Securing your home is a significant investment, and understanding the factors that influence your home insurance rates is crucial for responsible financial planning. This comprehensive guide delves into the complexities of home insurance pricing, empowering you to make informed decisions and potentially save money on your premiums. We’ll explore the key elements that determine your rates, allowing you to navigate the process with confidence and clarity.

From geographic location and property characteristics to personal risk factors and coverage choices, we’ll examine the multifaceted nature of home insurance costs. By understanding how these factors interact, you can gain a clearer picture of your own insurance landscape and take proactive steps to manage your expenses effectively. This guide will provide you with the tools and knowledge to become a more informed consumer, ultimately helping you secure the best possible coverage at a price that suits your budget.

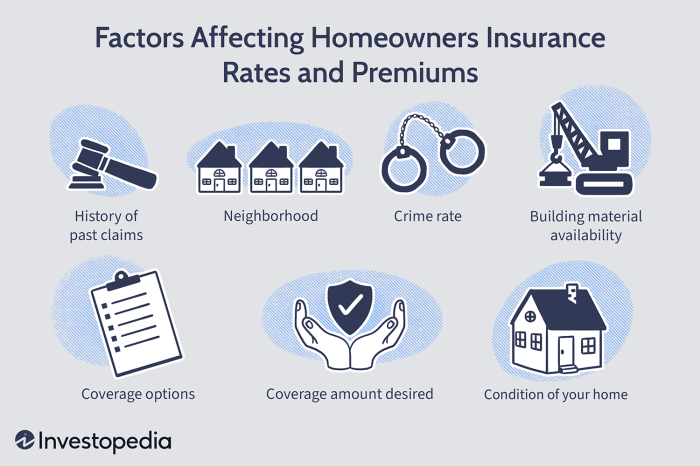

Factors Influencing Home Insurance Rates

Several key factors significantly impact the cost of home insurance. Understanding these factors can help homeowners make informed decisions and potentially lower their premiums. This section will explore the most influential elements, providing examples to illustrate their effects.

Location’s Impact on Home Insurance Costs

Geographic location is a primary determinant of home insurance rates. Insurers assess risk based on factors like the frequency of natural disasters (hurricanes, earthquakes, wildfires), crime rates, and the proximity to fire hydrants or other emergency services. Coastal areas prone to hurricanes, for instance, typically command higher premiums than inland locations. Similarly, areas with high crime rates will often have higher insurance costs due to the increased risk of theft or vandalism. For example, a home in a hurricane-prone coastal region like Florida might see premiums significantly higher than a similar home in a low-risk area like the Midwest. Conversely, a home situated in a rural area with a low crime rate and minimal risk of natural disasters will likely attract lower premiums.

Age and Condition of a Home

The age and condition of a home directly influence insurance costs. Older homes, especially those lacking modern safety features, are considered higher risk. Conversely, newer homes with updated electrical systems, plumbing, and fire-resistant materials often qualify for lower premiums. The condition of the roof, foundation, and overall structure also plays a significant role.

| Age | Condition | Estimated Premium | Risk Factor |

|---|---|---|---|

| New (less than 5 years) | Excellent | $1,000 annually | Low |

| 10-20 years | Good | $1,200 annually | Medium |

| 30-40 years | Fair | $1,500 annually | Medium-High |

| Over 50 years | Poor (requires significant repairs) | $2,000+ annually | High |

*Note: These are estimated premiums and can vary significantly based on other factors.*

Coverage Amounts and Deductibles

The amount of coverage you choose and your deductible significantly affect your premium. Higher coverage amounts mean higher premiums, as the insurer assumes greater financial responsibility in case of damage or loss. Conversely, a higher deductible (the amount you pay out-of-pocket before your insurance kicks in) results in lower premiums. For example, a homeowner with $250,000 coverage and a $1,000 deductible will likely pay less than a homeowner with $500,000 coverage and a $500 deductible. The trade-off involves balancing the cost of the premium with the amount of out-of-pocket expense in the event of a claim.

Individual Risk Factors

Several individual factors influence your home insurance rates. These factors are assessed by insurers to determine your overall risk profile.

The following factors significantly impact your insurance premiums:

- Credit Score: A higher credit score generally correlates with lower premiums, reflecting a lower perceived risk of non-payment.

- Claims History: A history of frequent claims can lead to higher premiums, as it suggests a higher likelihood of future claims.

- Security Systems: Homes equipped with security systems (alarm systems, fire sprinklers) often receive discounts, as these features reduce the risk of loss or damage.

Final Conclusion

Successfully navigating the world of home insurance rates requires a proactive approach and a thorough understanding of the influencing factors. By carefully considering your location, property condition, coverage needs, and personal risk profile, you can effectively manage your premiums and secure the best possible protection for your home. Remember to leverage online comparison tools, explore cost-saving strategies, and don’t hesitate to appeal if you believe your rate is unfairly high. Taking control of your home insurance costs allows you to allocate your financial resources more efficiently, ensuring peace of mind and financial stability.

FAQs

What is the difference between actual cash value (ACV) and replacement cost coverage?

ACV coverage pays for the current market value of your damaged property, minus depreciation. Replacement cost coverage pays for the cost to replace your damaged property with new, similar items, regardless of depreciation.

How often can I expect my home insurance rates to change?

Rates can change annually, or even more frequently depending on your insurer and any changes in your risk profile (e.g., claims, address change).

Can I get home insurance if I have a poor credit score?

Yes, but insurers may consider your credit score, leading to higher premiums. Shop around for insurers with more lenient credit score policies.

What is a binder in home insurance?

A binder is a temporary insurance policy providing coverage until your official policy is issued. It provides immediate coverage while the insurer processes your application.