Securing your home is a significant investment, and understanding the nuances of home insurance price is crucial. This guide delves into the multifaceted factors influencing your premiums, empowering you to make informed decisions and potentially save money. We’ll explore everything from location and home features to coverage types and comparison strategies, ensuring you have the knowledge to navigate the complexities of home insurance.

From identifying key factors affecting your home insurance price to effectively comparing quotes and implementing cost-saving strategies, this guide provides a structured approach to securing affordable and comprehensive coverage. We will demystify the process, offering actionable insights and clear explanations to help you confidently protect your most valuable asset.

Factors Influencing Home Insurance Costs

Understanding the factors that determine your home insurance premium is crucial for securing the best coverage at a reasonable price. Several interconnected elements contribute to the final cost, ranging from the inherent risks associated with your property to your personal choices and the broader economic climate. This information will help you understand how these factors interact and influence your insurance costs.

Key Factors Affecting Home Insurance Premiums

Several key factors significantly impact your home insurance premiums. The following table provides a detailed breakdown:

| Factor | Explanation | Impact on Price | Examples |

|---|---|---|---|

| Location | Your home’s location plays a significant role, as areas prone to natural disasters (hurricanes, earthquakes, wildfires) or high crime rates command higher premiums. | High | A coastal home in a hurricane-prone zone vs. a home in a rural, low-crime area. |

| Home Value | The higher the value of your home, the more it costs to insure. This is because the insurer’s potential payout in case of damage is greater. | High | A $500,000 home vs. a $200,000 home. |

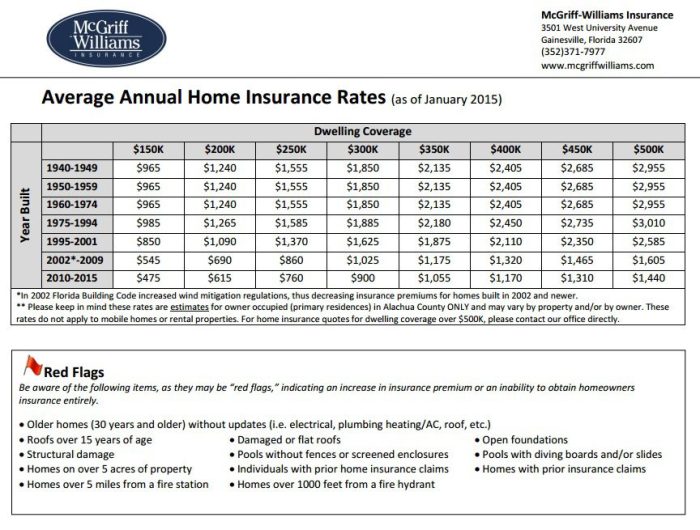

| Home Age and Condition | Older homes, especially those lacking modern safety features, are generally more expensive to insure due to increased risk of damage or obsolescence. Poor maintenance further increases risk. | Medium | A well-maintained 10-year-old home vs. an older home with outdated plumbing and electrical systems. |

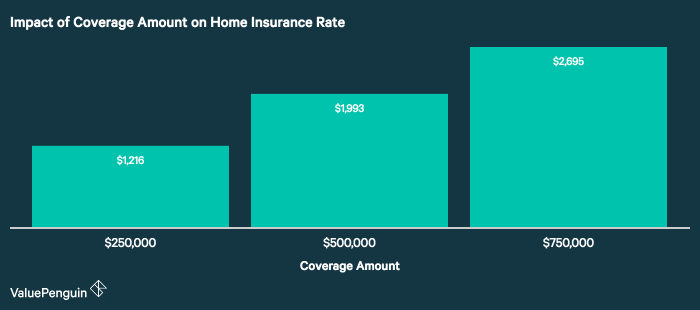

| Coverage Amount | The amount of coverage you choose (e.g., dwelling coverage, personal property coverage, liability coverage) directly affects your premium. More coverage equals higher costs. | High | Choosing a higher deductible will lower your premium but increases your out-of-pocket expenses in case of a claim. |

| Deductible | The amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums. | Medium | A $1,000 deductible vs. a $5,000 deductible. |

| Credit Score | In many states, insurers consider your credit score as an indicator of risk. A higher credit score typically translates to lower premiums. | Medium | A credit score of 750 vs. a credit score of 600. |

| Security Systems | Homes equipped with security systems (alarm systems, fire alarms, smoke detectors) are often considered lower risk and may qualify for discounts. | Low | A home with a monitored security system vs. a home without one. |

| Building Materials | Homes constructed with fire-resistant materials (brick, stone) may receive lower premiums compared to those built with more flammable materials (wood). | Low | A brick home vs. a wood-frame home. |

The Role of Location in Determining Insurance Prices

Location is a paramount factor in determining home insurance costs. High-risk areas, characterized by frequent natural disasters, high crime rates, or other hazards, will generally have significantly higher premiums than low-risk areas. For example, a home located in a flood plain will have a higher premium than a home situated on higher ground. Similarly, a home in a neighborhood with a high incidence of burglaries will likely cost more to insure than a home in a safer neighborhood. Conversely, a home in a rural area with a low crime rate and minimal risk of natural disasters will typically have lower premiums. The insurer’s assessment of the likelihood of claims in a specific area directly impacts the premium charged.

Impact of Home Features on Insurance Costs

Home features significantly influence insurance premiums. Security systems, as mentioned earlier, can lead to discounts. The age of the home is also crucial; older homes may require more maintenance and be more susceptible to damage, resulting in higher premiums. Building materials play a role in determining fire risk and potential damage costs. For instance, homes constructed with fire-resistant materials like brick or stone are generally considered less risky and may command lower premiums than wood-framed homes. Regular maintenance and upgrades to your home’s systems (plumbing, electrical, roofing) can also positively impact your insurance costs by demonstrating a lower risk profile.

Understanding Your Policy

Understanding your home insurance policy is crucial for protecting your financial investment. A comprehensive understanding of its terms, conditions, and the claims process will ensure you’re adequately covered and prepared in the event of unforeseen circumstances. This section will clarify key aspects of a standard home insurance policy.

Common Policy Terms and Conditions

It’s vital to familiarize yourself with the terminology used in your home insurance policy. Common terms often include definitions of covered perils, exclusions, deductibles, and policy limits. Understanding these terms allows for a clear comprehension of your coverage.

- Covered Perils: These are the specific events (e.g., fire, windstorm, theft) that your insurance policy agrees to cover. Policies vary, so carefully review your policy’s list of covered perils.

- Exclusions: These are events or situations that are specifically NOT covered by your policy. Common exclusions might include flood damage (often requiring separate flood insurance), earthquakes (similarly requiring separate coverage), or intentional acts of the policyholder.

- Deductible: This is the amount of money you must pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums.

- Policy Limits: This represents the maximum amount your insurance company will pay for a covered claim. It’s essential to ensure your policy limits are sufficient to rebuild or repair your home and replace your belongings.

- Liability Coverage: This part of your policy protects you if someone is injured on your property or if you accidentally damage someone else’s property. Liability coverage limits are typically expressed in monetary amounts.

The Claims Process

Filing a claim can be stressful, but understanding the process can help alleviate some anxiety. The steps generally follow a consistent pattern, from initial reporting to final settlement.

A flowchart illustrating the claims process:

Step 1: Incident Occurs. (e.g., fire, theft, water damage)

Step 2: Secure the Property. Take steps to prevent further damage and document the incident with photos and videos if possible.

Step 3: Contact Your Insurance Company. Report the claim as soon as reasonably possible, following the instructions in your policy.

Step 4: Claim Investigation. The insurance company will investigate the claim to verify the details and assess the damage.

Step 5: Damage Assessment. An adjuster will likely visit your property to assess the extent of the damage.

Step 6: Claim Settlement. Once the assessment is complete, the insurance company will determine the amount they will pay based on your policy and the damage assessment.

Step 7: Payment Received. The agreed-upon amount, less your deductible, will be paid to you, either directly or to contractors for repairs.

Regular Policy Review and Updates

Regularly reviewing and updating your home insurance policy is essential to maintain adequate coverage. Your needs and circumstances change over time—renovations, additions, increased property values, or even changes in your personal belongings.

For example, if you significantly renovate your home, increasing its value, you’ll need to update your coverage to reflect the increased rebuild cost. Similarly, if you acquire valuable items, you might need to increase your personal property coverage to ensure they are adequately protected. Failure to do so could result in underinsurance in the event of a claim.

Final Thoughts

Ultimately, understanding home insurance price is about more than just finding the cheapest policy; it’s about securing the right coverage at a price that fits your budget. By carefully considering the factors Artikeld in this guide, actively comparing quotes, and implementing cost-saving strategies, you can confidently navigate the insurance market and protect your home with peace of mind. Remember, regular review of your policy is key to ensuring ongoing adequate protection.

Key Questions Answered

What is the impact of my credit score on my home insurance price?

Many insurers consider your credit score when determining your premiums. A higher credit score often translates to lower premiums, reflecting a perceived lower risk.

How often should I review my home insurance policy?

It’s recommended to review your policy annually, or whenever there’s a significant change in your home’s value, risk profile, or your personal circumstances.

Can I get home insurance if I have a claim on my record?

Yes, but it might affect your premiums. Insurers will assess the nature and severity of the claim when determining your risk profile.

What is the difference between actual cash value and replacement cost coverage?

Actual cash value (ACV) covers the replacement cost minus depreciation, while replacement cost covers the full cost of replacing damaged items, regardless of depreciation.