Securing affordable and comprehensive home insurance is a crucial step in protecting your most valuable asset. The rise of online quote systems has revolutionized this process, offering convenience and transparency previously unavailable. This guide delves into the world of obtaining home insurance quotes online, exploring the factors influencing premium calculations, the technology behind instant quotes, and strategies for optimizing your online experience.

We’ll examine the user experience across different platforms, highlighting best practices and areas for improvement. Understanding how location, property type, and coverage choices impact your quote is essential for making informed decisions. We will also explore the technological underpinnings of online quote generation, including the role of AI and machine learning, and discuss ways to enhance the overall user experience for a smoother, more efficient process.

Analyzing Competitor Websites Offering Online Quotes

Understanding the strengths and weaknesses of competitor websites offering online home insurance quotes is crucial for optimizing our own platform. By analyzing their user interfaces, form design, and overall user experience, we can identify best practices and areas for improvement. This analysis will inform the development of a more efficient and user-friendly quote system.

This section examines the online quote systems of three major home insurance providers – Let’s call them Provider A, Provider B, and Provider C – to illustrate key design elements and user experience considerations.

Comparison of User Interfaces

Provider A’s website features a clean, minimalist design. The quote form is prominently displayed, and navigation is intuitive. Provider B employs a more visually busy interface, with numerous images and promotional banners. While visually engaging, this could potentially distract users from the core task of obtaining a quote. Provider C uses a straightforward, somewhat dated design, lacking the visual appeal of the other two. The quote form itself is functional but lacks modern design elements.

Best Practices in Online Quote Form Design and User Experience

Effective online quote forms prioritize simplicity and clarity. They employ clear and concise language, avoiding jargon. Progress indicators are vital, providing users with a sense of how far they’ve progressed in the process. Provider A’s use of progress bars is a good example of this best practice. Furthermore, forms should be mobile-responsive, ensuring a seamless experience across all devices. The use of auto-fill functionality for frequently used fields significantly reduces user effort and improves completion rates. Provider B’s incorporation of auto-fill is a positive feature, though it’s somewhat overshadowed by the cluttered design. Error handling is another critical aspect. Clear and helpful error messages guide users towards correcting mistakes, preventing frustration and abandonment. Provider C, while functional, lacks detailed error messages, potentially leading to user confusion.

Examples of Effective and Ineffective Website Features

Several features significantly impact the user experience in obtaining online home insurance quotes. The following examples highlight both effective and ineffective approaches observed in our competitor analysis.

| Feature | Effective Example (Provider A or B) | Ineffective Example (Provider C) |

|---|---|---|

| Progress Indicators | Provider A uses a clear progress bar showing the user’s progress through the quote form. | Provider C lacks any visual indication of progress, leaving users uncertain about how much further they need to go. |

| Auto-fill Functionality | Provider B uses auto-fill to pre-populate fields with previously entered information, speeding up the process. | Provider C lacks auto-fill, requiring users to manually enter all information. |

| Error Handling | Provider A provides clear and concise error messages, guiding users towards correcting mistakes. | Provider C’s error messages are generic and unhelpful, potentially frustrating users. |

| Mobile Responsiveness | Both Provider A and B have mobile-responsive websites, ensuring a consistent experience across devices. | Provider C’s website is not fully optimized for mobile devices, leading to a poor user experience on smaller screens. |

Improving the Online Quote Experience

A streamlined and user-friendly online quote process is crucial for converting website visitors into customers. By focusing on clarity, efficiency, and engaging features, we can significantly improve the overall experience and boost conversion rates. This involves careful consideration of the user flow, the inclusion of helpful features, and the implementation of effective communication strategies.

Optimizing the online quote process requires a multi-faceted approach, encompassing design, functionality, and communication. A well-designed user flow guides users seamlessly through each step, while helpful features enhance engagement and provide valuable information. Open and transparent communication builds trust and addresses potential concerns, leading to higher conversion rates.

Improved User Flow for Online Quotes

A clear and efficient user flow is paramount for a positive user experience. The process should be intuitive and straightforward, minimizing the number of steps and avoiding unnecessary complexities. This can be achieved through a well-structured interface, clear instructions, and progress indicators.

For example, a streamlined flow might begin with a concise introductory screen outlining the process. Next, a simple form would collect essential information, perhaps using auto-fill features for faster input. Progressive disclosure can be employed, presenting only necessary information at each stage. A progress bar visually indicates the user’s journey through the process. Finally, a clear summary screen displays the quote details before submission, allowing for final review and corrections. Error handling should be intuitive, providing clear explanations and guidance on how to correct mistakes.

Features Enhancing User Engagement and Conversion

Adding features that enhance user engagement and provide value beyond the quote itself can significantly improve conversion rates. These features should be carefully chosen to align with user needs and preferences.

- Interactive Map: Allows users to easily input their address and potentially view coverage areas.

- Personalized Recommendations: Based on user input, suggest appropriate coverage levels and add-ons.

- Instant Chat Support: Provides immediate assistance to answer questions and address concerns.

- Comparison Tool: Allows users to compare different coverage options side-by-side.

- Customer Reviews and Testimonials: Builds trust and social proof by showcasing positive experiences.

Effective Communication Strategies for Building Trust

Transparent and reassuring communication is essential for building trust and addressing user concerns during the quote process. This can be achieved through clear and concise language, proactive communication, and readily available support.

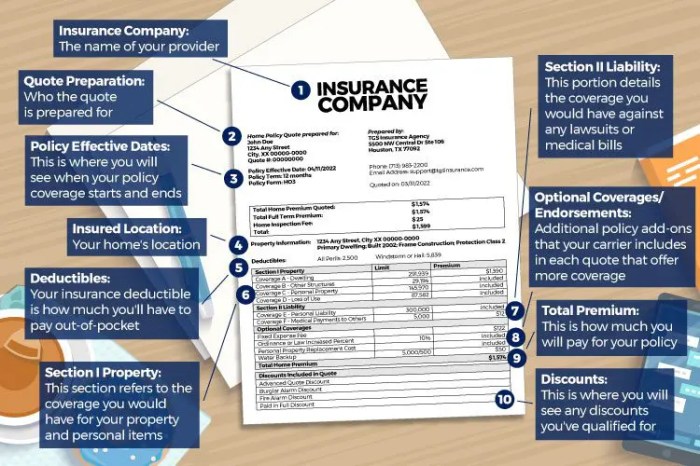

For instance, clearly explaining the terminology used, providing FAQs, and using visuals to illustrate complex concepts can significantly enhance understanding. Proactively addressing potential concerns, such as data privacy, can build trust. Offering multiple channels for support, including email, phone, and chat, ensures users can easily reach out with questions. Displaying security badges and certifications can further reassure users about data security.

Ending Remarks

Obtaining a home insurance quote online empowers you with control and transparency. By understanding the factors influencing premiums, navigating online platforms effectively, and leveraging available resources, you can secure the best coverage at a competitive price. Remember to compare quotes from multiple providers, carefully review coverage options, and don’t hesitate to ask questions to ensure you have the right protection for your home and family. This process, while initially daunting, becomes significantly easier with the right information and guidance.

FAQ

What information will I need to get an online home insurance quote?

Typically, you’ll need your address, property details (size, age, construction type), desired coverage amounts, and details about your current homeowners insurance (if applicable).

Are online home insurance quotes binding?

No, online quotes are generally not binding. They provide an estimate based on the information you provide. The final premium may vary slightly after a full application review.

Can I get a quote without providing my Social Security Number (SSN)?

You may be able to get a preliminary quote without your SSN, but you’ll need to provide it to finalize the application and purchase a policy.

How long does it take to get an online home insurance quote?

Most online quote systems provide instant or near-instant quotes. The exact time depends on the complexity of your property and the insurer’s system.

What if I have questions during the online quote process?

Most insurers offer live chat, email, or phone support to answer questions and assist you during the quote process.