Navigating the world of home insurance can feel like deciphering a complex code. Understanding the nuances of coverage, premiums, and policy details is crucial to securing the best protection for your most valuable asset. This guide delves into the intricacies of home insurance quotes comparison, empowering you to make informed decisions and find the policy that perfectly suits your needs and budget.

We’ll explore the key components of a home insurance quote, highlighting the factors that influence pricing variations and providing practical strategies for comparing quotes from different providers. We’ll also examine the impact of deductibles, location, and home features on your premiums, equipping you with the knowledge to confidently navigate the process of securing comprehensive and affordable home insurance.

Understanding Home Insurance Quotes

Obtaining multiple home insurance quotes is a crucial step in securing the best coverage at the most competitive price. Understanding the components of these quotes and the factors influencing their variations will empower you to make informed decisions.

A typical home insurance quote details the estimated cost of your coverage based on several key factors. It’s essentially a snapshot of what the insurer believes your risk profile is and how much it would cost them to cover potential losses.

Components of a Home Insurance Quote

A home insurance quote typically includes the premium (the amount you pay periodically), the deductible (the amount you pay out-of-pocket before your coverage kicks in), and a description of the coverage provided. You’ll also find details on the policy’s terms and conditions, including any exclusions or limitations. The quote will clearly state the coverage limits for various perils, like fire, theft, and liability.

Factors Influencing Quote Variations

Several factors significantly influence the variation between home insurance quotes from different providers. These include your home’s location (risk of natural disasters, crime rates), the age and condition of your home (potential for damage or maintenance issues), your credit score (used by some insurers as an indicator of risk), and the coverage amount and type you select. The presence of security systems (alarms, security cameras) can also impact your premium, as can your claims history. For instance, a home in a flood-prone area will generally receive higher quotes than one in a less risky location. Similarly, a home with a poor credit history might face higher premiums compared to one with an excellent credit score.

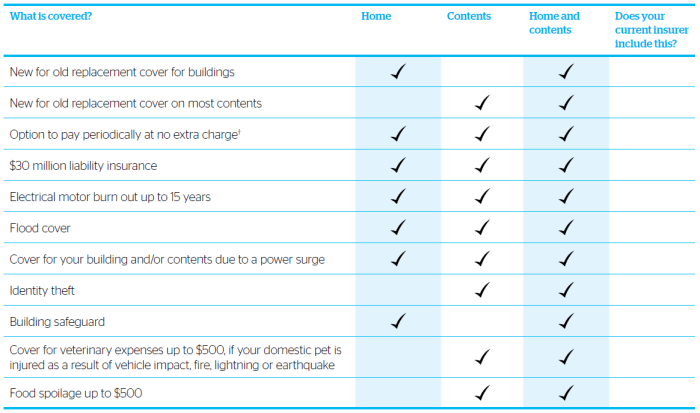

Common Coverage Options

Home insurance policies typically include several common coverage options. Dwelling coverage protects the physical structure of your home, while personal property coverage protects your belongings inside. Liability coverage protects you financially if someone is injured on your property. Additional living expenses coverage can help cover temporary housing costs if your home becomes uninhabitable due to a covered event. Some policies also include optional coverage for things like flood damage (often requiring separate flood insurance) or specific high-value items.

Coverage Level Comparison

| Coverage Level | Dwelling Coverage | Personal Property Coverage | Liability Coverage |

|---|---|---|---|

| Basic | $150,000 | $75,000 | $100,000 |

| Standard | $250,000 | $125,000 | $300,000 |

| Comprehensive | $500,000 | $250,000 | $500,000 |

| Premium | $750,000 | $375,000 | $1,000,000 |

Comparing Home Insurance Quotes from Different Providers

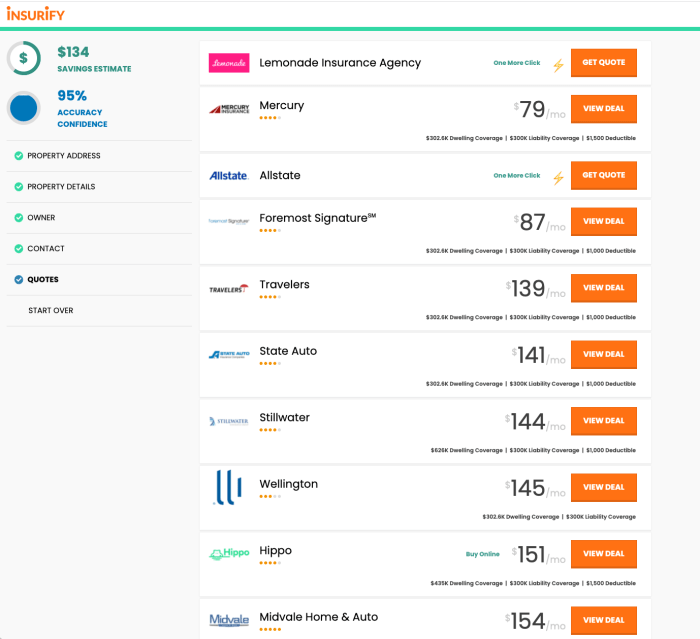

Choosing the right home insurance can feel overwhelming, especially when faced with numerous providers and varying coverage options. Effectively comparing quotes is crucial to securing the best protection at a competitive price. This section will guide you through the process of comparing quotes from different insurers, highlighting key differences and providing strategies for a side-by-side comparison.

Comparing quotes from at least three major insurance providers allows for a comprehensive understanding of market pricing and coverage variations. Let’s consider hypothetical examples from three fictional, but representative, providers: SafeHaven Insurance, SecureHome Insurers, and Guardian Shield. These examples will illustrate common differences found in real-world comparisons.

Key Differences in Coverage and Pricing

Coverage and pricing significantly vary among providers. SafeHaven Insurance, for instance, might offer broader coverage for specific perils like flooding or earthquakes, but at a higher premium. SecureHome Insurers may offer competitive pricing with standard coverage, while Guardian Shield might focus on customizable plans allowing for a balance between coverage and cost. These differences reflect each provider’s risk assessment models and target market. Factors such as your location, home features (age, construction materials), and coverage limits all play a role in determining your final premium.

Strategies for Effectively Comparing Quotes Side-by-Side

Direct comparison of quotes requires careful attention to detail. Begin by ensuring all quotes cover the same dwelling value, personal property, and liability limits. Look beyond the total premium and analyze the cost per coverage component. Note any exclusions or limitations in coverage. For example, some providers might exclude certain types of water damage or have higher deductibles for specific claims. Finally, consider each provider’s reputation for claims processing speed and customer service, which can significantly impact your experience should you need to file a claim.

Visual Comparison of Home Insurance Quotes

A well-organized table is essential for effectively comparing quotes. The table below illustrates a structured approach to comparing key features from SafeHaven Insurance, SecureHome Insurers, and Guardian Shield. Remember that these are hypothetical examples and actual quotes will vary based on individual circumstances.

| Feature | SafeHaven Insurance | SecureHome Insurers | Guardian Shield |

|---|---|---|---|

| Annual Premium | $1500 | $1200 | $1350 |

| Dwelling Coverage | $500,000 | $500,000 | $500,000 |

| Personal Property Coverage | $250,000 | $200,000 | $225,000 |

| Liability Coverage | $300,000 | $250,000 | $300,000 |

| Deductible | $1000 | $500 | $750 |

| Flood Coverage (Included?) | Yes | No (Additional Cost) | No (Additional Cost) |

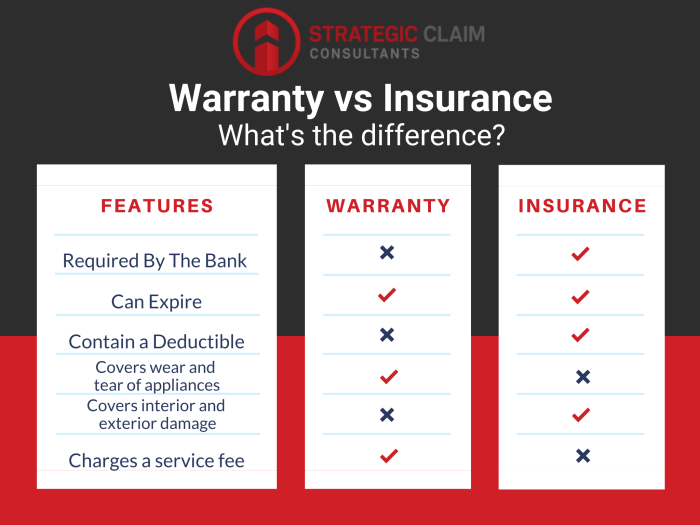

Understanding Policy Details and Fine Print

Securing the best home insurance quote is only half the battle. Understanding the fine print of your chosen policy is crucial to ensuring you’re adequately protected. Failing to thoroughly review your policy documents could leave you vulnerable to unexpected costs and insufficient coverage in the event of a claim.

Policy documents, while often dense and complex, contain vital information about your coverage, exclusions, and limitations. A careful review allows you to identify potential gaps in protection and understand the specific terms and conditions that govern your insurance. This proactive approach empowers you to make informed decisions and avoid unpleasant surprises down the line.

Common Exclusions and Limitations

Home insurance policies rarely cover everything. Many policies contain exclusions, which are specific events or circumstances that are explicitly not covered. Limitations, on the other hand, restrict the amount or type of coverage provided. Understanding these exclusions and limitations is essential to avoid disappointment during a claim.

Common exclusions often include damage caused by floods, earthquakes, or acts of war. Policies may also exclude certain types of property, such as valuable jewelry or collectibles, unless specifically scheduled and insured separately. Limitations may include caps on the amount of coverage for specific types of losses, such as liability claims or additional living expenses following a covered event. For instance, a policy might only cover a certain percentage of the rebuilding cost of your home, or have a limit on the amount it will pay for temporary accommodation after a fire.

Examples of Clauses Impacting Coverage

Several clauses within a policy can significantly affect your coverage. These clauses often dictate how claims are handled, what evidence is required, and the process for settling disputes.

One common clause is the “deductible,” which is the amount you must pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium, but you’ll bear more of the cost in the event of a claim. Another important clause relates to the “actual cash value” versus “replacement cost” coverage. Actual cash value considers depreciation, meaning you’ll receive less for damaged items than their current replacement cost. Replacement cost coverage, on the other hand, pays for the full cost of replacing damaged items without considering depreciation. Finally, clauses regarding the duty to mitigate losses emphasize the insured’s responsibility to take reasonable steps to minimize damage and expenses after an incident.

Important Policy Terms and Conditions

The following table summarizes some key terms and conditions you should carefully review in your home insurance policy:

| Term | Description | Impact on Coverage | Example |

|---|---|---|---|

| Deductible | Amount you pay before insurance coverage begins. | Higher deductible = lower premium, but higher out-of-pocket cost in case of a claim. | $500 deductible |

| Coverage Limits | Maximum amount the insurer will pay for a covered loss. | Limits the financial protection you receive. | $500,000 dwelling coverage |

| Actual Cash Value (ACV) | Coverage based on the item’s current value minus depreciation. | Results in lower payouts for damaged or lost items. | ACV for a 10-year-old sofa will be lower than its replacement cost. |

| Replacement Cost | Coverage that pays the full cost of replacing damaged or lost items without considering depreciation. | Provides greater financial protection but may result in higher premiums. | Replacement cost for a damaged roof will cover the full cost of a new roof. |

Illustrating the Impact of Deductibles on Premiums

Understanding the relationship between your deductible and your home insurance premium is crucial for finding the right balance between cost and risk. A higher deductible generally leads to a lower premium, while a lower deductible results in a higher premium. This is because the insurance company’s financial responsibility is reduced when you choose a higher deductible; you’re agreeing to cover a larger portion of any potential claim yourself.

The core principle is simple: you pay less upfront (lower premium) if you’re willing to absorb more of the cost in the event of a claim. Conversely, a lower upfront cost (lower deductible) means a higher premium because the insurer bears more risk.

Deductible and Premium Relationship Examples

Let’s consider three scenarios for a hypothetical homeowner, Sarah, seeking home insurance coverage of $300,000. These examples illustrate how different deductibles affect both her monthly premium and her out-of-pocket expenses in the event of a claim.

| Deductible | Estimated Monthly Premium | Out-of-Pocket Cost (Example: $10,000 Claim) | Out-of-Pocket Cost (Example: $50,000 Claim) |

|---|---|---|---|

| $500 | $150 | $500 | $500 |

| $1,000 | $125 | $1,000 | $1,000 |

| $2,500 | $100 | $2,500 | $2,500 |

Note that these are hypothetical examples. Actual premiums will vary depending on several factors including location, coverage, and the insurer.

Illustrative Financial Implications

Choosing a higher deductible, such as $2,500, significantly lowers Sarah’s monthly premium by $50 compared to a $500 deductible. However, if a $10,000 claim arises, she’ll pay $2,500 out-of-pocket versus $500 with the lower deductible. The financial implication depends on her risk tolerance and financial capacity to absorb a larger upfront cost in the event of a claim. A higher deductible is generally a good choice for individuals who can comfortably handle a larger potential out-of-pocket expense and prioritize lower premiums.

Visual Representation of Deductible and Premium Relationship

Imagine a graph with the x-axis representing the deductible amount (increasing from left to right) and the y-axis representing the monthly premium (decreasing from top to bottom). The line representing the relationship would slope downwards from left to right. A steep slope would indicate a significant premium reduction for a relatively small increase in the deductible, while a gentler slope suggests a smaller premium reduction for the same deductible increase. This visual representation clearly shows the inverse relationship: as the deductible increases, the premium decreases, and vice versa. The specific shape of the curve will vary depending on the insurance provider and other factors.

Final Conclusion

Ultimately, comparing home insurance quotes is not merely about finding the cheapest option; it’s about finding the policy that offers the most comprehensive coverage at a price you can comfortably afford. By understanding the factors that influence premiums, utilizing online comparison tools effectively, and carefully reviewing policy documents, you can confidently secure the best home insurance protection for your family and your property. Remember, a little research can save you significant money and peace of mind in the long run.

FAQ Resource

What is the difference between actual cash value (ACV) and replacement cost coverage?

ACV covers the replacement cost minus depreciation, while replacement cost covers the full cost of replacing damaged property without considering depreciation.

How often should I review my home insurance policy?

It’s recommended to review your policy annually, or whenever there are significant changes to your property or risk profile.

Can I bundle my home and auto insurance for a discount?

Yes, many insurers offer discounts for bundling home and auto insurance policies.

What information do I need to get a home insurance quote?

Typically, you’ll need your address, property details (size, age, materials), and information about your coverage needs.