Securing your home is a significant financial decision, and understanding the process of obtaining a home insurance online quote is crucial. This guide delves into the world of online home insurance, exploring user motivations, competitive landscapes, influencing factors, and user experience best practices. We’ll demystify the process, empowering you to make informed choices and find the best coverage at the most competitive price.

From navigating the various online platforms to understanding the intricacies of premium calculations, we’ll equip you with the knowledge to confidently navigate the world of home insurance online quotes. We’ll examine the factors that influence your premium, highlight key features offered by leading providers, and discuss strategies for a smooth and efficient online quote experience.

Understanding “Home Insurance Online Quote” User Intent

Understanding the user intent behind searches for “home insurance online quote” is crucial for optimizing online presence and providing a relevant user experience. This phrase reveals a user actively seeking information about home insurance costs, indicating a potential need or desire for coverage. The search implies a preference for convenience and speed, suggesting a desire to obtain information quickly and without extensive interaction.

The motivations behind searching for “home insurance online quote” are multifaceted. Users might be at different stages in their homeownership journey, each with unique needs and priorities.

Motivations Behind Searching for Home Insurance Online Quotes

Users searching for online home insurance quotes are driven by a variety of factors. Some are proactively seeking coverage for a newly purchased home, others are comparing existing policies to find better rates, and some are simply researching their options. The need for a quick and convenient way to gather information is a common thread across all motivations. For instance, a first-time homebuyer might search to understand the costs involved before closing, while a long-term homeowner might seek to reduce their premiums by comparing quotes from different providers.

Stages of the Customer Journey

The customer journey for a user searching “home insurance online quote” can be broadly categorized into awareness, consideration, and decision stages. The awareness stage involves initial research and understanding of the need for insurance. The consideration stage focuses on comparing different options and providers, often involving multiple quote requests. Finally, the decision stage involves selecting a policy and completing the purchase. For example, a user might begin by researching basic coverage options (awareness), then compare quotes from various companies (consideration), and finally purchase a policy from their preferred provider (decision).

Key Demographics and Psychographics

The typical user searching for “home insurance online quote” is likely to be a homeowner or prospective homeowner, aged between 25 and 55. They are digitally savvy, comfortable using online tools, and value convenience and speed. They may be financially responsible and proactive in managing their assets. Psychographically, they are likely to be practical, detail-oriented, and price-conscious. For example, a young professional purchasing their first home would fit this profile, prioritizing both affordability and ease of access to information. An older homeowner might be driven by a need to compare rates and potentially save money on premiums.

User Persona: Sarah Miller

To illustrate a typical user, consider Sarah Miller, a 32-year-old marketing manager who recently purchased a condo. She is tech-savvy and values efficiency. She’s researching home insurance online to compare prices and coverage options before making a purchase. She’s looking for a policy that provides adequate coverage at a competitive price and offers a straightforward online application process. Her primary concern is finding reliable protection for her new asset without spending more than necessary. Sarah represents the typical user searching for an online home insurance quote: digitally fluent, price-conscious, and prioritizing ease of use.

Competitive Landscape Analysis of Online Quote Providers

The online home insurance market is fiercely competitive, with numerous providers vying for customers’ attention. Understanding the nuances of each provider’s offerings, pricing, and customer experience is crucial for consumers seeking the best value. This analysis compares three major players to highlight their strengths and weaknesses.

Comparison of Online Home Insurance Quote Providers

The following table compares three prominent online home insurance quote providers, focusing on key features, pricing models, and customer feedback. This information is based on publicly available data and should be considered a snapshot in time, as offerings and reviews can change.

| Provider Name | Key Features | Pricing Model | Customer Reviews Summary |

|---|---|---|---|

| Provider A (e.g., Lemonade) | AI-powered claims process, easy-to-use mobile app, customizable coverage options, transparent pricing. | Subscription-based model, potentially lower premiums for bundled services. | Generally positive reviews praising the app and quick claims process; some criticisms regarding limited coverage options in certain areas. |

| Provider B (e.g., Geico) | Wide range of coverage options, discounts for bundling with other insurance products, strong brand recognition, extensive agent network. | Competitive pricing based on risk assessment, potential for discounts based on driving history and other factors (if applicable). | Mixed reviews, with praise for competitive pricing and established reputation, but some complaints about customer service responsiveness. |

| Provider C (e.g., State Farm) | Hybrid model offering both online quoting and in-person agent support, diverse coverage options, strong financial stability. | Competitive pricing, potential for discounts based on various factors, including home security features. | Generally positive reviews highlighting the reliability and established reputation of the company; some comments about the online process being less streamlined than competitors. |

Marketing Strategies Employed by Online Quote Providers

Effective marketing is crucial in the competitive online insurance landscape. Providers utilize various strategies to attract and retain customers. For example, Provider A (Lemonade) leverages a strong social media presence and emphasizes its innovative AI-powered features. Provider B (Geico) relies on memorable advertising campaigns and brand recognition built over years of marketing. Provider C (State Farm) utilizes a multi-channel approach, combining digital marketing with traditional methods like television commercials and local agent networks.

Strengths and Weaknesses of Online Quote Processes

Each provider’s online quote process presents unique strengths and weaknesses. Provider A’s streamlined, app-based process is user-friendly but may lack the depth of coverage options found in Provider B or C. Provider B’s comprehensive online tools are often praised for their ease of use, but the vast amount of information can feel overwhelming to some users. Provider C’s hybrid model provides flexibility but may not offer the same level of speed and convenience as purely online providers. Ultimately, the best provider depends on individual customer needs and preferences.

Visual Representation of Data

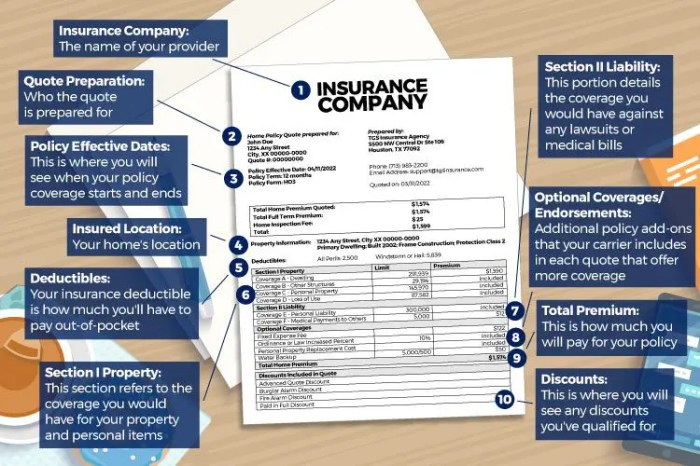

Effective communication of home insurance information is crucial for user understanding and engagement. Visual aids, such as charts and infographics, significantly enhance the clarity and memorability of complex data, making the quote process more transparent and user-friendly. This section explores the use of visual representations to convey key aspects of home insurance pricing and the online quoting process.

Bar Chart Comparing Average Premiums for Different Coverage Levels

The following bar chart illustrates the average premiums for three common coverage levels: Basic, Comprehensive, and Premium. The data is hypothetical, but representative of industry trends. Basic coverage typically includes only the minimum legal requirements, while comprehensive coverage provides broader protection against various risks. Premium coverage offers the most extensive protection, including high liability limits and additional benefits. The chart visually demonstrates the relationship between coverage level and premium cost, allowing users to quickly assess the value proposition of each option.

[Imagine a bar chart here. The horizontal axis would label “Coverage Level” with three bars: “Basic,” “Comprehensive,” and “Premium.” The vertical axis would represent “Average Premium” in dollars. The “Basic” bar would be the shortest, the “Comprehensive” bar would be taller, and the “Premium” bar would be the tallest, clearly showing the incremental cost with increased coverage. Numbers could be added to the top of each bar to represent the average premium cost (e.g., $500, $1000, $1500).]

Infographic Illustrating the Steps Involved in Getting a Home Insurance Quote Online

This infographic simplifies the online quote process, guiding users through each step with clear visuals and concise text.

[Imagine an infographic here. It would be a vertically oriented flow chart with numbered steps. Each step would include a relevant icon (e.g., a house for “Enter Address,” a magnifying glass for “Get Instant Quote,” a credit card for “Payment,” a checkmark for “Policy Confirmation”). The text for each step would be short and descriptive, such as:

1. Enter Address: Provide your home’s address for accurate risk assessment.

2. Answer Questions: Complete a short questionnaire about your property and coverage needs.

3. Get Instant Quote: Receive a personalized quote based on your input.

4. Review & Customize: Adjust coverage levels to match your preferences.

5. Purchase Policy: Secure your home insurance policy online with a secure payment method.

6. Policy Confirmation: Receive your policy documents via email.]

Importance of Using Visual Aids to Communicate Complex Information Effectively

Visual aids significantly improve the comprehension and retention of information, particularly when dealing with complex topics like insurance policies. Charts and infographics translate numerical data and procedural steps into easily digestible formats, reducing cognitive load and increasing user engagement. For example, a bar chart comparing premiums clearly shows the cost differences between coverage levels, allowing users to make informed decisions. Similarly, a step-by-step infographic simplifies the often-daunting process of obtaining an online quote, guiding users through each stage and minimizing potential confusion. This enhanced understanding fosters trust and confidence in the online quoting platform.

Last Word

Obtaining a home insurance online quote has become increasingly streamlined, offering convenience and transparency to homeowners. By understanding the factors influencing premiums, comparing providers effectively, and navigating user-friendly platforms, you can secure the right coverage at the right price. Remember to thoroughly review your policy details and contact providers with any questions to ensure complete understanding before making a final decision. This empowered approach to home insurance ensures peace of mind and financial protection for your most valuable asset.

FAQ Insights

What information do I need to get a home insurance online quote?

Typically, you’ll need your address, the value of your home, details about its construction, and information about any existing coverage.

How accurate are online home insurance quotes?

Online quotes provide estimates. The final premium may vary slightly after a full application review by the insurer.

Can I get coverage for specific items of high value?

Yes, many providers offer options to add coverage for valuable items like jewelry or artwork above standard limits.

What if I have a poor credit history?

Your credit history can affect your premium; it’s advisable to shop around and compare quotes from different providers.

What are the different types of home insurance coverage?

Common coverage types include dwelling coverage, liability coverage, and personal property coverage. Review policy details carefully to understand what each type covers.