The digital age has revolutionized how we approach insurance, offering unprecedented convenience in securing coverage for our homes and vehicles. Obtaining home and auto insurance quotes online has become the preferred method for many, driven by factors ranging from ease of access to the ability to compare multiple options simultaneously. This exploration delves into the intricacies of the online insurance quote landscape, examining consumer behavior, competitive strategies, and the overall user experience.

From understanding the typical online journey of a consumer seeking quotes to analyzing the design and functionality of leading insurance websites, we’ll uncover key insights into what makes an effective online quote process. We’ll also address common consumer concerns and explore strategies for enhancing trust and transparency throughout the process, ultimately aiming to provide a comprehensive guide for both consumers and providers navigating this increasingly important digital space.

Understanding Consumer Search Behavior

The online journey of a consumer seeking home and auto insurance quotes is often a complex process influenced by a multitude of factors, ranging from personal preferences to technological proficiency. Understanding this journey is crucial for insurers to effectively reach potential customers and convert them into policyholders.

The typical online journey begins with a general search query, often related to “cheap car insurance” or “homeowners insurance quotes.” Consumers then typically browse comparison websites, individual insurer sites, or utilize online insurance brokers. The process may involve multiple searches, comparisons of quotes, and reviews of insurer ratings before a final decision is made. This decision is often heavily influenced by price, but also takes into account factors like coverage options, customer service reviews, and brand reputation.

Factors Influencing Online vs. Offline Quote Acquisition

Several key factors determine whether a consumer chooses to obtain insurance quotes online or through a traditional offline method. Convenience is a major driver; online quote acquisition offers 24/7 accessibility and the ability to compare multiple options simultaneously without leaving home. Conversely, some consumers prefer the personalized service and guidance provided by an insurance agent, especially when dealing with complex insurance needs or when they lack confidence in navigating online platforms. Technological proficiency also plays a significant role, with digitally savvy individuals more likely to embrace online platforms. Finally, the perceived level of trust and security associated with a particular method can sway a consumer’s decision.

Demographics and Psychographics of Online Insurance Quote Seekers

Individuals most likely to search for online insurance quotes are typically younger, tech-savvy consumers who are comfortable using online tools and platforms. They are often price-conscious and value convenience. Psychographically, they tend to be independent, self-reliant individuals who prefer to manage their affairs online. This demographic includes millennials and Gen Z, who have grown up in a digital age and are accustomed to conducting various transactions online. However, it’s important to note that an increasing number of older consumers are also adopting online methods for obtaining insurance quotes, driven by similar factors of convenience and price comparison capabilities.

Comparison of Search Behavior: Home vs. Auto Insurance

The search behavior for home and auto insurance quotes differs in several key aspects. While both involve price comparisons, the factors considered and the search depth vary.

| Factor | Home Insurance | Auto Insurance |

|---|---|---|

| Primary Search Driver | Price, Coverage, Location-Specific Risks | Price, Driving Record, Vehicle Type |

| Search Depth | Often more extensive, involving research on specific coverages (e.g., flood, earthquake) | Generally less extensive, focusing primarily on price and coverage levels |

| Use of Comparison Websites | High usage, as home insurance policies can be complex and require detailed comparison | High usage, due to the competitive nature of the auto insurance market |

| Influence of Reviews | Significant influence, particularly regarding claims handling | Moderate influence, with price often outweighing review considerations |

Analyzing Competitor Websites

Understanding the online quote processes of our competitors is crucial for optimizing our own. By analyzing their strengths and weaknesses, we can identify best practices and areas for improvement in our user experience. This analysis will focus on three major providers, comparing their quote processes, evaluating their user experience, and ultimately informing the design of an improved quote form.

Comparison of Online Quote Processes

This section compares the online quote processes of three major insurance providers: Geico, Progressive, and State Farm. Geico’s process is generally praised for its speed and simplicity, often requiring minimal information upfront. Progressive utilizes a more interactive approach, frequently incorporating quizzes and personalized recommendations. State Farm offers a comprehensive, yet potentially more time-consuming, process that gathers extensive details. While Geico prioritizes speed, Progressive focuses on engagement, and State Farm emphasizes thoroughness, each approach caters to different user preferences and priorities. These differences highlight the diverse strategies available for obtaining customer information efficiently.

User Experience Evaluation of Competitor Websites

An evaluation of Geico and Progressive websites reveals key differences in user experience. Geico’s website is characterized by clean design and straightforward navigation. The quote process is linear and intuitive, minimizing cognitive load on the user. However, the limited customization options may not cater to users requiring specific coverage details. Progressive, in contrast, offers a more dynamic and personalized experience. The interactive elements, while engaging, can sometimes feel overwhelming, potentially increasing the time required to obtain a quote. This highlights a trade-off between simplicity and personalization in website design.

Best Practices in Website Design and Functionality

Several best practices emerged from analyzing competitor websites. Clear and concise language is paramount, avoiding industry jargon. Progressive use of visuals, such as progress bars and interactive maps, can improve user engagement and comprehension. Mobile responsiveness is crucial for accessibility across devices. Finally, a streamlined, multi-step process with clear progress indicators minimizes user frustration and enhances the overall experience. For example, a clear indication of the number of steps remaining in the quote process significantly improves user satisfaction.

Improved Online Quote Form Mock-up

Our improved online quote form for a hypothetical insurance company, “InsureEasy,” will prioritize ease of use and efficiency. The form will be divided into concise, logical sections, with clear headings and instructions. A progress bar will visually track the user’s progress. Dropdown menus and pre-filled fields will minimize manual input. Error messages will be informative and constructive, guiding users towards accurate input. The form will be fully responsive, adapting seamlessly to different screen sizes. A “Save & Continue Later” option will allow users to pause and resume the process at their convenience. The final screen will present a clear and concise quote summary, along with options for further customization or purchase. This design aims to minimize user effort and maximize efficiency, mirroring the speed of Geico with the personalization options of Progressive.

Improving the Online Quote Experience

A seamless and efficient online quote process is crucial for attracting and retaining customers in today’s competitive insurance market. By focusing on personalization, offering choice, and providing excellent customer support, insurers can significantly improve the user experience and drive conversions.

Personalization enhances the online quote experience by tailoring the process to individual customer needs and preferences. This can involve pre-filling forms with data obtained through secure means, offering customized coverage options based on user-provided information (e.g., vehicle type, driving history, home features), and providing personalized recommendations. For example, a system could identify a customer’s high-risk driving profile and suggest additional safety features or driver training discounts, while simultaneously offering a range of coverage levels to fit different budgets. This targeted approach makes the process more relevant and efficient, increasing customer satisfaction and the likelihood of a purchase.

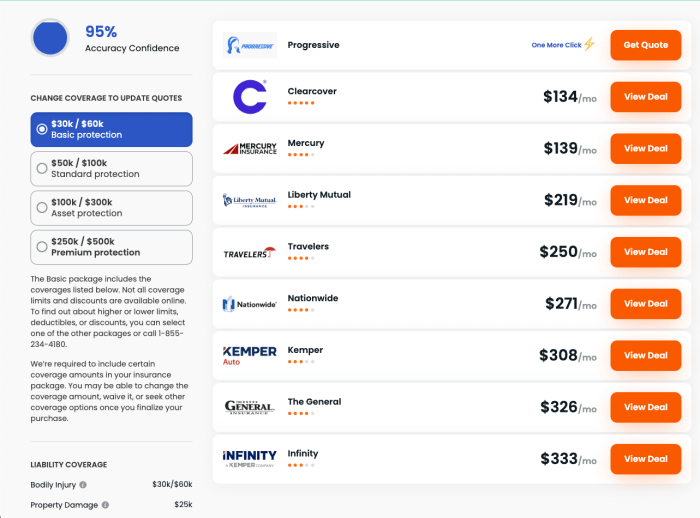

Multiple Quote Options from Different Providers

Offering multiple quote options from various insurance providers empowers consumers with choice and transparency. This allows customers to compare prices, coverage details, and policy features side-by-side, enabling them to make informed decisions based on their individual circumstances. This approach fosters trust and confidence in the platform as a reliable resource for insurance comparison. A visually clear comparison table, highlighting key differences between policies from different providers, is essential for effective implementation. For instance, the table could display premiums, deductibles, coverage limits, and policy features for each provider, making it easy to spot the best value proposition.

Integration of Online Chat Support

Integrating online chat support or other customer service features directly into the quote process provides immediate assistance to customers who encounter difficulties or have questions. This proactive approach minimizes frustration and ensures a smooth, uninterrupted experience. Live chat, in particular, offers immediate support and allows for personalized guidance, addressing specific concerns and clarifying complex insurance terminology. For example, a customer could use the chat feature to ask questions about specific coverage options or to get help with completing the online form. This instant access to support significantly enhances customer satisfaction and conversion rates.

Implementing a Streamlined and User-Friendly Online Quote Process

Implementing a streamlined and user-friendly online quote process involves several key steps. First, the design should be intuitive and easy to navigate, using clear and concise language. Second, the form should be short and only request essential information, minimizing the user’s effort. Third, the process should be mobile-responsive, ensuring a consistent experience across devices. Fourth, clear progress indicators should be included to keep the user informed about their progress. Fifth, the system should be secure and protect user data. Finally, regular testing and optimization based on user feedback are crucial for continuous improvement. A well-designed process, using progressive disclosure (revealing information gradually as the user progresses), minimizes cognitive load and ensures a positive experience. For example, instead of presenting all questions upfront, the system could start with basic information, progressively asking more detailed questions as the user completes each step.

Final Conclusion

Securing home and auto insurance is a significant financial decision, and the ability to quickly and efficiently compare quotes online has dramatically reshaped the landscape. By understanding consumer behavior, optimizing website design, and addressing user concerns, the online insurance quote experience can be significantly improved. This exploration highlights the importance of clear communication, transparent pricing, and a user-friendly interface in building trust and facilitating informed decision-making. The future of insurance quote acquisition undoubtedly lies in enhancing the digital experience, ensuring a seamless and efficient process for all involved.

Top FAQs

What information is typically needed to get an online quote?

Generally, you’ll need basic information about your property (for home insurance) or vehicle (for auto insurance), including address, age, value, and driving history (for auto).

Are online quotes binding?

No, online quotes are typically preliminary estimates. A final quote and policy will be issued after a full application review.

How secure is my personal information when obtaining quotes online?

Reputable insurance providers use encryption and security measures to protect your data. Look for sites with HTTPS and privacy policies.

Can I get quotes for both home and auto insurance from the same provider?

Yes, many insurance companies offer bundled home and auto insurance policies, often resulting in discounts.