Navigating the world of home insurance can feel like deciphering a complex code. Finding the right coverage at the best price requires careful consideration of numerous factors. Fortunately, home insurance calculators offer a powerful tool to simplify this process, providing personalized estimates and empowering you to make informed decisions about protecting your most valuable asset – your home.

This comprehensive guide delves into the intricacies of home insurance calculators, explaining their functionality, the key factors influencing premium costs, and how to effectively utilize these tools to secure optimal coverage. We’ll explore different calculator types, compare features, and provide practical advice for navigating the often-confusing world of insurance policies.

Understanding Home Insurance Calculators

Home insurance calculators are valuable tools designed to provide quick estimates of the cost of home insurance. They simplify a complex process, allowing individuals to explore different coverage options and understand the factors influencing their premiums before contacting an insurance provider directly. These calculators streamline the initial stages of the insurance-seeking process, offering a convenient way to gain a preliminary understanding of potential costs.

Home insurance calculators function by collecting specific information about your property and desired coverage. This data is then processed through an algorithm that calculates a projected premium. The accuracy of the estimate depends on the completeness and accuracy of the input data provided. While not a substitute for a formal quote from an insurer, these calculators provide a useful starting point for budgeting and planning.

Typical Inputs for Home Insurance Calculators

Home insurance calculators typically require a range of inputs to generate an accurate estimate. These inputs generally fall into several categories: property characteristics, location details, coverage preferences, and personal information. The specific fields may vary depending on the calculator used. For example, some calculators may request detailed information about the age and condition of your home’s systems (roof, plumbing, electrical), while others may focus on more general characteristics. The more detailed the information provided, the more accurate the resulting estimate is likely to be.

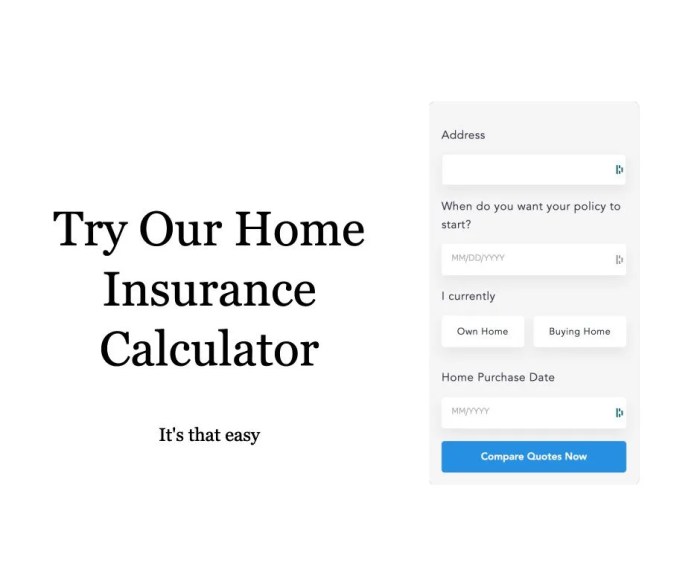

Examples of Online Home Insurance Calculators

Numerous online home insurance calculators are available from various sources, including insurance companies themselves, independent comparison websites, and financial planning tools. Examples might include calculators offered directly by major insurance providers like State Farm or Allstate, or those found on comparison sites such as NerdWallet or Policygenius. These calculators often differ in their features, the level of detail required, and the type of insurance they cover (e.g., homeowners, renters, condo). Some may offer additional features, such as the ability to compare quotes from multiple insurers.

Comparison of Home Insurance Calculator Features and Limitations

While home insurance calculators offer a convenient way to get a preliminary cost estimate, it’s crucial to understand their limitations. The estimates generated are just that – estimates. They do not represent a guaranteed premium. The actual cost of your home insurance will depend on a more thorough underwriting process conducted by the insurance company. Furthermore, the features and capabilities of different calculators can vary significantly. Some calculators might only offer basic estimates based on limited inputs, while others may offer more comprehensive estimations, considering a wider range of factors. The level of detail provided in the output also differs; some might only provide a total premium estimate, while others might break down the cost by coverage type. Therefore, comparing the features and limitations of different calculators before using them is advisable to ensure you are getting the most relevant and useful information for your needs. Always remember to obtain a formal quote from an insurer before making any decisions.

Closing Notes

Ultimately, understanding and effectively using a home insurance calculator is key to securing the right level of protection for your home without overspending. By carefully considering the factors that influence premiums, comparing quotes from different providers, and regularly reviewing your coverage, you can confidently navigate the complexities of home insurance and safeguard your investment.

Essential FAQs

What information do I need to use a home insurance calculator?

Typically, you’ll need your property’s address, estimated value, square footage, age, type of construction, and details about your desired coverage levels (liability, dwelling, personal property, etc.).

Are online home insurance calculators accurate?

Calculators provide estimates. The actual quote from an insurance company may vary due to underwriting factors not included in the calculator.

Can I use a home insurance calculator to compare different insurers?

Yes, using multiple calculators (or the same calculator with different insurer inputs) allows for comparison of estimated premiums.

What happens if I don’t have all the information needed for the calculator?

Most calculators allow for estimations. However, lacking precise data may result in a less accurate premium estimate. It’s best to gather as much information as possible.