobile app options; claims adjusters assigned for investigation | Similar options; claims adjusters assigned | Both offer multiple claim filing methods, but processing times might differ. |

| Customer Service | Multiple contact channels including phone, email, and online chat | Multiple contact channels, similar to Progressive | Customer service experience can vary based on individual experiences. |

| Discounts | Discounts for home security, bundling, claims-free history, etc. | Discounts for similar factors, potentially varying in specifics | Specific discounts and their values can change and differ between companies. |

Policy Coverage Scenarios

Progressive home insurance offers a range of coverage options to protect your home and belongings from various unforeseen events. Understanding these scenarios and the claims process is crucial for ensuring a smooth experience should you need to file a claim. This section details common covered damages, the claims procedure, and how Progressive handles liability claims.

Examples of Covered Home Damage

Progressive home insurance typically covers damage from a variety of events. For instance, damage caused by fire, including smoke and soot damage, is usually covered under most standard policies. Water damage resulting from burst pipes, plumbing failures, or even severe weather events like hurricanes or floods (depending on specific policy endorsements) are also often included. Furthermore, damage caused by theft or vandalism, including the cost of repairing damaged property and replacing stolen items, is generally covered. Wind damage to your roof or siding, as well as damage from hail, are frequently included in comprehensive policies. It’s important to review your specific policy documents for complete details on covered perils.

Filing a Claim for Home Damage

The claims process for different types of damage is generally similar. Upon experiencing a covered event, you should first contact Progressive’s claims department immediately. This initial contact will initiate the claims process and allow an adjuster to be assigned to your case. For fire damage, you will need to provide documentation of the incident (e.g., fire department report) and photos or videos of the damage. For water damage, detailed descriptions of the source and extent of the damage will be needed. In the case of theft, you’ll need to provide a police report and a list of stolen items with their estimated values. The adjuster will then assess the damage and determine the extent of coverage based on your policy. You will be required to cooperate fully with the adjuster throughout the investigation.

Progressive’s Handling of Liability Claims

Liability coverage protects you if someone is injured on your property or if you cause damage to someone else’s property. For example, if a guest slips and falls on your icy walkway and suffers injuries, your liability coverage may help pay for their medical expenses and legal fees. Similarly, if a tree on your property falls and damages your neighbor’s car, your liability coverage could assist in covering the repair costs. Progressive will investigate the claim to determine liability and the extent of damages. This process may involve gathering evidence, interviewing witnesses, and possibly legal representation.

Scenario: Claim Process Step-by-Step

Let’s imagine a homeowner, Sarah, experiences a covered event: a severe thunderstorm causes a tree to fall on her roof, resulting in significant damage. Here’s how the claim process might unfold:

- Contact Progressive: Sarah immediately contacts Progressive’s claims department to report the damage and initiate the claims process.

- Claim Assignment: A claims adjuster is assigned to Sarah’s case.

- Damage Assessment: The adjuster visits Sarah’s home to assess the damage to the roof, taking photos and documenting the extent of the damage.

- Evidence Gathering: Sarah provides any relevant documentation, such as photos she took immediately after the storm, and cooperates fully with the adjuster’s investigation.

- Coverage Determination: The adjuster determines the extent of coverage based on Sarah’s policy and the damage assessment.

- Repair Authorization: Once coverage is determined, Progressive authorizes the necessary repairs. Sarah may be able to choose her own contractor, subject to Progressive’s approval.

- Payment: Progressive makes payments to Sarah directly or to the contractors involved in the repairs, depending on the arrangement.

Customer Reviews and Feedback

Progressive home insurance, like any other insurance provider, receives a mixed bag of reviews online. Analyzing these reviews provides valuable insights into customer perceptions and areas for potential improvement. This section summarizes common positive and negative experiences reported by customers, highlighting key themes and their impact.

Summary of Positive and Negative Customer Reviews

Positive reviews frequently praise Progressive’s competitive pricing and user-friendly online platform. Many customers appreciate the ease of obtaining quotes, managing their policies, and filing claims through the company’s website and mobile app. The availability of various coverage options and add-ons is also frequently cited as a positive aspect. Conversely, negative reviews often focus on customer service experiences, with some customers reporting difficulties reaching representatives or experiencing long wait times. Issues with claim processing speed and the perceived fairness of settlements are also common complaints. Difficulties understanding policy details and navigating the claims process contribute to dissatisfaction for some policyholders.

Factors Contributing to Customer Satisfaction and Dissatisfaction

Customer satisfaction with Progressive home insurance is strongly correlated with the ease and speed of online interactions and the efficiency of the claims process. Positive experiences with responsive and helpful customer service representatives significantly contribute to positive reviews. Conversely, negative experiences, particularly those involving lengthy wait times, unclear communication, or perceived unfair claim settlements, frequently lead to negative feedback. The clarity and comprehensiveness of policy documents also play a significant role in customer satisfaction. Customers who feel they fully understand their coverage are more likely to express positive sentiments.

Areas for Improvement Based on Customer Reviews

Based on online reviews, Progressive could improve customer satisfaction by focusing on enhancing its customer service channels. Investing in additional resources to reduce wait times and improve the responsiveness of representatives would likely address a significant source of negative feedback. Streamlining the claims process and providing clearer, more accessible policy information would also benefit customers. Proactive communication with customers throughout the claims process, including regular updates and clear explanations of decisions, could mitigate concerns about fairness and transparency. Improving the overall clarity of policy documents and offering more personalized customer support could further enhance the customer experience.

Key Themes from Customer Reviews

| Theme | Frequency/Impact |

|---|---|

| Competitive Pricing | High; attracts many customers |

| User-Friendly Online Platform | High; contributes to positive overall experience |

| Customer Service Responsiveness | Low; major source of negative feedback |

| Claims Processing Speed and Fairness | Medium; significant impact on customer satisfaction |

| Policy Clarity and Comprehension | Medium; contributes to both positive and negative experiences depending on clarity |

Illustrative Scenarios

Understanding how Progressive Home Insurance responds in real-world situations is crucial. The following scenarios illustrate the claim process, customer experience, and the range of support offered.

Significant Home Damage Event and Progressive’s Response

Imagine a severe thunderstorm causes significant damage to your home: a tree crashes through your roof, causing extensive water damage to the interior and structural damage to the attic. You immediately contact Progressive’s claims department, as Artikeld in your policy. A claims adjuster is dispatched within 24 hours to assess the damage. Detailed photographs and documentation are taken, and the adjuster works with you to create a comprehensive damage report. Progressive then works with reputable contractors to facilitate repairs, often managing the entire process, from obtaining bids to overseeing the completion of the work. The settlement, based on the policy coverage and the assessed damages, is paid directly to the contractors, ensuring timely and efficient repairs. Throughout the process, you have regular communication with your assigned claims adjuster, keeping you informed of the progress and addressing any concerns. The experience, though stressful, is streamlined and supported by Progressive’s professional team, minimizing the disruption to your life.

Hypothetical Homeowner’s Experience with Progressive Home Insurance

Sarah purchased a Progressive home insurance policy online, finding the process straightforward and easy to navigate. She appreciated the clear explanation of coverage options and the ability to customize her policy to meet her specific needs. Six months later, a plumbing issue caused water damage to her basement. Sarah filed a claim through Progressive’s mobile app, uploading photos and providing a brief description of the incident. Within hours, she received confirmation of her claim and was assigned a claims adjuster. The adjuster promptly contacted her to schedule an inspection, and the repair process was managed efficiently by Progressive. The repairs were completed swiftly, and Sarah was satisfied with the transparency and professionalism throughout the entire process, from initial policy purchase to final claim resolution. The experience reinforced her confidence in her choice of Progressive Home Insurance.

Customer Service Assistance with Home Insurance Policy

John needed clarification on a specific clause in his Progressive home insurance policy regarding coverage for certain types of renovations. He contacted Progressive’s customer service department via phone. A knowledgeable representative answered his call promptly, patiently explained the relevant policy section, and answered all his questions thoroughly. The representative also provided additional information on related policy features, further clarifying John’s understanding of his coverage. This positive interaction reassured John about the quality of Progressive’s customer service and strengthened his trust in the company. The representative’s helpfulness and expertise resolved John’s concerns efficiently and effectively.

Final Summary

Choosing the right home insurance provider is a crucial decision impacting your financial security and peace of mind. This exploration of Progressive home insurance aims to equip you with the knowledge necessary to make an informed choice. By understanding the policy’s coverage, claims process, and customer feedback, you can assess whether Progressive aligns with your specific needs and risk profile. Remember to compare quotes from multiple providers to ensure you secure the best possible coverage at a competitive price.

Query Resolution

What types of disasters are typically covered under Progressive’s home insurance?

Progressive typically covers damage from fire, wind, hail, lightning, vandalism, and theft. Specific coverage can vary depending on your policy and chosen add-ons. It’s crucial to review your policy documents for exact details.

How does Progressive’s claims process work?

The process generally involves reporting the damage promptly, providing necessary documentation, and cooperating with Progressive’s adjusters who will assess the damage and determine the payout. The specific steps might vary depending on the nature and extent of the damage.

Does Progressive offer discounts on home insurance?

Yes, Progressive often offers discounts for various factors such as bundling with other Progressive insurance policies (auto, etc.), installing security systems, or having a good claims history. Contact Progressive directly or check their website for current discount offers.

What is the difference between actual cash value and replacement cost coverage?

Actual cash value (ACV) covers the replacement cost minus depreciation. Replacement cost coverage pays for the full cost of replacing damaged items without considering depreciation.