Navigating the world of insurance can feel overwhelming, especially when considering both home and vehicle coverage. Finding the right balance between comprehensive protection and affordable premiums requires careful research and comparison. This guide simplifies the process, offering insights into securing the best home and vehicle insurance quotes tailored to your specific needs.

From understanding the various types of quotes available – bundled packages offering potential savings versus separate policies – to analyzing the competitive landscape and identifying key features offered by different providers, we’ll equip you with the knowledge to make informed decisions. We’ll explore the factors influencing pricing, the advantages of bundling, and the importance of understanding policy coverage details. Ultimately, this guide aims to empower you to confidently secure the insurance protection you deserve.

Competitive Landscape Analysis

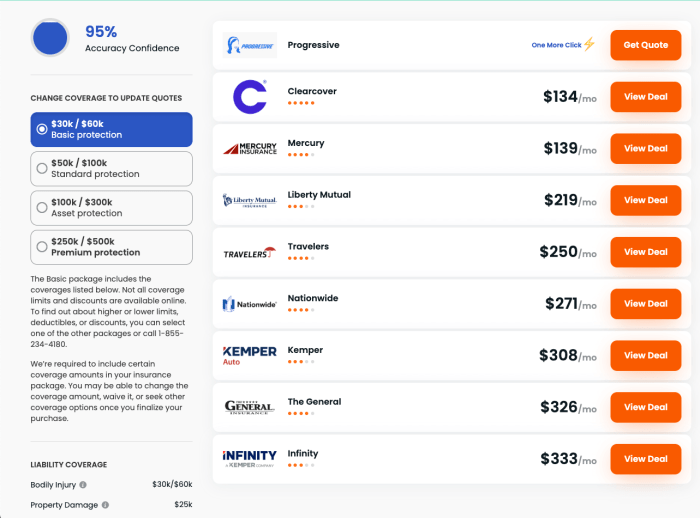

The home and vehicle insurance market is highly competitive, with numerous companies vying for customers through a variety of offerings and marketing strategies. Understanding this landscape is crucial for consumers seeking the best value and coverage. This analysis compares and contrasts several major providers, highlighting their key features, pricing strategies, and marketing approaches.

Comparison of Home and Vehicle Insurance Providers

Several key factors differentiate insurance providers. These include coverage options, pricing models, customer service quality, and the range of add-on features available. Understanding these differences allows consumers to make informed decisions based on their individual needs and priorities.

| Company Name | Key Features | Pricing Strategy | Marketing Approach |

|---|---|---|---|

| Progressive | Name Your Price® Tool, 24/7 customer service, various discounts (e.g., bundling, safe driver) | Competitive, often uses discounts to attract customers. | Focuses on digital marketing, emphasizing ease of use and price comparison. |

| State Farm | Wide range of coverage options, strong brand recognition, extensive agent network. | Generally competitive, but pricing can vary significantly based on location and risk profile. | Emphasizes long-term relationships and community involvement through local agents. |

| Geico | Simple and straightforward policies, strong online presence, 15-minute quote process. | Often aggressively competitive, focusing on low prices. | Relies heavily on memorable advertising campaigns and online marketing. |

| Allstate | MayDay® assistance, various coverage options, strong customer service reputation. | Pricing is competitive but can vary widely based on individual circumstances. | Emphasizes safety and security, often using testimonials and emotional appeals in advertising. |

Successful Marketing Strategies

Insurance companies employ diverse marketing strategies to reach their target audiences. These strategies leverage various channels and messaging to highlight the unique value propositions of each company. For instance, Progressive’s Name Your Price® tool allows consumers to actively participate in the quote process, giving them a sense of control and transparency. Geico’s memorable commercials and catchy slogans have built strong brand recognition and memorability. State Farm’s reliance on a vast network of local agents fosters personal connections and builds trust within communities. Allstate’s focus on safety and security, particularly through its MayDay® assistance program, appeals to customers’ concerns about protection and peace of mind. These examples showcase the varied and effective marketing approaches used within the industry.

Bundling Options and Their Advantages

Bundling your home and auto insurance policies with the same provider is a common strategy that can lead to significant savings. This practice offers more than just convenience; it often translates to a lower overall premium compared to purchasing separate policies from different companies. Understanding the cost-effectiveness and potential discounts associated with bundled insurance is crucial for making informed financial decisions.

Bundling home and auto insurance policies frequently results in lower premiums due to economies of scale for the insurance company. They streamline administrative processes, reduce marketing costs, and potentially lower their overall risk assessment. This efficiency is often passed on to the consumer in the form of discounts. The specific discount percentage varies widely depending on the insurer, your individual risk profile, and the specific policies being bundled.

Cost-Effectiveness of Bundled Home and Auto Insurance

The cost-effectiveness of bundling is highly dependent on individual circumstances. However, a common observation is that bundled policies generally cost less than purchasing individual policies separately. For example, a homeowner might pay $1,200 annually for home insurance and $800 annually for auto insurance when purchasing separately. Bundling those same policies with the same provider might reduce the total cost to $1,800, resulting in a $200 annual saving. This saving is not guaranteed and will vary widely based on factors such as location, coverage levels, and claims history.

Potential Discounts Associated with Bundled Policies

Insurance companies offer a variety of discounts for bundling home and auto insurance. These discounts can range from a modest percentage to a more substantial reduction in your overall premium. Some companies offer a flat percentage discount, such as 10% or 15% off the total premium. Others may offer discounts based on the specific features of your home and vehicle, such as security systems or safety features. For instance, a company might offer a 5% discount for bundling and an additional 5% for having a security system installed in your home. These discounts are designed to incentivize customers to consolidate their insurance needs with a single provider.

Benefits of Bundling for Consumers

Bundling home and auto insurance offers several advantages beyond cost savings. The convenience of having a single point of contact for all your insurance needs simplifies the claims process. Should you experience a covered loss affecting both your home and vehicle, dealing with a single insurer simplifies communication and potentially speeds up the claims resolution process. Furthermore, having a consolidated policy can streamline your financial planning, making it easier to track and manage your insurance expenses. The ease of payment and consistent communication with a single provider often adds to the overall value proposition.

Pros and Cons of Bundled Insurance Policies

Before deciding whether to bundle your insurance, carefully weigh the advantages and disadvantages:

- Pros:

- Cost savings through bundled discounts.

- Simplified administration and claims processing.

- Convenience of a single point of contact for all insurance needs.

- Potentially better customer service due to consolidated account.

- Cons:

- Limited choice of insurers and potentially less competitive pricing compared to shopping around individually.

- Possible difficulty switching insurers in the future if you are dissatisfied with one aspect of the service.

- The potential for a larger financial impact if you have a claim affecting both your home and vehicle.

Conclusion

Securing optimal home and vehicle insurance coverage involves careful consideration of various factors and a thorough comparison of available quotes. By understanding your needs, researching different providers, and carefully evaluating policy details, you can find a balance between comprehensive protection and affordability. Remember to leverage online resources, utilize comparison tools, and don’t hesitate to seek professional advice to ensure you’re making the best decision for your financial well-being and peace of mind.

Q&A

What is the difference between liability and collision coverage for vehicle insurance?

Liability coverage protects you financially if you cause an accident, covering damages to others’ property or injuries. Collision coverage protects your vehicle in case of an accident, regardless of fault.

How often should I review my home and vehicle insurance policies?

It’s recommended to review your policies annually, or whenever significant life changes occur (e.g., moving, new vehicle purchase, significant home improvements).

What factors influence the deductible amount on my insurance policy?

The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. It’s typically influenced by your coverage level and risk profile. A higher deductible usually results in lower premiums.

Can I get quotes without providing my personal information?

Some comparison websites allow you to get preliminary estimates without full personal details, but obtaining accurate quotes requires providing specific information for a personalized assessment.

What is the role of a claims adjuster in the insurance process?

A claims adjuster investigates and assesses the validity of your insurance claim, determining the extent of coverage and the amount to be paid.