Securing your home is a significant investment, and understanding home insurance policy quotes is crucial to protecting that investment. Navigating the complexities of insurance can feel overwhelming, but with a clear understanding of the key components, factors, and considerations, you can confidently choose a policy that aligns with your needs and budget. This guide provides a straightforward approach to demystifying home insurance quotes, empowering you to make informed decisions.

From exploring the various coverage options available to comparing quotes from different providers, we’ll break down the process step-by-step. We’ll examine the critical factors influencing premium costs, such as location, home value, and coverage levels, and highlight the importance of carefully reviewing policy exclusions and limitations. By the end, you’ll possess the knowledge to confidently select a home insurance policy that offers the right balance of protection and affordability.

Understanding Home Insurance Policy Quotes

Obtaining a home insurance quote is a crucial first step in protecting your most valuable asset. Understanding the intricacies of these quotes empowers you to make informed decisions and secure the best coverage for your needs. This section will break down the key components of a typical quote, highlighting the factors influencing price variations and the coverage options available.

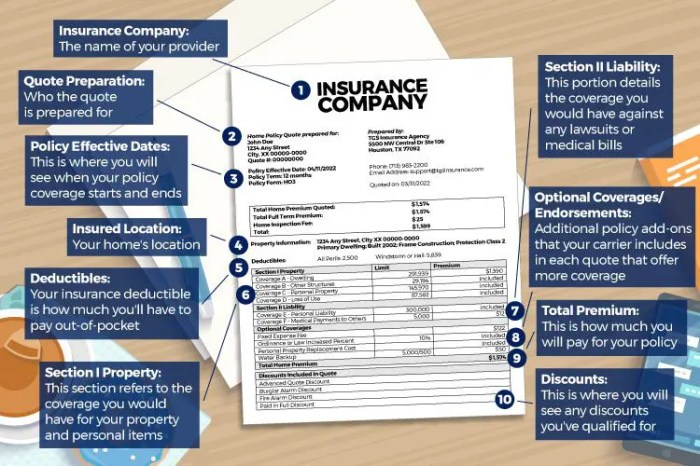

Components of a Home Insurance Quote

A home insurance quote typically includes several key components. Firstly, the estimated cost of your premium, which is the amount you’ll pay periodically (monthly, annually, etc.) for your coverage. Secondly, the quote details the coverage limits for various perils, specifying the maximum amount the insurer will pay for specific types of losses (e.g., fire damage, theft). Thirdly, the quote Artikels any deductibles you’ll be responsible for in the event of a claim. Finally, it will clearly state the policy’s effective dates and any specific exclusions or limitations. For example, flood damage might be excluded unless you purchase a separate flood insurance policy.

Factors Influencing Quote Variations

Several factors contribute to the differences in home insurance quotes from various providers. Your home’s location plays a significant role; properties in high-risk areas (prone to natural disasters or crime) will generally command higher premiums. The age and condition of your home, including its construction materials and the presence of safety features (e.g., smoke detectors, security systems), also impact the quote. Your credit score can influence your premium, as insurers often use this as an indicator of risk. The coverage amount you select – higher coverage generally means a higher premium – also affects the final quote. Finally, the insurer’s own risk assessment models and profit margins will also contribute to variations. For instance, a company specializing in high-risk areas might offer higher premiums than one focused on lower-risk areas, even for similar properties.

Common Coverage Options

Home insurance quotes typically include several common coverage options. Dwelling coverage protects the physical structure of your home against damage from covered perils. Liability coverage protects you financially if someone is injured on your property or you cause damage to someone else’s property. Personal property coverage protects your belongings inside and outside your home. Additional living expenses coverage helps cover temporary housing and living costs if your home becomes uninhabitable due to a covered event. These are the basic elements, and many policies offer optional add-ons such as coverage for specific valuable items (jewelry, artwork) or specialized endorsements for specific risks (water backup).

Comparison of Key Policy Features

The table below compares key features of different policy types. Remember that specific coverage details will vary based on the insurer and your individual circumstances.

| Policy Type | Coverage Level | Premium Cost (Example) | Deductible Options |

|---|---|---|---|

| Basic | Covers fundamental perils (fire, theft, etc.) | $500/year | $500, $1000 |

| Comprehensive | Covers a broader range of perils, including some additional hazards | $800/year | $500, $1000, $2500 |

| Luxury Home | High coverage limits tailored to high-value properties | $1200/year | $1000, $2500, $5000 |

| Condo | Covers personal belongings and structural elements within the condo owner’s responsibility | $300/year | $250, $500 |

Understanding Policy Exclusions and Limitations

Home insurance policies, while designed to protect your property and belongings, do not cover every conceivable event. Understanding the exclusions and limitations within your policy is crucial to avoid disappointment during a claim. Knowing what isn’t covered allows you to make informed decisions about additional coverage or risk mitigation.

It’s important to remember that insurance policies are contracts, and the terms and conditions, including exclusions, are legally binding. Failing to understand these limitations can lead to a denied claim, even in seemingly straightforward situations. Therefore, carefully reviewing your policy documents is paramount.

Common Policy Exclusions

Standard home insurance policies typically exclude coverage for a range of events and circumstances. These exclusions are often based on the inherent risks associated with certain events or the difficulty in assessing liability. The specific exclusions can vary between insurers and policy types, so always refer to your individual policy wording.

Circumstances Leading to Denied or Limited Coverage

Coverage might be denied or limited if the damage or loss falls under a specific exclusion listed in your policy. For instance, damage caused by gradual wear and tear, normal deterioration, or lack of maintenance is generally not covered. Similarly, intentional acts, such as self-inflicted damage, are excluded. Claims related to events you could have reasonably prevented through proper maintenance or precaution might also be denied or partially covered. The insurer will investigate the circumstances surrounding the claim to determine if the cause of loss falls within the policy’s coverage parameters.

Examples of Rejected Claims Due to Exclusions

Consider these scenarios: a homeowner fails to maintain their roof, leading to water damage during a storm. The insurer might deny the claim if the damage was a direct result of the pre-existing, neglected condition. Another example: a homeowner intentionally damages their property in a fit of anger; this act is explicitly excluded from coverage. Finally, flood damage in a flood-prone area might be excluded unless specific flood insurance is added to the policy. In each case, the exclusion clause in the policy would justify the denial.

Typical Exclusions and Their Implications

It is vital to understand the implications of these common exclusions:

- Acts of God (excluding specific named perils): Earthquakes, landslides, and volcanic eruptions are often excluded unless explicitly covered by endorsements. This means that damage from these events would not be compensated.

- Normal Wear and Tear: Gradual deterioration of materials over time is not covered. This includes things like fading paint or cracked flooring due to age. Regular maintenance is crucial to prevent these issues from escalating into larger, uncovered problems.

- Intentional Damage: Damage caused deliberately by the policyholder or someone they are responsible for is excluded. This applies to vandalism committed by a family member, for example.

- Neglect or Lack of Maintenance: Failure to maintain the property can lead to claim denials if the damage is a direct result of this neglect. For instance, a leaking roof ignored for months leading to extensive water damage is unlikely to be covered.

- Pest Infestation: Damage caused by insects or rodents is typically excluded unless the damage is a direct result of a covered peril (like a sudden roof collapse allowing entry). Regular pest control is recommended.

Choosing the Right Policy

Selecting the right home insurance policy is crucial for protecting your most valuable asset. The process involves careful consideration of your individual needs, budget, and an understanding of the policy’s terms and conditions. Failing to do so could leave you vulnerable to significant financial losses in the event of an unforeseen incident.

Finding the right balance between adequate coverage and affordability requires a systematic approach. This involves evaluating various policy options, comparing quotes, and understanding the implications of different coverage levels. Remember, the cheapest policy isn’t always the best if it leaves you underinsured.

Policy Term and Condition Understanding

Understanding the terms and conditions of your home insurance policy is paramount. This includes comprehending the specifics of your coverage, such as what perils are covered and any exclusions. For example, some policies might exclude flood damage, requiring separate flood insurance. Carefully reviewing the policy document, or seeking clarification from your insurer, will prevent unexpected surprises if a claim arises. Paying close attention to the definition of key terms, such as “actual cash value” versus “replacement cost,” is essential for ensuring you receive the appropriate compensation in the event of a covered loss.

Determining Appropriate Coverage Levels

Determining the appropriate level of coverage involves assessing the value of your home and its contents. This includes the structure’s replacement cost, which may differ significantly from its market value. For contents coverage, consider the value of your belongings, factoring in potential depreciation. Underinsurance can lead to significant out-of-pocket expenses in the event of a claim. For example, if your home is valued at $500,000 but you only have $400,000 in coverage, you would be responsible for $100,000 of the repair or rebuilding costs after a covered loss. It is advisable to obtain a professional appraisal to accurately determine the replacement cost of your home and its contents. Furthermore, review your coverage periodically, especially after major purchases or renovations, to ensure it aligns with the current value of your assets.

Home Insurance Policy Evaluation Checklist

Before committing to a policy, use this checklist to compare options:

- Coverage Amounts: Compare dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage offered by different insurers.

- Deductibles: Understand the deductible amounts and how they impact your out-of-pocket expenses in case of a claim. Higher deductibles generally result in lower premiums.

- Premiums: Compare the annual premiums from different insurers, keeping in mind the level of coverage offered.

- Exclusions and Limitations: Carefully review the policy’s exclusions and limitations to understand what is not covered.

- Claims Process: Inquire about the insurer’s claims process, including how claims are filed and processed.

- Financial Stability of the Insurer: Research the financial stability of the insurer to ensure they can pay out claims when needed.

- Customer Service: Consider the insurer’s reputation for customer service and responsiveness.

Remember, choosing the right home insurance policy is a significant decision. Taking the time to understand your needs and carefully compare options will ensure you have the protection you need at a price you can afford.

Outcome Summary

Ultimately, obtaining the best home insurance policy quote involves a combination of diligent research, careful comparison, and a thorough understanding of your individual needs. By actively engaging with the process and asking pertinent questions, you can ensure that your home and belongings are adequately protected against unforeseen circumstances. Remember, a well-chosen policy provides peace of mind, knowing you’re financially secure in the face of potential risks. Take control of your home insurance and secure the future of your most valuable asset.

Essential FAQs

What is the difference between actual cash value (ACV) and replacement cost coverage?

ACV coverage pays for the current market value of your damaged property, minus depreciation. Replacement cost coverage pays for the cost of replacing your damaged property with new, similar items, without deducting for depreciation.

How often should I review my home insurance policy?

It’s recommended to review your policy annually, or whenever there’s a significant change in your life, such as a home improvement, purchase of valuable items, or a change in your risk profile.

Can I get a home insurance quote without providing my personal information?

While some online tools offer preliminary estimates, you’ll typically need to provide some personal and property information to receive a precise quote from an insurance provider.

What happens if I make a claim and my insurer denies it?

If your claim is denied, carefully review the policy terms and the reasons for denial. You may be able to appeal the decision or consult with an insurance professional to explore your options.