Securing your home is a significant investment, and understanding the intricacies of your home insurance coverages is paramount. This guide delves into the essential components of a standard home insurance policy, clarifying what’s covered, what’s not, and how to maximize your protection. We’ll explore dwelling coverage, personal property protection, liability insurance, and additional living expenses, equipping you with the knowledge to make informed decisions about your homeowner’s insurance.

From defining the fundamental elements of a policy to navigating the complexities of exclusions and premium calculations, we aim to demystify the world of home insurance. This comprehensive overview will empower you to choose the right coverage for your specific needs and circumstances, ensuring peace of mind knowing your most valuable asset is adequately protected.

Defining Home Insurance Coverages

Understanding your home insurance policy is crucial for protecting your most valuable asset. A standard policy typically bundles several coverages designed to safeguard your property and your financial well-being in the event of unforeseen circumstances. Knowing what these coverages entail empowers you to make informed decisions about your insurance needs.

Fundamental Components of a Standard Home Insurance Policy

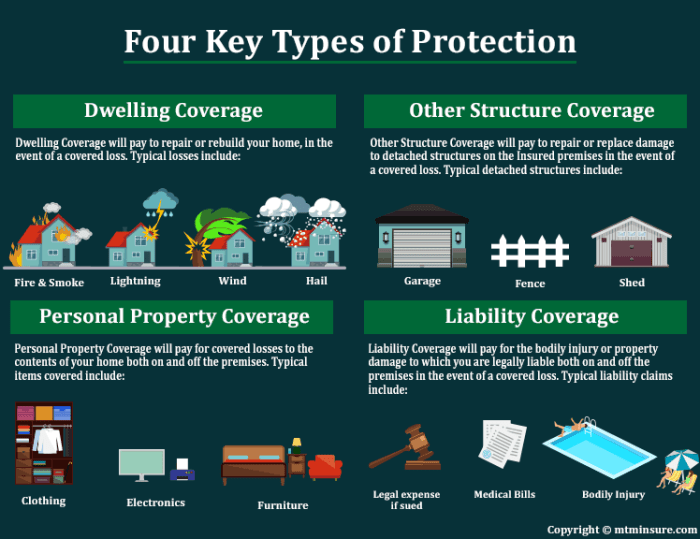

A typical home insurance policy consists of several key components. These include dwelling coverage (protecting the physical structure of your home), other structures coverage (covering detached structures like garages or sheds), personal property coverage (protecting your belongings inside and sometimes outside your home), loss of use coverage (providing temporary living expenses if your home becomes uninhabitable), and liability coverage (protecting you against lawsuits if someone is injured on your property). Additional coverages, such as flood or earthquake insurance, are often available as separate endorsements.

Types of Home Insurance Coverage

Several distinct types of coverage are commonly included in home insurance policies. Dwelling coverage protects the physical structure of your home from damage caused by covered perils, such as fire, wind, or hail. Other structures coverage extends this protection to detached buildings on your property. Personal property coverage safeguards your belongings from loss or damage due to covered perils. Loss of use coverage reimburses you for additional living expenses if your home becomes uninhabitable due to a covered event. Liability coverage protects you financially if someone is injured on your property or you are held responsible for damage to someone else’s property.

Coverage Variations Based on Location and Property Type

The specific coverages and their limits offered by a home insurance policy can vary significantly based on your location and the type of property you own. For instance, homes in areas prone to hurricanes or wildfires may require higher coverage limits and may face higher premiums. Similarly, the cost of insuring a large, multi-story home will generally be higher than that of a smaller, single-story home. Older homes may also require more extensive coverage due to potential issues with outdated building materials or systems. Rural properties may have different risk factors than urban properties, influencing coverage options and premiums.

Comparison of Common Home Insurance Policy Features

| Feature | Standard Policy | Enhanced Policy | Premium Differences |

|---|---|---|---|

| Dwelling Coverage | Covers damage from fire, wind, hail | Includes broader coverage, such as water backup and sewer damage | Enhanced policies typically cost more. |

| Personal Property Coverage | Covers basic personal belongings | May include higher coverage limits and specific coverage for valuable items | Higher coverage limits result in higher premiums. |

| Liability Coverage | Covers legal liability for injuries or property damage | Offers higher liability limits and potentially broader coverage | Higher limits translate to higher premiums. |

| Deductible | Typically a fixed amount you pay before coverage begins | Options for higher or lower deductibles are usually available | Lower deductibles generally mean higher premiums. |

Dwelling Coverage

Dwelling coverage is a crucial component of your home insurance policy, offering financial protection against damage or destruction to the physical structure of your house. This includes the attached structures, such as garages and porches, but generally excludes detached structures like sheds or fences (unless specifically included in your policy). Understanding the scope of this coverage is vital to ensuring you have adequate protection.

Dwelling coverage protects against a wide range of perils, depending on the type of policy you have. Commonly covered perils include fire, windstorms, hail, lightning, vandalism, and certain types of water damage (excluding flood damage, which typically requires separate flood insurance). The extent of the coverage is determined by your policy’s limits and the specific terms and conditions.

Limitations and Exclusions of Dwelling Coverage

Several limitations and exclusions commonly exist within dwelling coverage. These are important to understand as they can significantly impact the amount you receive in a claim. For example, most policies exclude damage caused by normal wear and tear, neglect, or gradual deterioration. Additionally, many policies exclude damage from events such as earthquakes, floods, and acts of war. Specific exclusions vary by insurer and policy, so it’s essential to carefully review your policy documents.

Examples of Dwelling Coverage Application

Dwelling coverage would apply in situations such as a house fire that causes significant structural damage, a windstorm that rips off part of your roof, or a burst pipe that causes water damage to your interior walls. In these cases, your insurance company would cover the cost of repairs or replacement up to your policy’s limits.

Examples of Situations Where Dwelling Coverage Would Not Apply

Dwelling coverage would typically not apply to damage caused by gradual deterioration, such as termite damage that weakens the structural integrity of your home over time. Similarly, damage resulting from a flood, earthquake, or neglect would usually not be covered. Furthermore, damage caused by intentional acts of the homeowner (e.g., intentionally setting fire to the house) would be excluded.

Hypothetical Claim Scenario

Imagine a homeowner, Sarah, lives in a house valued at $300,000 with a dwelling coverage limit of $250,000. A severe thunderstorm causes a tree to fall on her house, resulting in significant damage to the roof and a portion of the exterior wall. After assessing the damage, a qualified contractor estimates the repair costs at $50,000. Sarah files a claim with her insurance company, and after a thorough investigation, the claim is approved. The insurance company covers the $50,000 repair cost, as it falls within her policy’s dwelling coverage limit and is a covered peril (windstorm damage). However, if the damage had been caused by a flood, the claim would likely be denied.

Understanding Policy Exclusions and Limitations

Home insurance policies, while designed to protect your property and belongings, aren’t all-encompassing. Understanding the limitations and exclusions within your policy is crucial to avoid unexpected financial burdens in the event of a claim. This section clarifies common exclusions and how policy limits affect claim payouts.

Common Policy Exclusions

Standard home insurance policies typically exclude coverage for certain events or types of damage. These exclusions are often designed to manage risk and prevent the insurer from covering losses that are considered uninsurable or easily preventable. Familiarizing yourself with these exclusions is vital to accurately assess your level of protection.

- Acts of God: This typically includes events like earthquakes, floods, and landslides, although some policies offer optional add-on coverage for these events at an additional cost.

- Intentional Acts: Damage caused deliberately by the policyholder or someone acting on their behalf is generally not covered.

- Neglect or Lack of Maintenance: Damage resulting from a failure to maintain the property (e.g., a leaky roof ignored for years) is usually excluded.

- Specific Perils: Policies may exclude coverage for specific events such as termite damage, wear and tear, or mold unless specific endorsements are added.

- Certain Types of Property: Some items, like valuable jewelry or collections, might require separate coverage through riders or endorsements due to the higher risk involved.

Implications of Exclusions on Coverage

The presence of exclusions significantly impacts the scope of your coverage. For instance, if your home sustains damage during a flood (a common exclusion), your standard policy will not cover the repair costs unless you have purchased flood insurance as a separate rider or policy. Similarly, if a fire is caused by intentional arson, the claim will likely be denied. Understanding these exclusions allows you to take proactive measures, such as purchasing supplemental coverage or improving preventative maintenance, to better protect your assets.

Impact of Policy Limits on Claim Payouts

Policy limits define the maximum amount your insurer will pay for a specific covered loss or over the policy’s term. These limits are usually established per occurrence, per category of coverage (e.g., dwelling, personal property), and for the entire policy period. If a covered loss exceeds your policy limits, you will be responsible for the difference.

For example, if you have a dwelling coverage limit of $300,000 and your home sustains $400,000 in damage from a covered event (such as a fire), you would only receive $300,000 from your insurer. The remaining $100,000 would be your responsibility.

Illustrative Example of Exclusions and Limits

Let’s consider a hypothetical scenario: A homeowner has a home insurance policy with a dwelling coverage limit of $250,000 and a personal property limit of $50,000. A severe storm causes significant damage to their home. The damage assessment reveals $200,000 in dwelling damage and $75,000 in personal property loss. However, the storm also resulted in significant flooding in the basement, which is excluded from the policy. The basement damage is assessed at $50,000.

The visual representation would show a house divided into sections: A section showing the covered dwelling damage ($200,000) within the policy limit of $250,000. Another section representing the personal property loss ($75,000), exceeding the $50,000 limit, therefore only $50,000 would be covered. A third section would illustrate the excluded flood damage in the basement ($50,000) clearly marked as “Not Covered”. This illustrates how both policy limits and exclusions affect the total claim payout. The homeowner will receive $250,000 (dwelling) + $50,000 (personal property) = $300,000, leaving them responsible for the remaining $25,000 (personal property) and the full $50,000 of the flood damage.

Summary

Protecting your home and belongings requires a thorough understanding of your home insurance coverages. By carefully reviewing your policy, understanding its limitations, and considering the various factors influencing premiums, you can ensure you have the right level of protection. Remember, proactive planning and informed decision-making are key to safeguarding your investment and securing your future. This guide serves as a starting point; consulting with an insurance professional can provide personalized advice tailored to your individual requirements.

Questions Often Asked

What is the difference between actual cash value (ACV) and replacement cost coverage for personal property?

ACV considers depreciation, meaning you receive the item’s value minus depreciation. Replacement cost covers the cost of replacing the item with a new one of similar kind and quality, regardless of depreciation.

Does home insurance cover damage caused by flooding?

Standard home insurance policies typically exclude flood damage. Separate flood insurance is usually required for this type of coverage.

What is the purpose of an umbrella liability policy?

An umbrella liability policy provides additional liability coverage beyond the limits of your home and auto insurance policies, offering broader protection against significant lawsuits.

How often should I review my home insurance policy?

It’s advisable to review your policy annually, or whenever there are significant changes in your property, belongings, or risk factors.

Can I make changes to my home insurance policy after it’s been issued?

Yes, you can usually make changes, such as increasing coverage or adding riders, but this may affect your premium. Contact your insurer to discuss modifications.