Navigating the world of insurance can feel like deciphering a complex code, especially when considering the potential savings of bundling your home and car insurance. This comprehensive guide demystifies the process of obtaining home car insurance quotes, empowering you to make informed decisions and secure the best possible coverage at the most competitive price. We’ll explore everything from understanding different policy types to negotiating the best rates and filing claims effectively.

From comparing quotes from various providers to understanding the factors influencing your premium, this guide serves as your roadmap to securing comprehensive protection for your home and vehicle. We’ll delve into the intricacies of policy details, highlight money-saving strategies, and provide practical advice for navigating the often-confusing world of insurance paperwork.

Understanding “Home Car Insurance Quotes”

Home car insurance quotes represent the estimated cost of insuring both your home and your vehicle(s) through a single insurance provider. This bundled approach is frequently offered by insurance companies as a way to simplify the insurance process and potentially save money. Understanding the components of these quotes and the various policy options available is crucial for making informed decisions.

A home car insurance quote typically includes coverage for your home (homeowners or renters insurance) and your car(s) (auto insurance). These policies often have distinct components, but are priced together to offer a combined premium. The home insurance portion covers damage or loss to your home and its contents, as well as liability for accidents that occur on your property. The auto insurance portion covers damage to your vehicle, liability for accidents you cause, and potentially medical expenses for those involved.

Types of Insurance Policies Included in Quotes

Home car insurance quotes usually incorporate several types of coverage. For home insurance, this might include dwelling coverage (the structure itself), personal liability (protecting you from lawsuits), and contents coverage (your belongings). Auto insurance typically includes liability coverage (covering injuries and damages to others), collision coverage (damage to your car from an accident), comprehensive coverage (damage from events like theft or hail), and uninsured/underinsured motorist coverage (protection if you’re involved in an accident with an uninsured driver). Some policies may also include additional coverages, such as medical payments, roadside assistance, or rental car reimbursement. These add-ons can increase the overall premium but offer greater protection.

Situations Where Bundled Insurance is Beneficial

Bundling home and car insurance can be advantageous in various situations. For example, a homeowner with a single vehicle might find it simpler and more cost-effective to manage a single policy rather than two separate ones. Similarly, individuals who value convenience and streamlined billing appreciate the ease of a combined policy. Significant savings are often possible, as insurance companies often offer discounts for bundling policies. This is because they can reduce administrative costs and mitigate risk by insuring multiple assets for a single client. For example, a family living in a suburban area with two vehicles might save hundreds of dollars annually by bundling their home and auto insurance.

Advantages and Disadvantages of Bundled Home and Car Insurance

| Feature | Advantages | Disadvantages |

|---|---|---|

| Cost | Often lower premiums due to discounts offered by insurers. Simplified billing and payment process. | May not always be the cheapest option compared to separate policies from different providers. |

| Convenience | Simplified policy management with a single provider and a single bill. Easier to make changes or file claims. | Less flexibility in choosing individual coverage options. Switching providers for either home or auto insurance may be more complex. |

| Coverage | Comprehensive coverage for both home and auto, potentially including additional benefits. | Potential for limited choice in specific coverage details. May not offer the most specialized or customized coverage. |

| Customer Service | Single point of contact for all insurance needs. | Potentially longer wait times or less personalized service if the insurer is very large. |

Factors Affecting Quote Prices

Several key factors influence the price of car and home insurance quotes. Insurance companies use complex algorithms to assess risk, and your individual circumstances significantly impact the final premium. Understanding these factors can help you make informed decisions and potentially secure more favorable rates.

Driving History’s Impact on Car Insurance Premiums

Your driving record is a primary determinant of your car insurance cost. Insurance companies meticulously review your history for accidents, traffic violations, and claims. A clean driving record, characterized by no accidents or tickets within a specified period (often three to five years), typically results in lower premiums. Conversely, accidents, especially those deemed your fault, significantly increase your premiums. Similarly, multiple speeding tickets or other moving violations will raise your rates. The severity of the incident also plays a crucial role; a minor fender bender will have less impact than a serious accident involving injuries or significant property damage. For example, a driver with a history of three at-fault accidents in the past five years can expect substantially higher premiums compared to a driver with a spotless record.

Home Features and Their Influence on Home Insurance Costs

The characteristics of your home significantly affect your home insurance premium. Factors such as the age of your home, its construction materials (brick homes are generally considered more fire-resistant than wood-framed homes), the presence of security systems (alarms and security cameras can lead to discounts), and the location of your property all play a role. For instance, a home located in a high-risk area prone to wildfires or hurricanes will command higher premiums than a similar home in a low-risk area. The presence of features like updated plumbing and electrical systems can also influence the premium; these features often indicate a lower risk of damage and subsequent claims. A home with a newer roof, for example, is less likely to require costly repairs due to weather damage, potentially resulting in lower premiums.

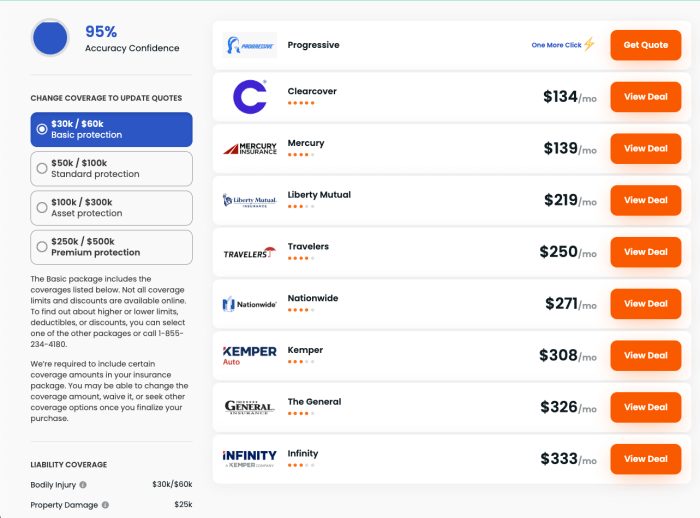

Pricing Differences Between Insurance Providers

Car and home insurance premiums vary considerably among different insurance providers. This is due to a variety of factors, including the company’s risk assessment models, their overhead costs, and their specific underwriting practices. Some insurers may specialize in insuring particular types of homes or drivers, allowing them to offer more competitive rates in certain segments. It’s crucial to compare quotes from multiple insurers to identify the most favorable rates for your specific circumstances. For example, a young driver with a less-than-perfect driving record might find significantly different premiums between a large national insurer and a smaller, regional company that focuses on young drivers. The availability of discounts also varies widely across providers; some may offer discounts for bundling home and auto insurance, while others might offer discounts for safe driving habits or for installing specific home security systems.

Saving Money on Insurance

Securing affordable home and car insurance is a priority for many. Fortunately, several strategies can significantly reduce your premiums. By understanding these methods and implementing them effectively, you can achieve substantial savings without compromising the essential protection these policies provide.

This section Artikels practical steps to lower your insurance costs, focusing on driving record, credit score, home security, and bundling options.

Good Driving Record and Credit Score

Maintaining a clean driving record is paramount for lower car insurance premiums. Insurance companies view drivers with fewer accidents and traffic violations as lower risk. A history of safe driving, demonstrated by a lack of at-fault accidents and speeding tickets, translates directly into lower rates. Similarly, a good credit score often correlates with responsible financial behavior, making you a less risky client for insurers. Many insurance companies use credit scores to assess risk, and a higher credit score typically leads to lower premiums for both home and auto insurance. For example, a driver with a spotless record for five years might qualify for a significant discount compared to someone with multiple accidents or moving violations. Similarly, someone with an excellent credit score (750 or above) could see a substantial reduction in their premiums compared to someone with a poor credit score.

Home Security Measures

Implementing robust home security measures can result in lower home insurance premiums. Insurance companies recognize that homes with effective security systems—including alarms, security cameras, and strong locks—are less prone to burglaries and vandalism. These security features demonstrate a proactive approach to risk mitigation, leading to reduced premiums. For instance, installing a monitored security system often qualifies homeowners for a significant discount, sometimes up to 20% or more, depending on the insurer and the system’s features. Features like fire alarms and smoke detectors can also contribute to lower premiums by mitigating fire-related risks.

Bundling Insurance Policies

Bundling your home and car insurance policies with the same insurer often leads to significant savings. Insurers frequently offer discounts for customers who bundle their policies, rewarding loyalty and simplifying their administrative processes. These discounts can range from a few percentage points to a substantial portion of your overall premium. For example, a customer might receive a 10-15% discount by bundling their home and auto insurance, effectively reducing their combined annual cost. This strategy not only saves money but also simplifies bill payment and policy management.

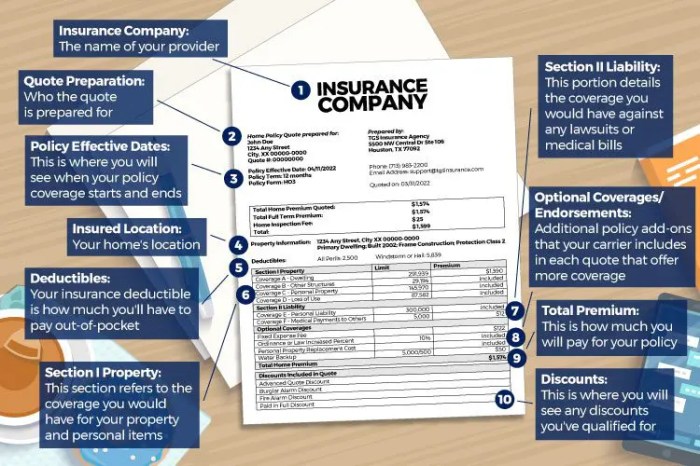

Understanding Policy Documents

Receiving your home and car insurance policy documents can feel overwhelming. However, understanding the key sections is crucial for ensuring you’re adequately covered and aware of your responsibilities. This section will guide you through the essential parts of a typical policy, clarifying common terminology along the way.

Key Sections of a Home and Car Insurance Policy

A typical policy document is divided into several sections, each providing critical information about your coverage. Familiarizing yourself with these sections will help you understand your policy’s scope and limitations.

- Declaration Page: This is the summary page of your policy. It lists your name, address, policy number, coverage details (like liability limits and deductibles), and the effective dates of your coverage. Think of it as your policy’s table of contents.

- Coverage Sections: This section details the specific types of coverage you have purchased. For home insurance, this might include dwelling coverage, liability coverage, and personal property coverage. For car insurance, this might include liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Each coverage type will have its own description and limitations.

- Exclusions: This is a crucial section that Artikels what is *not* covered by your policy. Understanding exclusions prevents unexpected surprises if a claim is denied. For example, flood damage might be excluded from a standard homeowner’s policy, requiring separate flood insurance.

- Conditions: This section describes your responsibilities as a policyholder. It Artikels what you must do in the event of a claim (e.g., reporting the incident promptly, cooperating with the investigation). It also might include details on cancellation and renewal procedures.

- Definitions: This section clarifies the meaning of key terms used throughout the policy. It’s a valuable resource for understanding the specific legal language used in insurance contracts.

Common Policy Jargon and Terminology

Insurance policies often use specialized terminology. Understanding this language is key to comprehending your coverage.

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in. For example, a $500 deductible means you pay the first $500 of any claim.

- Premium: The amount you pay regularly (monthly, quarterly, or annually) to maintain your insurance coverage.

- Liability Coverage: This covers damages or injuries you cause to others. For example, if you cause a car accident, liability coverage would help pay for the other person’s medical bills and vehicle repairs.

- Comprehensive Coverage (Auto): This covers damage to your vehicle from events other than collisions, such as theft, vandalism, or weather damage.

- Actual Cash Value (ACV): The replacement cost of an item minus depreciation. This is often used to determine the payout for damaged property.

- Replacement Cost Value (RCV): The cost to replace an item with a new one of similar kind and quality, regardless of depreciation. This is generally a more expensive coverage option.

Visual Guide to Policy Document Key Aspects

Imagine a policy document represented visually as a layered pie chart.

* The outermost layer (largest section): Represents the Coverage Sections. This is the core of your policy, detailing what is covered (e.g., liability, collision, dwelling, personal property).

* The next inner layer: Represents the Conditions and Exclusions. This shows the limitations and responsibilities that come with your coverage. This layer is smaller than the Coverage layer but equally important.

* The central, smallest section: Represents the Declaration Page. This is the summary providing policy details like your name, policy number, and effective dates.

This visual representation emphasizes that while the coverage details are the most extensive part, understanding the conditions and exclusions is vital for proper protection. The declaration page serves as the entry point to access all this information.

Filing a Claim

Filing an insurance claim, whether for your home or car, can seem daunting, but understanding the process can make it significantly less stressful. This section details the steps involved, provides examples of common claim scenarios, and Artikels the necessary documentation. Remember to always refer to your specific policy documents for detailed instructions and coverage specifics.

Claim Filing Steps

The process of filing a claim generally involves several key steps. First, report the incident promptly to your insurance company. This initial notification starts the claims process. Next, gather all relevant documentation to support your claim. This might include police reports, photos, repair estimates, and receipts. Following this, you’ll likely need to complete a claim form, providing detailed information about the incident and the resulting damages. Your insurance company will then investigate the claim, which may involve inspections or interviews. Finally, once the investigation is complete and liability is determined, your claim will be processed, and you will receive payment or other compensation as Artikeld in your policy.

Claim Scenarios and Handling

Different types of incidents require different approaches to filing a claim. For example, a car accident requires immediate notification to the police and your insurer, followed by documenting the damage with photos and obtaining witness statements. In contrast, a home burglary necessitates a police report and a detailed inventory of stolen or damaged items, supported by receipts or purchase records. A hail storm damaging your home would involve taking photos of the damage and contacting a qualified contractor for an estimate of repairs. Each scenario necessitates a specific approach to documentation and reporting.

Required Documentation

Supporting your claim with comprehensive documentation is crucial for a smooth and efficient process. Generally, this includes a completed claim form, police reports (if applicable), photographs or videos of the damage, repair estimates from qualified professionals, receipts for any expenses incurred due to the incident, and any relevant correspondence with other parties involved. The more detailed and thorough your documentation, the faster and more likely your claim will be approved.

Claim Filing Process Flowchart

Imagine a flowchart. The first box would be “Incident Occurs.” This flows to “Report Incident to Insurer.” From there, two branches diverge: “Police Report Required?” (Yes/No). If yes, the process flows to “Obtain Police Report” before continuing to “Gather Documentation.” If no, it proceeds directly to “Gather Documentation.” After “Gather Documentation,” the process continues to “Complete Claim Form,” then to “Insurer Investigation,” and finally to “Claim Processed/Payment.” This visual representation clarifies the sequential nature of the process.

Conclusion

Securing affordable and comprehensive home and car insurance doesn’t have to be an overwhelming task. By understanding the factors that influence your premiums, effectively comparing quotes, and leveraging strategies to reduce costs, you can achieve significant savings without compromising on essential coverage. Remember, informed choices lead to better protection and peace of mind. Take control of your insurance needs and start saving today.

FAQ Corner

What is the difference between liability and comprehensive coverage?

Liability coverage protects you against financial responsibility for accidents you cause, while comprehensive coverage protects your vehicle against damage from events not involving a collision, such as theft or hail.

How often should I review my insurance policies?

It’s recommended to review your policies annually, or whenever there’s a significant life change (e.g., moving, new car, marriage).

Can I bundle my renters insurance with my car insurance?

Yes, many insurers offer bundled packages including renters, homeowners, and auto insurance. Check with your provider for availability.

What happens if I have a lapse in my insurance coverage?

A lapse in coverage can lead to higher premiums in the future and may leave you without protection during the lapse period. Maintaining continuous coverage is crucial.

What documents do I need to file a claim?

Typically, you’ll need police reports (if applicable), photos of the damage, and details of the incident. Your insurer will provide specific instructions.