Securing your home is paramount, and understanding the nuances of home insurance in Utah is crucial for peace of mind. This guide delves into the intricacies of the Utah home insurance market, providing a clear and concise overview of policy types, cost factors, claim processes, and disaster preparedness. We’ll explore the key players, common coverage options, and strategies to optimize your insurance coverage and minimize costs.

From comparing average premiums across various Utah cities to understanding the impact of factors like location and credit score, this resource aims to empower Utah homeowners with the knowledge needed to make informed decisions about their home insurance. We will also address common concerns and offer practical advice for navigating the complexities of home insurance in the state.

Understanding Utah’s Home Insurance Market

Utah’s home insurance market, like any other state’s, is shaped by a complex interplay of factors including geographic risks, property values, and the competitive landscape of insurance providers. Understanding these elements is crucial for homeowners seeking the best coverage at a competitive price.

Key Characteristics of Utah’s Home Insurance Market

Utah’s home insurance market is characterized by a relatively low frequency of severe weather events compared to some other states, leading to potentially lower premiums in certain areas. However, wildfire risk, particularly in mountainous regions, significantly impacts premiums in those specific locations. The market is also competitive, with several major insurers vying for customers, offering a range of policy options and price points. This competition generally benefits consumers, encouraging insurers to offer competitive rates and comprehensive coverage. The state also has a robust regulatory framework overseeing the insurance industry, ensuring consumer protection and fair practices.

Major Home Insurance Providers in Utah

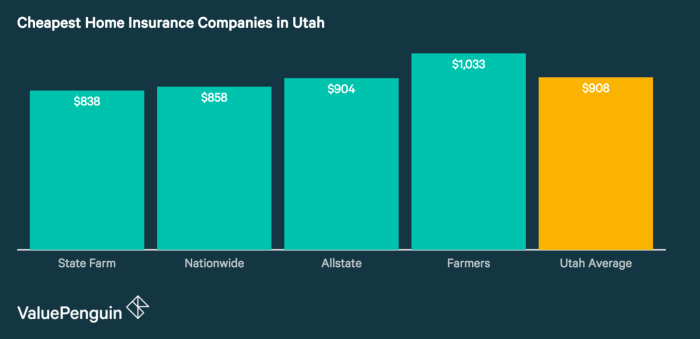

Several major national and regional insurance companies operate extensively in Utah. These include, but are not limited to, State Farm, Farmers Insurance, Allstate, Geico, and American Family Insurance. Many smaller, regional providers also compete within the state, offering specialized services or focusing on specific geographic areas. Consumers benefit from this diversity, allowing them to compare offerings and select a provider that best suits their needs and budget. It is advisable to compare quotes from multiple providers before selecting a policy.

Types of Home Insurance Policies Offered in Utah

Utah homeowners can typically choose from several standard home insurance policy types. The most common is the HO-3 policy, offering comprehensive coverage for dwelling, personal property, and liability. HO-4 policies (renters insurance) and HO-6 policies (condominium insurance) are also available, catering to different housing situations. Specialty policies, designed to address unique risks like flood or earthquake damage, may be purchased as supplemental coverage, depending on the specific location and homeowner’s needs. It’s important to understand the nuances of each policy type to ensure adequate protection.

Factors Influencing Home Insurance Premiums in Utah

Several factors significantly influence the cost of home insurance premiums in Utah. Location is a primary driver, with properties in high-risk areas (e.g., areas prone to wildfires or flooding) facing higher premiums. The type of property, its age, construction materials, and security features also play a role. The amount of coverage selected, the homeowner’s claims history, and even credit score can influence the final premium. Furthermore, the level of deductibles chosen directly affects the premium amount; higher deductibles generally lead to lower premiums.

Average Home Insurance Premiums in Different Utah Cities

The following table provides estimated average annual premiums for different Utah cities. These are illustrative averages and actual premiums will vary based on individual circumstances. Remember to obtain personalized quotes from multiple insurers for accurate pricing.

| City | Average Annual Premium (Estimate) | Factors Influencing Premium | Notes |

|---|---|---|---|

| Salt Lake City | $1,200 – $1,800 | Property value, location within city, risk factors | Higher in areas closer to canyons |

| Provo | $1,000 – $1,500 | Property type, age of home, proximity to wildfire risk | Wildfire risk impacts premiums in certain areas. |

| St. George | $1,100 – $1,700 | Property value, location within city, risk factors | Higher in areas closer to desert regions |

| Ogden | $900 – $1,400 | Property type, age of home, proximity to mountains | Lower in some areas but higher in mountain-adjacent neighborhoods |

Types of Home Insurance Coverage in Utah

Understanding the different types of home insurance coverage available in Utah is crucial for protecting your most valuable asset. Choosing the right policy depends on your specific needs and risk tolerance, considering factors like the age and condition of your home, its location, and the value of your belongings. This section details the common coverage options and helps you understand how to tailor your policy for optimal protection.

Standard Home Insurance Coverage in Utah

A typical Utah home insurance policy includes several standard coverages designed to protect your property and liability. These generally fall under the categories of dwelling coverage (protecting the structure of your home), other structures (like detached garages or sheds), personal property (your belongings), and liability (protecting you from lawsuits). Additional living expenses coverage is also common, providing temporary housing costs if your home becomes uninhabitable due to a covered event. The specific amounts covered will vary based on your policy and the assessed value of your property.

Actual Cash Value vs. Replacement Cost

Home insurance policies typically offer two valuation options for personal property and dwelling coverage: actual cash value (ACV) and replacement cost. ACV considers depreciation, meaning you’ll receive the current market value of your damaged item minus depreciation. Replacement cost, on the other hand, covers the full cost of replacing your damaged property with new items of like kind and quality, without deducting for depreciation. While replacement cost offers more comprehensive protection, it usually comes with a higher premium. For example, if a 10-year-old couch is damaged, ACV would pay its current value, significantly less than the cost of a new replacement, while replacement cost would cover the cost of a new, comparable couch.

Optional Home Insurance Add-ons in Utah

Many Utah homeowners opt for additional coverage beyond the standard policy. Earthquake insurance is a frequent addition, especially for those living in seismically active areas. Flood insurance, often purchased separately through the National Flood Insurance Program (NFIP), is essential for homeowners in flood-prone zones, regardless of the presence of a nearby river or lake. Personal liability coverage protects you financially if someone is injured on your property or you are held liable for damage to someone else’s property. Umbrella liability insurance provides extra liability coverage beyond your home and auto policies.

Examples of Beneficial Coverage Options for Utah Homeowners

Consider earthquake insurance if your home is situated in an area with a history of seismic activity, such as along the Wasatch Fault. Flood insurance is crucial for homes near rivers, streams, or in low-lying areas, particularly during Utah’s spring runoff season. If you have valuable collections or jewelry, you might consider scheduling these items for specific coverage amounts. High-value items may require additional endorsements beyond standard personal property coverage limits. A homeowner hosting frequent gatherings might benefit from increased personal liability coverage to protect against accidents.

Key Differences Between Basic and Comprehensive Home Insurance Plans

- Coverage Limits: Basic plans typically offer lower coverage limits for dwelling, personal property, and liability than comprehensive plans.

- Deductibles: Basic plans may have higher deductibles, meaning you pay more out-of-pocket before your insurance coverage kicks in.

- Optional Coverages: Comprehensive plans often include more optional coverages, such as replacement cost coverage, at no additional cost or with a smaller premium increase compared to adding them to a basic plan.

- Premium Costs: Comprehensive plans generally have higher premiums than basic plans, reflecting the broader protection offered.

Filing a Home Insurance Claim in Utah

Filing a home insurance claim in Utah can feel overwhelming, but understanding the process can make it significantly less stressful. This section Artikels the steps involved, from initial reporting to resolution, to help Utah homeowners navigate this process effectively. Remember to always refer to your specific policy for detailed information and coverage limits.

The Claim Filing Process

To initiate a claim, contact your insurance company immediately after an incident. Most companies offer 24/7 claim reporting through phone, online portals, or mobile apps. Provide accurate details of the event, including the date, time, and a brief description of the damage. Your insurer will then assign a claims adjuster to investigate the damage and assess the extent of the loss.

Required Documentation

Gathering necessary documentation is crucial for a smooth claim process. This typically includes your policy information, photographs and videos of the damage, police reports (if applicable, such as in cases of theft or vandalism), receipts for repairs or temporary housing (if applicable), and any other relevant documentation that supports your claim. Maintaining detailed records throughout the process is highly recommended.

Dealing with Insurance Adjusters

The claims adjuster will schedule an inspection of your property to assess the damage. Cooperate fully with the adjuster, providing them with access to the affected areas and answering their questions honestly and completely. Keep detailed records of all communication with the adjuster, including dates, times, and summaries of conversations. If you disagree with the adjuster’s assessment, you have the right to request a second opinion or mediation.

Common Claim Scenarios and Resolutions

Common claim scenarios in Utah include damage from hailstorms, wildfires (especially in areas prone to such events), water damage from plumbing issues or storms, and theft. Resolution processes vary depending on the nature and extent of the damage. For example, hail damage might involve roof repairs covered under your policy, while a wildfire might require more extensive repairs or even temporary relocation costs, subject to your coverage limits. Water damage from a burst pipe is usually covered, but negligence might affect the payout. Theft claims often require a police report. The resolution process generally involves assessment of damage, negotiation of settlement, and eventual payment or repair.

A Step-by-Step Guide for Utah Homeowners

- Report the incident: Contact your insurance company immediately after the damage occurs.

- Document the damage: Take photos and videos of the damage from multiple angles. Note the date and time.

- Gather necessary documentation: Collect your policy, police reports (if applicable), and any other relevant documents.

- Cooperate with the adjuster: Schedule an inspection and answer all questions honestly.

- Review the adjuster’s report: Carefully review the report and ensure the assessment is accurate.

- Negotiate the settlement: If you disagree with the assessment, negotiate a fair settlement or seek a second opinion.

- Receive payment or repairs: Once the settlement is agreed upon, receive payment or have the repairs completed.

Final Review

Ultimately, securing adequate home insurance in Utah involves careful consideration of your individual needs and risk profile. By understanding the market dynamics, available coverage options, and the factors influencing premiums, Utah homeowners can confidently protect their most valuable asset. This guide serves as a starting point for a more thorough exploration of your insurance options, encouraging proactive engagement with insurance providers to tailor a policy that best fits your specific circumstances and budget.

FAQ

What is the average cost of home insurance in Utah?

The average cost varies significantly based on location, property value, coverage level, and other factors. It’s best to obtain personalized quotes from multiple insurers.

How do I choose the right home insurance provider in Utah?

Compare quotes from several reputable insurers, considering factors like coverage, customer service ratings, and financial stability. Look for an insurer with a strong presence in Utah.

What are the consequences of not having home insurance in Utah?

Without insurance, you would be solely responsible for the financial burden of repairing or rebuilding your home after a covered event (fire, storm, etc.). This could lead to significant financial hardship.

Can I bundle my home and auto insurance in Utah?

Yes, many insurers offer discounts for bundling home and auto insurance policies. This can result in cost savings.

What types of natural disasters are most common in Utah and how are they covered?

Wildfires, earthquakes, and floods are common. Earthquake and flood insurance are typically separate policies, not included in standard home insurance. Wildfire coverage is usually part of a standard policy but may have limitations.