Navigating the world of insurance can feel overwhelming, especially when considering both home and auto coverage. Bundling these essential protections offers potential cost savings and streamlined management, but understanding the intricacies of home auto insurance quotes is key to securing the best deal. This guide will demystify the process, helping you compare quotes effectively and make informed decisions to protect your assets and your budget.

We’ll explore the various factors influencing your insurance costs, from your driving history and home security features to the specific coverage options available. Learning how to compare quotes from different providers, understand policy details, and identify potential discounts will empower you to find the most suitable and affordable home and auto insurance package.

Understanding “Home Auto Insurance Quotes”

Home auto insurance quotes are estimates of how much it will cost to insure both your home and your vehicle(s) with a single insurance provider. Bundling these policies together often leads to savings compared to purchasing separate home and auto insurance policies. Understanding these quotes involves knowing what factors influence the price and what coverage options are available.

A home auto insurance quote details the estimated premium you’ll pay for a specific coverage level. This premium is calculated based on several factors, including your location, credit history, the age and type of your home and vehicles, your driving record, and the amount of coverage you choose.

Bundled Home and Auto Insurance Packages

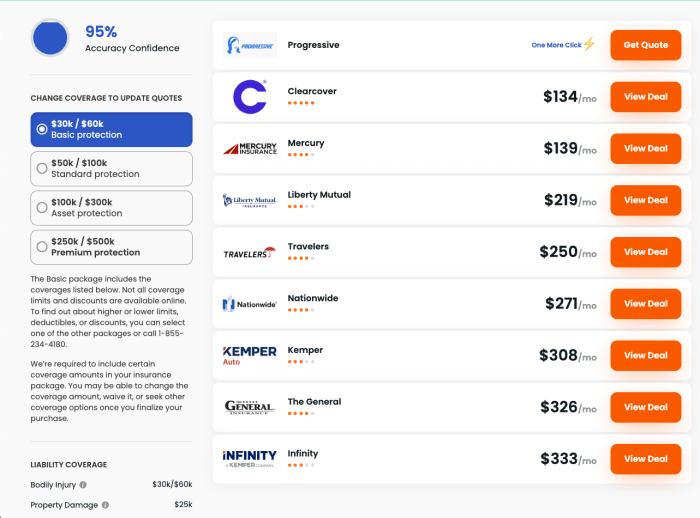

Bundling your home and auto insurance means purchasing both policies from the same insurance company. This often results in lower premiums than buying separate policies. Here are examples of different bundled packages:

- Basic Package: This typically includes liability coverage for both home and auto, covering damages caused to others. It might also include a minimal amount of property coverage for your home and collision/comprehensive coverage for your vehicle.

- Comprehensive Package: This offers broader coverage, including higher liability limits, more extensive property coverage for your home (covering things like fire, theft, and weather damage), and comprehensive auto coverage (covering damage from accidents, theft, and vandalism).

- Premium Package: This includes all the features of a comprehensive package, plus additional benefits such as higher coverage limits, replacement cost coverage for your home, and specialized auto coverage (e.g., for classic cars or high-value vehicles).

The specific coverage options and their costs will vary depending on the insurance company and your individual circumstances. For example, a homeowner with a newer, high-value home in a high-risk area might find that a premium package offers better value than a basic package, even if it’s more expensive upfront. Conversely, someone with an older home and a standard vehicle might find that a basic package adequately covers their needs.

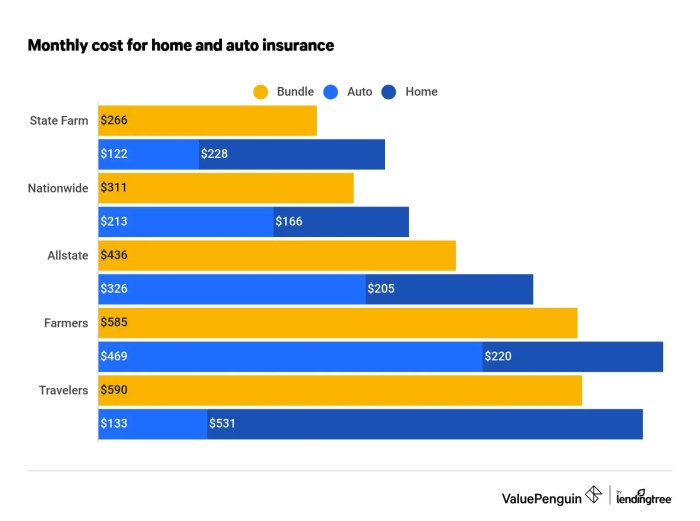

Comparison of Bundled vs. Separate Quotes

The key difference lies in the overall cost and convenience. A bundled quote typically offers a lower premium than purchasing separate home and auto insurance policies. This is because insurance companies often offer discounts for bundling policies, incentivizing customers to consolidate their coverage.

| Feature | Bundled Quote | Separate Quotes |

|---|---|---|

| Premium Cost | Generally lower due to discounts | Generally higher, no bundling discounts |

| Convenience | One bill, one company to contact for claims | Two separate bills, two companies to manage |

| Coverage Options | May offer bundled discounts or specialized options | More flexibility in choosing different coverage levels from different insurers |

| Claims Process | Simplified claims process with a single provider | More complex claims process with two different providers |

For example, imagine a homeowner with a $300,000 home and a standard vehicle. A separate home insurance quote might be $1,500 annually, and a separate auto insurance quote might be $1,000 annually, totaling $2,500. A bundled quote from the same company might offer a 10% discount, reducing the total annual premium to $2,250. The exact savings will vary depending on the insurance company, the individual’s risk profile, and the chosen coverage levels.

Factors Affecting Home Auto Insurance Quotes

Several interconnected factors influence the cost of your home and auto insurance premiums. Understanding these factors allows you to make informed decisions and potentially lower your overall costs. This section will explore the key elements that insurers consider when determining your rates.

Driving History’s Impact on Auto Insurance Premiums

Your driving record significantly impacts your auto insurance premiums. Insurers analyze your history to assess your risk profile. Factors such as accidents, speeding tickets, and DUI convictions directly increase your premiums. A clean driving record, conversely, results in lower rates. The severity of incidents also plays a crucial role; a minor fender bender will have less impact than a serious accident involving injuries or significant property damage. Furthermore, the frequency of incidents matters. Multiple incidents within a short period will likely lead to higher premiums than a single isolated incident years ago. Insurers often use a points system, where each violation or accident adds points, leading to higher premiums. Maintaining a clean driving record is therefore paramount in securing affordable auto insurance.

Home Features and Location Affecting Home Insurance Costs

The characteristics of your home and its location heavily influence your home insurance premiums. Features that enhance security, such as alarm systems, fire suppression systems, and reinforced doors and windows, typically result in lower premiums. These features mitigate the risk of theft, fire, and other damage, thus reducing the insurer’s potential payout. Conversely, homes lacking such features might attract higher premiums due to increased risk. The location of your home also plays a significant role. Homes located in areas prone to natural disasters, such as hurricanes, earthquakes, or wildfires, generally face higher premiums due to increased risk exposure. Similarly, homes situated in high-crime areas might also attract higher premiums because of a greater likelihood of burglaries or vandalism. The age and condition of your home also factor into the equation, with older homes potentially requiring more maintenance and thus leading to higher premiums.

Driver Profile and Auto Insurance Quotes

The following table illustrates how different driver profiles affect auto insurance quotes. Age and driving experience are key factors. Younger drivers, especially those with limited experience, typically face higher premiums due to their statistically higher accident risk. As drivers age and gain experience, their premiums generally decrease, reflecting a lower risk profile.

| Driver Age | Years of Driving Experience | Accident History | Estimated Premium Increase/Decrease (%) |

|---|---|---|---|

| 16-25 | 0-5 | None | +30% – +50% |

| 16-25 | 0-5 | At-fault accident | +70% – +100% |

| 26-35 | 5-15 | None | +10% – +20% |

| 26-35 | 5-15 | At-fault accident | +30% – +50% |

| 36+ | 15+ | None | 0% – +10% |

| 36+ | 15+ | At-fault accident | +15% – +30% |

Understanding Policy Details

Understanding the specifics of your home and auto insurance policies is crucial for ensuring you have adequate protection. This section will clarify common terms, coverage options, the claims process, and important questions to ask your insurer.

Common Policy Terms and Conditions

Insurance policies often utilize specialized terminology. Familiarizing yourself with these terms is essential for comprehending your coverage. For example, “deductible” refers to the amount you pay out-of-pocket before your insurance coverage kicks in. “Premium” is the regular payment you make to maintain your insurance policy. “Liability coverage” protects you financially if you’re responsible for someone else’s injuries or property damage. “Comprehensive coverage” in auto insurance extends beyond collision, covering damage from events like theft or hail. In homeowners insurance, “actual cash value” (ACV) compensates you for the depreciated value of damaged property, while “replacement cost” covers the cost of replacing the item with a new one. Understanding these terms helps you accurately assess the value and limitations of your policy.

Coverage Options and Their Implications

Homeowners insurance typically offers several coverage options, including dwelling coverage (protecting the structure of your home), personal property coverage (protecting your belongings), liability coverage (protecting you from lawsuits), and additional living expenses coverage (covering temporary housing costs if your home becomes uninhabitable). Auto insurance offers liability coverage (as described above), collision coverage (covering damage to your vehicle in an accident), comprehensive coverage (covering damage from non-collision events), uninsured/underinsured motorist coverage (protecting you if you’re involved in an accident with an uninsured driver), and medical payments coverage (covering medical expenses for you and your passengers). Choosing the right coverage depends on your individual needs and risk tolerance. For example, someone living in a high-risk area for theft might opt for higher personal property coverage, while someone with an older vehicle might choose to forgo comprehensive coverage to reduce premiums.

The Claims Process

Filing a claim involves reporting the incident to your insurance company promptly, usually via phone or online. For auto insurance, this typically involves providing details of the accident, including date, time, location, and involved parties. You’ll likely need to file a police report. For homeowners insurance, reporting a claim might involve describing the damage to your property and providing supporting documentation such as photos or videos. After reporting, the insurance company will investigate the claim and determine coverage. This process may involve inspections, appraisals, and negotiations. Once the claim is approved, the insurance company will pay the covered expenses, minus any applicable deductible. The exact process can vary slightly depending on the insurance company and the specifics of the claim.

Questions to Ask Insurance Providers

Before purchasing a policy, it’s crucial to ask clarifying questions. The specific coverage amounts offered for different aspects of your home and belongings should be clearly understood. The deductible amount and its impact on your out-of-pocket expenses should be carefully reviewed. The specific exclusions Artikeld in the policy, outlining situations not covered by the insurance, should be thoroughly examined. The process for filing a claim, including timelines and required documentation, should be explicitly detailed. The options available for payment plans and premium adjustments should be considered. Finally, the insurer’s customer service record and claims-handling reputation should be investigated. Asking these questions ensures you fully understand your policy and choose the best coverage for your needs.

Final Summary

Securing comprehensive home and auto insurance doesn’t have to be a daunting task. By understanding the factors that influence your premiums, effectively comparing quotes, and utilizing available discounts, you can achieve significant savings without compromising on essential coverage. Remember to thoroughly review policy details and ask clarifying questions before committing to a policy. Take control of your insurance costs and protect your future with a well-informed approach.

FAQ Corner

What is the difference between liability and comprehensive coverage?

Liability coverage protects you financially if you cause an accident, covering damages to other people’s property or injuries. Comprehensive coverage protects your own vehicle from damage caused by events outside of accidents, such as theft or weather.

How often should I review my insurance policies?

It’s recommended to review your home and auto insurance policies annually, or whenever there’s a significant life change (new car, home improvements, etc.), to ensure your coverage still meets your needs.

Can I get a quote without providing my personal information?

While some online tools offer preliminary estimates, obtaining a precise quote typically requires providing personal and vehicle information. This allows insurers to accurately assess your risk profile.

What happens if I make a claim?

The claims process involves reporting the incident to your insurer, providing necessary documentation (police reports, photos), and cooperating with their investigation. Your insurer will then assess the damage and determine the extent of coverage.