Navigating the world of home insurance in California can feel overwhelming. The Golden State’s unique geography and diverse housing market mean that securing the right coverage requires careful consideration. This guide delves into the intricacies of obtaining home insurance California quotes, equipping you with the knowledge to make informed decisions and protect your most valuable asset.

From understanding the factors that influence premiums to comparing quotes from multiple insurers, we’ll provide a comprehensive overview of the process. We’ll also explore the various types of coverage available, ensuring you’re adequately protected against potential risks. This guide aims to simplify the often-complex process of finding the best home insurance policy for your specific needs and budget in California.

Understanding California Home Insurance

Securing adequate home insurance in California is crucial given the state’s unique geographical features and susceptibility to natural disasters. Understanding the factors influencing costs and the available coverage options is essential for making informed decisions and protecting your investment.

Factors Influencing California Home Insurance Costs

Several factors significantly impact the cost of home insurance in California. These include the location of your property, its proximity to wildfire-prone areas, the age and construction of your home, its replacement cost, and the level of coverage you choose. The presence of safety features like fire-resistant roofing or updated electrical systems can also affect premiums. Furthermore, your claims history and credit score play a role in determining your insurance rate. For example, a home located in a high-risk wildfire zone will generally command higher premiums than a similar property in a low-risk area. Similarly, an older home requiring more extensive repairs may be more expensive to insure.

Types of Coverage Available for California Homeowners

California homeowners insurance policies typically offer several types of coverage. Dwelling coverage protects the physical structure of your home, while other structures coverage extends to detached buildings like garages or sheds. Personal property coverage protects your belongings inside and outside your home, while loss of use coverage provides temporary living expenses if your home becomes uninhabitable due to a covered event. Liability coverage protects you financially if someone is injured on your property. Additional coverage options may include earthquake insurance (often purchased separately), flood insurance (also typically separate), and personal liability umbrella policies for enhanced protection.

Comparison of Common Insurance Policy Features

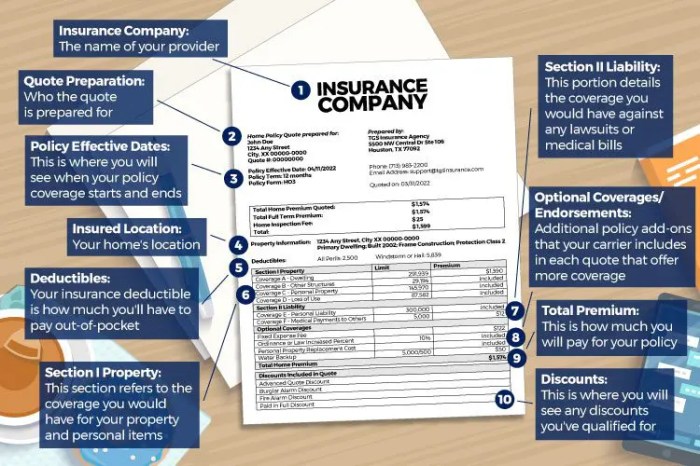

Common features found in California home insurance policies often include deductibles, which represent the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums. Coverage limits define the maximum amount your insurer will pay for a covered loss. Choosing adequate coverage limits is vital to ensure you’re sufficiently protected. Many policies also offer additional endorsements or riders to customize your coverage based on specific needs, such as valuable jewelry or collectibles. It’s important to carefully review the policy details and understand the implications of different features before selecting a policy.

Average Home Insurance Costs in Different California Regions

The cost of home insurance varies significantly across California due to the diverse geographical risks. The following table provides a general comparison of average annual premiums in different regions. These are estimates and actual costs may vary depending on individual factors.

| Region | Average Annual Premium (Estimate) | Factors Influencing Cost | Notes |

|---|---|---|---|

| Coastal Southern California (e.g., Los Angeles, San Diego) | $2,000 – $3,500 | Wildfire risk, high property values, coastal erosion | Higher premiums due to high property values and proximity to wildfire zones. |

| Northern California (e.g., Sacramento, San Francisco) | $1,500 – $2,800 | Wildfire risk (especially in certain areas), earthquake risk | Premiums vary significantly depending on specific location and wildfire risk. |

| Central Valley (e.g., Fresno, Bakersfield) | $1,000 – $2,000 | Lower property values, lower wildfire risk (generally) | Generally lower premiums due to lower property values and lower risk of wildfires compared to coastal areas. |

| Inland Empire (e.g., Riverside, San Bernardino) | $1,200 – $2,500 | Wildfire risk, increasing property values | Premiums increasing due to expanding development in wildfire-prone areas. |

Obtaining Home Insurance Quotes

Securing the right home insurance in California involves understanding the quoting process. Getting multiple quotes and comparing them is crucial to finding the best coverage at a competitive price. This section details how to obtain and effectively compare home insurance quotes.

Getting a home insurance quote online is generally straightforward and convenient. Most insurers offer online quote tools that guide you through the necessary steps. This allows you to receive an estimate quickly and easily, without the need for a phone call or in-person visit.

Information Needed for Accurate Quotes

Providing accurate information is essential for receiving an accurate home insurance quote. Inaccurate information can lead to a quote that doesn’t reflect your actual risk, potentially resulting in either inadequate coverage or paying more than necessary. Insurers use this information to assess your risk profile. Key information typically includes your address, the year your home was built, its square footage, the type of construction (e.g., wood, brick), the number of bedrooms and bathrooms, the value of your personal belongings, and details about any security systems installed. You’ll also need to provide information about your claims history.

The Importance of Comparing Quotes from Multiple Insurers

Comparing quotes from several insurers is paramount. Insurance companies use different rating models and offer varying coverage options. A quote from one insurer might be significantly higher or lower than another, even for the same level of coverage. This difference can translate to hundreds, or even thousands, of dollars in savings over the policy term. Failing to compare quotes could mean missing out on substantial cost savings. For example, one insurer might prioritize earthquake coverage, while another focuses on wind damage, reflecting differing regional risk assessments.

A Step-by-Step Guide to Comparing Home Insurance Quotes

To effectively compare quotes, follow these steps:

- Gather your information: Compile all the necessary details about your home and belongings as mentioned previously. This will streamline the quoting process.

- Obtain quotes from multiple insurers: Use online quote tools from at least three to five different insurance companies. This will give you a broader range of options to compare.

- Compare coverage: Don’t just focus on price. Carefully review the coverage details of each quote. Ensure the coverage limits are sufficient for your needs. Pay close attention to deductibles and what is, and is not, included in the policy.

- Analyze the price: Once you understand the coverage, compare the premiums. Consider the total annual cost, not just the monthly payment.

- Read the policy documents: Before making a decision, thoroughly review the policy documents from your top choices. Understand the terms and conditions, exclusions, and limitations.

- Choose the best policy: Select the policy that provides the most comprehensive coverage at a price you can afford. Remember that the cheapest policy isn’t always the best if it lacks sufficient coverage.

Understanding Policy Details

Choosing the right home insurance policy involves understanding its intricacies beyond just the premium. This section clarifies common exclusions, the claims process, and key policy elements to ensure you’re adequately protected.

Common Exclusions and Limitations

California home insurance policies, like those in other states, typically exclude certain types of damage or losses. These exclusions are often designed to manage risk and prevent abuse. For instance, most policies won’t cover damage caused by floods, earthquakes, or acts of war. Furthermore, there are often limitations on coverage for specific events, such as a cap on the amount paid for jewelry or other high-value items. Policies may also have limitations regarding liability coverage, defining the extent of the insurer’s responsibility for injuries or damages caused to others on your property. It is crucial to carefully review your policy documents to fully understand what is and isn’t covered. Reading the fine print is essential to avoid surprises in the event of a claim.

Filing a Home Insurance Claim

The claims process generally begins with contacting your insurance provider as soon as possible after an incident. You will typically need to provide details of the event, including the date, time, and circumstances. The insurer will then initiate an investigation, which may involve an adjuster visiting your property to assess the damage. Documentation is key; gathering evidence such as photos, videos, and repair estimates can expedite the process. The insurer will then determine the extent of coverage based on your policy and the assessment of the damage. Once approved, the claim will be processed, and payment will be disbursed according to the terms of your policy. This process can vary slightly depending on the insurance provider and the complexity of the claim.

Examples of Covered and Uncovered Situations

A covered situation might involve damage to your home caused by a fire, a covered peril under most standard policies. The insurer would typically cover the cost of repairs or rebuilding, up to the policy limits. Conversely, damage from a flood would usually be excluded, unless you have purchased separate flood insurance. Another example of a covered situation could be liability coverage for injuries sustained by a guest on your property. Conversely, damage caused by intentional acts or negligence on the part of the homeowner is generally not covered. For instance, damage caused by ignoring a known plumbing leak would likely not be covered. It is essential to understand the specific wording of your policy to determine what is and is not covered.

Essential Elements of a Comprehensive Home Insurance Policy

A thorough understanding of your policy is vital. Before signing, ensure you are familiar with these key components:

- Dwelling Coverage: This covers the structure of your home in case of damage or destruction from covered perils.

- Other Structures Coverage: This covers detached structures on your property, such as a garage or shed.

- Personal Property Coverage: This covers your belongings inside and outside your home.

- Liability Coverage: This protects you financially if someone is injured on your property or if you cause damage to someone else’s property.

- Additional Living Expenses (ALE): This covers temporary living expenses if your home becomes uninhabitable due to a covered event.

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in.

Understanding these elements will ensure you have appropriate coverage tailored to your specific needs and the value of your property.

Final Wrap-Up

Protecting your California home requires a proactive approach to insurance. By understanding the factors influencing your home insurance California quote, comparing multiple options, and carefully reviewing policy details, you can secure comprehensive coverage tailored to your specific needs. Remember, a well-informed decision today can provide peace of mind for years to come, ensuring your investment is safeguarded against unforeseen circumstances.

Quick FAQs

What is the average cost of home insurance in California?

The average cost varies significantly depending on location, home value, coverage level, and other factors. It’s best to obtain personalized quotes for an accurate estimate.

How long does it take to get a home insurance quote?

Online quotes can be generated instantly, while quotes requiring more detailed information may take a few days.

Can I get home insurance if I have a dog?

Yes, but certain breeds may affect your premiums. Disclose all pet information when obtaining a quote.

What happens if I need to file a claim?

Contact your insurance provider immediately to report the claim and follow their instructions for providing necessary documentation.