Owning a home is a significant investment, a symbol of stability and security. However, unforeseen events like fires, storms, or theft can quickly transform this dream into a financial nightmare. Understanding home hazard insurance costs is therefore crucial, not just for protecting your property but also for safeguarding your financial future. This guide delves into the intricacies of home hazard insurance, equipping you with the knowledge to make informed decisions and secure adequate coverage.

From identifying key factors influencing premiums to navigating the complexities of policy documents and claims processes, we’ll explore everything you need to know about minimizing your costs while maximizing your protection. We’ll examine how location, home age, and coverage choices impact your premiums, providing practical strategies for finding affordable insurance and avoiding costly surprises.

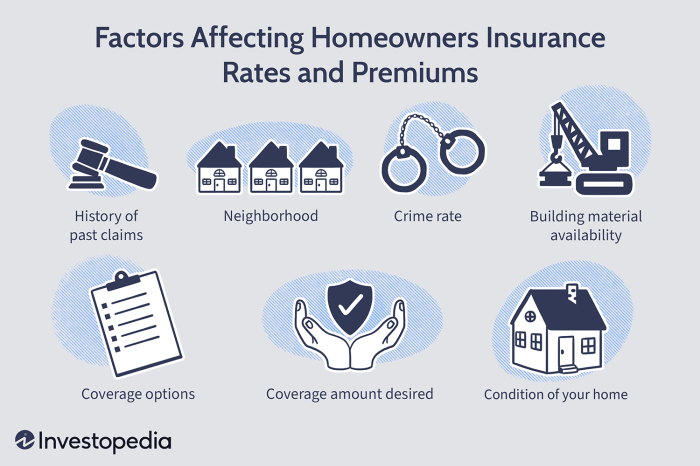

Factors Influencing Home Hazard Insurance Costs

Understanding the factors that determine your home hazard insurance premiums is crucial for budgeting and securing adequate coverage. Several key elements contribute to the final cost, and understanding these can help you make informed decisions. This section will explore the most significant factors, allowing you to better comprehend your insurance costs.

Top Five Factors Impacting Home Hazard Insurance Premiums

Several interconnected factors significantly influence the cost of your home hazard insurance. These factors, often considered by insurance companies in their risk assessment, directly impact the premium you pay.

| Factor | Description | Impact on Cost | Example |

|---|---|---|---|

| Location | Geographic location, including proximity to fire hazards, flood zones, or earthquake fault lines. | Higher risk areas result in significantly higher premiums. | A home in a coastal area prone to hurricanes will have a much higher premium than a home in a landlocked, less disaster-prone region. |

| Home Age and Condition | The age of the home and its overall condition, including the state of the roof, plumbing, electrical systems, and foundation. | Older homes or those requiring significant repairs will generally have higher premiums. | A 50-year-old home with a worn roof and outdated electrical system will likely cost more to insure than a newly constructed home with modern building codes. |

| Coverage Amount | The amount of insurance coverage selected to rebuild or repair your home in case of damage. | Higher coverage amounts lead to higher premiums. | Choosing a coverage amount that accurately reflects the cost of rebuilding your home, even with inflation considered, is crucial. Underinsuring can leave you vulnerable in case of a major event. |

| Deductible Amount | The amount you agree to pay out-of-pocket before your insurance coverage kicks in. | Higher deductibles result in lower premiums, and vice versa. | Selecting a $5,000 deductible will generally result in lower premiums than a $1,000 deductible. |

| Credit Score | Your credit score is often used by insurers as an indicator of risk. | A higher credit score typically leads to lower premiums. | Insurers often view individuals with good credit as less risky and therefore offer them more favorable rates. |

The Role of Location in Determining Insurance Costs

Location plays a pivotal role in determining home hazard insurance costs. Insurance companies carefully assess the risk associated with various geographic areas. High-risk areas, such as those prone to natural disasters or high crime rates, command significantly higher premiums than lower-risk areas.

High-risk areas often include coastal regions susceptible to hurricanes and flooding, areas prone to wildfires, or regions with a high frequency of earthquakes. For example, homes located within designated floodplains will face substantially higher premiums due to the increased likelihood of flood damage. Conversely, homes situated in less hazardous areas, such as those in the interior of the country far from natural disaster zones and with low crime rates, will generally have lower premiums. The underlying principle is that the greater the potential for loss, the higher the cost of insurance.

Home Age and Condition’s Impact on Insurance Premiums

The age and condition of a home directly influence insurance premiums. Older homes, particularly those with outdated systems or deferred maintenance, are considered higher risk than newer homes built to modern building codes. A newly constructed home, built with modern materials and safety features, typically receives lower premiums. Conversely, an older home requiring significant repairs, such as a new roof, plumbing upgrades, or foundation work, will often result in higher premiums due to the increased likelihood of future claims.

For example, let’s compare a newly built home and a 70-year-old home needing a new roof and significant foundation repairs. The newly built home might receive a premium of $1,000 annually, reflecting its low risk profile. The older home, due to its age and required repairs, could face a premium of $2,500 or more annually, reflecting the increased risk associated with potential issues. This substantial difference highlights the importance of home maintenance and its impact on insurance costs.

Types of Home Hazards Covered

Understanding the types of home hazards covered by your insurance policy is crucial for protecting your financial well-being. A comprehensive policy offers protection against a wide range of potential events that could damage your property or cause you financial liability. Knowing what’s included, and equally important, what’s excluded, is key to making informed decisions about your coverage.

Home hazard insurance policies typically cover a variety of risks, offering different levels of protection depending on the specific policy and endorsements purchased. It’s vital to carefully review your policy documents to understand the exact terms and conditions.

Common Home Hazards and Coverage

The following list details common home hazards and the type of coverage usually provided. Remember that specific coverage can vary significantly between insurance providers and policy types.

- Fire and Smoke Damage: Most policies cover damage caused by fire, including smoke and soot. This typically includes the cost of repairs or replacement of damaged structures and belongings.

- Wind and Hail Damage: Coverage often extends to damage caused by strong winds and hailstorms, encompassing roof damage, broken windows, and siding damage.

- Theft and Vandalism: Policies generally cover losses due to theft or vandalism, including the replacement of stolen or damaged property.

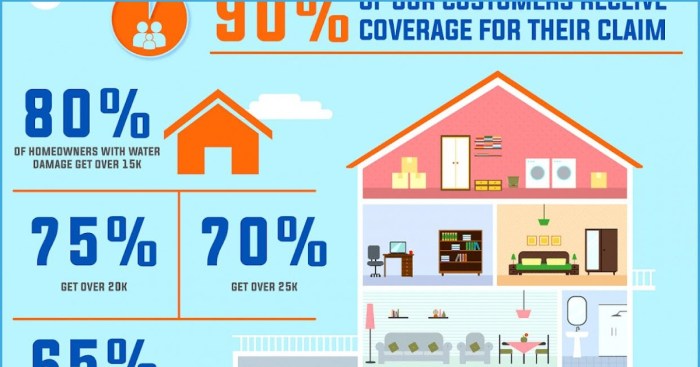

- Water Damage (excluding floods): Many policies cover damage from burst pipes, overflowing appliances, or other water-related incidents, but typically exclude flood damage, which usually requires separate flood insurance.

- Liability Coverage: This protects you financially if someone is injured on your property or you are held legally responsible for damage to someone else’s property.

- Falling Objects: Coverage can extend to damage caused by falling trees, branches, or other objects onto your home or property.

- Freezing Pipes: Damage caused by frozen and burst pipes is usually covered, provided steps were taken to prevent freezing (e.g., maintaining appropriate temperatures).

Natural Disasters vs. Other Hazards: Coverage Comparison

Coverage for natural disasters often differs significantly from coverage for other hazards. Many standard homeowners’ insurance policies exclude or limit coverage for certain catastrophic events. Understanding these differences is critical in determining the appropriate level of protection.

| Hazard Type | Coverage Type | Limitations |

|---|---|---|

| Fire | Typically comprehensive, covering damage to structure and contents. | May exclude damage caused by specific events, such as arson if proven intentional. |

| Theft | Covers loss or damage of personal property due to theft. | May have limits on the value of certain items (e.g., jewelry, cash) and may require additional endorsements for higher-value possessions. |

| Flood | Usually requires separate flood insurance policy. Not included in standard homeowners’ insurance. | Flood insurance has its own set of limitations, including waiting periods after policy purchase. |

| Earthquake | Usually requires a separate earthquake endorsement or policy. | Earthquake coverage often has deductibles significantly higher than standard homeowners’ insurance. |

| Wildfire | Coverage varies widely depending on location and insurer. | May have specific limitations regarding debris removal and the extent of rebuilding after a wildfire. |

Policy Exclusions and Limitations

It’s crucial to understand the exclusions and limitations within your policy. These clauses specify events or circumstances not covered by your insurance. Ignoring these can lead to significant financial burdens in the event of a covered loss.

Common exclusions include, but are not limited to:

- Normal wear and tear: Damage resulting from gradual deterioration is generally not covered.

- Neglect or intentional damage: Damage caused by homeowner negligence or intentional acts is typically excluded.

- Acts of war or nuclear events: These are usually excluded from standard homeowners’ insurance policies.

- Earth movement (excluding covered events specified in the policy): While some policies may cover earthquake damage with an endorsement, ground settling or landslides are often excluded.

- Mold and fungus: Unless caused by a covered peril (e.g., water damage), mold and fungus remediation is usually excluded.

Wrap-Up

Securing adequate home hazard insurance is not merely about mitigating financial risk; it’s about achieving peace of mind. By understanding the factors that influence costs, comparing policy options, and proactively managing your coverage, you can protect your most valuable asset – your home – and secure your financial well-being. Remember, proactive planning and informed decision-making are key to navigating the complexities of home insurance and ensuring you have the right protection for your specific needs and circumstances.

FAQ Insights

What is the difference between actual cash value (ACV) and replacement cost coverage?

ACV coverage pays for the current market value of damaged property, minus depreciation. Replacement cost coverage pays for the cost of replacing the damaged property with new, similar items, without deducting for depreciation.

How often should I review my home insurance policy?

It’s recommended to review your policy annually, or whenever there are significant changes to your property, such as renovations, additions, or increased valuable possessions.

Can I get discounts on my home insurance?

Yes, many insurers offer discounts for various factors, including security systems, fire alarms, bundling policies (home and auto), and claims-free history.

What should I do immediately after a covered incident occurs?

Contact your insurance company as soon as possible to report the incident, then take steps to protect your property from further damage (if safe to do so), and document the damage with photos and videos.