Securing your home is a significant investment, and understanding the associated costs is crucial. This guide delves into the complexities of home insurance, exploring what constitutes an “average” premium and the numerous factors influencing its variability. From geographical location and property characteristics to individual circumstances and policy choices, we’ll unpack the elements that shape your home insurance bill.

We will examine regional disparities in average premiums, detailing how factors like natural disaster risk and insurer competition impact costs. Furthermore, we will explore how individual factors, such as credit score and claims history, influence your personal insurance rate. Finally, we’ll provide actionable advice on finding affordable coverage and navigating the often-confusing world of insurance policies.

Regional Variations in Home Insurance Averages

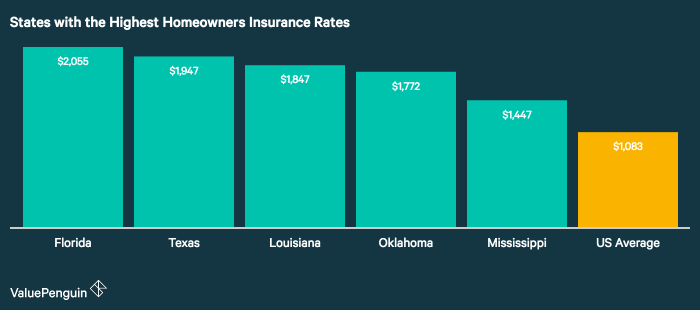

Home insurance costs aren’t uniform across the United States. Significant variations exist between states and regions, influenced by a complex interplay of factors. Understanding these regional differences is crucial for consumers seeking the best value and for insurers in assessing risk and setting premiums.

Factors Contributing to Regional Differences in Premiums

Several key factors contribute to the disparity in average home insurance costs across different regions. These include the frequency and severity of natural disasters, the density of population in an area, the prevalence of crime, the cost of construction and repair materials, and the level of competition among insurance providers. Areas prone to hurricanes, earthquakes, wildfires, or flooding will naturally command higher premiums due to the increased risk. Similarly, regions with high crime rates or a history of significant property damage may also see elevated insurance costs. The availability and competitiveness of insurers within a particular region also play a significant role.

Natural Disaster Risk and Regional Averages

The impact of natural disasters on home insurance premiums is substantial. Coastal regions facing hurricane risks, for instance, typically experience significantly higher premiums than inland areas. California’s wildfire-prone regions see similarly inflated costs. Insurers assess historical data on disaster frequency, severity, and resulting property damage to calculate risk and adjust premiums accordingly. For example, following a major hurricane season, premiums in affected coastal areas may increase substantially as insurers re-evaluate their risk assessments. Similarly, areas experiencing a surge in wildfire activity might face premium increases reflective of the heightened risk.

Local Competition Among Insurers and Regional Averages

The competitive landscape among insurance providers within a given region significantly influences premium levels. Areas with a high concentration of insurers often see more competitive pricing, benefiting consumers. Conversely, regions with limited insurer presence may experience higher premiums due to less competition and potentially less negotiating power for consumers. For example, a state with only a few major insurers operating might have higher average premiums than a state with many competing companies. This competition drives insurers to offer more competitive rates and a wider range of policy options to attract customers.

Illustrative Map of Regional Variations in Average Home Insurance Premiums

Imagine a map of the United States color-coded to represent average home insurance premiums. The darkest shades of red would represent states with the highest average premiums, possibly concentrated along the coasts (due to hurricane and wildfire risks) or in areas with high earthquake activity. Lighter shades of red, transitioning to yellow and then green, would indicate progressively lower average premiums, with the greenest areas representing states with the lowest average costs. Such a map would visually highlight the significant regional disparities in home insurance costs, illustrating the considerable influence of factors like geographic location, natural disaster risk, and the competitive landscape of the insurance market. The map would also serve as a useful tool for consumers to compare average costs across different regions and gain a better understanding of the factors driving these variations.

Resources for Finding Affordable Home Insurance

Securing affordable home insurance requires proactive research and strategic planning. This section Artikels key resources and strategies to help you navigate the process and find the best coverage at a price that fits your budget. Understanding your options and employing effective negotiation techniques can significantly impact your premiums.

Comparison Websites and Insurance Brokers

Numerous online resources facilitate the comparison of home insurance quotes from multiple providers. Websites such as NerdWallet, Policygenius, and The Zebra allow you to input your details and receive quotes from various insurers simultaneously, enabling side-by-side comparisons based on coverage and price. Independent insurance brokers can also be invaluable; they represent you, not the insurance companies, and can access a wider range of policies than you might find independently. They can often negotiate better rates on your behalf due to their established relationships with insurers.

Negotiating Lower Premiums

Negotiating lower premiums is achievable through several strategies. First, shop around and obtain multiple quotes; this demonstrates your willingness to switch providers, potentially encouraging insurers to offer more competitive pricing. Secondly, consider bundling your home and auto insurance with the same company; many insurers offer discounts for bundled policies. Thirdly, inquire about discounts based on your individual circumstances – security systems, fire suppression systems, or even your credit score (where legally permissible) can positively influence your premium. Finally, be prepared to negotiate. Don’t hesitate to politely discuss your findings from other insurers and express your desire for a lower rate, highlighting your loyalty or length of coverage if applicable.

Improving Insurability

Several factors influence your insurability and consequently your premiums. Improving your home’s security features, such as installing a security system or upgrading locks, can significantly reduce your risk profile and lead to lower premiums. Regular maintenance and updates to your home, including roof repairs and plumbing upgrades, demonstrate responsible homeownership and reduce the likelihood of claims. Maintaining a good credit score (where applicable) can also impact your premiums positively, as insurers often view a good credit score as an indicator of responsible financial behavior.

Types of Home Insurance Policies

Different types of home insurance policies offer varying levels of coverage and, consequently, premiums. A standard homeowners insurance policy typically covers damage to your home’s structure, personal belongings, and liability for injuries or accidents on your property. However, you might consider additional coverage options such as flood insurance (often purchased separately) or earthquake insurance, depending on your location and risk factors. Understanding the specific coverages offered by each policy is crucial for making an informed decision. While comprehensive coverage provides peace of mind, it usually comes at a higher cost. Conversely, a more basic policy might save money but leave you vulnerable to certain types of losses.

A Step-by-Step Guide to Finding Affordable Home Insurance

- Gather Information: Collect details about your home, including its age, size, location, and any security features.

- Compare Quotes: Utilize online comparison websites and/or contact independent insurance brokers to obtain multiple quotes.

- Negotiate Premiums: Contact insurers directly to discuss your quotes and explore potential discounts based on your circumstances.

- Review Policy Details: Carefully review the policy details of each quote, paying close attention to coverage limits and exclusions.

- Choose the Best Policy: Select the policy that offers the most comprehensive coverage at a price you can comfortably afford.

Epilogue

Navigating the world of home insurance can feel overwhelming, but understanding the key factors influencing your premium is the first step toward securing affordable and appropriate coverage. By considering your location, property specifics, individual circumstances, and policy options, you can make informed decisions to protect your most valuable asset. Remember to compare quotes from multiple insurers and leverage strategies to potentially lower your premiums. Ultimately, a well-informed approach ensures peace of mind knowing your home is adequately protected.

FAQ

What is the average deductible for home insurance?

Average deductibles vary widely, typically ranging from $500 to $2,000, depending on coverage and insurer. Higher deductibles generally lead to lower premiums.

How often can I expect my home insurance premium to change?

Premiums are typically reviewed annually. Changes can be influenced by factors like claims history, changes in your property, or shifts in the insurance market.

Does my home’s age affect my insurance premium?

Yes, older homes may have higher premiums due to potential increased risk of needing repairs or replacement of outdated systems. However, well-maintained older homes may not see a significant increase.

Can I bundle my home and auto insurance for a discount?

Yes, many insurers offer discounts for bundling home and auto insurance policies. This can lead to significant savings.