Finding the right home insurance can feel like navigating a maze. Premiums vary wildly, coverage options seem endless, and understanding the fine print is a challenge. This guide cuts through the complexity, offering a clear path to comparing home insurance policies effectively and securing the best protection for your most valuable asset.

We’ll explore key factors influencing your premium, delve into the nuances of different policy types, and provide practical tools and techniques to simplify the comparison process. Whether you’re a first-time homeowner or a seasoned pro, this resource will empower you to make informed decisions and save money.

Understanding Home Insurance Needs

Choosing the right home insurance policy is crucial for protecting your most valuable asset. Several factors influence the type and level of coverage needed, and understanding these factors is key to making an informed decision. This section will explore these factors and compare coverage options offered by different providers.

Key Factors Influencing Home Insurance Choices

Demographic factors significantly impact home insurance needs. For example, homeowners in high-risk areas (prone to wildfires, floods, or hurricanes) will require more extensive coverage and likely pay higher premiums than those in lower-risk zones. Similarly, the age and value of a home directly influence the premium and coverage required. A newer, more expensive home necessitates higher coverage limits for dwelling protection than an older, less valuable property. Lifestyle factors also play a role; homeowners with valuable collections or those who frequently entertain guests may need higher liability coverage. Finally, the individual’s financial situation influences the deductible chosen, balancing the cost of premiums with the ability to cover a potential out-of-pocket expense.

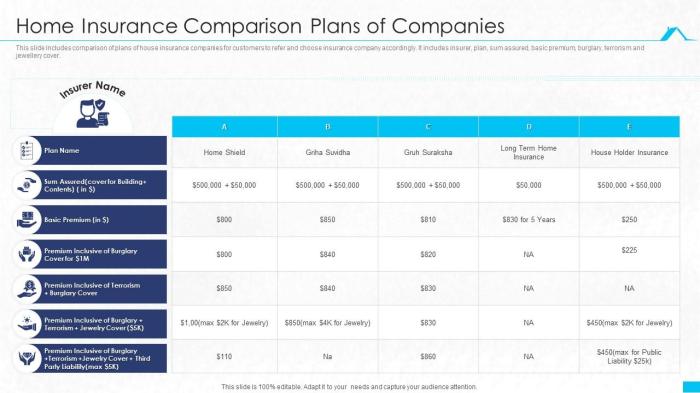

Comparison of Coverage Options

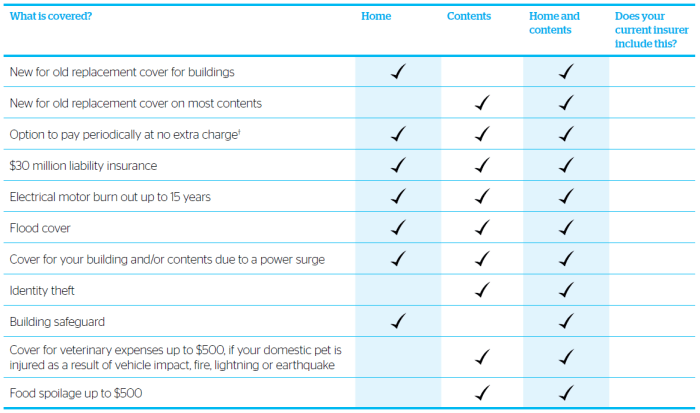

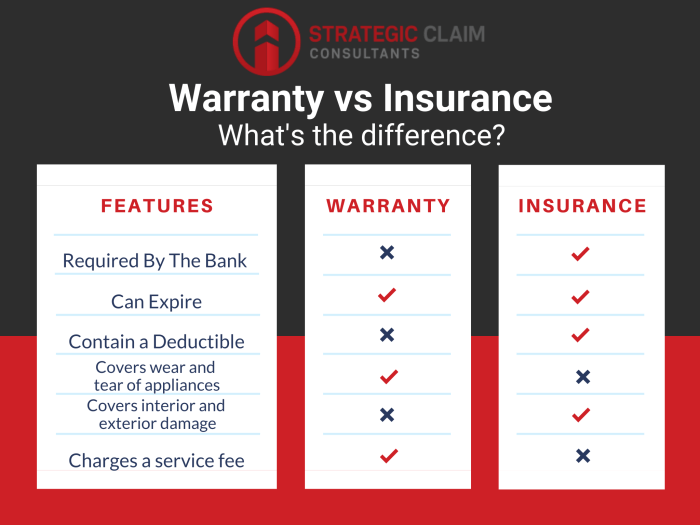

Home insurance providers offer a range of coverage options, each with varying levels of protection and premiums. Common coverage types include dwelling coverage (protecting the structure of the home), personal property coverage (protecting belongings within the home), liability coverage (protecting against lawsuits resulting from accidents on the property), and additional living expenses coverage (covering temporary living costs if the home becomes uninhabitable due to a covered event). The specific coverage offered and the limits vary significantly between providers. Some providers may offer specialized coverage for specific risks, such as earthquake or flood insurance, which might be purchased as add-ons or are not available in all areas. Policyholders should carefully compare these options to ensure their policy adequately protects their assets and financial well-being.

Understanding Policy Exclusions and Limitations

It’s equally important to understand what is *not* covered by a home insurance policy. Standard policies typically exclude damage caused by specific events, such as intentional acts, normal wear and tear, or certain types of pests. Many policies also have limitations on coverage amounts, such as sublimits for specific items like jewelry or electronics. Understanding these exclusions and limitations is crucial to avoid unexpected costs in the event of a claim. For example, a policy might cover damage from a fire but exclude damage caused by flooding unless a separate flood insurance policy is purchased. Carefully reviewing the policy documents is essential to fully comprehend its scope and limitations.

Comparison of Coverage Types Across Providers

The following table compares the coverage types offered by three hypothetical major providers (Provider A, Provider B, and Provider C). Note that these are examples and actual coverage and pricing will vary based on individual circumstances and location.

| Coverage Type | Provider A | Provider B | Provider C |

|---|---|---|---|

| Dwelling Coverage | Up to $500,000 | Up to $750,000 | Up to $600,000 |

| Personal Property Coverage | 50% of Dwelling Coverage | 60% of Dwelling Coverage | 70% of Dwelling Coverage |

| Liability Coverage | $300,000 | $500,000 | $1,000,000 |

Understanding Policy Documents and Jargon

Navigating the world of home insurance can feel overwhelming, especially when confronted with complex policy documents and unfamiliar terminology. Understanding the key components of your policy and the language used is crucial to ensuring you have the right coverage and know how to utilize it effectively. This section will demystify common insurance terms and guide you through the essential parts of your policy.

Common Home Insurance Terms

A clear understanding of common insurance terms is vital for interpreting your policy. The following glossary provides definitions for frequently encountered words and phrases.

- Actual Cash Value (ACV): The cost to replace your damaged property minus depreciation. For example, if your ten-year-old sofa is worth $500 new but depreciated to $250, the ACV is $250.

- Replacement Cost Value (RCV): The cost to replace your damaged property with a new item of similar kind and quality, without deduction for depreciation. Using the same sofa example, the RCV would be $500.

- Premium: The amount you pay regularly to maintain your home insurance coverage.

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in. For example, a $1000 deductible means you pay the first $1000 of any claim.

- Liability Coverage: Protection against financial responsibility for injuries or damages you cause to others.

- Peril: An event that could cause damage or loss, such as fire, wind, or theft.

- Exclusion: Specific events or circumstances that are not covered by your policy, such as flood damage (unless you have added flood insurance).

The Significance of the Declarations Page

The declarations page is the most important part of your home insurance policy. It summarizes your coverage details in a concise format. This page provides key information such as your policy number, the address of the insured property, the coverage amounts for different aspects of your home and possessions, your deductible, and the policy period. Carefully review this page to ensure all information is accurate and reflects your understanding of the coverage you purchased. Discrepancies should be reported to your insurance provider immediately.

Filing a Claim and Necessary Documentation

Filing a claim involves reporting a covered loss to your insurance company. The process typically begins with contacting your insurer, providing details of the incident, and following their instructions for submitting a claim. Essential documentation usually includes:

- A completed claim form.

- Photographs or videos of the damage.

- Police report (if applicable, such as in cases of theft or vandalism).

- Repair or replacement estimates from qualified contractors.

- Proof of ownership of damaged property.

The specific documentation required may vary depending on the nature of the claim and your insurance provider. It’s advisable to keep detailed records of all communication and documentation related to your claim.

Infographic: Key Sections of a Standard Home Insurance Policy

The infographic would visually represent the structure of a typical home insurance policy using a flowchart or layered diagram. The main sections would be clearly labeled and color-coded for easy understanding. For example, a central box labeled “Home Insurance Policy” would branch out into sections representing:

1. Declarations Page: A box showing key information such as policy number, address, coverage amounts, and deductible. A small inset image could depict a sample declarations page.

2. Coverage Sections: This section would be further divided into sub-sections for dwelling coverage (house structure), personal property coverage (belongings), liability coverage (injury to others), and additional living expenses (temporary housing if your home is uninhabitable). Each sub-section would include a brief description and relevant icons (e.g., a house icon for dwelling coverage).

3. Exclusions: This section would list common exclusions such as flood, earthquake, and intentional acts, using clear visual cues to highlight these limitations.

4. Conditions: This section would detail the policyholder’s responsibilities, such as timely notification of claims and cooperation with investigations.

5. Definitions: A section providing visual definitions for key terms like ACV and RCV. Simple visuals (like a scale for ACV vs. RCV) could aid understanding.

The infographic would use clear, concise language and visually appealing elements to ensure ease of understanding, making it a quick reference guide for policyholders.

Last Point

Ultimately, comparing home insurance isn’t just about finding the cheapest policy; it’s about finding the right coverage at the right price. By understanding your needs, leveraging available resources, and negotiating effectively, you can secure comprehensive protection that provides peace of mind without breaking the bank. Armed with the knowledge in this guide, you can confidently navigate the world of home insurance and choose a policy that perfectly fits your circumstances.

Questions and Answers

What is the difference between actual cash value (ACV) and replacement cost coverage?

ACV covers the replacement cost minus depreciation, while replacement cost covers the full cost of replacement without considering depreciation.

How often should I review my home insurance policy?

It’s advisable to review your policy annually, or whenever there are significant changes in your home, possessions, or risk factors.

Can I get home insurance if I have a dog?

Yes, but the premiums may be higher depending on the breed and history of the dog. Some insurers may refuse coverage for certain breeds.

What is a deductible, and how does it affect my premium?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically leads to lower premiums.

What factors might cause my home insurance premium to increase?

Factors such as claims history, location, age of the home, and improvements to the property can all affect your premium.