Navigating the world of insurance can feel overwhelming, especially when considering the often intertwined costs of protecting your home and your vehicle. Understanding home car insurance quotes is crucial for securing the best possible coverage at a price that fits your budget. This guide provides a clear and concise overview of the process, from obtaining quotes to comparing options and understanding the various factors influencing the final price.

We will explore the key components of a typical quote, the factors influencing its cost (including your driving history, vehicle details, and location), and the steps involved in obtaining and comparing multiple quotes from different providers. We’ll also delve into the benefits and drawbacks of bundling your home and auto insurance, ensuring you’re equipped to make informed decisions that safeguard your assets.

Comparing Home Car Insurance Quotes

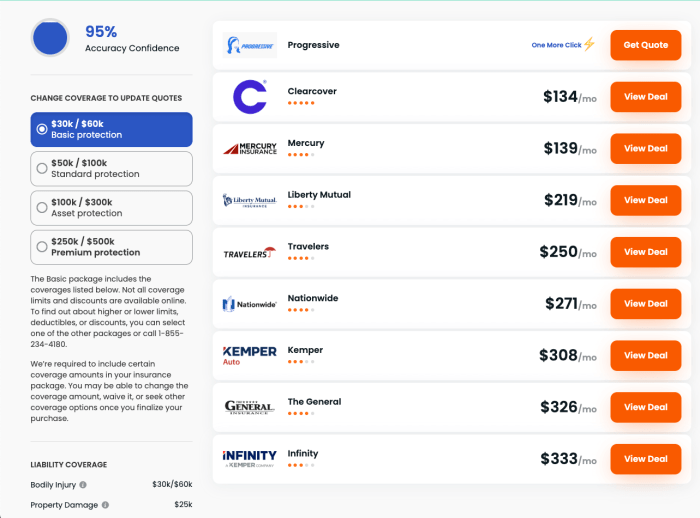

Obtaining multiple home car insurance quotes is a crucial step in securing the best possible coverage at the most competitive price. Carefully comparing these quotes, however, requires a keen eye for detail and an understanding of what factors truly matter. Failing to do so could result in overpaying for inadequate coverage or unknowingly accepting policies with hidden costs.

Comparing quotes involves more than just looking at the bottom-line price. A lower premium might seem attractive, but insufficient coverage could leave you financially vulnerable in the event of an accident or disaster. Conversely, a higher premium might reflect superior coverage that ultimately provides better value. Understanding the nuances of policy details is key to making an informed decision.

Key Aspects of Home Car Insurance Quote Comparison

To effectively compare home car insurance quotes, you should focus on several key aspects beyond the premium amount. These include the coverage limits, deductibles, policy exclusions, and the insurer’s financial stability and customer service reputation. A comprehensive comparison ensures you’re choosing a policy that aligns with your specific needs and risk tolerance. Consider the potential impact of each aspect on your financial well-being should an unforeseen event occur.

Potential Pitfalls and Hidden Costs

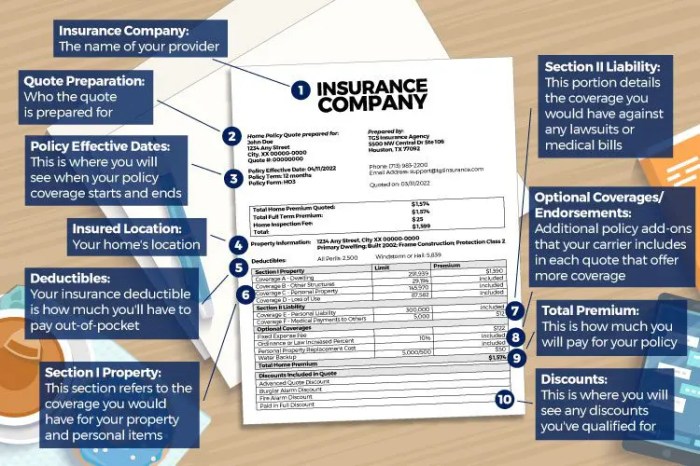

Several potential pitfalls and hidden costs can significantly impact the overall cost of your home car insurance. These often go unnoticed during a cursory review. For example, some insurers might offer seemingly low premiums, only to increase them substantially at renewal. Others might have hidden fees or charges associated with specific services or claims processes. Thorough investigation and a careful reading of the policy documents are essential to avoid these traps. For example, a policy might exclude certain types of coverage, or might have limitations on the amount paid out in certain scenarios. This could lead to unexpected out-of-pocket expenses in the event of a claim.

Questions to Ask Insurance Providers

Before committing to a home car insurance policy, it’s vital to directly address your concerns and seek clarifications. This proactive approach ensures you’re fully informed and can make a confident decision. It’s important to ask about specific details and to understand the implications of each aspect of the policy.

- What are the specific coverage limits for liability, collision, and comprehensive coverage?

- What is the deductible for each type of coverage, and how does it affect the premium?

- Are there any exclusions or limitations in the policy, and what are the circumstances under which coverage might be denied?

- What is the insurer’s financial strength rating, and what does this indicate about their ability to pay claims?

- What is the insurer’s customer service record, and what is their claims processing procedure?

- What discounts are available, and am I eligible for any of them (e.g., multi-car, good driver, safety features)?

- How will my premium be affected by factors such as my driving record, age, and location?

- What is the process for filing a claim, and what documentation will be required?

- What are the options for paying my premiums, and are there any penalties for late payments?

- Can I make changes to my policy after it has been issued, and what are the associated costs?

Summary

Ultimately, securing a home car insurance quote is about more than just numbers; it’s about securing your financial well-being and peace of mind. By understanding the factors influencing quote prices, diligently comparing options, and asking the right questions, you can confidently choose a policy that provides adequate protection without breaking the bank. Remember, taking the time to research and compare ensures you receive the best possible coverage tailored to your specific needs and circumstances.

Clarifying Questions

What is the difference between liability and collision coverage?

Liability coverage protects you if you cause an accident, paying for the other person’s damages. Collision coverage protects your vehicle in an accident, regardless of fault.

How often should I review my insurance policy?

It’s recommended to review your policy annually or whenever there’s a significant life change (new car, move, etc.) to ensure you have adequate coverage.

Can I get a quote without providing my driving history?

No, your driving history is a key factor in determining your insurance rates. Providing accurate information is essential for getting an accurate quote.

What happens if I make a claim?

The claims process varies by insurer, but generally involves reporting the incident, providing necessary documentation, and cooperating with the investigation.