Navigating the Dallas, TX home insurance market can feel like traversing a complex maze. This guide aims to illuminate the path, providing a clear understanding of the factors influencing premiums, the diverse coverage options available, and the crucial steps involved in finding the right policy for your needs. From understanding the nuances of different coverage types to effectively filing a claim, we’ll equip you with the knowledge to make informed decisions and protect your most valuable asset – your home.

We’ll delve into the specifics of the Dallas market, examining the unique challenges and opportunities presented by the city’s diverse neighborhoods and susceptibility to specific weather events. Whether you’re a first-time homeowner or a seasoned resident, this comprehensive resource will serve as your invaluable companion in securing the right home insurance protection.

Understanding Dallas TX Home Insurance Market

The Dallas, TX home insurance market is a dynamic and competitive landscape shaped by several key factors. Understanding these factors is crucial for homeowners seeking the best coverage at the most competitive price. This overview will examine the market’s intricacies, focusing on premium influences, diverse housing types, and neighborhood-specific cost variations.

Key Factors Influencing Dallas Home Insurance Premiums

Several factors significantly impact home insurance premiums in Dallas. These include the age and condition of the home, its location, the level of coverage desired, and the homeowner’s claims history. Homes in areas prone to natural disasters, such as hailstorms or tornadoes, typically command higher premiums. The value of the home and its contents also directly correlates with the cost of insurance. Furthermore, features like security systems and fire-resistant materials can influence premium calculations, often resulting in lower costs for homeowners who invest in these safety measures. Finally, a homeowner’s credit score can play a role, with better credit often associated with lower premiums.

Types of Homes and Associated Insurance Needs in Dallas

Dallas boasts a diverse range of housing styles, each presenting unique insurance considerations. Older homes, for example, might require more extensive coverage due to potential structural issues and outdated building materials. Conversely, newer homes often benefit from lower premiums due to modern construction techniques and updated safety features. Similarly, larger homes generally require higher premiums than smaller ones, reflecting the increased value and potential for greater losses. High-rise condominiums will have different insurance needs compared to single-family homes, often focusing on liability and contents coverage rather than extensive structural protection. The specific location of a home within Dallas, its proximity to fire hydrants, and its vulnerability to flooding will all affect insurance costs.

Average Home Insurance Premiums Across Dallas Neighborhoods

The following table offers a comparison of average annual home insurance premiums across several Dallas neighborhoods. Note that these figures are estimates and can vary based on the factors discussed previously. Actual premiums will depend on the specific home, coverage level, and insurer.

| Neighborhood | Average Annual Premium (Estimate) | Factors Influencing Premium | Notes |

|---|---|---|---|

| Highland Park | $2,500 – $3,500 | High property values, low crime rates | Premiums may be higher due to luxury homes. |

| Preston Hollow | $2,000 – $3,000 | Large properties, established neighborhood | Premiums influenced by home size and age. |

| Lakewood | $1,800 – $2,500 | Mature trees, potential for storm damage | Premiums can vary based on proximity to White Rock Lake. |

| Oak Cliff | $1,500 – $2,200 | Mix of property values, diverse housing stock | Premiums reflect the range of property values in the area. |

Types of Home Insurance Coverage in Dallas

Choosing the right home insurance policy in Dallas is crucial for protecting your valuable asset. Understanding the different coverage options available is the first step towards securing adequate protection. This section will detail the various types of coverage, highlighting their benefits and limitations to help you make an informed decision.

Basic Homeowners Insurance Coverage

Basic homeowners insurance, often referred to as HO-1, provides coverage for damage to your home and belongings caused by specific, named perils. These typically include fire, windstorms, hail, vandalism, and theft. This type of policy generally offers the lowest premiums but provides the least amount of protection. It only covers losses directly caused by the named perils; any damage resulting from an indirect cause might not be covered. For instance, if a tree falls on your house during a windstorm (a covered peril), the damage to the house is covered. However, if the ensuing water damage from the fallen tree isn’t specifically listed as a covered peril, it may not be covered under a basic policy.

Broad Homeowners Insurance Coverage

Broad coverage, often an HO-2 policy, expands upon the basic coverage by including protection against a wider range of perils. While still listing specific perils, it generally covers more than a basic policy. This provides more comprehensive protection than a basic policy but still excludes certain events. Examples of additional perils covered might include falling objects or damage from ice and snow. However, similar to the basic policy, indirect damage from covered events might still be excluded. For example, if a pipe bursts (a covered peril under this broader coverage), the resulting water damage to the property is typically covered, but damage resulting from mold growth *due to* the water damage might require a separate rider or might not be covered at all.

Comprehensive Homeowners Insurance Coverage

Comprehensive homeowners insurance, typically an HO-3 policy, provides the broadest protection. It covers damage to your home and belongings caused by almost any peril, except those specifically excluded in the policy. This offers peace of mind knowing that a wide array of potential incidents are covered. This contrasts sharply with basic coverage, which only protects against a limited list of named perils. However, even comprehensive policies have exclusions, which are discussed below. For example, while an HO-3 policy will typically cover damage from a fire, it will likely exclude losses due to flood or earthquake, unless you have added specific endorsements or riders for those events.

Comparing Comprehensive and Basic Coverage

The key difference between comprehensive and basic coverage lies in the scope of protection. Basic policies only cover losses from specifically named perils, while comprehensive policies cover nearly all perils except those explicitly excluded. This broader coverage naturally comes with higher premiums. Choosing between the two depends on your risk tolerance and budget. Someone with a modest home in a low-risk area might find basic coverage sufficient, while someone with a more valuable home in a higher-risk area would likely benefit from the greater security of a comprehensive policy.

Common Exclusions in Dallas Home Insurance Policies

It’s crucial to understand what is *not* covered by your policy. Many common exclusions apply across different policy types in Dallas, and understanding these is vital for avoiding unexpected costs.

- Flooding

- Earthquakes

- Acts of war

- Nuclear accidents

- Intentional damage

- Normal wear and tear

- Neglect

- Pest infestations (often, but not always)

It’s important to note that many of these exclusions can often be covered by purchasing separate, supplemental insurance policies (like flood insurance) or adding endorsements to your existing policy. Always review your policy carefully and discuss your coverage needs with your insurance agent to ensure you have adequate protection.

Finding and Choosing a Home Insurance Provider in Dallas

Securing the right home insurance provider is crucial for protecting your biggest investment. Dallas, with its diverse housing market and potential for weather-related damage, necessitates a careful approach to finding the best coverage at a competitive price. This section Artikels a step-by-step process to help you navigate the Dallas home insurance landscape effectively.

Steps to Finding a Suitable Home Insurance Provider

Finding the right home insurance provider involves several key steps. First, you’ll want to gather necessary information about your property, then begin researching potential insurers, obtain quotes, and finally, compare and select a policy.

- Gather Property Information: Before contacting insurers, compile essential details about your home, including its square footage, age, construction materials, security features (alarms, security systems), and any recent renovations or upgrades. Accurate information ensures you receive accurate quotes.

- Research Potential Insurers: Begin by researching insurance companies operating in Dallas. You can utilize online search engines, review websites like Yelp or Google Reviews, and seek recommendations from friends, family, or real estate professionals. Consider factors like company reputation, financial stability (ratings from agencies like A.M. Best), and customer service reviews.

- Obtain Quotes: Contact several insurance providers and request quotes. Be prepared to provide the information gathered in step one. Many companies offer online quote tools for convenience. Remember to specify the coverage you require.

- Compare Quotes and Policies: Carefully compare quotes, focusing not just on price but also on the scope of coverage offered. Pay close attention to deductibles, coverage limits, and exclusions. Don’t hesitate to ask clarifying questions about anything unclear.

- Review Policy Documents: Before signing any policy, thoroughly review the entire document. Understand the terms and conditions, coverage limits, exclusions, and cancellation policies. If anything is unclear, contact the insurer for clarification.

Tips for Comparing Quotes and Policies

Comparing quotes effectively requires a systematic approach. Don’t solely focus on the premium; consider the overall value proposition.

- Coverage Limits: Ensure the coverage limits are sufficient to rebuild your home and replace your belongings in case of a total loss. Consider inflation and increasing construction costs.

- Deductibles: Understand the impact of different deductible amounts on your premium. A higher deductible will generally result in a lower premium, but you’ll pay more out-of-pocket in case of a claim.

- Exclusions: Carefully review what’s not covered by the policy. Common exclusions might include flood damage (requiring separate flood insurance) or earthquakes.

- Customer Service: Check customer reviews and ratings to gauge the responsiveness and helpfulness of the insurer’s customer service team. A positive customer experience is crucial during claims processing.

Importance of Reading Policy Documents Carefully

Reading your policy thoroughly is non-negotiable. It protects you from unforeseen costs and disputes. A clear understanding of the policy’s terms prevents misunderstandings and ensures you are adequately protected. Don’t hesitate to ask for clarification on any aspect of the policy before signing.

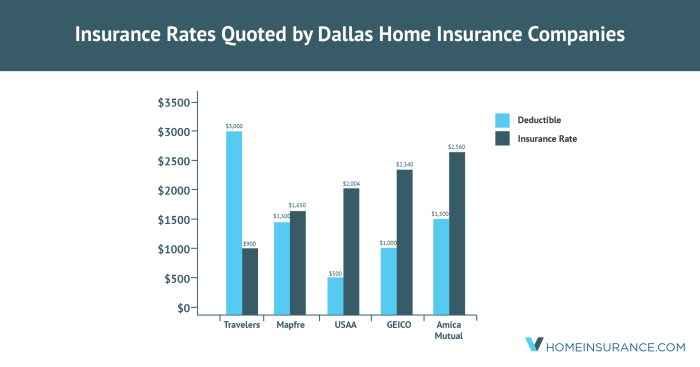

Comparison of Dallas Home Insurance Providers

The following table provides a sample comparison. Remember that rates and coverage can vary based on individual circumstances. This is not an exhaustive list and should not be considered financial advice.

| Provider | Coverage Options | Average Premium (Estimate) | Customer Reviews (Example) |

|---|---|---|---|

| Company A | Comprehensive coverage, including liability and additional living expenses | $1500-$2000 annually (estimate) | Generally positive, quick claims processing mentioned frequently |

| Company B | Standard coverage, customizable options available | $1200-$1800 annually (estimate) | Mixed reviews, some complaints about claim handling delays |

| Company C | Basic coverage, limited additional options | $1000-$1500 annually (estimate) | Mostly positive for affordability, but fewer features |

| Company D | Specialized coverage for older homes, including historical restoration | $1800-$2500 annually (estimate) | High ratings for specialized coverage and excellent customer service, but higher premiums |

Filing a Home Insurance Claim in Dallas

Filing a home insurance claim in Dallas, like in any other city, can be a stressful but necessary process after experiencing property damage or loss. Understanding the steps involved and preparing the necessary documentation will significantly streamline the process and help ensure a smoother resolution. This section details the typical procedure, from initial notification to claim settlement.

The process begins with promptly reporting the incident to your insurance provider. Most companies offer multiple reporting methods, including online portals, phone calls, and even mobile apps. It’s crucial to provide accurate and detailed information about the event, including the date, time, and circumstances of the damage or loss. After reporting, you’ll likely be assigned a claims adjuster who will be your primary point of contact throughout the process.

Required Documentation for a Home Insurance Claim

Gathering the necessary documentation is a crucial step in supporting your claim. This helps expedite the claims process and minimizes delays. A comprehensive collection of documentation demonstrates the validity of your claim and aids the adjuster in assessing the damage accurately. Failing to provide necessary documents can prolong the settlement process.

Typically, you will need to provide the following:

- Proof of Ownership: This could include your deed or mortgage documents.

- Detailed Description of the Damage or Loss: Include a written account of the event and a precise description of the affected property.

- Photographs and Videos: High-quality visual documentation of the damage is essential. Take pictures from multiple angles, showing the extent of the damage.

- Police Report (if applicable): If the damage resulted from a crime, such as theft or vandalism, a police report is crucial.

- Repair Estimates: Obtain estimates from licensed contractors for repairs or replacement of damaged property.

- Inventory of Damaged Items: For personal property claims, create a detailed list of lost or damaged items, including their purchase date, value, and any relevant receipts or documentation.

Communicating Effectively with Your Insurance Company

Maintaining clear and consistent communication with your insurance company is paramount throughout the claims process. Promptly responding to requests for information and actively participating in the investigation will contribute to a quicker resolution. Remember to be polite, professional, and factual in all your interactions.

Some advice for effective communication includes:

- Keep detailed records of all communication, including dates, times, and the names of individuals you speak with.

- Be patient and understanding; the claims process can take time.

- If you disagree with the adjuster’s assessment, express your concerns calmly and professionally, providing supporting documentation.

- Follow up on your communications to ensure your messages have been received and understood.

Typical Timeline for Claim Processing and Resolution

The timeframe for claim processing varies depending on the complexity of the claim and the insurance company’s efficiency. Simple claims, such as minor repairs, might be resolved within a few weeks. However, more complex claims, involving significant damage or disputes, could take several months.

Factors influencing the timeline include:

- Extent of Damage: Major damage naturally takes longer to assess and repair.

- Availability of Adjusters and Contractors: High demand for services can create delays.

- Complexity of the Claim: Claims involving multiple parties or significant legal issues will take longer.

- Cooperation of all Parties Involved: Prompt responses and cooperation significantly reduce processing time.

For example, a minor roof leak might be resolved within a month, while a major hailstorm causing widespread damage could take six months or more to fully settle. It’s important to remain patient and proactive throughout the process.

Ending Remarks

Protecting your Dallas home requires careful consideration of various factors and a thorough understanding of the insurance landscape. By understanding the intricacies of policy coverage, the influence of location and risk factors on premiums, and the process of filing claims, you can confidently secure a policy that provides the appropriate level of protection. Remember, proactive planning and informed decision-making are key to safeguarding your investment and ensuring peace of mind.

Essential FAQs

What is the average cost of home insurance in Dallas?

The average cost varies greatly depending on factors like home value, location, coverage level, and individual risk profile. It’s best to obtain quotes from multiple insurers for an accurate estimate.

How does my credit score affect my home insurance premium?

Many insurers consider credit scores when determining premiums. A higher credit score generally translates to lower premiums, reflecting a lower perceived risk.

What are some common exclusions in Dallas home insurance policies?

Common exclusions include flood damage (requiring separate flood insurance), earthquakes (often requiring a separate rider), and intentional acts by the homeowner.

What should I do if I need to file a claim?

Report the incident to your insurer immediately, gather necessary documentation (photos, receipts, etc.), and follow your insurer’s instructions for filing a claim.

How long does it take to get a home insurance quote?

Online quotes can be obtained instantly, while quotes from agents may take a few days depending on the complexity of your needs.