Finding the right home insurance can feel like navigating a maze. With a plethora of providers, policies, and coverage options, understanding your needs and comparing apples to apples is crucial. This guide simplifies the process, empowering you to make informed decisions and secure the best protection for your home.

We’ll delve into the intricacies of home insurance, exploring various coverage types, factors influencing premiums, and the claims process. By understanding these key elements, you’ll be well-equipped to compare providers effectively, ultimately finding a policy that aligns perfectly with your budget and risk profile. We’ll also equip you with strategies to potentially lower your premiums and maximize your savings.

Understanding Home Insurance Needs

Choosing the right home insurance policy can feel overwhelming, but understanding your needs is the first step towards securing adequate protection. This involves considering the value of your property, your personal belongings, and the potential risks you face. Different policies offer varying levels of coverage, and selecting the right one depends on your specific circumstances and risk tolerance.

Home insurance policies typically cover several key areas. The most common is dwelling coverage, which protects the physical structure of your home against damage from events like fire, windstorms, or hail. Personal property coverage protects your belongings inside your home, from furniture and electronics to clothing and jewelry. Liability coverage protects you financially if someone is injured on your property or if you accidentally damage someone else’s property. Additional living expenses coverage can help pay for temporary housing if your home becomes uninhabitable due to a covered event. Finally, some policies include optional coverage such as flood insurance or earthquake insurance, which are often purchased separately.

Types of Home Insurance Coverage and Their Applications

The level of coverage needed varies greatly depending on individual circumstances. For example, someone living in a high-risk area for wildfires might require higher dwelling coverage and potentially supplemental coverage for wildfire damage. Similarly, homeowners with valuable collections of art or antiques might need higher personal property coverage limits. Someone renting out a portion of their home might need increased liability coverage to protect against potential tenant-related incidents. Conversely, a homeowner in a low-risk area with modest possessions might find a more basic policy sufficient.

Comparison of Common Home Insurance Policy Features

The following table compares features of common home insurance policies. Remember that specific coverage amounts and deductibles vary greatly by insurer, location, and the specifics of your property and risk profile. It’s crucial to compare quotes from multiple insurers to find the best fit for your needs and budget.

| Policy Type | Dwelling Coverage | Personal Property Coverage | Deductible |

|---|---|---|---|

| Basic | $150,000 | $75,000 | $1,000 |

| Standard | $250,000 | $125,000 | $500 |

| Comprehensive | $500,000 | $250,000 | $250 |

| Luxury Home | $1,000,000+ | $500,000+ | Variable |

Factors Affecting Home Insurance Premiums

Understanding how insurance companies calculate your premiums is crucial for securing the best coverage at a reasonable price. Several interconnected factors contribute to the final cost, and a thorough understanding of these elements can empower you to make informed decisions. This section will explore the key factors influencing your home insurance premium.

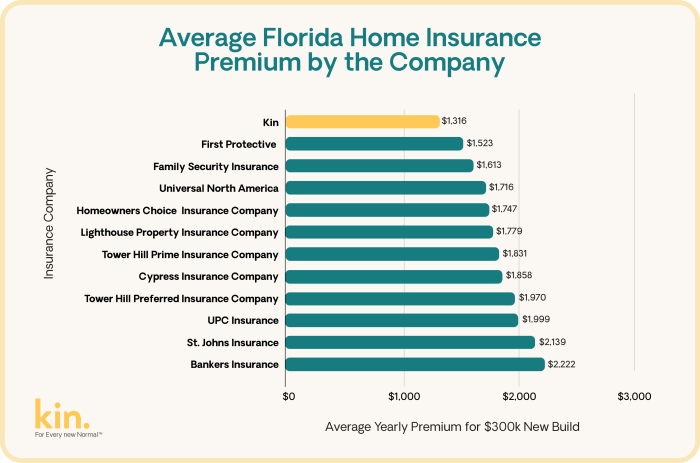

Several key factors influence the cost of your home insurance. These factors are broadly categorized into location-specific details, property characteristics, and individual risk assessments. Insurance companies meticulously analyze these aspects to determine the level of risk associated with insuring your home.

Location

Your home’s location significantly impacts your insurance premium. Areas prone to natural disasters like hurricanes, earthquakes, wildfires, or floods generally command higher premiums due to the increased risk of damage. For example, a home situated in a coastal region susceptible to hurricanes will likely have a higher premium than a similar home located inland. Furthermore, the crime rate in your neighborhood also plays a role; higher crime rates often translate to increased premiums due to the greater risk of theft or vandalism. The proximity to fire hydrants and the quality of your local fire department also influence premiums, reflecting the potential for rapid response in case of fire.

Home Features

The characteristics of your home itself heavily influence premium calculations. The age of your home, its construction materials, and the presence of safety features all play a role. Older homes, for example, might require higher premiums due to potential issues with outdated plumbing or electrical systems. Homes constructed with fire-resistant materials, such as brick or stone, typically attract lower premiums compared to those made of wood. The presence of security systems, smoke detectors, and fire sprinklers can significantly reduce your premium, as these features mitigate the risk of loss. Furthermore, the size of your home and the replacement cost of its structure and contents are crucial factors. A larger home, or one with high-value contents, will naturally command a higher premium.

Individual Risk Profile

Beyond location and home features, your personal risk profile is also considered. Your claims history is a significant factor; a history of filing claims can lead to higher premiums, reflecting a perceived higher risk. Your credit score can also influence premiums in some regions, as a poor credit score may indicate a higher likelihood of late or missed payments. Finally, the type and amount of coverage you choose directly affect your premium. Choosing higher coverage limits will naturally result in a higher premium, while opting for a higher deductible can lead to lower premiums.

Strategies for Lowering Home Insurance Premiums

Understanding the factors that affect your premium allows you to implement strategies to potentially reduce your costs.

Many strategies exist to help lower your home insurance premiums. These strategies focus on mitigating risk, improving home security, and selecting the right coverage.

- Improve Home Security: Installing security systems, smoke detectors, and fire sprinklers can significantly reduce your premiums.

- Maintain Your Home: Regularly maintaining your home’s structure and systems can prevent costly repairs and reduce the risk of claims.

- Increase Your Deductible: Choosing a higher deductible can lower your premium, but be sure you can comfortably afford the higher out-of-pocket expense in case of a claim.

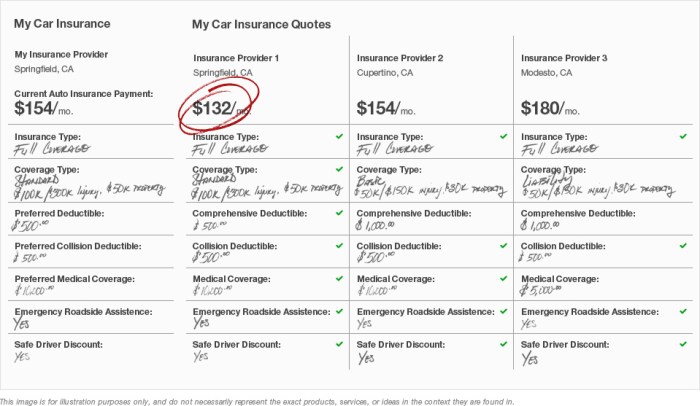

- Bundle Your Policies: Bundling your home and auto insurance with the same company often results in discounts.

- Shop Around: Comparing quotes from multiple insurance providers is crucial to finding the best rates.

- Consider Discounts: Inquire about available discounts, such as those for homeowners associations, multiple policies, or safety features.

Bundling and Discounts

Saving money on your home insurance is a smart financial move, and one of the most effective ways to achieve this is by exploring the various discounts and bundling options available. Bundling your home and auto insurance with the same provider often leads to significant cost reductions, while various other discounts can further reduce your premium. Understanding these options can significantly impact your overall insurance costs.

Bundling home and auto insurance policies offers considerable cost savings. Insurers often reward policyholders who consolidate their coverage with them by offering a bundled discount. This discount reflects the reduced administrative costs and increased customer loyalty associated with managing multiple policies under one umbrella. The exact percentage of the discount varies depending on the insurer and the specific policies involved, but it’s not uncommon to see savings of 10% to 25% or more. This translates to substantial savings over the policy term.

Bundled Insurance Savings

Many insurers offer significant discounts for bundling home and auto insurance. For example, let’s consider Sarah, a homeowner who pays $1,200 annually for her home insurance and $800 annually for her auto insurance with separate companies. If she bundled both policies with a single insurer offering a 15% discount on the combined premium, her savings would be calculated as follows: Combined premium = $1200 + $800 = $2000. Discount = $2000 * 0.15 = $300. Her new annual premium would be $1700, representing a $300 annual saving. This demonstrates the significant financial benefits of bundling.

Other Available Discounts

Beyond bundling, insurers frequently offer a range of additional discounts to incentivize safe driving and responsible homeownership. These can include discounts for:

- Home security systems: Installing and maintaining a monitored security system can often reduce premiums by 5-10%, reflecting the lower risk profile of a well-protected home.

- Claims-free history: Maintaining a consistent record without filing claims demonstrates responsible insurance behavior and can lead to significant premium reductions, often tiered based on the length of the claims-free period.

- Multiple policies: Some insurers offer discounts for having multiple policies beyond home and auto, such as umbrella liability or life insurance.

- Loyalty discounts: Long-term customers often qualify for discounts that reward their continued business.

- Senior citizen discounts: Insurers may offer reduced rates for older drivers and homeowners, reflecting lower average risk profiles.

- Green initiatives: Homeowners who have implemented energy-efficient upgrades might qualify for discounts due to the reduced risk of certain types of damage.

It’s important to contact individual insurers to understand the specific discounts available in your area and the eligibility criteria. These discounts can vary widely based on location, policy type, and individual circumstances.

Concluding Remarks

Securing adequate home insurance is a cornerstone of responsible homeownership. By carefully comparing providers, understanding policy details, and leveraging available discounts, you can achieve optimal coverage at a competitive price. Remember, the right policy provides peace of mind, knowing you’re protected against unforeseen circumstances. Take the time to thoroughly compare your options and invest in the protection your home deserves.

FAQ Summary

What is the difference between actual cash value (ACV) and replacement cost coverage?

ACV coverage pays for the current market value of damaged property, minus depreciation. Replacement cost coverage pays for the cost of replacing the damaged property with new, similar items, regardless of depreciation.

How often should I review my home insurance policy?

It’s recommended to review your policy annually, or whenever there are significant changes in your home or lifestyle (e.g., renovations, additions, increased possessions).

What factors can affect my home insurance deductible?

Your deductible is typically set when you purchase the policy and can influence your premium. A higher deductible generally leads to a lower premium, but you’ll pay more out-of-pocket in case of a claim.

Can I get home insurance if I have a dog?

Yes, but the type and breed of dog can influence your premium. Some insurers may consider certain breeds to be high-risk and charge accordingly, or may exclude coverage for specific breeds entirely.