Securing your Florida home requires more than just bricks and mortar; it demands a thorough understanding of homeowners insurance. This guide delves into the complexities of Florida’s unique insurance landscape, exploring everything from policy components and premium factors to hurricane coverage and claim processes. We’ll unravel the intricacies of finding the right provider, deciphering policy documents, and navigating potential disputes, ensuring you’re well-equipped to protect your most valuable asset.

Florida’s susceptibility to hurricanes and other natural disasters significantly impacts homeowners insurance. This guide aims to clarify the often-confusing aspects of coverage, costs, and claims, empowering you to make informed decisions and secure the best possible protection for your property.

Factors Affecting Insurance Premiums in Florida

Securing affordable homeowners insurance in Florida can be challenging, influenced by a complex interplay of factors. Understanding these elements is crucial for homeowners to make informed decisions and potentially lower their premiums. This section will delve into the key aspects that significantly impact insurance costs within the state.

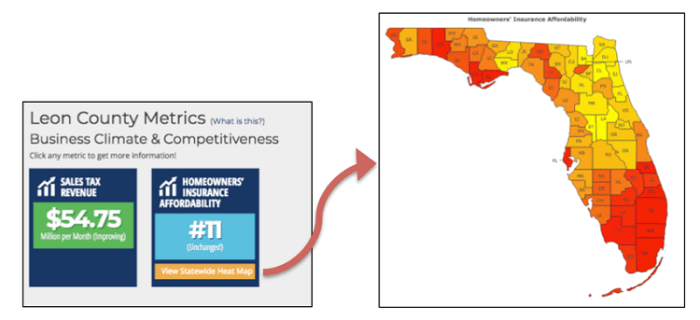

Location’s Influence on Insurance Costs

Your home’s location is a primary determinant of your insurance premium. Areas prone to hurricanes, floods, wildfires, or other natural disasters command higher premiums due to the increased risk. Coastal properties, for example, typically face significantly higher rates than inland properties. Furthermore, proximity to fire-prone areas or regions with a history of significant property damage can also elevate insurance costs. Insurance companies use sophisticated risk models that incorporate historical weather data, geographic information, and proximity to hazards to assess risk and set premiums accordingly. A home situated in a designated high-risk zone will inevitably attract a higher premium than a similar home in a lower-risk area.

Impact of Home Features on Premiums

The characteristics of your home play a substantial role in determining your insurance premium. The age of your home is a factor; older homes may require more extensive repairs and renovations, increasing the insurer’s potential liability. The construction materials used also influence premiums. Homes constructed with hurricane-resistant materials, such as reinforced concrete or impact-resistant windows, generally attract lower premiums than those built with less durable materials. The presence of safety features, such as security systems, fire alarms, and sprinkler systems, can also lead to reduced premiums as they mitigate the risk of loss or damage. For instance, a home with a monitored security system and impact-resistant roofing may qualify for discounts, reflecting the reduced risk profile.

Claims History and Premium Rates

Your claims history significantly impacts your insurance premium. A history of filing claims, especially for significant events, can lead to higher premiums. Insurance companies view frequent claims as an indicator of higher risk, increasing the likelihood of future claims. Conversely, a clean claims history, demonstrating responsible homeownership and a low risk profile, can result in lower premiums or even eligibility for discounts. Maintaining a good claims history is a proactive way to manage your insurance costs over time.

Premium Differences Across Coverage Levels

Homeowners insurance policies offer various coverage levels, each impacting the premium. Higher coverage levels, providing greater financial protection against losses, naturally result in higher premiums. Conversely, lower coverage levels, while offering less financial protection, will usually result in lower premiums. It’s crucial to find a balance between the level of coverage needed to protect your assets and the affordability of the premium. For example, choosing a policy with a higher dwelling coverage limit will increase the premium but provide greater financial security in the event of significant damage. Careful consideration of your individual needs and risk tolerance is necessary when selecting coverage levels.

Outcome Summary

Protecting your Florida home involves a multifaceted approach, demanding careful consideration of various factors and a proactive engagement with your insurance provider. By understanding the nuances of Florida homeowners insurance, from policy specifics and premium influences to navigating claims and disputes, you can confidently safeguard your investment and peace of mind. Remember, proactive planning and informed decision-making are key to securing adequate coverage and ensuring a smooth process should the unexpected occur.

Commonly Asked Questions

What is the average cost of homeowners insurance in Florida?

The average cost varies significantly based on location, property value, coverage level, and risk factors. It’s best to obtain personalized quotes from multiple insurers.

How long does it take to get a homeowners insurance claim approved?

The claim processing time depends on the complexity of the claim and the insurer’s efficiency. Simple claims may be processed within weeks, while more complex ones can take months.

Can I bundle my homeowners and auto insurance in Florida?

Yes, many insurers offer discounts for bundling homeowners and auto insurance policies. This can result in significant savings.

What are the penalties for not having homeowners insurance in Florida?

While not always legally mandated, lack of homeowners insurance can leave you financially vulnerable in the event of damage or loss. Mortgage lenders typically require it.

What is the difference between actual cash value (ACV) and replacement cost coverage?

ACV coverage pays for the depreciated value of damaged property, while replacement cost coverage pays for the cost of replacing it with new, similar items.