Navigating the world of home and auto insurance can feel like deciphering a complex code. With numerous providers, policies, and coverage options, finding the right balance of protection and affordability requires careful consideration. This comprehensive guide simplifies the process, empowering you to make informed decisions and secure the best insurance for your valuable assets and peace of mind.

We’ll delve into the intricacies of home and auto insurance, comparing policy types, coverage features, and the factors influencing premiums. Learn how to leverage online comparison tools, understand the benefits of bundling, and navigate the claims process with confidence. By the end, you’ll possess the knowledge to confidently choose the insurance plan that perfectly suits your lifestyle and budget.

Key Features to Compare in Home Insurance Policies

Choosing the right home insurance policy can feel overwhelming, but by focusing on key features and understanding your specific needs, you can find the best protection for your home and belongings. This section will guide you through the essential aspects to consider when comparing different policies.

Comparing home insurance policies requires a careful evaluation of several factors. Understanding coverage limits, deductibles, and policy exclusions is crucial to ensuring you have adequate protection. The type of dwelling you own significantly impacts the type of coverage you’ll need and the costs associated with it.

Coverage Options for Different Home Types

Home insurance coverage varies considerably depending on whether you live in a single-family home, a condominium, or an apartment. Single-family homes typically require comprehensive coverage encompassing the structure, personal belongings, and liability. Condominium insurance, often referred to as HO-6, typically covers personal belongings and liability, with the building itself insured under a master policy held by the condo association. Apartment renters, on the other hand, usually need renter’s insurance (HO-4), which primarily protects their personal belongings and provides liability coverage. It’s essential to understand the specific coverage provided by your building’s insurance policy before purchasing your own.

Determining Adequate Coverage Amounts

Determining the right coverage amount is crucial. Underinsurance can leave you financially vulnerable in the event of a significant loss. For home structure coverage, you should obtain an appraisal to determine the current replacement cost of your home, which accounts for rebuilding costs, not just market value. For personal property coverage, consider the value of your possessions, including furniture, electronics, and clothing. Consider creating a home inventory, documenting items with photos and receipts, to help accurately assess the value of your belongings. A good rule of thumb is to ensure your coverage is sufficient to rebuild your home and replace your possessions, factoring in potential inflation. For example, if your home’s replacement cost is $300,000, you should consider purchasing at least that amount of coverage, potentially more to account for potential increases in construction costs. Similarly, if your personal belongings are valued at $50,000, you should aim for a similar coverage amount.

Common Exclusions in Home Insurance Policies

It’s vital to understand what is *not* covered by your home insurance policy. Many policies have standard exclusions, which vary slightly between insurers.

Common exclusions often include:

- Damage caused by floods or earthquakes (usually requiring separate flood or earthquake insurance).

- Damage resulting from normal wear and tear.

- Losses due to intentional acts by the policyholder.

- Damage caused by pest infestations (unless specifically endorsed).

- Losses from certain types of business activities conducted at home.

Key Features to Compare in Auto Insurance Policies

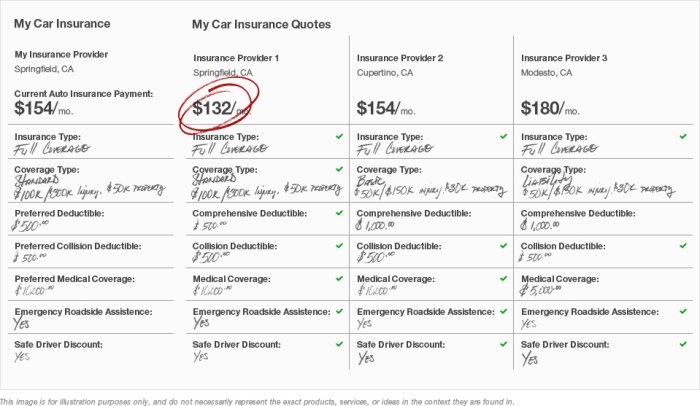

Choosing the right auto insurance policy can significantly impact your financial well-being. Understanding the key features and comparing different providers is crucial to finding the best coverage at a competitive price. This section will Artikel essential factors to consider when selecting an auto insurance policy.

Types of Auto Insurance Coverage

Auto insurance policies typically include several types of coverage, each designed to protect you in different situations. Liability coverage protects you against financial responsibility for injuries or damages you cause to others in an accident. Collision coverage pays for repairs to your vehicle, regardless of fault, if it’s damaged in an accident. Comprehensive coverage protects your vehicle against damage from events other than collisions, such as theft, vandalism, or natural disasters. Understanding the differences between these coverages is key to choosing the right level of protection. For example, liability coverage is usually legally mandated, while collision and comprehensive are optional but highly recommended. The amount of liability coverage you choose should reflect your assets and potential risk.

Impact of Driving History and Demographics on Premiums

Your driving history and demographic information significantly influence your auto insurance premiums. A clean driving record with no accidents or traffic violations typically results in lower premiums. Conversely, accidents, speeding tickets, or DUI convictions can lead to significantly higher premiums. Similarly, demographic factors such as age, location, and credit score can also affect your rates. Younger drivers generally pay more due to higher accident risk, while drivers in high-crime areas may face higher premiums due to increased risk of theft or vandalism. Credit scores are often used by insurance companies as an indicator of risk, with better credit scores often correlating with lower premiums. For instance, a young driver with multiple speeding tickets will likely pay substantially more than an older driver with a clean record living in a low-risk area.

Auto Insurance Discounts

Many auto insurance providers offer various discounts to incentivize safe driving and customer loyalty. These discounts can significantly reduce your premiums.

| Discount Type | Description | Example | Potential Savings |

|---|---|---|---|

| Good Driver Discount | Rewarding drivers with clean driving records. | No accidents or tickets in the past 3-5 years. | 5-15% |

| Bundling Discount | Combining home and auto insurance with the same provider. | Insuring both your home and car with the same company. | 10-20% |

| Safe Driver Discount (Telematics) | Using a telematics device to monitor driving habits. | Installing a device that tracks speed, braking, and mileage. | 5-15% |

| Multi-Car Discount | Insuring multiple vehicles under the same policy. | Insuring two or more cars with the same provider. | 10-25% |

Comparison Tools and Resources

Finding the best home and auto insurance can feel overwhelming, but leveraging comparison tools and understanding your resources significantly simplifies the process. This section explores various methods for comparing insurance quotes, highlighting their advantages and disadvantages to help you make informed decisions.

Online comparison tools streamline the process of obtaining and comparing insurance quotes from multiple providers. These websites typically allow you to input your personal information and desired coverage levels, then present you with a range of quotes based on your criteria. The benefits include saving time and effort by centralizing the search, enabling quick side-by-side comparisons, and potentially uncovering better rates than you might find searching individually.

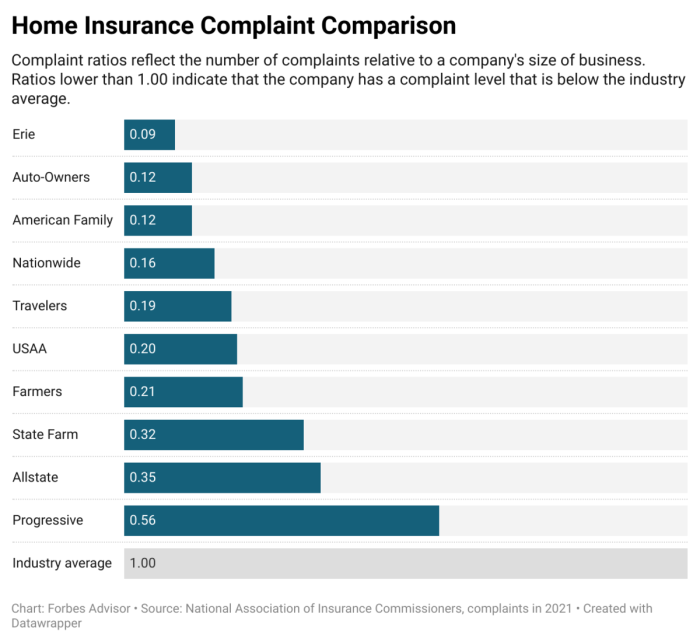

Reputable Sources for Insurance Quotes

Several reputable online platforms and individual insurers offer tools to compare home and auto insurance quotes. It’s crucial to use established and trustworthy sources to ensure accurate information and avoid scams.

- Major Insurance Company Websites: Many large insurance companies (e.g., State Farm, Geico, Progressive) have user-friendly websites where you can get personalized quotes.

- Independent Comparison Websites: Websites like NerdWallet, Policygenius, and The Zebra aggregate quotes from multiple insurers, allowing for broader comparison.

- Insurance Agents/Brokers (discussed below): While not strictly online tools, agents and brokers can access a wide network of insurers and assist with comparisons.

Advantages and Disadvantages of Using an Insurance Broker

Insurance brokers act as intermediaries, connecting you with multiple insurance companies. They can provide valuable expertise and assistance in navigating the complexities of insurance policies.

- Advantages: Brokers often have access to a wider range of insurers than you would find independently. They can explain policy details, help you choose the best coverage, and handle claims on your behalf. This saves you time and effort.

- Disadvantages: Brokers typically charge a fee or commission, which may increase the overall cost of your insurance. Finding a reputable broker requires due diligence.

Flowchart for Comparing Insurance Quotes

The process of comparing insurance quotes can be visualized as a flowchart, guiding you through each step.

[Imagine a flowchart here. The flowchart would begin with a box labeled “Determine your needs (coverage, deductible, etc.)”. This would lead to a box labeled “Use online comparison tools and contact insurers directly”. This would branch to boxes labeled “Gather quotes from multiple providers” and “Contact insurance brokers (optional)”. These would converge to a box labeled “Compare quotes side-by-side”. This would lead to a box labeled “Select the best policy based on price, coverage, and other factors”. Finally, a box labeled “Purchase the selected policy” would conclude the flowchart.] This systematic approach ensures a thorough and efficient comparison of various insurance options, maximizing your chances of finding the best fit for your needs and budget.

Final Summary

Securing adequate home and auto insurance is a crucial step in protecting your financial well-being. By understanding the key features of different policies, utilizing comparison tools, and considering the various factors affecting premiums, you can confidently choose a plan that provides comprehensive coverage at a competitive price. Remember to review policy documents carefully and familiarize yourself with the claims process to ensure a smooth experience should the unexpected occur. Empowered with knowledge, you can navigate the insurance landscape with ease and secure the best protection for your home and vehicle.

FAQ

What is the difference between liability and collision coverage in auto insurance?

Liability coverage protects you if you cause an accident, covering the other person’s injuries and property damage. Collision coverage protects your vehicle in an accident, regardless of fault.

How often should I review my home and auto insurance policies?

It’s recommended to review your policies annually, or whenever there’s a significant life change (e.g., marriage, new car, home improvements).

Can I get discounts on my insurance if I bundle my home and auto policies?

Yes, many insurers offer discounts for bundling home and auto insurance. The exact discount will vary depending on the provider and your specific circumstances.

What factors influence my home insurance premium besides the value of my home?

Several factors affect premiums, including your location, the age and condition of your home, security features, and your claims history.

What should I do if I’m involved in an accident?

Prioritize safety. Call emergency services if needed, exchange information with the other driver, contact your insurance company to report the accident, and document the incident thoroughly.