Securing your North Carolina home with the right insurance policy is a crucial step in responsible homeownership. The North Carolina home insurance market presents a diverse range of options, each with its own complexities and considerations. Understanding the factors influencing premiums, comparing providers, and navigating state regulations are key to finding the best coverage at a competitive price. This guide will illuminate the path to securing optimal protection for your North Carolina property.

From exploring the nuances of different coverage types and the impact of location and home features on costs, to understanding the role of the North Carolina Department of Insurance and utilizing preventative measures to reduce premiums, we aim to provide a clear and comprehensive overview of the North Carolina home insurance landscape. We’ll delve into the process of obtaining quotes, comparing providers, and understanding your policy details, empowering you to make informed decisions about protecting your valuable asset.

Understanding North Carolina Home Insurance Market

The North Carolina home insurance market is a dynamic landscape shaped by various factors, impacting both the availability and cost of coverage for homeowners. Understanding these factors is crucial for securing adequate protection at a reasonable price. This section will explore key characteristics of the market, influential premium factors, coverage types, and common policy exclusions.

Key Features of the North Carolina Home Insurance Market

North Carolina’s home insurance market is characterized by a competitive landscape with numerous insurers offering a range of policies. However, the market also experiences fluctuations in pricing and availability due to factors such as catastrophic weather events and changes in regulatory environments. The state’s coastal regions, particularly vulnerable to hurricanes, often face higher premiums and stricter underwriting guidelines. Conversely, inland areas generally enjoy more favorable rates. The availability of insurance in certain high-risk areas can be limited, leading to challenges for some homeowners in obtaining coverage.

Factors Influencing Home Insurance Premiums in North Carolina

Several factors significantly influence the cost of home insurance in North Carolina. These include the location of the property (coastal areas generally command higher premiums due to hurricane risk), the age and condition of the home (older homes may require more extensive repairs and thus higher premiums), the coverage amount (higher coverage equals higher premiums), the deductible chosen (higher deductibles usually mean lower premiums), the homeowner’s credit score (a good credit score can often lead to lower premiums), and the presence of safety features (smoke detectors, security systems, etc., can sometimes result in discounts). Claims history also plays a vital role; a history of filed claims can increase future premiums. Finally, the type of home construction also influences premiums; homes built with fire-resistant materials may attract lower premiums.

Types of Home Insurance Coverage Available in North Carolina

Homeowners in North Carolina have access to several types of insurance coverage. The most common is the standard HO-3 policy, offering broad coverage for dwelling, other structures, personal property, and liability. HO-3 policies cover losses due to many perils, but often exclude specific events like floods or earthquakes. Separate flood insurance (often through the National Flood Insurance Program) and earthquake insurance are usually necessary for complete protection. Other available policies include HO-4 (renters insurance), HO-6 (condominium insurance), and specialized policies tailored to unique properties or risks. The specific coverage offered varies between insurers and policy types.

Common Exclusions Found in North Carolina Home Insurance Policies

While home insurance policies offer broad coverage, many contain exclusions limiting liability. Common exclusions include damage caused by floods, earthquakes, and acts of war. Other common exclusions might encompass damage from neglect or faulty maintenance, or losses caused by certain insects or vermin. It’s crucial to review the specific policy wording to understand the limitations of coverage. For instance, damage resulting from wear and tear or gradual deterioration is typically not covered. Similarly, intentional acts by the homeowner or their family members would usually not be covered.

Finding the Right Home Insurance Provider in North Carolina

Securing the right home insurance provider is crucial for protecting your most valuable asset. North Carolina’s diverse climate and geographic features mean that finding a provider offering comprehensive coverage at a competitive price requires careful consideration. This section will guide you through the process of selecting and working with a home insurance provider in the state.

Comparing Home Insurance Providers in North Carolina

Choosing the right home insurance provider involves comparing several factors, including coverage options, pricing, and customer service. The following table provides a comparison of four major providers, though it’s important to note that specific rates and coverage details will vary based on individual circumstances. Always obtain personalized quotes to accurately assess your options.

| Provider | Coverage Options | Average Customer Review (Illustrative) | Additional Features (Illustrative) |

|---|---|---|---|

| State Farm | Dwelling, Personal Property, Liability, Medical Payments, Loss of Use; various endorsements available | 4.2 stars (based on hypothetical aggregated online reviews) | Bundling discounts, mobile app for claims |

| Allstate | Similar to State Farm, with options for flood and earthquake coverage (often as add-ons) | 4.0 stars (based on hypothetical aggregated online reviews) | 24/7 claims assistance, various deductible options |

| Farmers Insurance | Comprehensive coverage options, including specialized coverage for unique properties | 3.8 stars (based on hypothetical aggregated online reviews) | Local agent network, personalized service |

| USAA (Military Members and Families) | Highly competitive rates, robust coverage options, excellent customer service reputation | 4.5 stars (based on hypothetical aggregated online reviews) | Specialized discounts and programs for military personnel |

*Note: The customer review scores are illustrative and based on hypothetical aggregations of online reviews. Actual scores may vary.*

Obtaining Home Insurance Quotes

The process of obtaining quotes is relatively straightforward. Most providers allow you to request quotes online through their websites. You’ll generally need to provide information about your property, such as its address, size, age, and features. You’ll also need to provide details about your coverage preferences and any previous claims history. It’s advisable to obtain quotes from at least three different providers to compare pricing and coverage options. Some providers may also offer phone or in-person quote options.

Reviewing Policy Details Before Purchase

Before committing to a policy, meticulously review all policy details. Pay close attention to the coverage limits, deductibles, exclusions, and any specific conditions or restrictions. Understanding these details will help you ensure the policy adequately protects your property and your financial interests. Don’t hesitate to contact the provider directly to clarify anything you don’t understand. A clear understanding of your policy’s terms and conditions is essential.

Questions to Ask Potential Insurance Providers

Prospective homeowners should be prepared to ask clarifying questions to ensure they select the best policy for their needs. This includes inquiries about coverage specifics, claims processes, and customer service responsiveness. The following represents a list of questions that homeowners should consider asking.

The importance of asking questions cannot be overstated. Thorough inquiry ensures that you understand all aspects of the policy before committing to it.

- What are the specific coverage limits for dwelling, personal property, and liability?

- What is the claims process, and how quickly can I expect a response?

- What are the exclusions in the policy, and are there any circumstances that wouldn’t be covered?

- What is your customer service availability, and what methods are available for contacting you?

- What discounts are available, and am I eligible for any of them?

Understanding North Carolina’s Insurance Regulations

Navigating the North Carolina home insurance market requires understanding the regulatory framework in place to protect both consumers and insurers. The state’s Department of Insurance plays a crucial role in ensuring fair practices and market stability.

The North Carolina Department of Insurance (NCDIO) is the primary regulatory body overseeing the state’s home insurance market. Its responsibilities include licensing and monitoring insurance companies, investigating consumer complaints, and enforcing state insurance laws. The NCDIO works to maintain a competitive and stable market, ensuring consumers have access to affordable and reliable coverage. They also educate consumers about their rights and responsibilities related to home insurance.

North Carolina’s Home Insurance Requirements

North Carolina doesn’t mandate specific levels of home insurance coverage, but lenders typically require homeowners to carry sufficient insurance to cover the outstanding mortgage balance. This usually involves purchasing a homeowner’s insurance policy that protects against losses from fire, wind, hail, and other perils. The exact coverage needed depends on the property’s value, location, and the lender’s requirements. It’s advisable to discuss coverage needs with both an insurance agent and a mortgage lender to ensure adequate protection.

Consumer Protection Laws in North Carolina Home Insurance

North Carolina has several consumer protection laws designed to safeguard homeowners. These laws aim to prevent unfair or deceptive insurance practices. For example, insurance companies are prohibited from engaging in discriminatory practices when setting premiums or denying coverage. The state also has regulations regarding claim handling procedures, requiring insurers to act promptly and fairly when processing claims. Furthermore, the NCDIO provides resources and assistance to consumers who believe they have been treated unfairly by an insurance company. This can include mediation services and the ability to file formal complaints.

Filing a Home Insurance Claim in North Carolina

Filing a claim typically involves contacting your insurance provider as soon as possible after an incident. Most companies have a 24/7 claims hotline. You will likely need to provide details about the incident, including date, time, and location, along with any relevant documentation, such as photographs or police reports. The insurer will then assign an adjuster to assess the damage and determine the amount of coverage. It’s important to keep detailed records of all communication and documentation related to the claim. North Carolina law mandates that insurance companies investigate claims fairly and promptly. If you experience delays or difficulties, you can contact the NCDIO for assistance. The process generally involves several steps: initial notification, damage assessment, negotiation of settlement, and payment of the claim. Delays can occur depending on the complexity of the claim and the availability of adjusters.

Epilogue

Protecting your North Carolina home requires careful consideration of numerous factors, from the specifics of your policy to preventative measures you can take to mitigate risks. By understanding the intricacies of the North Carolina home insurance market, comparing providers, and proactively managing your home’s security and maintenance, you can secure comprehensive coverage at a reasonable cost. Remember to thoroughly review policy details, ask pertinent questions, and leverage available resources to ensure you have the right protection for your most valuable investment.

Key Questions Answered

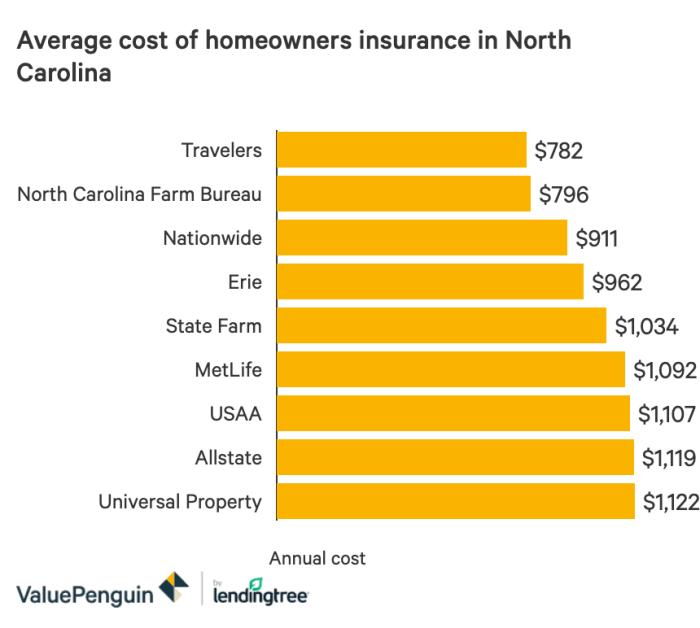

What is the average cost of home insurance in North Carolina?

The average cost varies significantly based on location, home value, coverage level, and individual risk factors. Obtaining quotes from multiple providers is essential to determine your specific cost.

What types of natural disasters are typically covered by North Carolina home insurance?

Standard policies usually cover wind and hail damage. However, flood insurance is typically separate and requires a separate policy through the National Flood Insurance Program (NFIP) or a private insurer.

How long does it take to get a home insurance quote in North Carolina?

Online quotes can be obtained instantly, while quotes requiring a phone call or in-person consultation may take a few days.

What happens if I need to file a claim?

Contact your insurance provider immediately after the incident. Follow their instructions for reporting the claim and providing necessary documentation. The claim process varies by provider and the specifics of the claim.