Securing your home is a significant investment, and understanding your home insurance policy quote is crucial. This guide delves into the intricacies of obtaining and interpreting home insurance quotes, empowering you to make informed decisions and find the best coverage for your needs. We’ll explore the factors influencing costs, the different types of coverage available, and the steps involved in securing the right policy.

From navigating the quoting process to understanding policy details and filing claims, we aim to demystify home insurance and equip you with the knowledge to confidently protect your most valuable asset. We’ll examine real-world examples and provide practical advice to help you navigate the complexities of home insurance with ease.

Understanding Home Insurance Policy Quotes

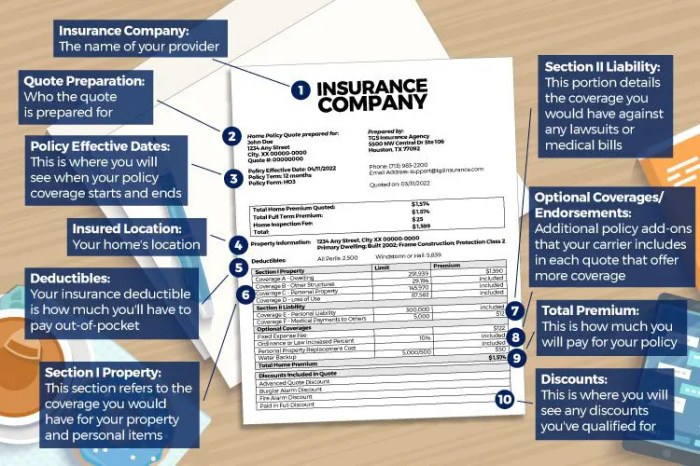

Receiving a home insurance quote can feel overwhelming, but understanding its components empowers you to make informed decisions. This section clarifies the key elements of a typical quote, factors influencing its cost, and how to compare different offers effectively.

Components of a Home Insurance Policy Quote

A home insurance quote typically includes several key components. These components provide a comprehensive overview of the coverage offered and the associated costs. The premium, deductibles, coverage limits, and exclusions are all critical elements to review. The policy’s effective date and duration are also usually specified. Finally, any applicable discounts or additional fees are usually clearly Artikeld.

Factors Influencing Home Insurance Costs

Numerous factors influence the cost of your home insurance. These factors are assessed by insurance companies to determine your risk profile. Location plays a significant role, as areas prone to natural disasters (earthquakes, hurricanes, wildfires) command higher premiums. The age and condition of your home, its construction materials, and the presence of security systems also impact costs. Your credit score can also influence the premium you’re offered, reflecting the insurer’s assessment of your risk. Finally, the amount of coverage you choose significantly affects your premium; higher coverage levels generally mean higher premiums.

Types of Home Insurance Coverage

Home insurance policies offer various types of coverage. Dwelling coverage protects the physical structure of your home. Liability coverage protects you financially if someone is injured on your property. Personal property coverage protects your belongings inside your home from damage or theft. Additional living expenses coverage covers temporary housing costs if your home becomes uninhabitable due to a covered event. Specific policies might also offer additional coverages, such as flood insurance (often purchased separately) or earthquake insurance.

Comparing Home Insurance Quotes

Comparing quotes from different insurance providers is crucial for securing the best coverage at the most competitive price. Factors to consider when comparing quotes include the coverage amounts, deductibles, and premiums offered by each provider. It’s essential to compare similar coverage levels across different quotes to ensure a fair comparison. Reviewing customer reviews and ratings can also provide valuable insights into the reliability and customer service of different insurers. Don’t just focus on the price; ensure the policy adequately protects your home and possessions.

Comparison of Three Home Insurance Quotes

Below is a table comparing three hypothetical home insurance quotes, highlighting key features and pricing. Remember, these are examples and actual quotes will vary based on individual circumstances and location.

| Insurance Provider | Annual Premium | Deductible | Dwelling Coverage |

|---|---|---|---|

| Company A | $1200 | $1000 | $300,000 |

| Company B | $1500 | $500 | $350,000 |

| Company C | $1100 | $1500 | $250,000 |

Factors Affecting Quote Prices

Several key factors influence the price you’ll pay for home insurance. Understanding these factors can help you make informed decisions and potentially secure more favorable rates. Insurers analyze a range of data points to assess risk and determine premiums, ultimately aiming to balance the cost of potential claims with the premiums they collect.

Location’s Impact on Home Insurance Costs

Your home’s location significantly impacts your insurance premium. Areas prone to natural disasters like hurricanes, earthquakes, wildfires, or floods will generally command higher premiums due to the increased risk of damage. Similarly, areas with high crime rates may also result in higher premiums as the risk of theft or vandalism increases. For example, a home in a coastal region susceptible to hurricanes will likely have a substantially higher premium than a similar home located inland in a less disaster-prone area. The insurer’s assessment of risk in your specific location is a major component of the quote calculation.

Home Characteristics and Premium Calculation

The age, size, and construction materials of your home are crucial factors in determining your insurance premium. Older homes, while often charming, may require more extensive maintenance and repairs, leading to higher premiums. Larger homes typically present a greater potential for damage and thus higher replacement costs. The type of construction materials also plays a role; homes built with fire-resistant materials, for example, might receive a lower premium than those built with more combustible materials. A 3000 square foot brick home built in 2020 will generally command a different premium than a 1500 square foot wood-frame home built in 1950, even if both are in the same location.

Security Features and Their Influence on Premiums

Security features significantly influence insurance premiums. Homes equipped with security systems, including alarms, smoke detectors, and fire sprinklers, are considered lower risk and may qualify for discounts. The presence of a security system actively monitored by a professional security company might result in a more substantial discount than a basic, self-monitored system. For instance, a home with a professionally monitored alarm system and fire sprinklers might receive a 10-15% discount compared to a similar home without these features. Insurers view these security measures as mitigating the risk of loss and therefore justify a lower premium.

Home Insurance Quote Calculation Process

The flowchart would visually represent the following steps:

1. Application Received: The insurer receives the homeowner’s application containing information about the property and the homeowner.

2. Risk Assessment: The insurer assesses the risk factors based on the information provided (location, home characteristics, security features, etc.).

3. Coverage Selection: The homeowner selects the desired coverage levels (dwelling, liability, personal property, etc.).

4. Premium Calculation: The insurer calculates the premium based on the assessed risk and selected coverage. This step involves applying various risk factors and discounts.

5. Quote Generation: The insurer generates a detailed quote outlining the coverage, premium, and other relevant details.

6. Policy Issuance: If the homeowner accepts the quote, the insurer issues the policy.

Navigating the Quoting Process

Obtaining a home insurance quote might seem daunting, but understanding the process can make it straightforward. This section details the steps involved, emphasizing the importance of accuracy and outlining various methods for obtaining quotes. We will also provide a structured approach to comparing quotes effectively.

The process of securing a home insurance quote involves several key steps, each contributing to the accuracy and relevance of the final price offered. Providing accurate information is paramount to receiving a quote that truly reflects your risk profile and needs. Inaccurate data can lead to insufficient coverage or even policy cancellation.

Methods for Obtaining Home Insurance Quotes

Home insurance quotes can be obtained through several convenient methods, each with its own advantages and disadvantages. Online quote tools offer speed and convenience, allowing for instant comparisons. Phone quotes provide personalized assistance from insurance agents, who can answer specific questions. In-person quotes, while requiring more time and effort, allow for detailed discussions and relationship building with local agents.

Step-by-Step Guide for Comparing Home Insurance Quotes

Comparing home insurance quotes requires a systematic approach to ensure a fair and accurate assessment. This involves organizing the information received, considering the coverage details, and evaluating the overall value provided by each policy.

- Gather Quotes: Obtain quotes from at least three different insurers using a mix of online, phone, and potentially in-person methods.

- Standardize Information: Ensure all quotes cover the same aspects, such as dwelling coverage, liability, and personal property.

- Compare Coverage Details: Carefully review the policy documents for each quote, paying close attention to deductibles, coverage limits, and exclusions.

- Analyze Premiums: Compare the total annual premiums for each policy, considering the level of coverage provided.

- Review Customer Reviews: Research the insurers’ reputation and customer service ratings before making a decision.

- Select the Best Policy: Choose the policy that offers the most comprehensive coverage at a price you can afford.

Essential Information for Accurate Quotes

Providing complete and accurate information is crucial for receiving a precise home insurance quote. Missing or inaccurate details can lead to significant discrepancies in the final premium, potentially leaving you underinsured.

- Property Address: The exact address of your home, including any relevant unit numbers.

- Property Details: Year built, square footage, number of bedrooms and bathrooms, type of construction (e.g., brick, wood), and any recent renovations or improvements.

- Coverage Needs: Desired coverage amounts for dwelling, personal property, liability, and other optional coverages (e.g., flood, earthquake).

- Claim History: Details of any previous insurance claims, including dates and amounts.

- Security Features: Presence of security systems (e.g., alarm systems, smoke detectors), and any other safety features.

- Occupancy Status: Whether the property is owner-occupied, rented, or vacant.

Illustrative Examples

Understanding home insurance can be challenging, but real-life scenarios help clarify the process. The following examples illustrate key aspects of home insurance, from filing claims to adjusting coverage based on life changes.

Homeowner Filing a Claim After a Burst Pipe

Imagine Sarah, a homeowner, wakes up to find her basement flooded due to a burst pipe. This is a covered peril under most standard home insurance policies. To file a claim, Sarah would contact her insurance company’s claims department, usually via phone or their online portal. The claims adjuster would then guide her through the process. This involves providing details about the incident, including date, time, and a description of the damage. Essential documentation includes photos and videos of the damage, receipts for any emergency repairs, and a copy of her insurance policy. The adjuster will likely inspect the property to assess the damage and determine the extent of the coverage. The insurance company will then process the claim and provide compensation based on the policy’s terms and the assessed damage. This compensation could cover repairs, replacement of damaged items, and potentially additional living expenses if Sarah needs to stay elsewhere during repairs.

Example Home Insurance Policy Quote

Let’s consider a sample quote for a 2,000 square foot home in a low-risk area with a market value of $350,000. The policy might include:

| Coverage | Amount |

|---|---|

| Dwelling Coverage | $300,000 |

| Other Structures | $50,000 |

| Personal Property | $150,000 |

| Liability Coverage | $300,000 |

| Medical Payments | $5,000 |

| Annual Premium | $1,200 |

This is a hypothetical example and actual quotes will vary based on several factors. Note that dwelling coverage protects the structure of the house, other structures cover detached buildings like garages, personal property covers belongings inside the home, and liability protects against lawsuits if someone is injured on the property.

Beneficial Additional Coverage: Flood Insurance

While many standard home insurance policies do not cover flood damage, it’s a significant risk in certain areas. Imagine John lives in a coastal region prone to flooding. A standard policy won’t cover flood damage to his home or belongings. Purchasing a separate flood insurance policy through the National Flood Insurance Program (NFIP) or a private insurer would be highly beneficial. This supplemental coverage would protect John’s financial investment in his home in case of a flood. The cost of flood insurance varies depending on location and risk level, but the peace of mind it provides can be invaluable.

Adjusting Policy After a Significant Life Event: Marriage and New Jewelry

After getting married, Sarah and her husband, Mark, acquire several valuable items, including a significant jewelry collection. Their existing home insurance policy’s personal property coverage may not adequately cover these new assets. To adjust their policy, they should contact their insurance provider and request an increase in their personal property coverage limit. They might need to provide appraisals or detailed descriptions and values of the new items to ensure adequate coverage. This ensures their valuables are protected in case of loss or damage. The premium will likely increase to reflect the higher coverage amount, but this is a small price to pay for the added protection.

End of Discussion

Ultimately, obtaining the right home insurance policy quote involves careful consideration of your individual needs, a thorough understanding of the coverage options, and a proactive approach to the quoting process. By utilizing the information and strategies Artikeld in this guide, you can confidently secure a policy that offers comprehensive protection at a competitive price, providing peace of mind and safeguarding your home for years to come. Remember, comparing quotes and understanding the fine print are key to making an informed decision.

Clarifying Questions

What is a deductible, and how does it affect my premium?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, while lower deductibles mean higher premiums.

How often should I review my home insurance policy?

It’s recommended to review your home insurance policy annually, or whenever there are significant life changes (e.g., renovations, additions, increased possessions).

Can I get a quote without providing my personal information?

While some online tools offer preliminary estimates, obtaining a full and accurate quote typically requires providing personal and property details to insurance providers.

What happens if I make a claim and my insurer denies it?

If your claim is denied, review your policy carefully and understand the reasons for denial. You may be able to appeal the decision or seek legal advice.