Securing your home is a significant financial commitment, and understanding the associated costs is crucial. This guide delves into the intricacies of home insurance, exploring the factors that influence the average monthly cost. We’ll examine various coverage types, regional variations, and strategies for finding affordable premiums, empowering you to make informed decisions about protecting your most valuable asset.

From the impact of your credit score to the benefits of bundling insurance policies, we’ll navigate the complexities of home insurance pricing, providing clear explanations and practical advice. By the end, you’ll have a comprehensive understanding of what influences your monthly premiums and how to potentially reduce them.

Factors Influencing Home Insurance Costs

Understanding the cost of home insurance involves considering several key factors that insurance companies use to assess risk. These factors interact to determine your monthly premium, and it’s helpful to understand how each contributes to the overall price. This allows for informed decision-making when selecting a policy and potentially reducing your costs.

Home Location

Your home’s location significantly impacts insurance premiums. Areas prone to natural disasters like hurricanes, earthquakes, wildfires, or floods command higher premiums due to the increased risk of claims. Similarly, neighborhoods with high crime rates or a history of property damage may also lead to higher costs. For example, a home in a coastal area susceptible to hurricanes will typically have a much higher premium than a similar home located inland in a less disaster-prone region. The insurer considers factors like proximity to fire hydrants, distance from fire stations, and the overall risk profile of the neighborhood.

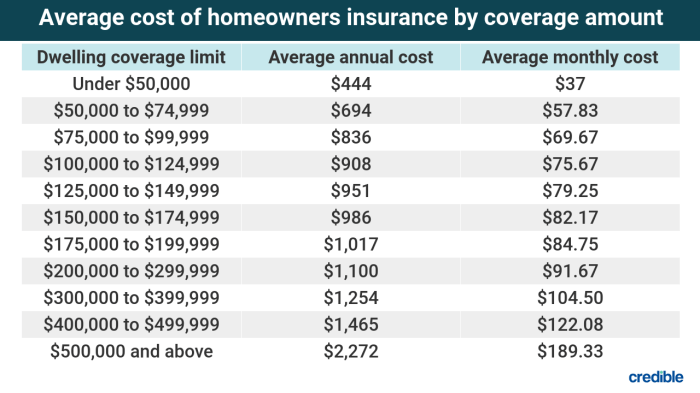

Coverage Type

The type of coverage you choose directly affects your premium. A comprehensive policy offering broader protection against various perils (fire, theft, liability, etc.) will naturally be more expensive than a basic policy with limited coverage. Higher coverage limits for dwelling and personal property also increase premiums. For instance, opting for a policy with replacement cost coverage, which covers the full cost of rebuilding or replacing your home and belongings regardless of market value, will be more expensive than actual cash value coverage, which considers depreciation.

Dwelling Size

The size of your home is a significant factor in determining insurance costs. Larger homes generally require more extensive coverage and thus cost more to insure. This is because the potential cost of damage or loss is higher for larger structures. A 5,000 square foot home will typically have a higher premium than a 1,500 square foot home, even if both are in the same location and have similar coverage levels. The cost of rebuilding a larger home is simply greater.

Credit Score

Many insurance companies use credit-based insurance scores to assess risk. A higher credit score generally correlates with lower premiums, as it suggests a lower likelihood of late payments or financial instability. Conversely, a lower credit score can lead to higher premiums. This is because insurers view individuals with poor credit history as higher risk, indicating a potential for increased claim frequency or difficulty in collecting premiums. The impact of credit score varies by state and insurer.

| Factor | Low Impact on Monthly Cost | Medium Impact on Monthly Cost | High Impact on Monthly Cost |

|---|---|---|---|

| Home Location | Inland, low crime area | Suburban area, moderate crime | Coastal area, high crime, disaster-prone |

| Coverage Type | Basic coverage, low limits | Standard coverage, moderate limits | Comprehensive coverage, high limits |

| Dwelling Size | Small home (under 1500 sq ft) | Medium-sized home (1500-3000 sq ft) | Large home (over 3000 sq ft) |

| Credit Score | Excellent (750+) | Good (650-749) | Fair or Poor (below 650) |

Claims History

Your claims history significantly influences your premiums. A history of filing claims, especially multiple claims, will likely result in higher premiums. Insurers view frequent claims as an indicator of higher risk. Conversely, a clean claims history, indicating responsible homeownership and fewer incidents, can lead to lower premiums. Some insurers may even offer discounts for policyholders with no claims over a specific period.

| Claims History | Average Monthly Premium Increase (Example) |

|---|---|

| No claims in the past 5 years | 0% |

| One claim in the past 5 years | 10-15% |

| Two or more claims in the past 5 years | 20-30% or more |

Note: These percentages are illustrative examples and actual increases will vary based on several factors.

Security Features

Installing security features like burglar alarms, security systems, and smoke detectors can positively impact your premiums. Many insurers offer discounts for homes equipped with these safety measures, as they reduce the likelihood of theft, fire damage, and other insured events. For example, a home with a monitored alarm system might receive a 5-10% discount on its premium. The specific discount offered varies by insurer and the type of security system installed.

Average Monthly Costs by Location

Home insurance premiums vary significantly across different regions of the country, influenced by a multitude of factors. Understanding these regional differences is crucial for homeowners seeking to budget effectively and secure the most appropriate coverage. This section details average monthly costs across various regions, comparing urban and rural premiums, and explores the key factors driving these disparities.

Regional Average Monthly Home Insurance Costs

The following table presents estimated average monthly home insurance costs for selected regions. Note that these figures are averages and actual costs can vary considerably based on individual circumstances and property specifics. The data is based on a compilation of industry reports and publicly available insurance rate information, providing a general overview. It’s important to consult individual insurers for accurate quotes.

| Region | Average Monthly Cost | Highest Monthly Cost | Lowest Monthly Cost |

|---|---|---|---|

| Northeast (e.g., New York, Massachusetts) | $150 | $250 | $100 |

| Southeast (e.g., Florida, Georgia) | $120 | $200 | $75 |

| Midwest (e.g., Illinois, Ohio) | $100 | $175 | $60 |

| Southwest (e.g., Texas, Arizona) | $110 | $180 | $80 |

| West Coast (e.g., California, Oregon) | $160 | $275 | $110 |

Urban vs. Rural Premium Comparison

A bar chart illustrating the difference in average monthly premiums between urban and rural areas would show significantly higher premiums for urban locations. The chart would have two bars for each region (one for urban and one for rural). For example, in the Northeast, the urban bar might reach $175, while the rural bar might only reach $125. This difference would be consistent across all regions, though the exact values would vary. The increased cost in urban areas reflects higher property values, increased risk of theft and vandalism, and higher density leading to a greater potential for claims. The visual representation would clearly demonstrate the substantial premium disparity.

Factors Contributing to Regional Variations

Several key factors contribute to the regional variations observed in home insurance prices. These include:

* Property Values: Higher property values in certain regions naturally lead to higher insurance premiums, as the insurer’s potential payout in case of damage or loss is greater.

* Natural Disaster Risk: Areas prone to hurricanes, earthquakes, wildfires, or floods command significantly higher premiums due to the increased likelihood of substantial claims. Coastal regions, for example, typically face higher rates than inland areas.

* Crime Rates: Higher crime rates in certain urban areas contribute to increased premiums due to a higher risk of theft, vandalism, and other property-related crimes.

* Construction Costs: The cost of rebuilding a home varies geographically, influencing insurance premiums. Areas with high construction costs will typically have higher insurance premiums.

* Competition among Insurers: The level of competition among insurers in a particular region can influence premiums. Highly competitive markets may lead to lower prices.

Finding Affordable Home Insurance

Securing affordable home insurance is a crucial aspect of responsible homeownership. Understanding the factors that influence premiums and employing effective strategies can significantly reduce your monthly costs. This section Artikels practical steps to achieve lower premiums and maintain adequate coverage.

Several strategies can help you lower your monthly home insurance premiums. Implementing these can result in considerable savings over time, without compromising necessary protection for your home and belongings.

Strategies for Reducing Home Insurance Premiums

The following points detail various approaches to potentially lower your home insurance costs. Remember to always compare quotes and thoroughly review policy details before making a decision.

- Improve your home’s security: Installing security systems, such as alarms and security cameras, can significantly reduce your premiums. Many insurers offer discounts for these features, recognizing the reduced risk of theft or damage.

- Increase your deductible: Opting for a higher deductible means you’ll pay more out-of-pocket in case of a claim, but it will lower your monthly premiums. Carefully weigh the potential cost of a higher deductible against the savings in your monthly payments. For example, increasing your deductible from $500 to $1000 could result in a noticeable reduction in your premium.

- Maintain good credit: Insurers often consider your credit score when determining your premiums. Maintaining a good credit history can lead to lower rates. A higher credit score often reflects responsible financial management, which insurers view as a lower risk.

- Bundle your home and auto insurance: Many insurance companies offer discounts for bundling your home and auto insurance policies. This is often a significant way to reduce your overall insurance costs. The savings are often a result of streamlined administration and reduced risk assessment for the insurer.

- Shop around and compare quotes: Obtaining quotes from multiple insurers is essential to finding the best rates. Don’t settle for the first quote you receive; compare prices and coverage options from at least three different companies.

- Consider discounts: Inquire about any available discounts. Insurers may offer discounts for various factors, such as being a long-term customer, belonging to certain professional organizations, or having certain home features like fire-resistant roofing materials.

Benefits of Bundling Home and Auto Insurance

Bundling your home and auto insurance policies with the same provider frequently results in substantial savings. This strategy offers more than just financial advantages; it also simplifies policy management.

The primary benefit is the cost savings through bundled discounts. Insurers often offer significant reductions in premiums for customers who bundle their policies. For instance, a hypothetical 15% discount on both your home and auto insurance could result in considerable annual savings. Additionally, managing both policies through a single provider streamlines billing and communication, making the process more convenient.

Obtaining Quotes from Multiple Insurers

To secure the most competitive home insurance rates, obtaining quotes from several insurers is paramount. This process involves a systematic approach to ensure a comprehensive comparison.

Start by identifying at least three to five different insurance providers operating in your area. You can use online comparison tools or directly contact insurers. Provide consistent information across all quotes to ensure accurate comparisons. Carefully review each quote, paying close attention to the coverage details and any exclusions. Finally, compare the total annual cost, considering deductibles and any discounts offered.

Ending Remarks

Ultimately, understanding the average monthly cost of home insurance involves a multifaceted assessment of individual circumstances and regional factors. While a precise figure remains elusive due to this variability, this guide provides a framework for navigating the complexities of home insurance pricing. By considering the factors discussed and employing the strategies Artikeld, homeowners can confidently secure adequate coverage while managing their monthly expenses effectively. Remember to always obtain multiple quotes and compare policies before making a decision.

FAQ Guide

What is the difference between homeowner’s and renter’s insurance?

Homeowner’s insurance covers damage to the structure of your home and your personal belongings, while renter’s insurance covers your personal belongings and liability. Homeowner’s insurance is for property owners; renter’s insurance is for tenants.

How often can my home insurance premiums change?

Premiums typically change annually upon policy renewal. However, they can also adjust mid-term if your risk profile changes significantly (e.g., major home renovations, claims filed).

Does paying my home insurance annually save me money?

Many insurers offer discounts for paying annually, but this isn’t always the case. Check with your provider to see if this option is available and if it offers a significant savings compared to monthly payments.

What is the impact of a high credit score on my home insurance?

A high credit score often leads to lower premiums as it indicates a lower risk to the insurer. Insurers view individuals with good credit as more likely to pay their bills on time.