Navigating the world of home and auto insurance can feel overwhelming. The sheer number of providers, policies, and potential savings can leave even the most diligent consumer feeling lost. This guide aims to simplify the process, offering a clear understanding of how to find the best home and auto insurance quotes tailored to your specific needs and budget. We’ll explore the factors influencing pricing, the advantages of bundling, and how to compare different providers effectively.

Understanding your insurance needs is the first step toward securing the best coverage at the most competitive price. Whether you’re a first-time homeowner, a seasoned driver, or simply looking to optimize your existing policies, this comprehensive guide will equip you with the knowledge to make informed decisions and save money.

Competitive Landscape Analysis

The home and auto insurance market is highly competitive, with numerous companies vying for customers through various online platforms. Understanding the competitive landscape, particularly the features and functionalities of leading websites, is crucial for any insurance provider seeking to optimize their online presence and customer acquisition strategies. This analysis examines three major competitors, highlighting key differences in their approaches to quote generation and user experience.

Website Examples and Feature Comparison

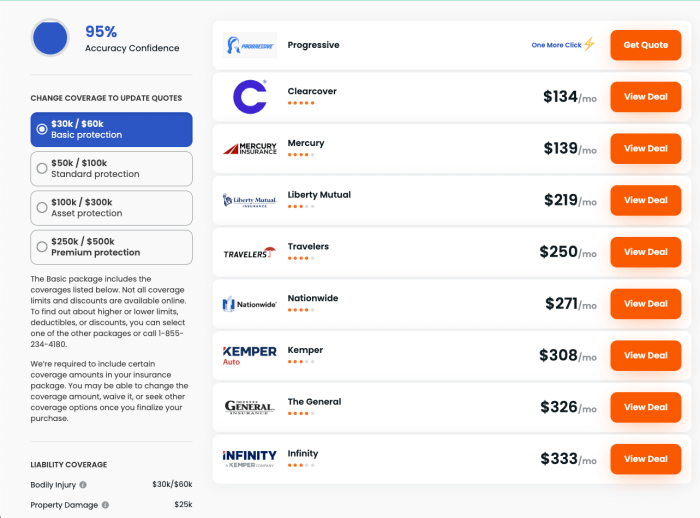

Several websites offer online quotes for home and auto insurance. Examples include Progressive, Geico, and State Farm. These companies represent a range of approaches to online quote generation and customer interaction, offering valuable insights into best practices and potential areas for improvement.

- Progressive: Progressive’s website is known for its user-friendly interface and its “Name Your Price® Tool,” allowing users to input their desired premium and see options that fit their budget. The quote process is relatively straightforward and quick, guided by clear instructions and progress indicators. However, the sheer volume of options and customization can sometimes feel overwhelming to less tech-savvy users.

- Geico: Geico emphasizes speed and simplicity. Their website offers a streamlined quote process, requiring minimal information upfront. This approach prioritizes ease of use but may sacrifice some level of personalization. The lack of detailed policy information readily available online could be a drawback for users seeking in-depth comparisons.

- State Farm: State Farm’s website provides a more comprehensive approach, offering detailed policy information and numerous tools to help users understand their coverage options. While this detailed approach can be beneficial for informed consumers, it can also be less intuitive for those seeking a quick and simple quote. The website’s design may feel less modern compared to Progressive and Geico.

Key Differences in User Experience and Quote Generation

The differences in user experience across these three websites are significant. This section details the key variations in their quote generation processes and overall user experience.

- Quote Process Complexity: Geico prioritizes a rapid, simplified quote process, while Progressive offers a more customizable, albeit potentially more complex, experience. State Farm falls somewhere in between, balancing simplicity with comprehensive information.

- Information Presentation: Geico presents information concisely, focusing on key details. Progressive provides a wider range of options and customization choices, potentially leading to information overload. State Farm strikes a balance, providing detailed information but potentially in a less visually appealing format.

- Mobile Optimization: All three websites offer mobile-optimized versions, but the level of optimization and user-friendliness may vary. Progressive’s mobile app, for instance, is often cited as particularly user-friendly.

Strengths and Weaknesses of Information Presentation

Each competitor has its strengths and weaknesses in how it presents insurance information.

- Progressive: Strength – Interactive tools and personalized options; Weakness – Information overload for some users.

- Geico: Strength – Speed and simplicity; Weakness – Lack of detailed information readily available online.

- State Farm: Strength – Comprehensive information and resources; Weakness – Potentially less intuitive navigation and design.

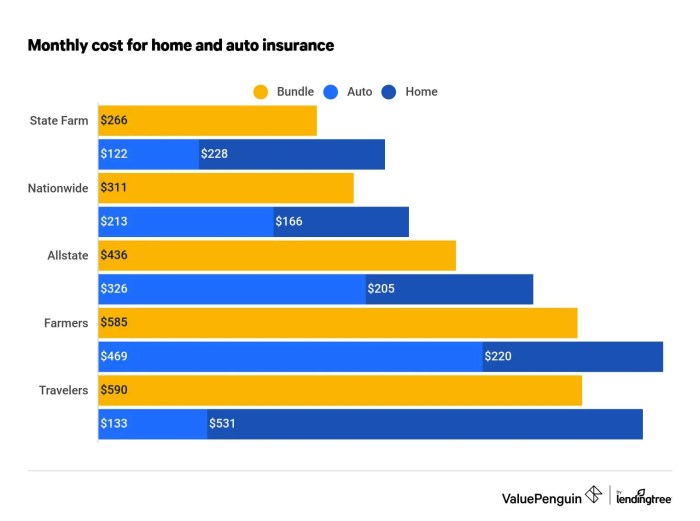

Bundling Options and Savings

Bundling your home and auto insurance policies with the same provider is a popular strategy for saving money and simplifying your insurance management. This practice offers several advantages, primarily focusing on cost reduction and streamlined administration. Let’s explore the details of bundling and its associated benefits.

Bundling home and auto insurance typically results in significant cost savings compared to purchasing separate policies from different companies. Insurance companies offer discounts for bundling because it reduces their administrative costs and increases customer loyalty. This is because they have fewer policies to manage per customer and a reduced risk of losing a customer to a competitor. The amount of savings varies depending on the insurer, the types of coverage, and the individual’s risk profile. However, savings can often reach 10% to 20% or even more in some cases.

Bundling Benefits Compared to Separate Policies

The primary advantage of bundling lies in the considerable financial savings. Managing two separate policies with different companies involves more paperwork, more communication, and the potential for missed payments or coverage gaps. Bundling streamlines this process, providing a single point of contact for all insurance needs. This simplification reduces stress and enhances convenience.

Potential Cost Savings with Bundled Policies

The cost savings associated with bundled policies are a major incentive. A hypothetical example: Let’s say your annual auto insurance premium is $1200, and your home insurance premium is $800. Separately, this totals $2000. With a 15% bundle discount, your combined premium could be reduced to $1700, representing a $300 annual saving. Real-world savings can vary based on factors like location, coverage levels, and the insurer’s specific discount structure. Some companies might offer tiered discounts, with greater savings for bundling more policies (e.g., adding life insurance).

Examples of Bundling Options Presented by Insurance Companies

Insurance companies typically highlight bundling options prominently on their websites and in marketing materials. Many companies feature dedicated sections on their websites outlining the specific discounts available for bundled policies, often with easy-to-use online tools for calculating potential savings. Sales representatives also actively promote bundling during initial contact and policy renewal periods. Some companies may use comparative charts or personalized quotes to showcase the cost benefits. Others may offer bundled packages with pre-selected coverage levels for greater simplicity.

Sample Promotional Graphic

Imagine a graphic with a split screen. One side shows a stressed person juggling multiple insurance documents and phone calls, labeled “Separate Policies: Stressful & Expensive.” The other side depicts a relaxed person enjoying their home with a single, unified insurance document, labeled “Bundled Policies: Simple & Affordable.” A large, bold text overlay states “Save up to 20% by Bundling!” The graphic uses bright, cheerful colors and clear, concise language. Beneath the main text, smaller text highlights the ease of managing a single policy and the potential for significant cost savings with a concrete example (e.g., “Save $300 annually!”). The company logo is subtly placed in a corner.

Closing Notes

Securing the right home and auto insurance coverage shouldn’t be a daunting task. By understanding the factors that influence pricing, comparing quotes from multiple providers, and leveraging bundling options, you can find a policy that provides comprehensive protection while fitting comfortably within your budget. Remember to regularly review your coverage and make adjustments as your circumstances change to ensure you maintain optimal protection and financial security.

Quick FAQs

What is the difference between liability and comprehensive car insurance?

Liability coverage pays for damages you cause to others’ property or injuries you inflict on others in an accident. Comprehensive coverage protects your own vehicle from damage caused by events not involving a collision, such as theft, vandalism, or weather.

How often should I review my home and auto insurance policies?

It’s advisable to review your policies at least annually, or whenever significant life changes occur (e.g., moving, getting married, buying a new car). This allows you to ensure your coverage still meets your needs and to potentially adjust your premiums based on changes in risk factors.

What documents do I need to get a home insurance quote?

Typically, you’ll need information about your property (address, square footage, age, construction materials), details about your mortgage (if applicable), and information about any security systems installed.

Can I get discounts on my insurance if I have a good driving record?

Yes, many insurers offer discounts for drivers with clean driving records, demonstrating a lower risk profile. The specific discount amount varies by insurer and your driving history.